▼ Strong increase in sales: resilient volumes across almost

all cement markets and higher selling prices ▼ Recovery in

profitability, especially with the gradual ramp-up in the Ragland

plant’s new kiln ▼ Tight grip on debt with the leverage

ratio falling over the past year to 2.6x ▼ FY 2023 EBITDA is

expected to rise towards a level appreciably above that recorded in

2021

Regulatory News:

Vicat (Paris:VCT):

Condensed income statement approved by the Board of Directors

on 25 July 2023

(€ million)

H1 2023

H1 2022

Change (reported)

Change (at constant scope and

exchange rates)

Consolidated sales

1,912

1,755

+9.0%

+16.5%

EBITDA

314

269

+17.0%

+21.6%

Margin (%)

16.4%

15.3%

Recurring EBIT

166

128

+29.4%

+34.4%

Margin (%)

8.7%

7.3%

Consolidated net income

109

88

+24.5%

+17.8%

Margin (%)

5.7%

5.0%

Net income, Group share

94

78

+20.9%

+14.0%

Cash flow from operations

239

218

+9.5%

+10.1%

Guy Sidos, the Group’s Chairman and CEO commented:

“The Vicat Group recorded a solid set of first-half 2023

results. Demand for cement remained broadly favourable across all

our markets, with pricing levels offsetting the cumulative effects

of cost inflation, especially higher energy prices. Profitability

moved higher in line with our expectations, with the ramp-up in the

Ragland plant’s new kiln in the United States, which will continue

during the second half. However, the Group has not yet returned to

its pre-crisis margins rates.

I’d like to thank all our teams for their unwavering commitment

enabling us to reach our industrial, financial and climate targets.

The Group has reduced its specific carbon emissions by 3.6% from

the level of 591 kg CO2 net per tonne of cement equivalent of a

year ago and is on pace to reach its climate roadmap goal of 497 kg

CO2 net per tonne of cement equivalent by 2030.”

Disclaimer:

- In this press release, and unless indicated otherwise, all

changes are stated on a year-on-year basis (2023/2022), and at

constant scope and exchange rates.

- The alternative performance measures (APMs), such as “at

constant scope and exchange rates”, “operational sales”, “EBITDA”,

“EBIT”, “net debt”, “gearing” and “leverage” are defined in the

appendix to this press release.

- This press release may contain forward-looking statements. Such

forward-looking statements do not constitute forecasts regarding

results or any other performance indicator, but rather trends or

targets. These statements are by their nature subject to risks and

uncertainties as described in the Company’s annual report available

on its website (www.vicat.fr). These statements do not reflect the

future performance of the Company, which may differ significantly.

The Company does not undertake to provide updates on these

statements.

Further information about Vicat is available from its website

(www.vicat.fr).

The Group’s consolidated sales grew in the first six

months of 2023. This increase chiefly reflected:

- growth in Cement volumes to an extent varying from market to

market, with a slowdown in certain developed markets (France,

Switzerland) and positive momentum in the Mediterranean and, to a

lesser extent, in Africa;

- an increase in selling prices across almost all Vicat’s

markets in an inflationary environment resulting mainly from

energy costs.

Overall, the Group’s consolidated sales totalled

€1,912 million, up from €1,755 million in the first six

months of 2023, representing a +9.0% rise on a reported basis.

These trends reflected:

- organic growth of +16.5% at constant scope and exchange

rates;

- an unfavourable currency effect of –7.5%, representing a

negative impact of –€131 million over the period. Appreciation in

the US dollar and Swiss franc against the euro offset only to a

very limited extent the impact of depreciation in the Turkish lira

and Egyptian pound against the euro;

- negligible changes in the scope of consolidation over the

period.

The Group’s operational sales totalled €1,938 million

over the period, up +9.0% on a reported basis and up +16.3% at

constant scope and exchange rates. Each of the Group’s businesses

contributed to this positive trend.

The Group’s consolidated EBITDA came to €314 million in

the first half of 2023, up +17.0% on a reported basis and up +21.6%

at constant scope and exchange rates compared to the first half of

2022. The EBITDA margin on consolidated sales came to 16.4%, an

increase of +110 basis points year-on-year. The trend in reported

EBITDA reflects an unfavourable currency effect of –€12

million.

At constant scope and exchange rates, the EBITDA increase flowed

from a year-on-year price-cost differential that was

favourable owing to:

- the ramp-up in the Ragland plant’s new kiln, whereas

start-up operations had adversely affected results in the first

half of 2022;

- the impact of price increases introduced across almost all

Group markets, which tempered the increase in variable costs,

especially energy. In the first half of 2023, energy costs grew

+12% at constant volume to €327 million, up from €293 million in

the first half of 2022;

- greater use of alternative fuels, which rose by +4.1

points relative to the same period of 2022, replacing fossil

fuels;

- Lastly, the basis of comparison for EBITDA was made more

favourable with a return to normal levels in maintenance costs in

France.

