Hydreight Technologies Inc. (“

Hydreight” or

the

“Company”) ( TSXV:

NURS )( OTCQB: HYDTF )( FSE: SO6 ), a

fast-growing mobile clinical network and medical platform which

enables flexible at-home medical services across 50 states in the

United States, is pleased to announce its financial results for the

third quarter ended September 30, 2024. All financial information

is presented in Canadian dollars unless otherwise indicated.

Summary of Q3, 2024 Financial

Highlights:

- Q3, 2024 GAAP revenue was

$4.53 million an increase of 47% compared to Q3,

2023.

- Q3 2024 Topline¹ record

revenue of $6.12 million, an increase of 54% compared to Q3,

2023.

- Q3, 2024 Adjusted EBITDA¹

was $48K compared to ($265K) in the comparative

quarter.

- Q3, 2024 gross margin

of $1.53 million compared to $1.27 million in Q3,

2023.

- The company has never

raised or borrowed any additional capital since the original going

public transaction in December 2022.

- The Company’s cash position

at September 30, 2024 is $1.21 million.

- The first 9 months of 2024

GAAP revenue was $12.00 million, an increase of 48% compared to the

first 9 months of 2023.

- The first 9 months of 2024

Topline¹ revenue was $16.58 million, an increase of 37% compared to

the first 9 months of 2023.

- Hydreight Ranked Number 56

Fastest-Growing Company in North America on the 2024 Deloitte

Technology Fast 500™ and 9th in Deloitte’s Technology Fast 50

Program Winners in Canada for 2024

- In partnership with two other companies, Hydreight

launched VSDHOne, a telemedicine and e-Commerce solution, that

helps companies launch a direct to consumer (“DTC”) healthcare

brand in all 50 States.

- Within the first 90 days, VSDHOne sold over 200

licenses across 50 States.

- Announced a normal course issuer bid on August 28,

2024, covering the period from Oct 4, 2024, to October 3,

2025.

- Signed a partnership with a company that works with US

Government agencies for service and healthcare

contracts.

Shane Madden, CEO of Hydreight

commented, “We had an outstanding quarter with record revenue,

Adjusted EBITDA¹ and Adjusted Revenue¹. We are very excited for our

“VSDHONE” products expansion and cashflow from that in the upcoming

year”. Madden continues "Our balance sheet and P&L reflect a

provision for US sales and use tax where we have taken the most

conservative approach in recognizing a liability of uncertain

timing and amount based on our internal and preliminary assessment

of sales and use tax nexus under the most expansive taxability

assumptions. Given the complexity of our corporate structure and

State excise tax laws and regulations, we have engaged external tax

professionals to prepare a detailed review of our corporate

structure to determine the Company’s liability for sales and use

tax by revenue stream at the State-by-State level. We anticipate

the liability to be settled at an amount materially less than the

provision.

The Company believes the following Non-GAAP1

financial measures provide meaningful insight to aid in the

understanding of the Company’s performance and may assist in the

evaluation of the Company’s business relative to that of its

peers:

