Nevada Zinc Corporation (“

Nevada Zinc” or the

“

Company”) (

TSX-V: NZN) is

pleased to comment on the U.S. Department of Agriculture

(“

USDA”) announcement to support additional

fertilizer production. On March 11, 2022, the USDA announced plans

for a US$250 million investment to support innovative American-made

fertilizer to provide US farmers with more choices in the

marketplace.

Nevada Zinc, with its unique Lone Mountain

high-grade zinc carbonate-oxide project, is planning on becoming a

Nevada-based producer of zinc sulfate monohydrate, commonly used as

a micronutrient fertilizer or a source of zinc in fertilizer

products. The Company recently commenced a bulk operation to

produce zinc sulfate monohydrate as part of its ongoing multiphase

pilot plant program.

Zinc plays an important role in plant

development and is an essential element in soil health. It is an

important component of various enzymes that are responsible for

driving metabolic reactions in all crops. Zinc deficiency in soils

and plants is a global micronutrient deficiency problem with

carbohydrate, protein, and chlorophyll formation being

significantly reduced in zinc-deficient crops.

Max Vichniakov, President and CEO of Nevada Zinc

commented: “We are extremely pleased to see the recent USDA

announcement on its initiative to strengthen domestic fertilizer

production. Our zinc sulfate would be produced from a naturally

occurring zinc carbonate-oxide mineralization from our site in

central Nevada which we expect would meet the USDA’s program

designed to support independent, made in America, innovative,

sustainable, and farmer-focused fertilizer production. In this

light, we are very excited about our ongoing multiphase pilot plant

program with the objective of designing a sustainable,

environmentally friendly process to make a naturally produced,

traceable to the source, high-grade zinc sulfate product”.

Closing of Debt Settlement

Further to the Company’s press release dated

February 22, 2022, Nevada Zinc is pleased to announce that it has

issued an aggregate of 5,197,813 common shares in the capital of

the Company (the “Common Shares”), at a deemed

price of $0.075 per Common Share, in consideration for the

settlement of an aggregate of $389,836 in accrued liabilities owing

to certain of its creditors in respect of intercorporate debts and

management fees (the “Debt Settlement”). A

majority of the Debt Settlement, namely $332,236, was advanced to

the Company by Olive Resource Capital Inc.

(“Olive”, formerly Norvista Capital Corporation)

and its affiliated entities, in connection with the Company’s

mineral lease payments and mining claims maintenance fees paid over

the course of 2019 and 2020. The Debt Settlement is aimed at

preserving the Company’s cash and improving its balance sheet.

The Common Shares issued pursuant to the Debt

Settlement will be subject to a hold period expiring on July 19,

2022.

Immediately prior to the completion of the Debt

Settlement, Olive held, directly or indirectly, 13,573,593 Common

Shares, representing approximately 14.39% of the Common Shares then

issued and outstanding on a non-diluted basis. Following the Debt

Settlement Olive holds, directly or indirectly, 18,003,406 Common

Shares, representing approximately 18.09% of Common Shares issued

and outstanding on a non-diluted basis. Olive increased its

position in the Company for investment purposes, and in accordance

with applicable securities laws, and depending on market and other

conditions, Olive may from time to time in the future increase or

decrease its ownership, control or direction over the Common Shares

it holds, through market transactions, private agreements, or

otherwise. For the purposes of this notice, the address of Olive is

82 Richmond Street East, Toronto, Ontario, M5C 1P1.

This disclosure is made pursuant to National

Instrument 62-103 - The Early Warning System and Related Take-Over

Bid and Insider Reporting Issues, which also requires a report to

be filed with regulatory authorities in each of the jurisdictions

in which Olive is a reporting issuer containing information with

respect to the foregoing matters (the "Early Warning

Report"). A copy of the Early Warning Report is available

on the Company’s profile on SEDAR at www.sedar.com.

About Nevada Zinc

Nevada Zinc is an exploration and development

company focused on its wholly-owned Lone Mountain zinc project in

central Nevada, with the strategic objective of producing

zinc-based products including fertilizers, animal feed, and

chemicals. In July 2020, the Company entered into a Collaboration

Agreement with Cameron Chemicals Inc. (“Cameron”),

a leading U.S. producer and distributor of granular micronutrients

to the agricultural, turf, and horticultural industries with

manufacturing facilities in Washington, Virginia and Michigan.

Under the terms of the Collaboration Agreement, Nevada Zinc and

Cameron would work together to establish a range of zinc-based

micronutrient fertilizers to be produced by the Company and

marketed by Cameron through its distribution networks. In March

2021, Nevada Zinc commenced a multiphase pilot plant program to

produce zinc sulfate and further de-risk and advance the Lone

Mountain high-grade zinc carbonate-oxide deposit.

Additional information about the Company is

available on the Company’s website: www.nevadazinc.com

For further information please contact:

Nevada Zinc Corporation

82 Richmond St. East, First FloorToronto, Ontario M5C 1P1Tel:

416-409-8441 Email: info@nevadazinc.com

Max Vichniakov, President, CEO and Director

Caution Regarding Forward-Looking

Statements

This news release may contain forward-looking

statements including but not limited to comments regarding the

Company’s objectives, goals or future plans, exploration results,

potential mineralization, the estimation of mineral resources,

exploration and mine development plans, timing, procedure and

content of upcoming test work and pilot plant programs, timing of

commencement of operations, estimates of market conditions,

successful completion of ongoing programs, projected demands for

zinc and plant fertilizer, the Company’s ability to obtain funding

under or otherwise benefit from government initiatives, potential

economic outcomes, etc. The Company’s operations are in the

development stage only and there is no actual mineral production;

without a formal independent feasibility study, there is no

assurance that mineral production is feasible on an economic basis.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "does not expect", "plans", "anticipates", "does not

anticipate", "believes", "intends", "estimates", "projects",

"potential", "scheduled", "forecast", "budget" and similar

expressions, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. Forward-looking statements are

based on the current opinions and expectations of management. All

forward-looking information is inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including

failure to identify mineral resources, inaccuracy of preliminary

results, the inability to complete a feasibility study which

recommends a production decision, delays in obtaining or failures

to obtain required governmental, environmental or other project

approvals, fluctuating commodity and zinc chemicals prices, an

inability to predict demand for zinc and plant fertilizer, an

inability to predict and counteract the effects of COVID-19 on the

business of the Company (including but not limited to the effects

on the price of commodities, capital market conditions, restriction

on labour and international travel, and disruptions to supply

chains), changes to government initiatives in the US, the changing

regulatory landscape in the US and abroad, the effectiveness and

feasibility of technologies which have not yet been tested or

proven on a commercial scale, competitive risks and the

availability of financing, as described in more detail in our

recent securities filings available at www.sedar.com. Actual events

or results may differ materially from those projected in the

forward-looking statements and the Company cautions against placing

undue reliance thereon. The Company assumes no obligation to revise

or update these forward-looking statements except as required by

applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) has reviewed or accepts

responsibility for the adequacy or accuracy of this news

release.

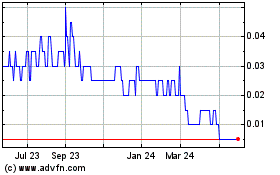

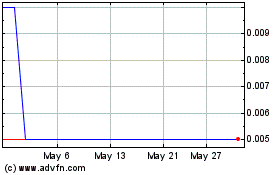

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Nov 2024 to Nov 2024

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Nov 2023 to Nov 2024