Alberta Star Proposes Change of Business

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 22, 2014) -

Alberta Star Development Corp.

(TSX-VENTURE:ASX)(OTCBB:ASXSF)(FRANKFURT:QLD) (the "Company") is

pleased to announce that it will be pursuing a proposed change of

business to a tier 2 investment company (the "Proposed COB") listed

on the TSX Venture Exchange ("TSXV").

Summary of the Proposed

COB

The Company has Company determined to refocus its business

operations from a "mining issuer" to an "investment issuer" after a

strategic review. The Company believes that the experience and

contacts of its board of directors and management will enable it to

identify and capitalize upon investment opportunities as an

"investment issuer". Upon completion of the Proposed COB, the

Company's primary focus will be to seek returns through investments

in the securities of other companies and other assets.

Investment Objectives

In connection with the Proposed COB, the Company intends to

adopt an investment policy (the "Investment Policy") to govern its

investment activities and investment strategy. A copy of the

Investment Policy will be posted on the Company's profiled at

www.sedar.com.

The Investment Policy will provide, among other things, that:

(a) the Company will seek high return investment opportunities in

privately held and in publicly traded companies with a focus on

publicly traded resource issuers; (b) the Company will seek to

preserve capital and limit downside risk which achieving a

reasonable rate of capital appreciation; and (c) the Company will

seek investments that provide liquidity.

Investment Strategy

In pursuit of the investment objectives stated above, the

Company, when appropriate, shall employ the following disciplines:

(a) investments shall focus on resource companies, concentrating on

advanced stage companies, but also early stage and senior companies

where appropriate; (b) the Company will obtain detailed knowledge

of the relevant business the investment shall be made in, as well

as the investee company. The Company will work closely with the

investee company's management and directors, and in some cases

assist in sourcing experienced and qualified persons to add to the

directors and/or management of the investee companies; (c) the

Company will limit 25% of its investment capital (at the time of

the investment) to any one investment; and (d) a minimum of 50% of

the Company's available funds will be allocated to a minimum of two

specific investments.

The Investment Policy will provide the Company with broad

discretion with respect to the form of investment taken. The

Company may employ a wide range of investment instruments,

including: equity, bridge loans, secured loans, unsecured loans,

convertible debentures, warrants, options, royalties, net profit

interests and other hybrid instruments. The Company may acquire

interests in real property and mineral claims, including carried

interests, royalty interests or joint venture interests. Where

appropriate the Company may act as a third party advisor of

opportunities in target or other companies, in exchange for a fee.

The Investment Policy shall not permit the Company to invest in

physical commodities, derivatives, "short" sales or other similar

transactions. Notwithstanding the above, the Company may authorize

investments outside of these disciplines for the benefit of the

Company and its shareholders.

Investment Evaluation Process

The Company will establish an investment committee ("Investment

Committee") of at least two members of its directors to monitor its

investment portfolio on an ongoing basis and to review the status

of each investment at least once a month or on an as-needed basis.

Nominees for the Investment Committee shall be recommended by the

Board.

The members of the Investment Committee shall be appointed

annually by the Board at the first Board meeting subsequent to the

annual meeting of shareholders or on such other date as the Board

shall determine. Members of the Investment Committee may be removed

or replaced by the Board. Officers of the Company may be members of

the Investment Committee. Each member of the Investment Committee

shall be financially literate.

It is anticipated that upon completion of the Proposed COB, the

Investment Committee shall be comprised of Stuart Rogers,

President, Chief Executive Officer and director, Guido Cloetens,

director and Martin Burian, director.

Composition of Investment Portfolio

The Company further intends to seek additional investment

opportunities in accordance with the policies and processes

described herein and the policies of the TSXV applicable to an

"investment issuer".

Initial Investments

Currently, the Company has the following assets, which it

proposes shall comprise part of its initial investment portfolio:

(a) 1,300,000 common shares in the capital of TerraX Minerals Inc.

("TerraX"); (b) 650,000 warrants to purchase common shares in the

capital of TerraX; and (c) an option to acquire a 60% interest in a

mineral property from TerraX. TerraX is a mineral exploration

Company listed on the TSXV. These investments have a value of

approximately $1,000,000 as of February 28, 2014. Further

information regarding these investments is set out in the Company's

news release of March 3, 2014 and will also be contained in the

Circular (as defined below).

The Company proposes to invest a further $1,000,000 in

accordance with its Investment Policy subsequent to receipt of

conditional TSXV approval and prior to final TSXV approval of the

Proposed COB. The Company will issue a news release with

comprehensive disclosure of each proposed investment. Each proposed

investment shall be subject to TSXV approval.

Future Investments

Subject to certain conditions, the Company has received from the

TSXV a waiver from the initial listing requirement for a tier 2

investment issuer that at least 50% of available funds be allocated

to at least two investments at the time of completion of the

Proposed COB. Pursuant to the waiver, the Company is required to

have at least $2,000,000 allocated to at least two investments at

the time of completion of the Proposed COB. The Company will

undertake to the TSXV to invest such further amounts as are

necessary to ensure that at least 50% of available funds

(currently, an estimated $3,000,000) are invested within 12 months

of completion of the Proposed COB.

Shareholder Approval

The Proposed COB requires the approval of the shareholders of

the Company. The Company has scheduled a meeting of its

shareholders on June 24, 2014 (the "Meeting") to obtain this

approval. A majority of shareholders present at the Meeting must

approve the Proposed COB for it to proceed. Further information

regarding the Meeting and the Proposed COB will be contained in the

management information circular (the "Circular") to be prepared and

mailed to the Company's shareholders in respect of the Meeting. A

copy of the Circular will also be available on the Company's

profile at www.sedar.com.

Sponsorship

The Company has received from the TSXV a waiver from the

requirement to engage a sponsor in connection with the Proposed

COB.

Name Change

In connection with the Proposed COB, the Company anticipates

changing its name to Trafalgar Capital Corp. Approval of any change

of name of the Company is subject to approval of the Company's

shareholders at the Meeting.

Other Information

Completion of the Proposed COB is subject to a number of

conditions, including TSXV acceptance and shareholder approval. The

transaction cannot close until the required shareholder approval is

obtained. There can be no assurance that the Proposed COB will be

completed as proposed or at all.

Investors are cautioned that, except as disclosed in the

Circular to be prepared in connection with the Proposed COB any

information released or received with respect to the Proposed COB

may not be accurate or complete and should not be relied upon.

Trading in the securities of the Company should be considered

highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the

merits of the Proposed COB and has neither approved nor disapproved

the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as the term is defined in the Policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Caution Regarding

Forward-Looking Statements - This news release

contains certain forward-looking statements, including statements

regarding the Proposed COB. These statements are subject to a

number of risks and uncertainties. Actual results may differ

materially from results contemplated by the forward-looking

statements. When relying on forward-looking statements to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and should not place

undue reliance on such forward-looking statements. The Company does

not undertake to update any forward looking statements, oral or

written, made by itself or on its behalf, except as required by

applicable law.

Alberta Star Development Corp.Stuart RogersPresident & Chief

Executive Officer(604) 689-1749

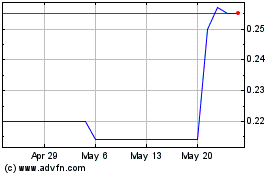

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Jan 2025 to Feb 2025

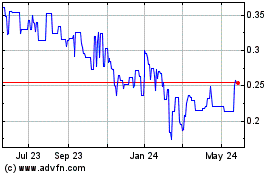

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Feb 2024 to Feb 2025