Compared with the first half of 2021, EBITDA moved +4.8%

higher on a reported basis, in line with the outlook given by the

Group at the beginning of the year. Nonetheless, the EBITDA margin

was 280 basis points below the 19.2% level recorded in the first

six half of 2021. Selling price increases offset the impact of

cumulative higher costs but have not yet restored the Group’s

margins to their previous levels.

Recurring EBIT totalled €166 million in the first half of

2023 compared with €128 million in the same period of 2022. That

represented an increase of +29.4% on a reported basis and of +34.4%

at constant scope and exchange rates. The recurring EBIT margin on

consolidated sales came to 8.7%, a year-on-year increase of +140

basis points.

The Group’s operating income totalled €161 million,

representing a rise of +25.7% on a reported basis and of +30.6% at

constant scope and exchange rates.

The –€32 million movement during the first half of 2023 in

net financial income (expense) relative to 2022 was

attributable to:

- the –€22 million year-on-year increase in the cost of the net

debt, including:

- a –€11 million increase in interest expense, offset partially

by €6 million in hedging gains;

- the change in the method used to account for caps (designated

as hedges from December, leading to a –€20 million impact relative

to the first half of 2022).

- a negative currency effect of –€7 million (–€4 million increase

compared with 2022), predominantly as a result of depreciation in

the euro against the Egyptian pound and Turkish lira;

Tax expense declined €20 million compared with 2022. The

effective tax rate was 12.4%, far lower than the first-half 2022

rate of 29.6%. A key factor was the cancellation of a €26 million

non-recurring tax liability owing to a merger between entities in

Brazil.

Consolidated net income totalled €109 million in the

first half of 2023, up +17.8% at constant scope and exchange rates

and up +24.5% on a reported basis relative to the same period of

2022.

Net income, Group share rose +14.0% at constant scope and

exchange rates and +20.9% on a reported basis to €94 million.

Non-controlling interest rose €5 million in the first half of 2023

related to the non-recurring deferred tax income resulting from the

reorganisation in Brazil.

Cash flow from operations came to €239 million, up +9.5%

on a reported basis and up +10.1% at constant scope and exchange

rates.

1. Income statement analysed by geographical region

1.1. Income statement, France

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant scope and

exchange rates)

Consolidated sales

630

606

+4.0%

+4.0%

EBITDA

106

80

+31.7%

+31.7%

Recurring EBIT

58

31

+85.8%

+85.8%

The Group’s sales in France were mixed during the first

half of 2023, with cement volumes contracting slightly and a more

significant slowdown in concrete and aggregates. Even so, the Group

raised its selling prices, which offset the impact of the higher

production costs, especially those linked to energy price inflation

(up +12% in the first half of 2023 relative to the same period of

2022). As a result, EBITDA rose +31.7% in the first half of 2023.

Although first-half EBITDA was slightly above its 2021 level, the

EBITDA margin still lagged behind previous levels (16.8% in 2023

versus 18.5% in 2021).

- Cement – Operational sales rose +15.9% at constant scope. The

selling price increases introduced since 2022 to curb the effects

of inflation enabled to offset the slight decline in production

volumes in France (lower residential construction and stable level

of public works);

- Concrete & Aggregates – Operational sales declined –2.2% at

constant scope. This performance was the product of lower concrete

and aggregates volumes as a result of the slowdown in residential

construction and roadworks sectors, partially offset by the hikes

in selling prices to make up for the effects of inflation in the

cost of raw materials and transport costs on margins. As a result,

EBITDA generated in the period moved up +1.3% at constant

scope.

- Other Products & Services – Operational sales edged up

+0.5% at constant scope over the period. The EBITDA recorded by the

business climbed +5.0% over the period.

1.2 Income statement for Europe (excluding France)

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant

scope and exchange rates)

Consolidated sales

195

184

+6.4%

+2.1%

EBITDA

46

41

+11.6%

+7.7%

Recurring EBIT

29

25

+16.0%

+11.3%

Sales in Europe (excluding France) rose in the first half

of 2023, supported by favourable pricing conditions, which more

than made up for the volume contraction in Switzerland. EBITDA

moved up +11.6% during the period on a reported basis and up +7.7%

at constant scope and exchange rates with the Swiss franc’s

appreciation against the euro.

In Switzerland, the Group’s consolidated sales were

stable at constant scope and exchange rates (up +4.7% on a reported

basis). EBITDA rose +7.3% at constant scope and exchange rates. The

EBITDA margin on operational sales improved in the first half of

2023 to 24.3%.

- Cement – Operational sales grew +5.4% at constant scope and

exchange rates in the first six months of 2023. This evolution

reflects a small contraction in demand during the period, largely

offset by a solid increase in selling prices. The EBITDA generated

by the business rose +17.8% at constant scope and exchange

rates.

