UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December

2018

Commission File Number

001-16429

ABB Ltd

(Translation of registrant’s

name into English)

P.O. Box

1831, Affolternstrasse 44, CH-8050, Zurich, Switzerland

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

⬜

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in

paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indication by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

⬜

Note:

Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or

other document that the registrant foreign private issuer must furnish and make

public under the laws of the jurisdiction in which the registrant is

incorporated, domiciled or legally organized (the registrant’s “home country”),

or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press

release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

This Form 6-K consists of the following:

1.

Press

release issued by ABB Ltd dated December 17, 2018, titled “ABB: Shaping a

leader focused in digital industries”.

2

—

Zurich, Switzerland, December 17, 2018

ABB: Shaping a leader

focused in digital industries

Fundamental actions to focus, simplify and lead in digital

industries for enhanced customer value and shareholder returns

─

Focus of portfolio on digital industries

through divestment of Power Grids

•

Divestment of Power Grids to Hitachi expands existing partnership

and strengthens Power Grids as a global infrastructure leader with enhanced

access to markets and financing

•

Enterprise Value of $11 billion for 100% of Power Grids,

equivalent to an EV/op. EBITA multiple of 11.2x

1

•

Crystallizing value from the transformation of Power Grids

including doubling operational EBITA margin since 2014

2

•

ABB initially to retain 19.9 percent in the equity of carved-out

Power Grids to ensure transition; pre-defined exit option on 19.9 percent

equity at fair market value with floor price at 90 percent of agreed Enterprise

Value, exercisable by ABB three years after closing

•

Closing expected by first half of 2020

3

•

ABB intends to return 100% of the estimated net cash proceeds of

$7.6-7.8 billion

4

from the 80.1% sale to shareholders in an

expeditious and efficient manner through share buyback or similar mechanism

─

Simplification of business model and

structure

•

Discontinuation of legacy matrix structure

•

Businesses will run all customer-facing activities as well as

business functions and territories, fostering ABB’s entrepreneurial business

culture

•

Businesses to be strengthened by transfer of experienced country

management resources

•

Existing country and regional structures including regional

Executive Committee roles to be discontinued after closing of the transaction

•

Corporate activities to be focused on Group strategy, portfolio

and performance management, capital allocation, core technologies and ABB

Ability™ platform

─

Shape four leading businesses aligned with customer patterns

•

All businesses global #1 or #2 in attractive growth markets:

─

Electrification led by Tarak Mehta

─

Industrial Automation led by Peter Terwiesch

─

Robotics & Discrete Automation, a unique combination of

B&R and Robotics, led by Sami Atiya

─

Motion, combining ABB’s market-leading offering in motors and

drives, led by Morten Wierod, appointed to Executive Committee as of April 1,

2019

•

ABB Ability™ tailored digital solutions will drive customer value

in each business whilst capturing synergies through common platform

•

Actions position ABB with a leadership role in digital solutions,

and evolving technologies such as artificial intelligence

______

1 EV/LTM operational EBITA multiple, operational EBITA calculated

using results from twelve-month period to end Q3 2018, before share of

corporate cost

2 2014 operational EBITA margin as calculated under old Power

Grids portfolio structure

3 Subject to regulatory approvals and fulfillment of closing

conditions

4 Post estimated one-time transaction and separation related costs

of $500-600 million and cash tax leakage of $800-900 million. Total enterprise

value adjustments of ~$3.0 billion, including ~$2.7 billion of net leverage

(intercompany loan net of cash transferred) and ~$0.3 billion after-tax

unfunded pensions and other liabilities

─

Financial impact of new ABB

•

$500 million annual run-rate cost reductions across the group

•

Approx. $500 million non-operational restructuring charges

─

New financial framework post-closing defined

•

New group target framework

•

Capital allocation priorities unchanged

•

Dividend policy of rising sustainable dividend per share

•

ABB intends to maintain the level of dividend per share post close

•

ABB intends to maintain its long-term “single A” credit rating

•

Business targets and further financials to be disclosed with

strategy update

─

Strategy update on February 28, 2019, in combination with the Q4

and Full Year 2018 results to provide further details on ABB’s new strategy,

businesses and financials

“ABB has been driving industrial change

for more than a century as a global pioneering technology leader. As a result

of our Next Level strategy, all of our businesses are today number 1 or 2 in

their respective markets. To support our customers in a world of unprecedented

technological change and digitalization, we must focus, simplify and shape our

business for leadership. Today’s actions will create a new ABB, a leader

focused in digital industries,”

said ABB CEO, Ulrich Spiesshofer.

