UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 13D

Under the Securities Exchange Act of 1934

| Cellectis S.A. |

| (Name of Issuer) |

| |

| Ordinary shares, nominal value of €0.05 per ordinary share |

| (Title of Class of Securities) |

| |

| 15117K103 |

| (CUSIP Number) |

| |

|

Adrian Kemp

AstraZeneca PLC

1 Francis Crick Avenue

Cambridge Biomedical Campus

Cambridge CB2 0AA

England

Telephone: +44 20 3749 5000

with a copy to:

Julian G. Long

Sebastian L. Fain

Freshfields Bruckhaus Deringer LLP

100 Bishopsgate

London EC2P 2SR

United Kingdom

Tel: +44 20 7936 4000 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

| November 1, 2023 |

| (Date of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 15117K103

Schedule 13D

| 1 |

NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

AstraZeneca Holdings B.V. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS (See Instructions)

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Netherlands |

| |

7 |

SOLE

VOTING POWER

16,000,000 Ordinary Shares1 |

| |

8 |

SHARED

VOTING POWER

0 |

| |

9 |

SOLE

DISPOSITIVE POWER

16,000,000 Ordinary Shares1 |

| |

10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,000,000 Ordinary Shares1 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

22.4%2 |

| 14 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

1 Represents Ordinary Shares held directly by AstraZeneca

Holdings B.V., a wholly owned subsidiary of AstraZeneca PLC. AstraZeneca PLC and AstraZeneca Holdings B.V. may each be deemed to have

sole voting and dispositive power over the Ordinary Shares.

2 Based on 71,583,768 outstanding Ordinary Shares

(composed of 55,583,768 Ordinary Shares outstanding as of October 31, 2023 according to information received from the Issuer on

November 8, 2023, plus 16,000,000 Ordinary Shares issued to AstraZeneca Holdings B.V. on November 6, 2023 pursuant to the Initial

Investment Agreement).

CUSIP No. 15117K103

| 1 |

NAME

OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

AstraZeneca PLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS (See Instructions)

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United Kingdom |

| |

7 |

SOLE

VOTING POWER

16,000,000 Ordinary Shares3 |

| |

8 |

SHARED

VOTING POWER

0 |

| |

9 |

SOLE

DISPOSITIVE POWER

16,000,000 Ordinary Shares3 |

| |

10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,000,000 Ordinary Shares3 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

22.4%4 |

| 14 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

3 Represents Ordinary Shares held directly by AstraZeneca

Holdings B.V., a wholly owned subsidiary of AstraZeneca PLC. AstraZeneca PLC and AstraZeneca Holdings B.V. may each be deemed to have

sole voting and dispositive power over the Ordinary Shares.

4 Based on 71,583,768 outstanding Ordinary Shares (composed

of 55,583,768 Ordinary Shares outstanding as of October 31, 2023 according to information received from the Issuer on November 8, 2023,

plus 16,000,000 Ordinary Shares issued to AstraZeneca Holdings B.V. on November 6, 2023 pursuant to the Initial Investment Agreement).

CUSIP No. 15117K103

SCHEDULE 13D

Item 1. Security and Issuer.

This Schedule 13D relates to the ordinary shares with nominal value

of €0.05 per ordinary share (the “Ordinary Shares”) of Cellectis S.A. (the “Issuer”). The principal executive

offices of the Issuer are located at 8 rue de la Croix Jarry, Paris 75013, France.

Item 2. Identity and Background.

(a) This Schedule 13D is being filed on behalf of AstraZeneca

PLC, a public limited company incorporated under the laws of England and Wales (“AstraZeneca”), and AstraZeneca Holdings

B.V., a company organized under the laws of the Netherlands (“AZ Holdings BV”).

(b) The principal business address of AstraZeneca is 1 Francis

Crick Avenue, Cambridge Biomedical Campus, Cambridge, CB2 0A, England, and the principal business address of AZ Holdings BV is Pr. Beatrixlaan

582, 2595 BM Den Haag, Netherlands.

