Remedent, Inc. (OTCBB: REMI), an international company specializing

in the research, development, and manufacturing of oral care and

cosmetic dentistry products, reported results for the fiscal fourth

quarter and year ended March 31, 2009 (in U.S. dollars).

Net sales in the fourth quarter totaled $3.4 million, an

increase of 12% from $3.0 million in the same year-ago quarter. Net

sales for the fiscal year 2009 totaled a record $14.6 million, an

increase of 96% from $7.5 million in fiscal 2008.

The increase in net sales was primarily due to the increased

sales by the company's GlamSmile Product Group. In fiscal 2009,

sales of GlamSmile(TM), the company's leading dental veneer

product, increased year-over-year by $6.7 million or 564% to $7.9

million, compared to sales of $1.2 million in fiscal 2008.

Loss from operations in the fourth quarter was $468,000, an

improvement from a loss of $550,000 in the same year-ago quarter.

Loss from operations for fiscal 2009 was $946,000, an improvement

from a loss of $3.1 million in fiscal 2008. The narrowing of the

loss from operations is attributed to the increase in sales, as

well as reorganization of the company's production process and more

in-house manufacturing that resulted in lower costs than the

previously outsourced third party manufacturing.

Net loss for the fourth quarter totaled $1.1 million or $(0.05)

per share (after minority interest and based on 20.0 million

weighted average shares outstanding), as compared to a loss of

$623,000 or $(0.03) per share (based on 17.8 million weighted

average shares outstanding) in the same year-ago quarter.

Net loss for fiscal 2009 totaled $3.0 million or $(0.15) per

share (after minority interest and based on 19.6 million weighted

average shares outstanding), as compared to a loss of $3.1 million

or $(0.17) per share (based on 17.8 million weighted average shares

outstanding) in fiscal 2008. The net loss in fiscal 2009 included

$4.3 million in warrants issued to Den-Mat Holdings, partially

offset by a gain of $2.8 million from the sale of a portion of the

company's over-the-counter retail product business.

Net comprehensive loss in the fourth quarter after foreign

currency translation adjustment was $1.3 million or $(0.07) per

share, compared to a net loss of $572,000 or $(0.03) per share in

the same year-ago quarter. Net comprehensive loss in fiscal 2009

after foreign currency translation adjustment was $3.6 million or

$(0.19) per share, compared to a net loss of $3.1 million or

$(0.17) per share in fiscal 2008.

Cash and cash equivalents totaled $1.8 million at March 31,

2009, an increase of 5% from $1.7 million at March 31, 2008.

Management Commentary

"Fiscal 2009 represented strong progress for Remedent across the

board -- operationally, in product development, and in record sales

for the year," said Guy De Vreese, CEO of Remedent. "The year was

highlighted by dramatically increased sales of our flagship

GlamSmile product, which is being adopted increasingly by dentists

around the world. The year also represented a period of

restructuring and realigning our efforts through the divesture of

our OTC business, as well as advancing the development of our

revolutionary, patent-pending FirstFit(TM) system for crowns and

bridges.

"Our FirstFit development effort culminated with the recent

expansion of our distribution agreement with Den-Mat Holdings to

include FirstFit. As the world's largest producer of dental

veneers, Den-Mat's complete adoption of our GlamSmile technology in

August of 2008 has solidified our position as a world leader in the

dental veneer space. Den-Mat will now champion the market

introduction of FirstFit in the United States through their network

of more than 10,000 dentists.

"We are now beginning to emerge from a pivotal stage in our

development, with a new operational structure designed to leverage

the tremendous potential of our unique veneer technology. In

addition to Den-Mat in the United States, we are also realizing

increasing success in China and Australia. Meanwhile, we are

finding ways to reduce our costs, including doing more in-house

production. We believe our wide-ranging progress in fiscal 2009 has

put us on course for continued growth and market expansion in

fiscal 2010."

Teleconference Information

Remedent will host a conference call on Wednesday, July 1, 2009

at 11:00 a.m. Eastern time to discuss these results. A question and

answer session will follow management's presentation. To

participate in the call, dial the appropriate number 5-10 minutes

prior to the start time, request the Remedent conference call and

provide the conference ID.