“Power Grids will strengthen Hitachi as

global leader in energy infrastructure and Hitachi will strengthen Power Grids’

position as a global leader in power grids. With this transaction, we are

realizing the value we have built through the transformation of Power Grids

over the last four years. Our shareholders will directly benefit through the

return of the proceeds of the divestment. Building on our existing partnership

announced in 2014, the initial joint venture will provide continuity for

customers and our global team.”

“To compete in today’s fast-changing

world, we fully empower our businesses, through the discontinuation of the

legacy matrix structure ensuring zero-distance to customers and increasing our

agility in decision-making. Our four newly shaped businesses, each a global

leader, will be well aligned to the way our customers operate and focus

stronger on emerging technologies such as artificial intelligence. The

continued simplification of our business model and structure will be a catalyst

for growth and efficiency in our businesses. Our businesses will be further

supported through the transfer of experienced resources from today’s country

organizations.”

“All of this will only be possible due to

the commitment of our global team who has made ABB what it is today. Our

innovation power together with our inclusive culture will continue to be a

differentiating strength of our company. We will live enhanced customer focus,

provide attractive opportunities for our employees and deliver value for

shareholders.”

Peter Voser, Chairman of ABB

, said, “Today´s announcement

marks the beginning of a new chapter in ABB´s history. Building on our

technology and global talented employee base we will further strengthen our

focus in digital industries, delivering competitive returns for shareholders,

including our committed dividend policy. Over the past five years the

deliberate execution of ABB’s strategy laid the foundation for our businesses

to compete in the fast changing digital industries and deliver profitable

growth.”

“We were very clear in the past that the

actions required for the turnaround of Power Grids could be best achieved

within ABB. Following completion of this step, we undertook a review of the

Power Grids business and decided to secure the best home for the future

development of the business through the combination with Hitachi. The new ABB

will be positioned to write the future as a customer focused technology leader

in digital industries.”

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

2/7

|

Focus of

portfolio on digital industries through divestment of Power Grids

ABB announces today that Hitachi will acquire ABB’s Power Grids

business, an expansion of its existing partnership with Hitachi. The agreed

price represents a transaction Enterprise Value of $11 billion for 100 percent

of Power Grids, the equivalent to an EV/op. EBITA multiple of 11.2x

1

,

before share of corporate cost. ABB will initially realize a levered

consideration of ~$9.1 billion from the sale of 80.1 percent of Power Grids,

including pre-sale net leverage (intercompany loan net of cash transferred),

before one-time transaction and separation related costs as well as cash tax

impacts.

In the fast-changing world of energy infrastructure, with a

shifting customer landscape and the need for financing and increased government

influence, ABB believes Hitachi is the best owner for Power Grids. As a stable

and long-term committed owner, with whom ABB has developed a strong business

partnership since 2014, Hitachi will further strengthen the business, providing

it with access to new and growing markets as well as financing. Hitachi will

accelerate Power Grids to the next stage of its development, building on the

solid foundation achieved under ABB’s previous ownership.

Since 2014, Power Grids has been significantly improved under the

ownership of ABB. The latest results (Q3 2018) are at the target margin

corridor, having more than doubled margins, with positive third party base

order development recorded for the last six consecutive quarters.

ABB will initially retain a 19.9 percent equity stake in the joint

venture, allowing a seamless transition. The transaction agreement includes a

pre-defined option for ABB to exit the retained 19.9 percent share, exercisable

three years after closing, at fair market value with floor price at 90 percent

of agreed Enterprise Value. Hitachi holds a call option over the remaining 19.9

percent share at fair market value with floor price at 100 percent of agreed

Enterprise Value.

The joint venture will be headquartered in Switzerland, with

Hitachi retaining the management team to ensure business continuity.