(c) AstraZeneca and AZ Holdings BV are members of a global, science-led

biopharmaceutical business that focuses on the discovery, development, and commercialisation of prescription medicines in Oncology, Rare

Diseases, and BioPharmaceuticals, including Cardiovascular, Renal & Metabolism, and Respiratory & Immunology. The name,

citizenship, business address and present principal occupation of each executive officer and director of each of AstraZeneca and AZ Holdings

BV (who, together with AstraZeneca and AZ Holdings BV, are referred to herein as the “Reporting Persons”) are set forth on

Schedule I, attached hereto.

(d)-(e) Neither AstraZeneca nor AZ Holdings BV, nor to the knowledge

of AstraZeneca nor AZ Holdings BV, any other Reporting Person, has during the last five years (i) been convicted in a criminal proceeding

(excluding traffic violations and similar misdemeanors) or (ii) been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violation with respect

to such laws.

(f) The jurisdiction of organization of each of AstraZeneca and

AZ Holdings BV is set forth in subsection (a) above. The citizenship of each of the individuals referred to in Schedule I is set

forth on Schedule I.

Item 3. Source and Amount of Funds or Other Consideration.

On November 1, 2023, AZ Holdings BV and the Issuer entered into

an investment agreement (the “Initial Investment Agreement”) pursuant to which, on November 6, 2023, the Issuer issued

16,000,000 Ordinary Shares to AZ Holdings BV at a price of $5.00 per Ordinary Share for a total subscription price of $80,000,000. The

source of the funds for the subscription price was working capital.

CUSIP No. 15117K103

Item 4. Purpose of Transaction.

The acquisition by AZ Holdings BV of the Issuer’s securities

as described herein was effected simultaneously with, and was a condition to the entry into, a joint research and collaboration agreement

between AstraZeneca and the Issuer to accelerate the development of next generation therapeutics in areas of high unmet need, including

oncology, immunology and rare diseases.

As described in Item 3, AZ Holdings BV acquired 16,000,000 Ordinary

Shares on November 6, 2023 for a total subscription price of $80,000,000 pursuant to the Initial Investment Agreement. Pursuant

to the Initial Investment Agreement, for so long as AZ Holdings BV and its affiliates hold, in aggregate, at least 20% of the share capital

and voting rights of the Issuer, AstraZeneca shall be entitled to subscribe on the same terms as other investors for its pro rata

share on a non-diluted basis of any securities issued by the Issuer, subject to certain customary exceptions such as issuances of

securities of the Issuer pursuant to incentive equity compensation plans. In addition, AstraZeneca is entitled to nominate an individual

as a non-voting observer (censeur) on the board of directors of the Issuer. The Issuer has agreed to provide AZ Holdings BV with

certain registration rights, including agreeing to register the resale of any Ordinary Shares acquired by AZ Holdings BV pursuant to

the Initial Investment Agreement and the Additional Investment (as defined below) contemplated by the MOU (as defined below).

In addition to the Initial Investment Agreement, AstraZeneca Ireland

Limited (a wholly owned subsidiary of AstraZeneca) and the Issuer entered into a joint research and collaboration agreement (the “JRCA”),

and AZ Holdings BV and the Issuer entered into a non-binding memorandum of understanding (the “MOU”) on November 1,

2023.

Pursuant to the JRCA, AstraZeneca Ireland Limited paid to the Issuer

$25,000,000 and AstraZeneca will leverage the Issuer’s proprietary gene editing technologies and manufacturing capabilities, to

develop novel cell and gene therapy candidate products. Under the terms of the JRCA, the Issuer is also eligible to receive an investigational

new drug (“IND”) option fee and development, regulatory and sales-related milestone payments, ranging from $70 million up

to $220 million, per each of the 10 candidate products, plus tiered royalties. Pursuant to the JRCA, AstraZeneca Ireland Limited was

also granted an option for a worldwide exclusive license for the candidate products, to be exercised before IND filing.

