Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” today announced its annual financial results for the

year ended June 30, 2024 (“Fiscal 2024” or “FY 2024”). All amounts

are in United States dollars unless otherwise indicated (refer to

www.sedar.com for full financial results).

Cathy Zhai, the President and CEO commented,

“Fiscal year 2024 was a remarkable year for the Company. The gold

production generated $51.42 million gross revenue with net earnings

of $6.44 million, or $0.02 per share contrary to net loss of

($6.27) million, or ($0.2) per share last year. $14 million cash

flow with $10.86 million on hand and a healthy working capital of

$20.55 million has turned around the Company to a much stronger

financial position. The operation is sustainable and we are ready

to move forward with further corporate development.”

Ms. Zhai further added: “The Company is

assessing the potential production restart at the Murchison Gold

Project while gold prices are at record high, and capitalizing its

effort on resource expansion, market growth and returning to our

shareholders.”

Fiscal Year 2024

Highlights:

- Heathy cash flow, stable

production: a net cash of $14.39 million generated from FY 2024

production compared to $0.12 million in FY 2023, increasing the

cash balance to $10.86 million as of FY 2024 from $5.96 million at

of FY 2023.

- Working capital increased 109% to

$20.55 million at the end of FY 2024 from $9.82 million at the end

of FY 2023

- Net profit positive: $6.44 million

for FY 2024, or $0.02 per share, compared to a net loss of $6.27

million for FY 2023, or ($0.02) per share;

- Significant increase in gross

margin by 14 times: $24.83 million for FY 2024 compared to $1.75

million in FY 2023;

- 2024 production performance:

- 31,542 ounces of gold produced (FY 2023: 10,775 ounces);

- 30,713 ounces of gold sold at a record average realized price

of $2,116 per ounce for gross revenue of $51.42 million (FY 2023:

7,060 ounces sold at an average realized price of $1,824 per ounce

for gross revenue $12.39 million);

- Cash cost per ounce sold of $866 per ounce (FY 2023: $1,507 per

ounce);

- A decrease of 32% in all in sustaining cost to $1,173/oz in FY

2024 compared to $1,722/oz in FY 2023.

Fourth Quarter Production Highlights:

- Gold concentrate production improved during the three months

ended June 30, 2024 (“Q4 FY2024”), with a total of 12,003 ounces of

gold produced;

- 10,413 oz gold sold at an average realized price of $2,295/oz

for $18.60 million (Q4 FY2023: 1,910 oz gold sold for $3.18 million

in total including 1,148 oz at $1,949/oz for $1.74 million from

gold concentrate sales and 762 oz at $1,883/oz for $1.44 million

from gold bullion sales);

- Cash cost per ounce for gold concentrate sold at $842/oz (Q4

FY2023: $917/oz);

- AISC decreased to $1,183/oz (Q4 FY2023: $1,567/oz).