- Concrete & Aggregates – Operational sales declined –7.0% at

constant scope and exchange rates amid weaker demand in both

concrete and aggregates. Selling prices moved higher, especially in

concrete, but this rise was not sufficient to fully offset the

inflationary pressures affecting inputs. As a result, the EBITDA

generated by this business fell –20.6% at constant scope and

exchange rates.

- Other Products & Services – Operational sales moved up

+8.1% at constant scope. The EBITDA generated by the business

grew.

In Italy, consolidated sales rose +24.6% at constant

scope and exchange rates. Volumes rose and selling prices moved

significantly higher. EBITDA grew +12.3% owing to the impact of the

inflation in production costs.

1.3 Income statement for the Americas

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant

scope and exchange rates)

Consolidated sales

450

401

+12.3%

+11.0%

EBITDA

84

55

+52.6%

+50.7%

Recurring EBIT

45

22

+102.1%

+99.6%

Business grew across the Americas, with sales moving up

+11.0% at constant scope and exchange rates, supported by a steady

increase in selling prices and delivery volumes. The region

benefited from the ramp-up in production and commercial operations

at the Ragland plant’s new kiln. As a result, EBITDA in the

Americas rose +50.7% at constant scope and exchange rates in the

first half of 2023 by comparison with the same period in 2022.

In the United States, the industry environment remained

broadly positive, but performance varied from market to market,

California was affected by heavy rainfall, which had an impact on

the construction market for most of the period, while the

South-East US region achieved strong growth, as the ramp-up in the

Ragland plant’s new kiln enabled the Group to capitalise on

supportive market conditions. Price increases were introduced in

the first half to offset the effects of inflation. Consolidated

sales totalled €318 million, up +15.1% at constant scope and

exchange rates. As a result of these factors and the low basis of

comparison linked to the Ragland kiln’s start-up in 2022, EBITDA

totalled €56 million, up +59.5% at constant scope and exchange

rates.

- Cement – Operational sales grew +19.2% at constant scope and

exchange rates in the first six months of 2023. A significant

increase in selling prices and the ramp-up in the Ragland’s new

kiln were the main drivers behind this increase. EBITDA rose +27.9%

at constant scope and exchange rates.

- Concrete & Aggregates – Operational sales moved up +11.2%

at constant scope and exchange rates, with mixed performance across

the region as a whole. Torrential rain dampened demand in

California, while the concrete business was boosted by the greater

availability of cement in Alabama with the ramp-up in the Ragland

plant’s new kiln. Selling prices moved higher in both the Group’s

markets. As a result, EBITDA soared +189% over the period.

In Brazil, consolidated sales totalled €132 million, up

+2.0% at constant scope and exchange rates. Sales were held back by

the slowdown in the Brazilian economy, but the hike in prices to

offset the higher production costs made a positive contribution. As

a result, EBITDA rose +35.5% at constant scope and exchange rates

to €28 million in the first half of 2023.

- Cement – Operational sales were €103 million in the first half

of 2023, in line with 2022 at constant scope and exchange rates.

The increase in selling prices and improved industrial performance

offset the impact of higher production costs and volume

contraction. As a result, EBITDA rose +46.9% at constant scope and

exchange rates.

- Concrete & Aggregates business – Operational sales came to

€46 million, an increase of +12.8% at constant scope and exchange

rates, supported by higher selling prices. EBITDA rose +2.7% at

constant scope and exchange rates.

1.4 Asia (India and Kazakhstan)

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant

scope and exchange rates)

Consolidated sales

233

249

–6.5%

–1.2%

EBITDA

32

52

–39.2%

–36.0%

Recurring EBIT

15

35

–56.1%

–54.0%

In India, consolidated first-half 2023 sales came to €201

million, stable compared with 2022 at constant scope and exchange

rates, but down –6.0% on reported basis. Amid robust demand and

aggressive competition, especially in southern India, the Group

introduced price increases, but these only partially offset the

still high level of input costs in the first six months, especially

energy costs. Volumes remained stable over the period.

EBITDA came to €26 million in the first half of 2023, down

–27.4% at constant scope and exchange rates compared with the first

half of 2022.

Consolidated sales in Kazakhstan came to €32 million,

down –10.2% at constant scope and exchange rates.

This performance reflects a contraction in delivery volumes

towards the beginning of the year given the severe logistics

disruption to the Kazakh rail operator and lower prices.

EBITDA came to €6 million, down -58.4% in the first half of 2023

at constant scope and exchange rates compared with the first half

of 2022.