The MOU contemplates that AZ Holdings BV will, subject to the terms

and conditions set forth therein, make a further equity investment in the Issuer of $140,000,000 (the “Additional Investment”)

by subscribing for two classes of convertible preferred shares of the Issuer, pursuant to a subsequent investment agreement, the form

of which is attached as a schedule to the MOU (the “Subsequent Investment Agreement”).

Under the terms of the MOU, the Issuer must inform and consult with

its Comité Social et Economique (the “Works Council”) regarding the Additional Investment prior to entering

into the Subsequent Investment Agreement. Upon completion of the consultation process, the parties will then determine whether to enter

into the Subsequent Investment Agreement. The MOU provides that if one party fails to execute the Subsequent Investment Agreement within

four months after entry into the MOU, such party must pay the other party a break fee as compensation for external costs and expenses.

CUSIP No. 15117K103

The Subsequent Investment Agreement contemplates that AZ Holdings

BV will subscribe for (i) 10,000,000 series A convertible preferred shares of the Issuer; and (ii) 18,000,000 series B convertible

preferred shares of the Issuer, each at a price of $5.00 per convertible preferred share. The series A convertible preferred shares will

have single voting rights, and the series B convertible preferred shares will carry no voting rights. Both the series A and series B

convertible preferred shares will be convertible, at AstraZeneca’s discretion into Ordinary Shares with all of their associated

rights, provided that AstraZeneca shall provide 12 months’ prior notice of its intention to convert all or part of the series

B convertible preferred shares that it holds. The closing of the Additional Investment is subject to (i) the Issuer’s shareholders’

approval, with such approval requiring two-thirds of the votes cast by voting shareholders, (ii) clearance of such investment from

the French Ministry of Economy according to the foreign direct investment French regulations and (iii) other customary closing conditions.

Following the closing of the Additional Investment, it is anticipated that AZ Holdings BV would own approximately 44.2% of the Ordinary

Shares then outstanding.

Pursuant to the proposed Subsequent Investment Agreement, for so long

as AZ Holdings BV and its affiliates would hold, in aggregate, at least 20% of the share capital and voting rights of the Issuer, AstraZeneca

would be entitled to subscribe on the same terms as other investors for its pro rata share on a non-diluted basis of any securities

issued by the Issuer, subject to certain customary exceptions such as issuances of securities of the Issuer pursuant to incentive equity

compensation plans. Pursuant to the proposed Subsequent Investment Agreement, the Issuer would agree to provide AZ Holdings BV with certain

registration rights, including agreeing to register the resale of any shares acquired by AZ Holdings BV pursuant to the Initial Investment

Agreement and the Subsequent Investment Agreement.

If the closing of the Additional Investment occurs, then from such

date and for so long as AZ Holdings BV and its affiliates hold, in the aggregate, at least 40% of the share capital and voting rights

of the Issuer, AstraZeneca would be entitled to nominate two directors for appointment to the board of directors of the Issuer, which

directors would be entitled to be appointed to each committee of the board of directors or, if such committee membership is not permitted

under applicable stock exchange rules, to attend any meeting of the committees of the board of directors as non-voting observers. If

AZ Holdings BV’s ownership were to fall below 40%, then for so long as AZ Holdings BV and its affiliates would own, in the aggregate,

at least 20% of the share capital and voting rights of the Issuer, AstraZeneca would retain the foregoing appointment right, but solely

with respect to one director.

AstraZeneca intends to continue to review its investment in the Issuer

on an ongoing basis and, depending on various factors, including, without limitation, the Issuer’s financial position, the price

of the Ordinary Shares and the American Depositary Shares representing Ordinary Shares, conditions in the securities markets and general

economic and industry conditions, AstraZeneca may, in the future, take such actions with respect to the Ordinary Shares as they deem

appropriate, including, without limitation: purchasing additional Ordinary Shares; selling Ordinary Shares; taking any other action with

respect to the Issuer or any of its securities in any manner permitted by law or changing their intention with respect to any and all

matters referred to in paragraphs (a) through (j) below in this Item 4.

