Metalla Royalty & Streaming Ltd. (“Metalla”)

(TSX-V:MTA) (OTCQX:MTAFF) (Frankfurt:X9CP)

and ValGold

Resources Ltd. (“ValGold”) (TSX-V:VAL) are pleased to

announce that they have entered into a definitive arrangement

agreement (the "Arrangement Agreement") whereby Metalla will

acquire all of the issued and outstanding common shares of ValGold

(the "Arrangement"). Under the terms of the Arrangement Agreement,

all of ValGold’s issued and outstanding common shares will be

exchanged for Metalla common shares on the basis of 0.1667 of a

Metalla common share for each ValGold common share (the "Exchange

Ratio"). All currency is in Canadian Dollars unless otherwise

noted.

The Exchange Ratio implies a consideration of

$0.13 per ValGold common share, based on the 40-day volume weighted

average price (“VWAP”) of the Metalla common shares on the TSX

Venture Exchange (“TSXV”) for the period ending May 9, 2018. This

represents a 79% premium to the 40-day VWAP of ValGold common

shares and 62.5% premium as of market close on May 9, 2018, on the

TSXV. The undiluted equity value of the transaction is

approximately $7.2 million.

BENEFITS TO METALLA

SHAREHOLDERS

- Acquisition of a 2% NSR royalty on the Garrison Project in a

world-class mining district in Ontario, Canada

- Addition of a proven mine builder and high-quality counterparty

Osisko Mining Inc. (TSX:OSK) the management team largely

responsible for the discovery, development, financing, and

commissioning of the Canadian Malartic Mine

- Enhances and expands growth-profile with a royalty on a gold

development asset with approximately 1.2 million oz. measured and

indicated resource and a 0.8 million oz. inferred resource

- Maintains cash balance through an all-share transaction

- Accretive to existing Metalla shareholders on a per share

basis

BENEFITS TO VALGOLD

SHAREHOLDERS

- An immediate premium of 79% to Valgold’s 40-day VWAP

- Enhanced market liquidity

- Access to Metalla’s dividend stream and policy on closing

- Significant asset diversification from Metalla’s portfolio of

producing, development, and exploration royalties and streams with

top-tier operators

- Maintains upside exposure to the Garrison Project through a

Metalla ownership position and expected re-valuation of the related

royalty through enhanced price discovery reflected in Metalla

shares

Brett Heath, President, and CEO of Metalla,

stated, "The acquisition of ValGold is an exciting transaction that

strengthens Metalla’s development pipeline of royalties and adds a

top-tier operator in a world-class mining jurisdiction with

significant potential upside. This acquisition is consistent with

our long-term strategy of executing accretive deals in known mining

camps with strong counterparties.”

Kevin Snook, Chairman, and CEO of ValGold

stated, “Metalla’s management team and board has built an

impressive and diversified royalty and streaming portfolio in only

20 months. ValGold shareholders can look forward to seeing

the full value of the Garrison royalty recognized in Metalla’s

share price as well as improved market liquidity and exposure to

Metalla’s dividend and diversified royalty and streaming

assets.”

GARRISON ROYALTY

ValGold holds a 2% net smelter return (“NSR”)

royalty on certain claims of the Garrison Project (the “Garrison

Royalty”), which covers the Garrcon and Jonpol properties, and the

eastern portion of the 903 Zone. The Garrison Project is located

approximately 100 kilometers east of Timmins Ontario, and 40

kilometers north of Kirkland Lake. It resides along the famous

Golden Highway in the Timmins and Kirkland Lake region which has

historically produced over 100 million ounces of gold.

The Garrison Project is 100% owned by Osisko

Mining Inc. (“Osisko”) and consists of a portfolio of properties

spanning a 50 km distance along the Destor-Porcupine Fault Zone,

encompassing 16 non-contiguous properties including the Garrcon and

Jonpol properties, 903 Zone, and Buffonta, and Golden Pike advanced

exploration properties.

