Aben Resources Announces Shares-for-Debt Settlement, Share Consolidation and Amendment to Articles

January 14 2014 - 10:58AM

Marketwired

Aben Resources Announces Shares-for-Debt Settlement, Share

Consolidation and Amendment to Articles

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 14, 2014) - Aben

Resources Ltd. (TSX-VENTURE:ABN)(FRANKFURT:E2L)(PINKSHEETS:ABNAF)

("Aben" or the "Company") announces the following transactions:

Shares for

Debt

The Company has entered into a shares-for-debt agreement with

TerraLogic Exploration Inc. ("TerraLogic") (the "Agreement") to

satisfy the remaining amount owing under a geological consultant

services agreement between Aben and TerraLogic dated March 19, 2012

(the "Consultant Agreement"). Aben will pay CAD$50,000 in cash and

issue 6,728,000 common shares in the capital of the Company, as

constituted prior to the share consolidation referred to hereafter,

to TerraLogic at a deemed price of $0.05 per share to satisfy the

debt of CAD$386,400 owing under the Consultant Agreement. The

Agreement is subject to approval from the TSX Venture Exchange (the

"Exchange") and the common shares will be subject to a four (4)

month hold period upon issuance.

Share

Consolidation

The Company has convened an Annual and Special General Meeting

to be held February 20, 2014 (the "Shareholders' Meeting"). At the

Shareholders' Meeting, the shareholders will be asked to approve a

consolidation of the Company's share capital on the basis of one

post-consolidation share for each 10 pre-consolidation shares. The

issued capital of the Company is currently 125,631,846 common

shares, which will become 12,563,185 common shares, before

adjustments for fractions and subject to the issuance of additional

shares in the intervening period, after the consolidation. The

purpose of the consolidation is to make the Company's securities

more attractive to potential investors, and others who may have an

interest in receiving shares in other transactions, by increasing

the market price for the Company's post-consolidation shares above

the minimum issue price thresholds established by the Exchange.

The proposed consolidation is subject to the approval of the

Company's shareholders and the Exchange.

Amendment to

Articles

The Exchange has recently amended its policy to provide that

share consolidations may be effected by a resolution of a company's

directors, without shareholder approval, for consolidations with a

consolidation ratio of up to 10:1. The Company's articles currently

require shareholder approval of all consolidations, regardless of

the consolidation ratio. The Exchange's policy amendment enables a

listed company to act quickly, efficiently and with minimal expense

to consolidate its share capital in circumstances where capital is

needed, but Exchange policy prevents the company from conducting a

private placement at the current market price for its shares. The

Company's management believes it to be in the best interests of the

Company that the Company be able to avail itself of this policy

amendment. Accordingly, it is proposed that the articles of the

Company be amended to permit share consolidations to be effected by

a resolution of the directors only. A resolution to this effect

will be placed before the shareholders at the Shareholders'

Meeting.

The amendment to the Company's articles is subject to the

approval of the shareholders and the TSX Venture Exchange.

About Aben Resources:

Aben Resources Ltd. is a Canadian gold, silver and uranium

exploration company developing properties in the Yukon, NWT, and

Saskatchewan's Athabasca Basin.

For further information on Aben Resources Ltd.

(TSX-VENTURE:ABN), visit our Company's web site at

www.abenresources.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Jim Pettit"

JAMES G. PETTIT, President

Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed to

be "forward-looking statements". All statements in this release,

other than statements of historical facts, that address events or

developments that management of the Company expects, are

forward-looking statements. Although management believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance, and actual results or developments may differ

materially from those in the forward-looking statements. The

Company undertakes no obligation to update these forward-looking

statements if management's beliefs, estimates or opinions, or other

factors, should change. Factors that could cause actual results to

differ materially from those in forward-looking statements, include

market prices, exploration and development successes, continued

availability of capital and financing, and general economic, market

or business conditions. Please see the public filings of the

Company at www.sedar.com for further information.

Aben Resources Ltd.Don MyersCorporate Communications604-687-3376

or Toll Free:

800-567-8181604-687-3119info@abenresources.comwww.abenresources.com

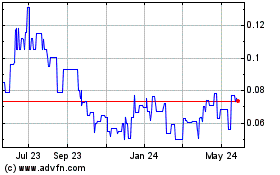

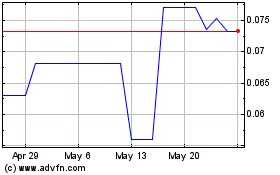

Aben Minerals (PK) (USOTC:ABNAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aben Minerals (PK) (USOTC:ABNAF)

Historical Stock Chart

From Jan 2024 to Jan 2025