CUSIP No. 15117K103

Except as otherwise described in this Schedule 13D, none of the Reporting

Persons currently has any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a

merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount

of assets of the Issuer or any of its subsidiaries; (d) any change in the present board of directors or management of the Issuer,

including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board; (e) any

material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s

business or corporate structure; (g) any changes in the Issuer’s charter or bylaws or other actions which may impede the acquisition

of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities

exchange or to cease to be authorized to be quoted in an interdealer quotation system of a registered national securities association;

(i) causing a class of equity securities of the Issuer to become eligible for termination of registration pursuant to Section 12(g)(4) of

the Securities Exchange Act of 1934, as amended; or (j) any action similar to any of those enumerated above.

Item 5. Interest in Securities of the Issuer.

(a) As at the date of this Schedule 13D, each of AstraZeneca

and AZ Holdings BV may be deemed to beneficially own 16,000,000 Ordinary Shares, representing approximately 22.4% of the Ordinary Shares

outstanding. This percentage is based on 71,583,768 outstanding Ordinary Shares (composed of 55,583,768 Ordinary Shares outstanding as

of October 31, 2023 according to information received from the Issuer on November 8, 2023, plus 16,000,000 Ordinary Shares

issued to AZ Holdings BV on November 6, 2023 pursuant to the Initial Investment Agreement).

To the knowledge of AstraZeneca and AZ Holdings BV, no other Reporting

Person beneficially owns any Ordinary Shares.

(b) As at the date of this Schedule 13D, each of AstraZeneca

and AZ Holdings BV may be deemed to have sole voting and dispositive power over 16,000,000 Ordinary Shares. Neither AstraZeneca nor AZ

Holdings BV has shared voting or dispositive power over any Ordinary Shares.

To the knowledge of AstraZeneca and AZ Holdings BV, no other Reporting

Person has any voting or dispositive power over any Ordinary Shares.

(c) Except as set forth in this Schedule 13D, neither AstraZeneca

nor AZ Holdings BV, nor, to the knowledge of AstraZeneca and AZ Holdings BV, any other Reporting Person, has effected any transactions

with respect to the Ordinary Shares within the last 60 days.

(d) To the knowledge of AstraZeneca and AZ Holdings BV, no person

has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities of the

Issuer beneficially owned by AstraZeneca and/or AZ Holdings BV.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Items 3 and 4 of this Schedule 13D are incorporated by reference herein.

Other than as described in Items 3 and 4, there are no contracts, arrangements, understandings or relationships with respect to the securities

of the Issuer between the Reporting Persons or the individuals listed on Schedule I and any other person or entity.

CUSIP No. 15117K103

The descriptions of the Initial Investment Agreement, the JRCA, the

MOU and the Subsequent Investment Agreement are not complete and are qualified in their entirety by reference to the complete text of

such agreements, copies of which are filed as exhibits hereto and the terms of which are incorporated herein by reference.

Item 7. Material to Be Filed as Exhibits.

CUSIP No. 15117K103

SIGNATURE

After reasonable inquiry and to the best of each of the undersigned’s

knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

| Date: November 9, 2023 |

ASTRAZENECA PLC |

| |

|

|

| |

By: |

/s/

Adrian Kemp |

| |

Name: Adrian Kemp |

| |

Title: Company

Secretary |

| |

|

|

| Date: November 9, 2023 |

ASTRAZENECA HOLDINGS

B.V. |

| |

|

|

| |

By: |

/s/

Kamila Kozikowska |

| |

Name: Kamila Kozikowska |

| |

Title:

Director |

| |

|

|

CUSIP No. 15117K103

Schedule I

The name and present principal occupation

of each of the executive officers and directors of AstraZeneca PLC are set forth below. Unless otherwise noted, each of these persons

have as their business address 1 Francis Crick Avenue, Cambridge Biomedical Campus, Cambridge CB2 0AA, England.