Fourth Quarter and Fiscal Year 2024 Production and

Financial Highlights

|

|

|

Three months ended June 30, |

Year ended June 30, |

|

|

|

2024 |

2023 |

2024 |

2023 |

|

Production |

|

|

|

|

| Ore mined

(tonnes) |

187,723 |

144,148 |

|

977,987 |

439,022 |

|

| Waste removed

(tonnes) |

2,718,199 |

2,104,082 |

|

10,283,519 |

8,051,618 |

|

| Gold Oxide

Production |

|

|

|

|

|

Ore processed (tonnes) |

- |

- |

|

- |

195,263 |

|

|

Average mill feed grade (g/t) |

- |

- |

|

- |

1.03 |

|

|

Processing recovery rate (%) |

- |

- |

|

- |

44.87 |

|

|

Gold produced (1) (oz) |

- |

362 |

|

- |

3,926 |

|

|

Gold sold (oz) |

- |

762 |

|

- |

5,912 |

|

| Gold

Sulphide Production |

|

|

|

|

|

Ore processed (tonnes) |

179,364 |

124,768 |

|

715,553 |

223,494 |

|

|

Average mill feed grade (g/t) |

2.52 |

1.66 |

|

1.84 |

1.80 |

|

|

Processing recovery rate (%) |

82.59 |

66.47 |

|

74.20 |

54.06 |

|

|

Gold produced (oz) |

12,003 |

4,409 |

|

31,542 |

6,849 |

|

|

Gold sold (oz) |

10,413 |

1,148 |

|

30,713 |

1,148 |

|

| |

|

|

|

|

|

Financial (expressed in thousands of US$) |

$ |

$ |

$ |

$ |

| Revenue |

18,602 |

3,177 |

|

51,421 |

12,386 |

|

| Gross margin from

mining operations |

9,835 |

450 |

|

24,827 |

1,749 |

|

| Net Income /

(loss) before other items |

2,715 |

(891 |

) |

13,678 |

(3,948 |

) |

| Net income /

(loss) |

884 |

(1,951 |

) |

6,443 |

(6,273 |

) |

| Cash flows

provided by (used in) operations |

5,750 |

(3,327 |

) |

14,385 |

118 |

|

| Working

capital |

20,552 |

9,822 |

|

20,552 |

9,822 |

|

| |

|

|

|

|

|

Earnings (Loss) per share – basic and diluted (US$/share) |

0.02 |

(0.01 |

) |

0.02 |

(0.02 |

) |

| |

|

|

|

|

| Weighted

average gold price |

US$/oz |

US$/oz |

US$/oz |

US$/oz |

| Realized price -

oxide production (2) |

- |

1,883 |

|

- |

1,800 |

|

| Realized price -

sulphide production (2) |

2,295 |

1,949 |

|

2,116 |

1,949 |

|

| |

|

|

|

|

| Cash cost

per ounce sold |

|

|

|

|

| Mining |

220 |

392 |

|

274 |

513 |

|

| Processing |

262 |

810 |

|

318 |

797 |

|

| Royalties |

290 |

179 |

|

205 |

178 |

|

| Operations, net of

silver recovery |

70 |

47 |

|

69 |

19 |

|

| Total cash

cost per ounce sold (3) |

842 |

1428 |

|

866 |

1507 |

|

|

By-product silver recovery |

- |

- |

|

- |

1 |

|

|

Operation expenses |

5 |

84 |

|

5 |

23 |

|

|

Corporate expenses |

1 |

5 |

|

5 |

15 |

|

|

Accretion of asset retirement obligation |

5 |

27 |

|

7 |

28 |

|

|

Exploration and evaluation expenditures |

1 |

(21 |

) |

1 |

66 |

|

|

Sustaining capital expenditures |

329 |

44 |

|

289 |

82 |

|

|

Total all-in sustaining costs per ounce

sold(4) |

1,183 |

1,567 |

|

1,173 |

1,722 |

|

(1) Defined as good delivery

gold oxide production according to London Bullion Market

Association (“LBMA”), net of gold doŕe in transit and refinery

adjustment.(2) Exclude gold prepaid delivery for

comparison purposes. (3) Total cash cost for both

oxide and sulphide plant production includes production costs such

as mining, processing, tailing facility maintenance and camp

administration, royalties, and operating costs such as storage,

temporary mine production closure, community development cost and

property fees, net of by-product credits. For Q4 FY2024 and FY2024,

there’s sulphide production only. Cash cost excludes amortization,

depletion, accretion expenses, operation expenses, capital costs,

exploration costs and corporate administration costs.

(4) All-in sustaining cost per ounce includes

total cash costs, operation expenses, and adds sustaining capital

expenditures, corporate administrative expenses for the Selinsing

Gold Mine including share-based compensation, exploration and

evaluation costs, and accretion of asset retirement obligations.

Certain other cash expenditures, including tax payments and

acquisition costs, are not included.

GOLD PRODUCTION RESULTS

Annual gold production

- Sulphide

flotation plant production in FY 2024 was 31,542 ounces (FY 2023:

6,849 ounces) of gold contained in gold concentrate. The mill

processed 715,553 tonnes of sulphide ore at a head grade of 1.84g/t

with a recovery of 74.20% (FY 2023: 223,494 tonnes of sulphide ore

at a head grade of 1.80g/t with a recovery of 54.06%). The higher

gold recovery was due to optimising performance through plant

modifications and improvements and the treatment of higher-grade

sulphide ore.

- CIL plant

production in FY 2024 was nil, with the CIL circuit now on care and

maintenance for a potential restart in the future (FY 2023:

recovered 2,910oz of gold with the mil feed of 195,264 tonnes, the

average grade of 1.03g/t at the recovery of 44.87%).

- Mining focused

on Buffalo Reef and Felda Block 7 to source sulphide ore for the

flotation plant. A total of 977,987 tonnes of ore was mined (FY

2023: 439,022 tonnes) and 10,283,519 tonnes of waste (FY 2023:

8,051,618 tonnes) moved at a lower stripping ratio of 10.51

compared to 18.34 in the prior year primarily due to the mining

sequence and the progress to access ore body.