1.5 Mediterranean (Turkey and Egypt) income statement

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant

scope and exchange rates)

Consolidated sales

196

145

+34.9%

+126.0%

EBITDA

21

16

+26.9%

+110.0%

Recurring EBIT

12

9

+24.9%

+105.9%

Volumes picked up in the Mediterranean region, and

selling prices achieved healthy momentum in local currency amid

high inflation. However, performance was held back by the

significant depreciation in the Turkish lira and Egyptian pound

against the euro during the period.

In Turkey, the market grew sharply during the first six

months thanks to an upbeat construction sector and better weather

conditions at the beginning of the year. Hyperinflation and the

strong depreciation in the Turkish lira against the euro were again

the main factors influencing the macroeconomic environment. The

Group maintained its strategy of firm support for prices to offset

the effects of inflation on production costs. As a result,

consolidated sales totalled €124 million in the first half of 2023,

up +123% at constant scope and exchange rates and up +36.6% on a

reported basis.

EBITDA moved higher in the first six months of 2023, totalling

€17 million, despite a negative currency impact of -€11

million.

- Cement – The Group recorded a strong increase in volumes owing

to the combined impact of favourable weather conditions and

supportive demand from the construction sector despite the

hyperinflationary environment. As a result, the Group’s operational

sales rose +128% at constant scope and exchange rates and +39.6% on

a reported basis to reach €90 million. EBITDA also rose +90.5% at

constant scope and exchange rates.

- Concrete & Aggregates business – Operational sales rose

+102% at constant scope and exchange rates to €56 million thanks to

growth in concrete and aggregates volumes. Significant price hikes

were introduced, following the Cement business’ lead. EBITDA moved

up +81.9% at constant scope and exchange rates.

In Egypt, consolidated sales totalled €72 million, up

+130% at constant scope and exchange rates and up +32.0% on a

reported basis as the depreciation in the Egyptian pound against

the euro had a negative impact. Amid sluggish conditions in the

domestic market, business was boosted by an opportunity to export

clinker. In the domestic market, where the market regulation

agreement introduced by the authorities remains in place, selling

prices continued to improve, which almost completely offset the

impact of higher input costs. As a result, the EBITDA generated in

Egypt recovered further in the first six months of 2023, almost

reaching €4 million despite a negative currency impact of -€3

million.

1.6 Africa (Senegal, Mali, Mauritania) income

statement

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant

scope and exchange rates)

Consolidated sales

208

170

+22.2%

+21.7%

EBITDA

26

24

+11.0%

+10.3%

Recurring EBIT

7

6

+21.8%

+20.0%

In Africa, the Group continued to reap the benefit of

positive sector demand trends, especially with the sharp recovery

in the Malian market after the political crisis, which had

significantly cut deliveries to the country during the first six

months of 2022 and the resumption of government projects in

Senegal.

- Cement – Operational sales in the Africa region grew +20.3% at

constant scope and exchange rates. The increase in capacity

currently underway will enable to reduce production costs and meet

strong market demand. In Mali, the Group benefited from a

favourable basis of comparison because of the closure of Mali’s

borders, which had impacted sales in the first half of 2022. Prices

rose in Senegal with the increase in government cement price cap in

September 2022. As a result, EBITDA moved up +16.1% over the

period.

- Aggregates – In Senegal, aggregates sales were again

underpinned by the public works sector as major projects went

ahead. Operational sales climbed +19.7% at constant scope and

exchange rates to €21 million. Selling prices remained stable over

the period as a result of an unfavourable mix effect. EBITDA moved

–13.4% lower at constant scope and exchange rates in the first half

of 2023.

2. Changes in the Group’s financial position at 30 June

2023

At 30 June 2023, the Group’s financial structure remained

solid, with a strong equity base and net debt under control.

Consolidated equity totalled €2,853 million at that date, compared

with €2,896 million at 30 June 2022.

(€ million)

30 June 2023

31 December 2022

30 June 2022

Gross financial debt

2,055

2,070

2,153

Cash

–463

–504

–481

Net financial debt

1,592

1,567

1,670

EBITDA (12-month rolling)

616

570

588

Leverage ratio (x)

2.59

2.75

2.84

Medium- to long-term borrowings are subject to special clauses

(covenants) requiring certain financial ratios to be met. Given the

level of Group’s net debt and balance sheet liquidity, the bank

covenants do not pose a risk for the Group’s financial

position.

The average interest rate on gross debt at 30 June 2023 was 3.6%

– stable compared with at 31 December 2022. The average maturity of

the Group’s debt was 4.7 years at 30 June 2023.

3. Capital expenditure and free cash flow

Capital expenditure totalled €144 million in the first six

months of 2023, up from €178 million in the equivalent period of

2022. These include amounts linked to the Group’s strategic

investments, including the Ragland plant’s new kiln and the new

kiln in Senegal.

Free cash flow amounted to €71 million, versus –€203 million in

the first half of 2022. This improvement in free cash flow derived

from the increase in EBITDA during the first six months of 2023 and

a normalisation in the change in working capital requirement.