Starting in Q4 2018 until closing, ABB will report Power Grids in

discontinued operations. As a consequence, ABB will record $350-400 million of

stranded and other carve-out related costs, which are currently predominately

recorded as part of the Power Grids cost base. These will now be recognized in

ABB’s corporate & other operational EBITA. ABB expects to eliminate the

vast majority of these costs by deal closing by transferring them back to Power

Grids. ABB expects approximately $200 million of charges in Q4 2018 related

predominantly to the legacy EPC substation business reported in non-core

corporate & other operational EBITA.

ABB expects to incur one-time non-operational transaction and

separation related costs of $500-600 million. ABB anticipates $800-900 million

related cash tax impact. The completion of the transaction is expected by first

half of 2020, subject to regulatory approvals and fulfillment of closing

conditions. ABB intends to return 100 percent of the estimated net cash

proceeds of $7.6-7.8 billion

5

from the 80.1 percent sale to

shareholders in an expeditious and efficient manner through share buyback or

similar mechanism.

Simplification of business model and structure

Effective April 1, 2019, ABB will simplify its organizational

structure through discontinuation of the legacy matrix structure, thereby

empowering its four leading businesses to serve customers even better, while

further sharpening responsibilities and increasing efficiency.

______

5 After estimated one-time transaction and separation related

costs of $500-600 million and cash tax leakage of $800-900 million. Total

enterprise value adjustments of ~$3.0 billion, including ~$2.7 billion of net

leverage (intercompany loan net of cash transferred) and ~$0.3 billion

after-tax unfunded pensions and other liabilities

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

3/7

|

ABB’s new organization will provide each business with full

operational ownership of products, functions, R&D and territories. The

businesses will be the single interface to customers, maximizing proximity and

speed.

The corporate center will be further streamlined. It will set the

long-term vision and strategy for the group, guided by ABB’s values. It will

drive capital allocation, portfolio and performance management, core

technologies ABB Ability™, ABB’s brand and investment in people. As a key

building block of the simplification, existing country and regional structures

including regional Executive Committee roles will be discontinued after the

closing of the transaction. Existing resources from country level will

strengthen the new businesses. ABB expects a total of $500 million annual

run-rate cost reductions across the group over the medium-term. Approximately

$500 million of related non-operational restructuring charges are expected to

be taken over the coming two years.

Shape four leading businesses aligned with customer

patterns

ABB will shape four customer-focused, entrepreneurial businesses –

Electrification, Industrial Automation, Robotics & Discrete Automation and

Motion. Each business will be either the global #1 or #2 player in attractive

markets with strong secular drivers. ABB’s established domain know-how,

world-class engineering and technology expertise, will position the four

businesses well to deliver innovative products and solutions for enhanced

customer value. ABB’s addressable market is growing by 3.5-4 percent per annum,

adding $140 billion in size to reach $550 billion by 2025.

Based on ABB’s common digital platform ABB Ability™, the

businesses will provide tailored digital solutions, driving enhanced customer

value. Building on emerging technologies including artificial intelligence and

its strong software offering, ABB Ability™ will meet the increasing demand from

ABB’s customers for digital solutions in the rapidly changing industrial world.

Electrification – writing the future of safe, smart and

sustainable electrification

The existing business will provide a complete portfolio of

innovative products, digital solutions and services from substation to socket.

With a #2 market position globally, its addressable market is presently $160

billion and will grow on average around 3 percent per annum over the long-term.

The Electrification business will have strong exposure to rapidly growing

customer segments including renewables, e-mobility, data centers and smart

buildings. The business will be led by Tarak Mehta, currently president of the

Electrification Product division. The Electrification business would have

generated approximately $13 billion of revenues in the twelve-month period to

end September 2018, including an estimated revenue contribution across the

period from GEIS, a business that was acquired June 30, 2018.

Industrial Automation – writing the future of safe and smart

operations

The newly shaped business will offer a complete range of

innovative solutions enabling customers to operate safe and energy-efficient

processes with increasing autonomy. Industrial Automation will include ABB’s

industry-specific integrated automation, electrification and digital solutions,

control technologies, software and advanced services, as well as measurement

& analytics, marine, and turbo-charging offerings. Industrial Automation

will be #2 in the market globally. The addressable market of $90 billion is

expected to grow on average by 3-4 percent per annum over the long-term. The

business will be led by Peter Terwiesch, currently president of the Industrial

Automation division. Industrial Automation would have generated approximately

$7 billion of revenues in the twelve-month period to end September 2018.