Fourth quarter gold production

- The sulphide

flotation plant produced 12,003 ounces (Q4 FY2023: 4,409 ounces) of

gold, comprised of 9,968 ounces from Q4, and an additional 2,035

ounce adjustment from previous quarters. The mill processed 179,364

tonnes of sulphide ore at a head grade of 2.52g/t and a recovery of

82.59% (Q4 FY2023: 124,768 tonnes of sulphide ore at a head grade

of 1.66g/t with a recovery of 66.47%), benefiting from improved

plant performance and optimization and the processing of

higher-grade sulphide ore.

- The CIL plant was

put on care and maintenance with no production (Q4 FY2023: cleaned

up 362 ounces of gold from the circuit with no mill feed).

FINANCIAL RESULTS

Fiscal 2024 financial results

- Gold concentrate

sales generated revenue of $51.42 million for the year ended June

30, 2024, compared to $12.39 million for the year ended June 30,

2023. 30,713 ounces of gold were sold at an average realized gold

price of $2,116 per ounce from the gold concentrate operations (FY

2023: 1,148 oz of gold at $1,949/oz), whereas revenue from the gold

bullion operations was $nil compared to $10.64 million during the

FY 2023, from 5,912 ounces of gold sold at an average realized

price of $1,800 per ounce.

- Gross margin was

higher at $24.83 million (FY 2023: $1.75 million) due to increased

gold concentrate sales at higher realized gold prices.

- Cash cost per gold

ounce sold from the gold concentrate operations was $866 (FY 2023:

$917). Cash cost per gold ounce sold from the gold bullion

operations was $nil (FY2023: $1,622).

- As of June 30, 2024,

cash and cash equivalents were $10.86 million, an increase of $4.90

million from June 30, 2023. The Company’s cash and cash equivalents

primarily comprised funds held with reputable financial

institutions and were invested in cash accounts.

- Cash used in

investing activities of $9.37 million (FY 2023: $15.12 million)

represented $9.16 million invested in Selinsing for sulphide

project development, including the Flotation Plant improvements,

Tailings Storage Facility (“TSF”) upgrades and cutbacks, and

stripping activities (FY 2023: $14.17 million), while $0.86 million

(FY 2023: $0.95 million) was invested in Murchison exploration and

evaluation projects, offset by the proceeds of $0.68 million for

the contingency Milestone Performance payment from the sale of 80%

controlling interest in Tuckanarra.

Quarter four financial results

- Q4 FY2024 gold

concentrate sales generated revenue of $18.60 million from 10,413

oz gold sold at an average realized price of $2,295 per ounce (Q4

FY2023: 1,148 oz at $1,949 per ounce).

- Total production

costs during Q4 FY2024 were $8.77 million compared to $2.73 million

during Q4 FY2023. The increase was due to higher mining volumes and

greater processing rates achieved by the sulphide plant at

Selinsing, and more gold concentrate sold.

- Mining

operations before non-cash amortization and depreciation generated

a gross margin of $9.84 million, a significant increase from $0.45

million in Q4 FY2023, and resulting from more gold concentrate

sales and a higher realized gold price.

- The cash cost

per gold ounce sold from the sulphide operations was $842 for Q4

FY2024 (Q4 FY2023: $917 for sulphide operations).

MINE

DEVELOPMENT

Selinsing Gold Mine

Development work at Selinsing focused on ongoing

plant optimisation through plant modifications and refilling

critical parts. A new rougher tailings hopper was installed, and

the rougher tailings pumps were upgraded with new motors and power

supply. A bigger rougher concentrate launder was installed to

replace the original undersized unit, in addition to a new scalping

screen in the crushing plant. One rougher agitator assembly and two

cleaner agitator assemblies were replaced. Further upgrades to the

filter press operation including a new filter press, new compressor

and new concentrate surge tank have been planned and are expected

to be completed in October 2024. Since May 2024, a Knelson

concentrator has been reinstated to recover any free gold before

sending the slurry to the flotation plant, and the control of

oxidation-reduction potential and pH, frother selection, mill power

draw and steel ball usage to avoid overgrinding have contributed to

further processing recovery improvements.

Mine development for gold concentrate production

continued with open pit push backs, while site infrastructure

development included finishing construction of the tailings storage

facility.