| |

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

% change |

|

|

2024 |

|

|

2023 |

|

% change |

|

|

|

|

|

|

|

|

|

|

Adjusted Revenue |

$ |

6,122,257 |

|

$ |

3,974,626 |

|

54 |

% |

$ |

16,578,742 |

|

$ |

12,058,150 |

|

37 |

% |

|

Deduct - deferred business partner contract revenue |

|

50,160 |

|

|

(1,784 |

) |

|

|

(253,753 |

) |

|

170,102 |

|

|

|

Deduct - business partner payouts on app service gross revenue |

|

1,545,776 |

|

|

888,191 |

|

|

|

4,828,357 |

|

|

3,751,745 |

|

|

|

GAAP Revenue |

$ |

4,526,320 |

|

$ |

3,088,219 |

|

47 |

% |

$ |

12,004,138 |

|

$ |

8,136,303 |

|

48 |

% |

|

|

|

|

|

|

|

|

|

Adjusted Gross Margin |

$ |

1,583,331 |

|

$ |

1,267,431 |

|

25 |

% |

$ |

4,070,549 |

|

$ |

3,561,578 |

|

14 |

% |

|

Deduct - deferred business partner contract revenue |

|

50,160 |

|

|

(1,784 |

) |

|

|

(253,753 |

) |

|

170,102 |

|

|

|

GAAP Gross Margin |

$ |

1,533,171 |

|

$ |

1,269,215 |

|

21 |

% |

$ |

4,324,302 |

|

$ |

3,391,476 |

|

28 |

% |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

47,690 |

|

$ |

(265,221 |

) |

118 |

% |

$ |

219,525 |

|

$ |

(827,157 |

) |

127 |

% |

|

Deduct - amortization and depreciation |

|

47,094 |

|

$ |

7,470 |

|

|

|

118,283 |

|

|

39,728 |

|

|

|

Deduct - share-based payments |

|

90,534 |

|

$ |

194,282 |

|

|

|

526,988 |

|

|

194,282 |

|

|

|

GAAP Net Loss |

$ |

(89,938 |

) |

$ |

(466,973 |

) |

81 |

% |

$ |

(425,746 |

) |

$ |

(1,061,167 |

) |

60 |

% |

| |

|

|

|

|

|

|

1 Refer to Use of Non-GAAP Financial MeasuresThe

table below sets out a summary of certain financial results of the

Company over the past eight quarters and is derived from the

audited annual consolidated financial statements and unaudited

quarterly consolidated financial statements of the Company.

|

|

|

Net Income (Loss) After Taxes |

Comprehensive Income (Loss) |

Basic and Diluted Income (Loss) Per Share |

|

Fiscal Quarter Ended |

Revenue |

|

September 30, 2024 |

4,526,320 |

(89,938 |

) |

(53,119 |

) |

(0 |

) |

| June 30,

2024 |

4,100,212 |

(27,087 |

) |

(48,184 |

) |

(0 |

) |

| March 31,

2024 |

3,377,606 |

(308,721 |

) |

(370,559 |

) |

(0 |

) |

| December

31, 2023 |

3,373,193 |

(898,561 |

) |

(865,068 |

) |

(0 |

) |

| September

30, 2023 |

3,088,219 |

(466,973 |

) |

(548,954 |

) |

(0 |

) |

| June 30,

2023 |

2,699,668 |

(471,890 |

) |

(405,638 |

) |

(0 |

) |

| March 31,

2023 |

2,348,416 |

(122,304 |

) |

(121,502 |

) |

(0 |

) |

|

December 31, 2022 |

1,695,134 |

(5,060,755 |

) |

(5,062,144 |

) |

(1 |

) |

The Company has experienced dramatic user growth

over the past two years as can be seen by the consistent revenue

growth over the past eight quarters.

The Company continues to deliver on its mission

of building one of the largest mobile clinical networks in the

United States. Through its medical network, pharmacy network and

proprietary technology platform that adheres to the complex

healthcare legislation across 50 states, Hydreight has provided a

fully integrated solution for healthcare providers to become

independent contractors.

Hydreight remains focused on its strategic

priorities of (1) Profitability (2) adding more product and service

offerings for its customers, (3) introducing Hydreight story with

more potential shareholders (4) driving white label partnerships

and Nurses to the platform and (5) looking for strategic tuck in

M&A opportunities to scale and grow the business quickly and

efficiently. Hydreight will continue to invest into its technology

to ensure continuous improvements, advancements and updates

adhering to changes within the healthcare industry.

Please see SEDAR+ for the Company's condensed

interim consolidated unaudited financial statements and MD&A

for the three and six months ended September 30, 2024 and 2023 and

for the Company’s audited annual consolidated financial statements

and MD&A for the year ended December 31, 2023 and 2022.

About VSDHOne - Direct to Consumer

Platform

In a partnership with two other parties,

Hydreight Technologies launched the VSDHOne (Read as

VSDH-One)platform. VSDHOne simplifies the entry challenges for

companies and medi-spa businesses to enter the online healthcare

space compliantly. This platform will help all businesses to launch

a direct-to-consumer healthcare brand in a matter of days in all 50

states. Compliant offerings include: GLP-1s (semaglutide,

tirzepatide), peptides, personalized healthcare treatments,

sermorelin, testosterone replacement therapy (“TRT”), hair loss,

skincare, sexual health and more.

Hydreight invested in technology, legal and

infrastructure to launch this platform. The VSDHOne platform offers

a complete, end-to-end solution for businesses looking to launch

direct-to-consumer healthcare brands. From compliance and

telemedicine technology to nationwide doctor and pharmacy networks,

VSDHOne provides all the tools needed for a seamless entry into the

online healthcare space. The platform is designed to significantly

reduce the time and costs associated with launching such services,

making it possible for businesses to go live in days instead of

months.

About Hydreight Technologies

Inc.