Date: Wednesday, July 1, 2009

Time: 11:00 a.m. Eastern time (8:00 a.m. Pacific time)

Dial-In Number: 1-800-894-5910

International: 1-785-424-1052

Conference ID#: 7REMEDENT

A simultaneous webcast and replay of the call will be accessible

via this link: http://viavid.net/dce.aspx?sid=0000666B.

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization and ask you to wait until the call begins. If you have

any difficulty connecting with the conference call, please contact

the Liolios Group at 1-949-574-3860.

A telephone replay of the call will be available from 2:00 p.m.

Eastern time on the same day until August 1, 2009:

Toll-free replay number: 1-800-695-0395

International replay number: 1-402-220-1388

(No passcode required)

About Remedent

Remedent, Inc. specializes in the research, development,

manufacturing and marketing of oral care and cosmetic dentistry

products. The company serves professional dental industry with

breakthrough technology for dental veneers, bridges and crowns that

are recognized worldwide for their technological superiority and

ease-of-application. These products are supported by a line of

professional veneer whitening and teeth sensitivity solutions.

Headquartered in Belgium, Remedent distributes its products to more

than 35 countries worldwide. For more information, go to

www.remedent.com.

Statement under the Private Securities Litigation Reform Act of

1995

Statements in this press release that are "forward-looking

statements" are based on current expectations and assumptions that

are subject to risks and uncertainties. Such forward-looking

statements involve known and unknown risks, uncertainties and other

unknown factors that could cause Remedent's actual operating

results to be materially different from any historical results or

from any future results expressed or implied by such

forward-looking statements. In addition to statements that

explicitly describe these risks and uncertainties, readers are

urged to consider statements that contain terms such as "believes,"

"belief," "expects," "expect," "intends," "intend," "anticipate,"

"anticipates," "plans," "plan," "projects," "project," to be

uncertain and forward-looking. Actual results could differ

materially because of factors such as Remedent's ability to achieve

the synergies and value creation contemplated by the proposed

transaction. For further information regarding risks and

uncertainties associated with Remedent's business, please refer to

the risk factors described in Remedent's filings with the

Securities and Exchange Commission, including, but not limited to,

its annual report on Form 10-K and quarterly reports on Form

10-Q.

REMEDENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

Three months ended Year ended

March 31, March 31,

2009 2008 2009 2008

------------ ------------ ------------ ------------

Net sales $ 3,390,355 $ 3,028,362 $ 14,639,541 $ 7,482,261

Cost of sales 1,650,315 1,352,271 6,614,723 3,975,777

------------ ------------ ------------ ------------

Gross profit 1,740,040 1,676,091 8,024,818 3,506,484

Operating Expenses

Research and

development 24,273 85,293 248,652 332,958

Sales and

marketing 370,042 889,452 2,793,970 1,886,389

General and

administrative 1,639,656 1,165,842 5,312,192 4,057,007

Depreciation and

amortization 173,903 85,319 615,674 301,260

------------ ------------ ------------ ------------

TOTAL

OPERATING

EXPENSES 2,207,874 2,225,906 8,970,488 6,577,614

------------ ------------ ------------ ------------

OPERATING LOSS (467,834) (549,815) (945,670) (3,071,130)

NON-OPERATING

(EXPENSE) INCOME

Warrants issued

pursuant to

Distribution

Agreement - - (4,323,207) -

Gain on

disposition of

OTC - - 2,830,953 -

IMDS provision (300,000) - (300,000) -

Interest

expense/other

deductions (166,972) (66,366) (417,147) (138,168)

Interest

income/other

income 1,884 20,367 348,997 -

Other income - - - 121,032

------------ ------------ ------------ ------------

TOTAL OTHER

INCOME

(EXPENSES) (465,088) (45,999) (1,860,404) (17,136)

------------ ------------ ------------ ------------

LOSS FROM

CONTINUING

OPERATIONS BEFORE

INCOME TAXES AND

MINORITY INTEREST (932,922) (595,814) (2,806,074) (3,088,266)

Income tax expense (32,633) (27,247) (32,633) (27,247)