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

4/7

|

Robotics & Discrete

Automation – writing the future of flexible manufacturing and smart machines

The newly shaped business will uniquely combine machine and

factory automation solutions, mainly from B&R, with the most comprehensive

robotics solutions and applications suite in the market. The business will be

#2 globally, with a #1 position in robotics in the important, high-growth

Chinese market. The addressable market, already $80 billion in size, is

anticipated to grow on average at 6-7 percent per annum over the long-term. The

businesses digital solutions and services provide customers with enhanced

safety, efficiency, up-time and speed, and cater to the growing customer demand

for flexible and integrated manufacturing solutions. Robotics & Discrete

Automation will be led by Sami Atiya, currently president of the Robotics and

Motion division. Robotics & Discrete Automation would have generated

approximately $4 billion of revenues in the twelve-month period to end

September 2018.

Motion – writing the future of smart motion.

The business will provide customers with a comprehensive range of

innovative electrical motors, generators, drives, and service, as well as

integrated digital powertrain solutions. Motion will be the #1 player in the

market globally, with the largest installed base in an $80 billion market that

grows on average around 3 percent per annum. The business will be led by Morten

Wierod, currently Managing Director Business Unit Drives. He will become a

member of the Executive Committee effective April 1, 2019. Motion would have

generated approximately $6 billion of revenues in the twelve-month period to

end September 2018.

Attractive financial profile

ABB will demonstrate improved commercial quality of business,

enhanced exposure to faster growing markets, with a greater emphasis on high

value-add solutions, less large order volatility and more recurrent revenues

through digital solutions, software and services.

ABB’s investment proposition is reflected in a new medium-term

group target framework:

•

3-6 percent annual comparable revenue growth

•

operational EBITA margin of 13-16 percent

•

Return on Capital Employed (ROCE) of 15-20 percent

•

Cash conversion to net income of approximately 100 percent, and

•

Basic EPS growth above revenue growth

ABB would have generated revenues of approximately $29 billion in

the twelve-month period to end September 2018, including an estimated revenue

contribution across the period from GEIS, a business that was acquired June 30,

2018, and excluding Power Grids contribution.

Capital allocation

ABB’s sustained capital allocation priorities are unchanged,

namely:

•

fund organic growth, R&D and capex to yield attractive returns

•

rising sustainable dividend

•

value-creating acquisitions

•

returning additional cash to shareholders

Following completion of the divestment of Power Grids, ABB intends

to return 100 percent of the net cash proceeds

6

to shareholders in

an expeditious and efficient manner and execute a policy of a rising

sustainable dividend. ABB intends to maintain the level of dividend per share

post close and aims to maintain its “single A” credit rating long term.

______

6 Post estimated one-time transaction and separation related costs

of $500-600 million and cash tax leakage of $800-900 million. Total enterprise

value adjustments of ~$3.0 billion, including ~$2.7 billion of net leverage

(intercompany loan net of cash transferred) and ~$0.3 billion after-tax

unfunded pensions and other liabilities

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

5/7

|

Strategy update

ABB intends to host a strategy update alongside the Q4 2018

results. At the strategy update, ABB’s leaders and management teams of the four

business areas will provide detailed overviews of their markets, strategies,

businesses and targets.

Revised dates

In light of these fundamental changes, ABB will amend the

announced dates for:

•

Q4 and FY 2018 results to February 28, 2019

•

Q1 2019 and the AGM to May 2, 2019

Credit Suisse AG and Dyal Co. LLC acted as financial advisors, and

Freshfields Bruckhaus Deringer LLP as legal advisors, to ABB.

More information

For further information on today’s announcement, please see

ABB.com/writing-the-future.

ABB will host a press conference today starting at 10:00 a.m.

Central European Time (CET) (9:00 a.m. BST, 4:00 a.m. EDT). The event will be

accessible by webcast on

https://swisscomstream.ch/abb/20181217/en

ABB will host a conference call for analysts and investors,

starting at 2:00 p.m. Central European Time (CET) (1:00 p.m. GMT, 8:00 a.m.

