Avidbank Holdings, Inc. Releases Third Quarter Results

October 20 2011 - 10:03AM

Business Wire

Avidbank Holdings, Inc., parent company of Avidbank, today

announced its unaudited results for the third quarter of 2011.

“Our continued profitability is derived from aggressively

managing our infrastructure and balance sheet in what continues to

be a challenging market for quality loans,” stated Chairman Mark D.

Mordell. “Management has done an excellent job improving the

quality of our loan portfolio while at the same time significantly

reducing our cost of funds. This stable platform is allowing the

Bank to pursue quality relationships and credits in an improving

market.”

Financial Results

In thousands, except share and per share

amounts (unaudited)

% vs.

9/30/11

9/30/10

% Change

12/31/10

9/30/11

Total Assets $328,629 $341,235 -4% $316,789 4% Loans $185,067

$214,323 -14% $208,542 -11% Deposits $295,489 $308,098 -4% $284,688

4% Loans to Deposits 63% 70% -10% 73% -15% Net Interest

Margin 4.06% 3.92% 3% 4.01% 1% Efficiency Ratio 72% 74% -3% 74% -3%

ALLL to Loans 2.09% 1.85% 13% 2.12% -1% Shareholders' Equity

$32,223 $30,676 5% $30,354 6% Common Shares 2,602 2,602 0% 2,602 0%

Book Value per Share $12.38 $11.79 5% $11.66 6%

Book Value per Share

excluding TARP

$10.08 $9.48 6% $9.36 8% Tier 1 Leverage Ratio 9.78% 9.06%

8% 9.18% 7% Total Risk Based Capital Ratio 13.29% 12.62% 5% 12.88%

3% Quarter Ending Quarter Ending Year-to-Date Year-to-Date

9/30/11

9/30/10

% Change

9/30/11

9/30/10

Revenue $3,930 $4,104 -4% $11,620 $11,591 Interest Expense $547

$819 -33% $1,783 $2,670 Loan Loss Provision $0 $383 -100% $50 $583

Total Operating Expenses $2,354 $2,188 8% $7,067 $6,607 Net Income

$909 $663 37% $2,421 $1,618 Earnings Per Share $0.32 $0.23 42%

$0.76 $0.57

“Over the past several months, we have invested in additional

business development officers as we have seen renewed confidence in

our markets and an increase in new lending activity,” said Kenneth

D. Brenner, the Company's Chief Executive Officer. “We plan to take

advantage of opportunities as conditions improve.”

About Avidbank

Our goal at Avidbank is to advance our clients’ success by

offering innovative financial solutions and service. Our

experienced people provide a unique and individualized banking

experience based on mutual effort, ingenuity and trust, creating

long-term banking relationships. Avidbank specializes in the

following markets: commercial and industrial, corporate finance,

technology and asset-based lending, real estate construction,

commercial real estate lending and real estate bridge

financing.

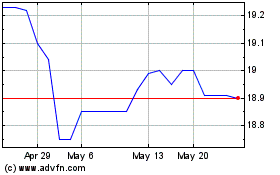

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Jan 2025 to Feb 2025

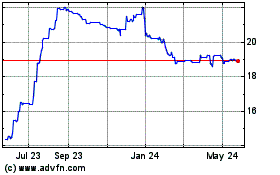

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Feb 2024 to Feb 2025