Murchison Gold Project

The Company continued working on a review of the

Murchison Gold Project, including reassessment of the economics of

a production restart and a review of all historical and recent

drillhole data for the Gabanintha tenement holdings, in order to

plan infill drilling programmes for completion in subsequent

quarters, and also confirmation drilling such that certain

historical resources can be included in any future mine plan.

The construction of a new core shed was

completed in March 2024, including new core yard racking and trays.

Drill core samples have been reorganized to be ready for geological

inspection. A heritage specialist was engaged during Q4 2024 to

research and ensure ongoing compliance with recent regulatory

changes and other regulatory compliance was also under review. The

processing plant, accommodation, catering facilities, offices, and

associated infrastructure were maintained to a high standard

ensuring operational readiness. Accommodation and catering

facilities were fully operational during the quarter and equipped

to support administrative, exploration, and mining activities.

Exploration

Malaysia

There was no exploration drilling undertaken at

Selinsing during the year, with exploration activities to identify

additional oxide and sulphide mineralisation expected to resume in

2025 fiscal year.

Western Australia

No exploration was undertaken at the Murchison

project during fiscal year 2024, although the intention remains to

begin with historical resource confirmation drilling at Gabanintha

as part of a potential production restart. Subsequent exploration

activities will include regional geological interpretation

following the two-phases of exploration completed at Burnakura

during FY 2022 and FY 2023, while also assessing the viability of

restarting production supported by an internal economic assessment

reviewed by SRK in 2021.

_______________________________________

About Monument

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1)

is an established Canadian gold producer that 100% owns and

operates the Selinsing Gold Mine in Malaysia and the Murchison Gold

Project in the Murchison area of Western Australia. It has 20%

interest in Tuckanarra Gold Project jointly owned with Odyssey Gold

Ltd in the same region. The Company employs approximately 250

people in both regions and is committed to the highest standards of

environmental management, social responsibility, and health and

safety for its employees and neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville StreetVancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

Richard Cushing, MMY VancouverT: +1-604-638-1661

x102rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Disclaimer Regarding Forward-Looking

Statements

This news release includes statements containing

forward-looking information about Monument, its business and future

plans ("forward-looking statements"). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company's plans with respect to its mineral projects, expectations

regarding the completion of the ramp-up period to target production

level at Selinsing and the timing thereof, expectations regarding

the Company’s continuing ability to source explosives from

suppliers, expectations regarding completion of the proposed

storage shed and ammonium nitrate depot and the timing thereof, and

the timing and results of the other proposed programs and events

referred to in this news release. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". The forward-looking

statements in this news release are subject to various risks,

uncertainties and other factors that could cause actual results or

achievements to differ materially from those expressed or implied

by the forward-looking statements. These risks and certain other

factors include, without limitation: risks related to general

business, economic, competitive, geopolitical and social

uncertainties; uncertainties regarding the results of current

exploration activities; uncertainties in the progress and timing of

development activities, including those related to the ramp-up

process at Selinsing and the completion of the proposed storage

shed and ammonium nitrate depot; uncertainties and risks related to

the Company’s ability to source explosives from suppliers; foreign

operations risks; other risks inherent in the mining industry and

other risks described in the management discussion and analysis of

the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Material factors and assumptions used to

develop forward-looking statements in this news release include:

expectations regarding the estimated cash cost per ounce of gold

production and the estimated cash flows which may be generated from

the operations, general economic factors and other factors that may

be beyond the control of Monument; assumptions and expectations

regarding the results of exploration on the Company's projects;

assumptions regarding the future price of gold of other minerals;

the timing and amount of estimated future production; assumptions

regarding the timing and results of development activities,

including the ramp-up process at Selinsing and the completion of

the proposed storage shed and ammonium nitrate depot; expectations

that the Company will continue to be able to source explosives from

suppliers in a timely manner; costs of future activities; capital

and operating expenditures; success of exploration activities;

mining or processing issues; exchange rates; and all of the factors

and assumptions described in the management discussion and analysis

of the Company and the technical reports on the Company's projects,

all of which are available under the profile of the Company on

SEDAR at www.sedar.com. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company does not

undertake to update any forward-looking statements, except in

accordance with applicable securities laws.

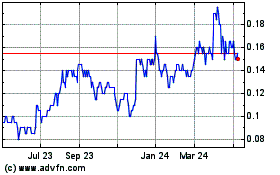

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

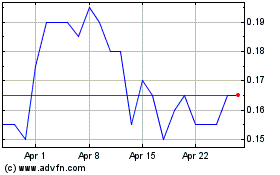

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024