The Garrison Royalty covers 35 patented mining

claims and three deposits known as the Garrcon and Jonpol

properties, and the eastern portion of the 903 Zone. These claims

were the subject of a National Instrument (NI) 43-101 resource

estimate dated March 2014 by ACA Howe International Inc. which

estimated the mineral resource according to CIM standards at the

Garrcon and Jonpol properties to be:

|

Domain |

Category |

Tonnes |

Au Grade(g/tonne) |

Au (troy oz) |

|

Garrcon |

Measured |

15,100,000 |

1.07 |

521,000 |

|

Garrcon and Jonpol |

Total Indicated |

14,972,000 |

1.40 |

676,000 |

|

Garrcon and Jonpol |

Total Measured + Indicated |

30,072,000 |

1.24 |

1,197,000 |

|

Garrcon and Jonpol |

Total Inferred |

7,873,000 |

3.19 |

808,000 |

For further details, see technical report

entitled “Technical Report on the Golden Bear Project - Garrison

Property Larder Lake Mining Division Garrison Township, Ontario,

Canada for Northern Gold Mining Inc.” dated March 3, 2014, filed by

Northern Gold Mining Inc. on May 2, 2014 and available under

Northern Gold Mining Inc.’s profile on SEDAR. This is a

summary table for the Garrison Property (Garrcon and Jonpol

deposits). These mineral resources were estimated using a 0.4 gpt

Au cut-off grade for open pit and 1.5 gpt Au for underground

resources. Moreover, all raw assays were top-cut to 112

g/tonne Au and 114 g/tonne Au for higher grade and lower grade

domains, respectively. Mineral resources are not mineral reserves

and by definition do not demonstrate economic viability. This

mineral resource estimate includes inferred mineral resources that

are normally considered too speculative geologically to have

economic considerations applied to them that would enable them to

be categorized as mineral reserves. There is also no

certainty that these inferred mineral resources will be converted

to the measured and indicated resource categories through further

drilling, or into mineral reserves, once economic considerations

are applied. Readers are cautioned that inferred resources have a

great amount of uncertainty as to their existence and as to whether

they can be mined economically.

As of the end of January 2018, Osisko has

completed 85,000 meters of new drilling since the 2014 resource

update to complement the 108,000 meters drilled at Garrison by

previous operators. Osisko has announced that it expects to release

an updated resource estimate in July 2018.

BOARD OF DIRECTORS'

RECOMMENDATION

The Arrangement Agreement has been unanimously

approved by the board of directors of each of Metalla and ValGold.

The ValGold board of directors recommends that ValGold shareholders

vote in favour of the Arrangement at the special meeting of

shareholders to be called to approve the Arrangement (the “Special

Meeting”). Evans & Evans, Inc. has provided an opinion to

the board of directors of ValGold, stating that, as of the date of

the opinion and based upon and subject to the assumptions,

limitations, and qualifications set forth therein, the

consideration to be received by the holders of ValGold common

shares pursuant to the Arrangement is fair, from a financial point

of view to such holders.

Certain executive officers and directors of

ValGold have entered into lockup agreements and have agreed to vote

their ValGold securities in favour of the Arrangement.

TRANSACTION SUMMARY

Under the terms of the Arrangement Agreement,

ValGold shareholders will receive 0.1667 common shares of Metalla

for each ValGold common share held as of the effective date of the

Arrangement. Holders of ValGold stock options outstanding at

closing will receive Metalla common shares on the basis of the

in-the-money value of their ValGold options. Pursuant to the

transaction, Metalla will issue an aggregate of approximately 9.5

million common shares to ValGold shareholders and optionholders.

Upon completion of the Arrangement, current ValGold shareholders

and optionholders will own approximately 11.2% of the issued and

outstanding common shares of Metalla. Under the Arrangement,

all existing warrants of ValGold will become exercisable to acquire

Metalla common shares at exercise prices adjusted by the Exchange

Ratio.

The Arrangement will be effected by way of a

plan of arrangement under the Business Corporations Act (British

Columbia). The Arrangement will require approval by 66 2/3rds

percent of the votes cast at the Special Meeting and any additional

shareholder approvals which may be required under Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions. In addition to shareholder and court

approvals, the Arrangement is subject to applicable regulatory

approvals (including approval of the TSX Venture Exchange) and the

satisfaction of certain other closing conditions customary in

transactions of this nature.

