Zenyatta Ventures; Technical Report Highlights a Large & Discrete Graphite Resource Insensitive to Varying Cut-Off Grades

January 22 2014 - 9:30AM

Marketwired

Zenyatta Ventures; Technical Report Highlights a Large &

Discrete Graphite Resource Insensitive to Varying Cut-Off Grades

THUNDER BAY, ONTARIO--(Marketwired - Jan 22, 2014) - Zenyatta

Ventures Ltd. ("Zenyatta" or "Company") (TSX-VENTURE:ZEN) is

pleased to announce it has filed a complete technical report (the

"Technical Report") on SEDAR at www.sedar.com further to the news

releases dated December 2, 2013 and January 16, 2014 with respect

to the Company's 100%-owned Albany graphite deposit in northeastern

Ontario, Canada.

The Technical Report is titled "Technical Report on the Albany

Graphite Deposit, Northern Ontario, Canada", and was authored by

David Ross, P. Geo., and Katherine Masun, P. Geo., of Roscoe Postle

Associates Inc. ("RPA"), who are independent "qualified persons" as

defined by National Instrument 43-101. Significantly, the Technical

Report highlights a large and discrete graphite deposit with an

estimated Mineral Resource which is relatively insensitive to

cut-off grades from 0.4% Cg up to at least 2.0% Cg.

RPA estimates Indicated Mineral Resources delineated to date

total 25.1 million tonnes ("Mt") at an average grade of 3.89%

graphitic carbon ("Cg"), containing 977,000 tonnes of Cg. In

addition, Inferred Mineral Resources delineated to date are

estimated to total 20.1 million tonnes at an average grade of 2.20%

Cg, containing 441,000 tonnes of Cg. These results are based on a

cut-off grade of 0.6% Cg with an assumed market price of $8,500 per

tonne Cg. The results below, as given in the Technical Report, show

that even if the assumed market price of Cg varies, any appropriate

increase in the cut-off grade results in a relatively minor

reduction of the resource estimate.

| Classification, |

Tonnage |

Grade |

Tonnes Graphitic Carbon |

| Cut-off Grade |

(Mt) |

(%Cg) |

(t Cg) |

| Indicated |

|

|

|

|

2.0 |

20.7 |

4.41 |

914,000 |

|

1.0 |

24.3 |

3.99 |

971,000 |

|

0.6 |

25.1 |

3.89 |

977,000 |

|

0.4 |

25.4 |

3.85 |

978,000 |

| Inferred |

|

|

|

|

2.0 |

9.4 |

3.34 |

315,000 |

|

1.0 |

15.9 |

2.57 |

408,000 |

|

0.6 |

20.1 |

2.20 |

441,000 |

|

0.4 |

23.0 |

1.98 |

455,000 |

It is emphasised that the Technical Report defines a preliminary

pit shell to fulfill the NI 43-101 requirement of "reasonable

prospects for economic extraction". The economic potential and

mining plans of these Mineral Resources will be determined in the

upcoming Preliminary Economic Assessment (PEA) including more

detailed definition of mining methods, pit slopes, costs and price

assumptions.

Aubrey Eveleigh, President and CEO of Zenyatta noted, "The

significance of the insensitive nature of the Mineral Resource to

varying cut-off grades highlights the distinct and continuous

occurrence of graphite mineralization within well-defined breccia

pipes that were not particularly dependent on cut-off grades

related to commodity price assumptions." Aubrey Eveleigh further

commented "Not only is a NI 43-101 Mineral Resource an important

confirmation of a significant and unique graphite discovery, but

the completion of the Technical Report required the input of a

number of skilled and competent professionals. We are extremely

pleased with quality of work represented by the report, and now

look forward to the completion of a PEA".

Mr. Peter Wood, P.Geo., Zenyatta Ventures Ltd., Vice President

Exploration, is the "Qualified Person" under National Instrument

43-101 and has reviewed and approved the technical information

contained in this news release.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. This News Release includes certain

"forward-looking statements", which often, but not always, can be

identified by the use of words such as "believes", "anticipates",

"expects", "estimates", "may", "could", "would", "will", or "plan"

. These statements are based on information currently available to

Zenyatta and Zenyatta provides no assurance that actual results

will meet management's expectations. Forward-looking statements

include estimates and statements with respect to Zenyatta's future

plans, objectives or goals, to the effect that Zenyatta or

management expects a stated condition or result to occur, including

in this News Release. Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results relating to, among other things, results of exploration,

project development, reclamation and capital costs of Zenyatta's

mineral properties, and Zenyatta's financial condition and

prospects, could differ materially from those currently anticipated

in such statements for many reasons such as: changes in general

economic conditions and conditions in the financial markets;

changes in demand and prices for minerals; litigation, legislative,

environmental and other judicial, regulatory, political and

competitive developments; technological and operational

difficulties encountered in connection with Zenyatta's activities;

and other matters discussed in this News Release and in filings

made with securities regulators. This list is not exhaustive of the

factors that may affect any of Zenyatta's forward-looking

statements. These and other factors should be considered carefully

and readers should not place undue reliance on Zenyatta's

forward-looking statements. Zenyatta does not undertake to update

any forward-looking statement that may be made from time to time by

Zenyatta or on its behalf, except in accordance with applicable

securities laws.

Zenyatta Ventures

Ltd.807-346-1660info@zenyatta.cawww.zenyatta.ca

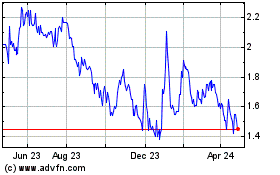

Zentek (TSXV:ZEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

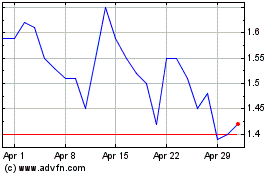

Zentek (TSXV:ZEN)

Historical Stock Chart

From Dec 2023 to Dec 2024