------------ ------------ ------------ ------------

NET LOSS FROM

CONTINUING

OPERATIONS BEFORE

MINORITY INTEREST (965,555) (623,061) (2,838,707) (3,115,513)

MINORITY INTEREST (114,208) - (114,208) -

------------ ------------ ------------ ------------

NET LOSS FROM

CONTINUING

OPERATIONS $ (1,079,763) $ (623,061) $ (2,952,915) $ (3,115,513)

============ ============ ============ ============

LOSS PER SHARE

Basic and fully

diluted $ (0.05) $ (0.03) $ (0.15) $ (0.17)

============ ============ ============ ============

WEIGHTED AVERAGE

SHARES OUTSTANDING

Basic and fully

diluted 19,995,969 17,823,012 19,559,653 17,823,012

============ ============ ============ ============

OTHER COMPREHENSIVE

INCOME (LOSS):

Foreign currency

translation

adjustment (259,045) 50,608 (668,245) 60,953

------------ ------------ ------------ ------------

Comprehensive

income (loss) $ (1,338,808) $ (572,453) $ (3,621,160) $ (3,054,560)

============ ============ ============ ============

Comprehensive loss

per share $ (0.07) $ (0.03) $ (0.19) $ (0.17)

============ ============ ============ ============

REMEDENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

March 31, 2009 March 31, 2008

-------------- --------------

ASSETS

CURRENT ASSETS:

Cash and cash equivalents $ 1,807,271 $ 1,728,281

Accounts receivable, net of allowance

for doubtful accounts of $33,966 at

March 31, 2009 and $32,181 at March 31,

2008 3,208,120 1,902,920

Inventories, net 1,937,946 1,360,709

Prepaid expense 1,310,900 970,173

-------------- --------------

Total current assets 8,264,237 5,962,083

-------------- --------------

PROPERTY AND EQUIPMENT, NET 1,024,999 692,609

OTHER ASSETS

Long term investments and advances 750,000 675,000

Patents, net 163,106 115,827

-------------- --------------

Total assets $ 10,202,342 $ 7,445,519

============== ==============

LIABILITIES AND STOCKHOLDERS? EQUITY

(DEFICIT)

CURRENT LIABILITIES:

Current portion, long term debt $ 78,798 $ 58,583

Line of Credit 660,200 779,718

Accounts payable 1,398,420 2,002,439

Accrued liabilities 1,590,360 781,737

Income taxes payable 39,339 15,121

-------------- --------------

Total current liabilities 3,767,117 3,637,598

Long term debt less current portion 100,542 94,754

Minority interest 896,705 --

Total liabilities 4,764,364 3,732,352

-------------- --------------

STOCKHOLDERS? EQUITY:

Preferred Stock $0.001 par value

(10,000,000 shares authorized, none

issued and outstanding) -- --

Common stock, $0.001 par value;

(50,000,000 shares authorized,

19,995,969 shares issued and

outstanding at March 31, 2009 and

18,637,803 shares issued and

outstanding at March 31, 2008) 19,996 18,638

Treasury stock, at cost; 723,000 and 0

shares at March 31, 2009 and March 31,

2008 respectively (831,450) --

--------------

Additional paid-in capital 24,106,055 17,929,992

Accumulated deficit (17,216,028) (14,263,113)

Accumulated other comprehensive income

(loss) (foreign currency translation

adjustment) (640,595) 27,650

-------------- --------------

Total stockholders? equity 5,437,978 3,713,167

-------------- --------------

Total liabilities and stockholders?

equity $ 10,202,342 $ 7,445,519

============== ==============

Company Contacts: Stephen Ross Chief Financial Officer Remedent,

Inc. Tel 310-922-5685 Email Contact Investor Relations: Ron Both

Scott Liolios Managing Director Liolios Group, Inc. Tel (949)

574-3860 Email Contact

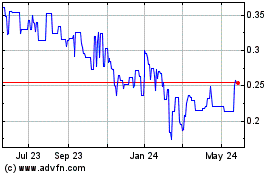

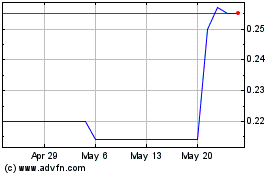

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Jul 2023 to Jul 2024