4. Climate performance

In February 2023, the Vicat Group announced a significantly more

ambitious 2030 carbon emission reduction target: Vicat now aims

to reduce its emissions to 497 kg CO2 net per tonne of cement

equivalent by 2030 (versus the previous target 540 kg CO2 net

per tonne of cement equivalent), with a specific target for the

Europe region of 430 kg CO2 net per tonne of cement equivalent.

By the mid-point of 2023, Vicat is in line with its 2030 target,

recording average Group-wide emissions of 591 kg net CO2 per tonne

of cement equivalent, which represents an improvement of –3.6% on

the first-half 2022 level and –2.8% on the second-half 2022

level.

This performance was achieved through implementation of the

Group’s climate roadmap. Notable achievements included the

4.1-point increase in use of alternative fuels to 31.5% and a

–0.5-point reduction in the clinker rate to 77.4%.

5. Recent events

With effect from 1 October 2023, Gianfranco Tantardini has

been appointed Executive Vice-President in charge of the Asia and

Mediterranean regions.

Pierre Pedrosa has been appointed as Director of Financial

Communications and Investor Relations.

Pierre Pedrosa has joined the Vicat Group as Director of

Financial Communications and Investor Relations in June 2023. He

reports directly to Hugues Chomel, Executive Vice-President and

Group Chief Financial Officer. An engineer by training, Pierre

began his career in industry in operational roles. He has over 10

years' experience in finance, gained in institutional asset

management and investor relations.

6. Outlook for 2023

In 2023, the Group is targeting further significant sales

growth, with its markets overall expected to display resilience

and reflect the full benefit of the price hikes in selling prices

implemented in 2022 and the fresh increases introduced in 2023. In

addition, performance in 2023 will reap the benefit of:

- the full impact of the new kiln at the Ragland plant in the

United States;

- elimination of the non-recurring costs incurred in 2022;

- a stabilisation in energy costs.

Taking these factors into

account, the Group’s 2023 EBITDA is expected to rise towards a

level appreciably above that recorded in 2021.

Previously (3 May 2023): “towards a level at

least equivalent to that recorded in 2021”

In 2023 and 2024, the Group plans to scale back its capital

expenditure outlays to around €350 million in 2023 followed by

another reduction in 2024. Over the period as a whole, this capital

expenditure will focus on:

- completion of the construction work on the new kiln in

Senegal;

- investment projects to meet the carbon footprint reduction

targets; and

- maintenance capex.

The Group does not plan to launch any further strategic

growth capex projects until the leverage ratio has been brought

down below 2.0x.

Outlook for 2023 by country:

- in France, demand may tail off slightly during the year,

with conditions affected by inflation and interest rate hikes.

Selling prices are expected to rise further, however, to offset

cost inflation, particularly in energy costs;

- in Switzerland, the market is expected to contract over

the full year, stabilising progressively in the second half. As in

France, selling prices are expected to move higher, after the

increases introduced at the beginning of the year;

- in the United States, business trends are expected to

remain strong and favour logistics over office real estate. In the

South-East, the Group will reap the benefit of the commercial

ramp-up in the new industrial facility, which is expected to

continue in the second half and favourable price conditions. To

recap, sales in the second and third quarters of 2022 were impacted

in the South-East US region by the start-up of the Ragland plant’s

new kiln;

- in Brazil, business levels in the markets in which the

Group operates may decline slightly over the year amid persistently

fierce competition. The strong industrial performance should help

bring down cost prices;

- In India, the macroeconomic environment is expected to

remain favourable, with demand strengthening. Amid still aggressive

competition, prices are expected to remain volatile, with energy

prices set to head lower in the second part of the year;

- In Kazakhstan, despite a persistently high basis for

comparison and fiercer competition, market conditions are expected

to remain favourable provided efficient rail logistics are

restored;

- in Turkey, amid a still uncertain macroeconomic

environment, the Group will mobilise its production facilities to

meet demand arising from the reconstruction drive and will continue

to pursue a pricing policy geared to the hyperinflationary

environment;

- In Egypt, the economic and monetary effects of the

Ukrainian crisis have caused the overall outlook and the country’s

currency to deteriorate. With the sector agreement in force since

July 2021 expected to remain in place, the Group anticipates stable

demand and further improvement in selling prices, which will curb

the effects of inflation. It also foresees further clinker export

opportunities;

- in West Africa, trends in Cement are expected to remain

dynamic as a result of a favourable sector environment, especially

after the recent reopening of the border with Mali. With cement

price controls still in place in Senegal, the full impact of cost

increases is unlikely to be offset. Infrastructure project-led

growth in the Aggregates business in Senegal is expected to

continue.