Hydreight Technologies Inc. is building one of

the largest mobile clinic networks in the United States. Its

proprietary, fully integrated platform hosts a network of over 2500

nurses, over 100 doctors and a pharmacy network across 50 states.

The platform includes a built-in, easy-to-use suite of fully

integrated tools for accounting, documentation, sales, inventory,

booking, and managing patient data, which enables licensed

healthcare professionals to provide services directly to patients

at home, office or hotel. Hydreight is bridging the gap between

provider compliance and patient convenience, empowering nurses, med

spa technicians, and other licensed healthcare professionals. The

Hydreight platform allows healthcare professionals to deliver

services independently, on their own terms, or to add mobile

services to existing location-based operations. Hydreight has a

503B pharmacy network servicing all 50 states and is closely

affiliated with a U.S. certified e-script and telemedicine provider

network.

On behalf of the Board of DirectorsShane MaddenDirector and

Chief Executive OfficerHydreight Technologies Inc.

Contact

Email: ir@hydreight.com; Telephone:

(702) 970 8112

This press release does not constitute an offer

of securities for sale in the United States. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States

absent U.S. registration or an applicable exemption from U.S.

registration requirements.

Use of Non-GAAP Financial

Measures:

This release contains references to non-GAAP

financial measures Adjusted Revenue (also referred to as Topline

Revenue), Adjusted Gross Margin, and Adjusted EBITDA. The Company

defines Adjusted Revenue as gross cash income before adjustment for

the deferred portion of business partner contract revenue and gross

receipts from Hydreight App service sales. The Company defines

Adjusted Gross Margin as GAAP gross margin plus inventory

impairment plus the deferred portion of business partner contract

revenue. The Company defines Adjusted EBITDA as net income (loss)

before interest, taxes, depreciation and amortization and before

(i) transaction, restructuring, and integration costs and

share-based payments expense, and (iii) gains/losses that are not

reflective of ongoing operating performance. The Company believes

that the measures provide information useful to its shareholders

and investors in understanding the Company’s operating cash flow

growth, user growth, and cash generating potential for funding

working capital requirements, service future interest and principal

debt repayments and fund future growth initiatives. These non-GAAP

measures may assist in the evaluation of the Company’s business

relative to that of its peers more accurately than GAAP financial

measures alone. This data is furnished to provide additional

information and does not have any standardized meaning prescribed

by GAAP. Accordingly, it should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with GAAP and is not necessarily indicative of other metrics

presented in accordance with GAAP.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release. This

press release does not constitute an offer of securities for sale

in the United States. The securities being offered have not been,

nor will they be, registered under the United States Securities Act

of 1933, as amended, and such securities may not be offered or sold

within the United States absent U.S. registration or an applicable

exemption from U.S. registration requirements.

Cautionary Note Regarding

Forward-Looking Information

This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, path to profitability, intentions, beliefs and current

expectations of the Company with respect to future business

activities and operating performance. Forward-looking information

is often identified by the words “may”, “would”, “could”, “should”,

“will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”,

“expect” or similar expressions and includes information regarding

expectations for the Company's growth and profitability in

2024.

Investors are cautioned that forward-looking

information is not based on historical facts but instead reflects

the Company’s management’s expectations, estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the statements are made. Although the Company believes

that the expectations reflected in such forward-looking information

are reasonable, such information involves risks and uncertainties,

and undue reliance should not be placed on such information, as

unknown or unpredictable factors could have material adverse

effects on future results, performance or achievements of the

Company. Among the key factors that could cause actual results to

differ materially from those projected in the forward-looking

information are the following: the ability to obtain requisite

regulatory and other approvals with respect to the business

operated by the Company and/or the potential impact of the listing

of the Company’s shares on the TSXV on relationships, including

with regulatory bodies, employees, suppliers, customers and

competitors; changes in general economic, business and political

conditions, including changes in the financial markets; changes in

applicable laws; compliance with extensive government regulation;

and the diversion of management time as a result of being a

publicly listed entity. This forward-looking information may be

affected by risks and uncertainties in the business of the Company

and market conditions.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and does not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

¹See Use of Non-GAAP Financial Measures

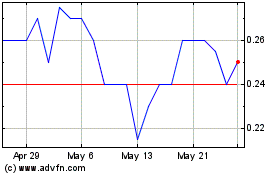

Hydreight Technologies (TSXV:NURS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hydreight Technologies (TSXV:NURS)

Historical Stock Chart

From Feb 2024 to Feb 2025