The Arrangement Agreement includes customary

provisions including non-solicitation of alternative transactions,

right to match superior proposals and fiduciary-out provisions. In

addition, ValGold has agreed to pay a termination fee to Metalla of

$600,000 in the event of a termination of the Arrangement Agreement

due to the occurrence of certain events. Metalla and ValGold have

each agreed to pay a $150,000 expense reimbursement fee to the

other party as reimbursement for certain expenses upon termination

of the Arrangement Agreement due to the occurrence of certain other

specified events.

TIMING

Full details of the proposed transaction will be

included in ValGold’s management information circular, which is

expected to be mailed to shareholders in early June 2018. It is

anticipated that the Special Meeting and the closing of the

proposed transactions will take place in mid-July 2018.

QUALIFIED PERSON

The technical information contained in this news

release has been reviewed and approved by Charles Beaudry,

geologist M.Sc., member of the Association of Professional

Geoscientists of Ontario and the Ordre des Géologues du Québec and

a consultant to Metalla. Mr. Beaudry is a Qualified Person as

defined in “National Instrument 43-101 Standards of disclosure for

mineral projects”.

ABOUT METALLA

Metalla is a precious metals royalty and

streaming company. Metalla provides shareholders with leveraged

precious metal exposure through a diversified and growing portfolio

of royalties and streams. Metalla’s strong foundation of current

and future cash-generating asset base, combined with an experienced

team gives Metalla a path to become one of the leading gold and

silver companies for the next commodities cycle. For further

information, please visit Metalla’s website at

www.metallaroyalty.com.

ABOUT VALGOLD

ValGold is a royalty and mineral exploration and

development company based in Ontario, which holds a 2% net smelter

return royalty on certain claims on the Garrison Project on the

“Golden Highway”, east of Timmins, Ontario, a 100% interest in the

Tower Mountain Gold Project near Thunder Bay, Ontario, and

exploration properties in Venezuela. For further information,

please visit ValGold’s website at www.valgold.com and filings on

SEDAR.

| ON BEHALF OF

THE BOARD OF |

ON BEHALF OF

THE BOARD OF |

| METALLA ROYALTY

AND STREAMING LTD. |

VALGOLD

RESOURCES LTD. |

| |

|

| |

|

| Brett Heath, President

and CEO |

Kevin Snook, Chairman

and CEO |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSXV) accept responsibility for the adequacy or

accuracy of this release.

CONTACT INFORMATION

Metalla Royalty & Streaming Ltd. Brett Heath, President

& CEO Phone: 604-696-0741 Email: info@metallaroyalty.com

Website: www.metallaroyalty.com

Valgold Resources Ltd.Kevin Snook, Chairman & CEOTel:

844-230-6000Email: ksnook@valgold.comRod Whyte, Director (London,

England)Tel: (44) 207-736-2321Jonathon SnookTel:

905-325-4584Website: www.valgold.com

Cautionary Note Regarding

Forward-Looking Statements

This press release contains "forward-looking

information" and "forward-looking statements" within the meaning of

applicable Canadian and U.S. securities legislation. The

forward-looking statements herein are made as of the date of this

press release only, and the Company does not assume any obligation

to update or revise them to reflect new information, estimates or

opinions, future events or results or otherwise, except as required

by applicable law.

Often, but not always, forward-looking

statements can be identified by the use of words such as “plans”,

“expects”, “is expected”, “scheduled”, “estimates”, “projects”,

“intends”, “aims”, “anticipates” or “believes” or variations

(including negative variations) of such words and phrases or may be

identified by statements to the effect that certain actions “may”,

“could”, “should”, “would”, “might” or “will” be taken, occur or be

achieved. Forward-looking information in this press release

includes, but is not limited to Metalla, ValGold and their

respective shareholders; the timing and receipt of required

shareholder, court, stock exchange and regulatory approvals for the

Arrangement; the ability of ValGold and Metalla to satisfy the

other conditions to, and to complete, the Arrangement, the

anticipated timing of the mailing of ValGold’s information circular

regarding the Arrangement; liquidity, enhanced value and capital

markets profile of Metalla; future growth potential for Metalla,

ValGold and their respective businesses; estimates regarding future

profitability, release of a new resource estimate on the Garrison

property, and expected re-valuation of Garrison royalty.