Presentation meeting and conference call

To accompany this publication, the Vicat Group is holding an

information conference call in English on 27 July 2023 at 3pm Paris

time (2pm London time and 9am New York time).

To take part in the conference call live, dial in on one of the

following numbers:

France: +33 (0)1 70 37 71 66 United Kingdom: +44 (0)33 0551 0200

United States: +1 786 697 3501

The conference call will also be livestreamed from the Vicat

website or by clicking here. A replay of the conference call will

be immediately available for streaming via the Vicat website or by

clicking here.

The presentation supporting the event will be available on

Vicat’s website or by clicking here from 10am.

Next event:

Third-quarter 2023 sales on 7 November 2023.

About Vicat

The Vicat Group has close to 9,500 employees working in three

core divisions, Cement, Concrete & Aggregates and Other

Products & Services, which generated consolidated sales of

€3.642 billion in 2022. The Group operates in twelve countries:

France, Switzerland, Italy, the United States, Turkey, Egypt,

Senegal, Mali, Mauritania, Kazakhstan, India and Brazil. The Vicat

Group, a family-owned group, is the heir to an industrial tradition

dating back to 1817, when Louis Vicat invented artificial cement.

Founded in 1853, the Vicat Group now operates three core lines of

business: Cement, Ready-Mixed Concrete and Aggregates, as well as

related activities.

Vicat Group – Financial data – Appendix

Definition of alternative performance measures

(APMs):

- Performance at constant scope and exchange rates is used

to determine the organic growth trend in P&L items between two

periods and to compare them by eliminating the impact of exchange

rate fluctuations and changes in the scope of consolidation. It is

calculated by applying exchange rates and the scope of

consolidation from the prior period to figures for the current

period.

- A geographical (or a business) segment’s operational

sales are the sales posted by the geographical (or business)

segment in question less intra-region (or intra-segment)

sales.

- EBITDA (earnings before interest, tax, depreciation and

amortisation): sum of gross operating income and other income and

expenses on ongoing business.

- EBIT: (earnings before interest and tax): EBITDA less

net depreciation, amortisation, additions to provisions and

impairment losses on ongoing business.

- Cash flow from operations: net income before net

non-cash expenses (i.e., predominantly depreciation, amortisation,

additions to provisions and impairment losses, deferred taxes,

gains and losses on disposals and fair value adjustments).

- Free cash flow: net operating cash flow after deducting

capital expenditure net of disposals.

- Net debt represents gross debt (consisting of the

outstanding amount of borrowings from investors and credit

institutions, residual financial liabilities under finance leases,

any other borrowings and financial liabilities excluding options to

sell and bank overdrafts), net of cash and cash equivalents,

including remeasured hedging derivatives and debt.

- Gearing is a ratio reflecting a company’s financial

structure calculated as net debt/consolidated equity.

- Leverage is a ratio based on a company’s profitability,

calculated as net debt/consolidated EBITDA.

Income statement by business

Cement

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant scope and

exchange rates)

Volume (thousands of tonnes)

13,967

13,457

3.8%

Operational sales

1,236

1,095

12.9%

23.5%

Consolidated sales

1,058

937

12.9%

24.1%

EBITDA

224

192

16.8%

22.0%

EBIT

130

105

23.9%

28.6%

Concrete & Aggregates

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant scope and

exchange rates)

Concrete volumes (thousands of

m3)

4,696

4,957

–5.3%

Aggregates volumes (thousands of

tonnes)

11,810

12,049

–2.0%

Operational sales

708

675

4.8%

9.1%

Consolidated sales

691

659

4.9%

9.1%

EBITDA

74

63

17.6%

21.6%

EBIT

28

18

58.2%

67.6%

Other Products & Services

(€ million)

H1 2023

H1 2022

Change

(reported)

Change (at constant scope and

exchange rates)

Operational sales

232

226

2.6%

4.5%

Consolidated sales

163

158

2.9%

2.4%

EBITDA

16

14

15.7%

16.1%

EBIT

8

6

39.6%

37.4%

Principal H1 2023 financial statements

The full set of consolidated financial statements for the first

six months of 2023, together with the notes, are now available on

the Company’s website at: www.vicat.fr.