EST). The call will be available to join via webcast

https://swisscomstream.ch/abb/20181217/en

The event will be accessible by conference call. Callers are

requested to phone in 10 minutes before the start of the call. The analyst and

investor conference call dial-in numbers are:

UK +44 207 107 0613

Sweden +46 8 5051 0031

Rest of Europe, +41 58 310 5000

US and Canada +1 866 291 4166 (toll-free) or +1 631 570 5613

(long-distance charges)

Lines will be open 10-15 minutes before the start of the call.

ABB

(ABBN: SIX Swiss Ex) is a

pioneering technology leader in power grids, electrification products,

industrial automation and robotics and motion, serving customers in utilities,

industry and transport & infrastructure globally. Continuing a history of

innovation spanning more than 130 years, ABB today is writing the future of

industrial digitalization with two clear value propositions: bringing

electricity from any power plant to any plug and automating industries from

natural resources to finished products. As title partner in ABB Formula E, the

fully electric international FIA motorsport class, ABB is pushing the

boundaries of e-mobility to contribute to a sustainable future. ABB operates in

more than 100 countries with about 147,000 employees.

www.abb.com

This information is information that ABB is obliged to make public

pursuant to the EU Market Abuse Regulation. The information was submitted for

publication, through the agency of the contact person set out below, at 7:00

a.m. CET on December 17, 2018.

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

6/7

|

Important notice about

forward-looking information

This press release includes forward-looking information and

statements as well as other statements concerning the outlook for our business.

These statements are based on current expectations, estimates and projections

about the factors that may affect our future performance, including global

economic conditions, the economic conditions of the regions and industries that

are major markets for ABB Ltd. These expectations, estimates and projections

are generally identifiable by statements containing words such as “expects,”

“believes,” “estimates,” “anticipates”, “targets,” “plans,” “is likely”,

“intends”, “aims”, “framework” or similar expressions. However, there are many

risks and uncertainties, many of which are beyond our control, that could cause

our actual results to differ materially from the forward-looking information

and statements made in this press release and which could affect our ability to

achieve any or all of our stated targets. The important factors that could

cause such differences include, among others, business risks associated with

the volatile global economic environment and political conditions, costs

associated with compliance activities, market acceptance of new products and

services, changes in governmental regulations and currency exchange rates and

such other factors as may be discussed from time to time in ABB Ltd’s filings

with the U.S. Securities and Exchange Commission, including its Annual Reports

on Form 20-F. Although ABB Ltd believes that its expectations reflected in any such

forward-looking statement are based upon reasonable assumptions, it can give no

assurance that those expectations will be achieved.

The planned changes might be subject to any relevant engagement

processes with local employee representatives/employees. ABB will fully honor

any such legal obligations.

|

—

|

|

For more information, please

contact:

|

|

Media Relations

Phone: +41 43 317 71 11

Email:

media.relations@ch.abb.com

|

Investor Relations

Jessica Mitchell

Phone: +41 43 317 71 11

Email:

investor.relations@ch.abb.com

|

ABB

Ltd

Affolternstrasse 44

8050 Zurich

Switzerland

|

|

ABB: SHAPING A LEADER FOCUSED IN DIGITAL INDUSTRIES

|

7/7

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

ABB LTD

|

|

|

|

|

|

|

|

|

|

Date: December 17, 2018.

|

By:

|

|

|

|

|

Name:

|

Jessica Mitchell

|

|

|

|

Title:

|

Group Senior Vice President

and

Head of Investor Relations

|

|

|

|

|

|

|

|

|

|

Date: December 17, 2018.

|

By:

|

|

|

|

|

Name:

|

Richard A. Brown

|

|

|

|

Title:

|

Group Senior Vice President

and

Chief Counsel Corporate & Finance

|

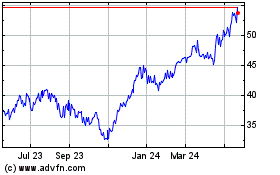

ABB (PK) (USOTC:ABLZF)

Historical Stock Chart

From Dec 2024 to Jan 2025

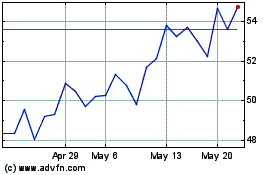

ABB (PK) (USOTC:ABLZF)

Historical Stock Chart

From Jan 2024 to Jan 2025