In respect of the forward‐looking statements and

forward-looking information concerning the anticipated completion

of the proposed Arrangement and the anticipated timing for

completion of the Arrangement, the parties have provided such

statements in reliance on certain assumptions that they believe are

reasonable at this time, including assumptions as to the time

required to prepare and mail shareholder meeting materials,

including the required information circular; the ability of the

parties to receive, in a timely manner, the necessary shareholder,

court, stock exchange and regulatory approvals; and the ability of

the parties to satisfy, in a timely manner, the other conditions to

the closing of the Arrangement. These dates may change for a number

of reasons, including, but not limited to, unforeseen delays in

preparing meeting materials; inability to secure necessary

shareholder, court, stock exchange and regulatory approvals in the

time assumed or the need for additional time to satisfy the other

conditions to the completion of the Arrangement. Accordingly,

readers should not place undue reliance on the forward‐looking

statements and forward-looking information contained in this news

release concerning these times and dates.

Forward‐looking statements and forward‐looking

information relating to any future mineral production, liquidity,

enhanced value and capital markets profile of Metalla, future

growth potential for Metalla, ValGold and their respective

businesses, future exploration plans, which are based on such

management's experience and perception of trends, current

conditions and expected developments, and other factors that the

applicable parties' management believes are relevant and reasonable

in the circumstances, but which may prove to be incorrect.

Assumptions have been made regarding, among other things, the price

of silver, gold, and other metals; costs of development and

production; Metalla and/or ValGold’s ability to operate in a safe

and effective manner and their ability to obtain financing on

reasonable terms.

These statements reflect the parties’ respective

current views with respect to future events and are necessarily

based upon a number of other assumptions and estimates that, while

considered reasonable by the respective parties, are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors, both

known and unknown, could cause actual results, performance or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward‐looking statements or forward-looking information

and the parties have made assumptions and estimates based on or

related to many of these factors. Such factors include, without

limitation: satisfaction or waiver of all applicable conditions to

closing of the Arrangement including, without limitation, receipt

of all necessary shareholder, court, stock exchange and regulatory

approvals or consents and lack of material changes with respect to

Metalla and ValGold and their respective businesses, all as more

particularly set forth in the Arrangement Agreement; the synergies

expected from the Arrangement not being realized; business

integration risks; fluctuations in general macro‐economic

conditions; fluctuations in securities markets and the market price

of Metalla’s common shares. In addition, the failure of a party to

comply with the terms of the Arrangement Agreement may result in

that party being required to pay a fee to the other party, the

result of which could have a material adverse effect on the paying

party’s financial position and results of operations and its

ability to fund growth prospects and current operations. Readers

are cautioned against attributing undue certainty to

forward‐looking statements or forward-looking information. Although

the parties have attempted to identify important factors that could

cause actual results to differ materially, there may be other

factors that cause results not to be anticipated, estimated or

intended. The parties do not intend and do not assume any

obligation, to update these forward‐looking statements or

forward-looking information to reflect changes in assumptions or

changes in circumstances or any other events affecting such

statements or information, other than as required by applicable

law.

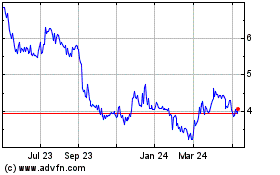

Metalla Royalty and Stre... (TSXV:MTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

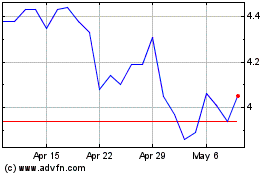

Metalla Royalty and Stre... (TSXV:MTA)

Historical Stock Chart

From Jan 2024 to Jan 2025