Consolidated income statement

(in thousands of euros)

Notes

June 30, 2023

June 30, 2022

Revenue

4

1 912 294

1 754 520

Raw materials and consumables used

(1 296 329)

(1 202 784)

Employees expenses

5

(279 802)

(260 382)

Taxes

(34 621)

(35 688)

Other operating income (expenses)

6

12 926

13 217

EBITDA

314 469

268 883

Net charges to operating depreciation,

amortization and provisions

6

(148 227)

(140 389)

Recurring EBIT

166 243

128 495

Other non-operating income (expenses)

7

(4 842)

116

Net charges to non-operating depreciation,

amortization and provisions

7

(352)

(540)

Operating profit (loss)

161 049

128 071

Cost of net financial debt

(24 523)

(2 333)

Other financial income

20 916

16 677

Other financial expenses

(38 055)

(24 074)

Financial income (expenses)

8

(41 662)

(9 730)

Share of profit (loss) of associates

4 706

4 439

Profit (loss) before tax

124 093

122 780

Income tax

9

(14 771)

(34 971)

Consolidated net income

109 322

87 810

Portion attributable to minority

interests

15 274

10 027

Portion attributable to the

Group

94 048

77 783

Earnings per share (in euros)

Basic and diluted earnings per share

2.09

1.73

Comprehensive income

(in thousands of euros)

June 30, 2023

June 30, 2022

Consolidated net income

109 322

87 810

Other items not recycled to profit and

loss:

Remeasurement of defined benefit

(2 690)

89 612

Tax on non-recycled items

665

(18 579)

Other items recycled to profit and

loss:

Changes in currency translation

adjustments

(65 128)

106 490

Cash flow hedge instruments

9 551

(1 776)

Tax on recycled items

1 208

505

Other comprehensive income (after

tax)

(56 394)

176 252

TOTAL COMPREHENSIVE INCOME

52 928

264 062

Portion attributable to minority

interests

10 107

18 909

Portion attributable to the

Group

42 821

245 153

Consolidated statement of financial position

ASSETS

(in thousands of euros)

Notes

June 30, 2023

December 31, 2022

Goodwill

10.1

1 197 466

1 204 814

Other intangible assets

10.2

180 917

183 066

Property, plant and equipment

10.3

2 500 127

2 504 926

Right of use related to leases

10.4

184 848

193 122

Investment properties

31 949

32 124

Investments in associated companies

82 426

80 804

Deferred tax assets

118 166

126 212

Receivables and other non-current

financial assets

11

264 512

269 651

Total non-current assets

4 560 411

4 594 719

Inventories and work-in-progress

12.1

542 553

560 795

Trade and other receivables

12.2

567 007

464 216

Income tax receivables

3 609

45 201

Other current assets

207 645

204 690

Assets held for sale

17 133

21 780

Cash and cash equivalents

13

462 723

503 597

Total current assets

1 800 670

1 800 279

TOTAL ASSETS

6 361 080

6 394 998

SHAREHOLDERS’ EQUITY AND

LIABILITIES

(in thousands of euros)

Notes

June 30, 2023

December 31, 2022

Share capital

179 600

179 600

Additional paid-in capital

11 207

11 207

Treasury shares

(41 654)

(47 097)

Consolidated reserves

3 035 292

3 003 393

Translation reserves

(603 259)

(558 838)

Shareholders’ equity, Group

share

2 581 186

2 588 265

Minority interests

272 102

274 529

Total shareholders’ equity

14

2 853 288

2 862 794

Provisions for pensions and other

post-employment benefits

15.1

87 766

86 355

Other provisions more than 1 year

15.2

128 832

123 413

Financial debts and put options more than

1 year

16.1

1 563 520

1 672 772

Lease liabilities

16.1

155 296

161 045

Deferred tax liabilities

9

287 910

325 188

Other non-current liabilities

20 755

21 594

Total non-current liabilities

2 244 079

2 390 367

Other provisions less than 1 year

15.2

12 108

12 570

Financial debts and put options at less

than one year

16.1

342 258

242 161

Lease liabilities at less than one

year

16.1

45 135

47 537

Trade and other accounts payable

17

528 350

540 374

Income tax payables

20 776

14 814

Other liabilities

315 085

284 381

Total current liabilities

1 263 713

1 141 837

Total liabilities

0

3 507 791

3 532 204

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

6 361 080

6 394 998

Cash flows

(in thousands of euros)

Notes

June 30, 2023

June 30, 2022

CASH FLOWS FROM

OPERATING ACTIVITIES

Consolidated net income

109 322

87 810

Share of profit (loss) of associates

(4 706)

(4 439)

Dividends received from associated

companies

2 465

2 345

Elimination of non-monetary items:

- depreciation, amortization and

provisions

154 010

140 124

- deferred taxes

(27 316)

1 315

- net gain (loss) on disposal of

assets

(2 559)

(1 959)

- unrealized fair value gains (losses)

1 976

(12 662)

- other non-monetary items (1)

5 578

5 445

Cash flows from operating

activities

238 766

217 979

Changes in working capital

(24 086)

(242 102)

Net cash flows from operating

activities (2)

18.1

214 680

(24 123)

CASH FLOWS FROM

INVESTING ACTIVITIES

Cash-out related to acquisitions of

non-current assets:

- tangible and intangible assets

(147 159)

(182 507)

- financial investments

(9 480)

(21 481)

Cash-in related to disposals of

non-current assets:

- tangible and intangible assets

3 329

4 031

- financial investments

0

1 463

Changes in consolidation scope

(346)

(40 034)

Net cash flows from investing

activities

18.2

(153 656)

(238 528)

CASH FLOWS FROM

FINANCING ACTIVITIES

Dividends paid

(86 250)

(78 820)

Increases/decreases in share capital

Proceeds from borrowings

16

182 725

373 269

Repayments of borrowings

16

(158 931)

(33 129)

Repayment of lease liabilities

16

(24 987)

(28 815)

Purchase of treasury shares

(7 274)

(11 525)

Disposals on treasury shares

9 943

13 346

Net cash flows from financing

activities

(84 773)

234 326

Currency translation effect on net cash

and cash equivalents

(11 622)

2 475

Change in cash position

(35 372)

(25 850)

Net cash and cash equivalents - opening

balance

13.2

471 347

430 442

Net cash and cash equivalents - closing

balance

13.2

435 977

404 700

(1) : - Including the effect of the

application of IAS 29 € (2.3) millions as at June 30, 2023.

(2) : - Including cash flows from income

taxes: € (23.8) million as of June 30, 2023 and € (45.2) million as

June 30, 2022.

- Cash flows from interests paid and

received: € (22.5) million as of June 30, 2023 including € (4.9)

million for financial expenses on IFRS16 leases and € (18.1)

million as of June 30, 2022 including € (4.8) million for interest

expenses on IFRS16 leases.

Statement of changes in consolidated shareholder’s

equity

(in thousands of euros)

Share capital

Additional paid-in capital

Treasury shares

Consolidated reserves

Translation reserves

Shareholders' equity, Group

share

Minority interests

Total shareholders'

equity

At January 1st, 2022

179 600

11 207

(52 018)

2 800 579

(579 950)

2 359 418

246 681

2 606 099

Half year net income

0

0

0

77 783

0

77 783

10 027

87 810

Other comprehensive income (1)

0

0

0

61 511

105 859

167 370

8 882

176 252

Total comprehensive income

0

0

0

139 294

105 859

245 153

18 909

264 062

0

Dividends paid

0

0

0

(72 613)

0

(72 613)

(8 981)

(81 594)

Net change in treasury shares

0

0

3 154

(1 378)

0

1 776

0

1 776

Change in consolidation scope and

additional acquisitions

0

0

0

(6 889)

0

(6 889)

(3 170)

(10 059)

Application of IAS29

0

0

0

85 201

0

85 201

10 894

96 095

Other changes

0

0

0

4 149

0

4 149

15 566

19 715

At December 31, 2022

179 600

11 207

(48 864)

2 948 343

(474 091)

2 616 195

279 899

2 896 094

At January 1st, 2023 published

179 600

11 207

(47 097)

3 003 393

(558 838)

2 588 265

274 529

2 862 794

Net income

0

0

0

94 048

0

94 048

15 274

109 322

Other comprehensive income (1)

0

0

0

(6 805)

(44 422)

(51 227)

(5 167)

(56 394)

Total comprehensive income

0

0

0

87 243

(44 422)

42 821

10 107

52 928

Dividends paid

0

0

0

(73 233)

0

(73 233)

(15 033)

(88 266)

Net change in treasury shares

0

0

5 443

(2 832)

0

2 611

0

2 611

Changes in scope of consolidation and

additional acquisitions

0

0

0

(306)

0

(306)

81

(225)

Application of IAS29

0

0

0

20 251

0

20 251

2 454

22 705

Other changes

0

0

0

777

0

777

(36)

741

At June 30, 2023

179 600

11 207

(41 654)

3 035 293

(603 260)

2 581 186

272 102

2 853 288

(1) Breakdown by nature of other

comprehensive income: Other comprehensive income includes mainly

cumulative translation adjustments from end 2003. To recap,

applying the option offered by IFRS 1, the conversion differences

accumulated before the transition date to IFRS were reclassified by

allocating them to retained earnings as at that date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726089337/en/

Investor relations contact: Hugues Chomel: Tel.: +33 (0)1 58 86

86 05 hugues.chomel@vicat.fr

Press contacts: Karine Boistelle-Adnet Tel.: +33 (0)4 74 27 58

04 karine.boistelleadnet@vicat.fr

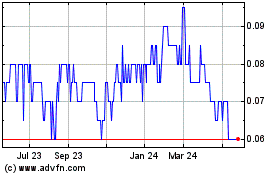

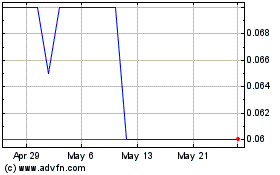

Volt Carbon Technologies (TSXV:VCT)

Historical Stock Chart

From Apr 2024 to May 2024

Volt Carbon Technologies (TSXV:VCT)

Historical Stock Chart

From May 2023 to May 2024