| Name |

|

Position with AstraZeneca

PLC |

|

Principal Occupation and, if

not employed by

AstraZeneca PLC, Name,

Principal Business and

Address of Employer |

|

Citizenship |

| Michel Demaré |

|

Non-Executive Chair of the Board |

|

|

|

Belgian and Swiss |

| Pascal Soriot |

|

Executive Director and Chief Executive Officer |

|

|

|

French and Australian |

| Aradhana Sarin |

|

Executive Director and Chief Financial Officer |

|

|

|

American |

| Philip Broadley |

|

Senior Independent Non-Executive Director |

|

|

|

British |

| Euan Ashley |

|

Non-Executive Director |

|

Stanford University

Department: Medicine - Med/Cardiovascular Medicine

Position: Professor-Univ Med Line

Falk Building CV267

870 Quarry Road

Stanford, California 94305

United States |

|

British |

| Deborah DiSanzo |

|

Non-Executive Director |

|

President, Best Buy Health

Best Buy Co., Inc.

7601 Penn Avenue S.

Richfield, MN 55423

United States |

|

American |

| Diana Layfield |

|

Non-Executive Director |

|

General Manager, International

Search, Google

Alphabet Inc.

600 Amphitheatre Parkway

Mountain View, CA 94043

United States |

|

British |

| Anna Manz |

|

Non-Executive Director |

|

Chief Financial Officer

London Stock Exchange Group

10 Paternoster Square

London

EC4M 7LS

United Kingdom |

|

British |

| Sheri McCoy |

|

Non-Executive Director |

|

|

|

American |

| Tony Mok |

|

Non-Executive Director |

|

Professor and Chair

Department of Clinical Oncology

The Chinese University of Hong Kong

Hong Kong

China |

|

Canadian |

| Nazneen Rahman |

|

Non-Executive Director |

|

Chief Executive Officer

YewMaker Medicines Ltd

Unit 3 Upp Hall Farm

Salmons Lane

Colchester

CO6 1RY

United Kingdom |

|

British |

| Andreas Rummelt |

|

Non-Executive Director |

|

Chairman and Managing Partner

InterpharmaLink AG

Münchensteinerstrasse 41

4052 Basel

Switzerland |

|

German |

| Marcus Wallenberg |

|

Non-Executive Director |

|

Chairman of Skandinaviska

Enskilda Banken,

Kungsträdgårdsgatan 8,

106 40 Stockholm

Sweden |

|

Swedish |

CUSIP No. 15117K103

The name and present principal occupation of each of the executive

officers and directors of AstraZeneca Holdings B.V. are set forth below. Unless otherwise noted, each of these persons have as their

business address Prinses Beatrixlaan 582, 2595 BM, The Hague, the Netherlands.

| Name |

|

Position with AstraZeneca

Holdings B.V. |

|

Principal Occupation and, if

not employed by

AstraZeneca Holdings B.V., Name,

Principal Business and

Address of Employer |

|

Citizenship |

| Martijn Bernard Adriaan Bax |

|

Director |

|

Director |

|

Netherlands |

| Elisabeth Antonia Petronella van Gorp |

|

Director |

|

Director |

|

Netherlands |

| Kamila Katarzyna Kozikowska |

|

Director |

|

Director |

|

Poland |

EXHIBIT 1

CUSIP No. 15117K103

JOINT FILING AGREEMENT

The undersigned acknowledge and agree that the foregoing statement

on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to this statement on Schedule 13D shall

be filed on behalf of each of the undersigned without the necessity of filing additional joint filing statements. The undersigned acknowledge

that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the information concerning

him, her or it contained herein, but shall not be responsible for the completeness and accuracy of the information concerning the other

entities or persons, except to the extent that he, she or it knows or has reason to believe that such information is inaccurate.

| Date:

November 9, 2023 |

ASTRAZENECA PLC |

| |

|

|

| |

By: |

/s/ Adrian Kemp |

| |

Name: |

Adrian Kemp |

| |

Title: |

Company Secretary |

| |

|

|

| Date:

November 9, 2023 |

ASTRAZENECA HOLDINGS B.V. |

| |

|

|

| |

By: |

/s/ Kamila Kozikowska |

| |

Name: |

Kamila Kozikowska |

| |

Title: |

Director |

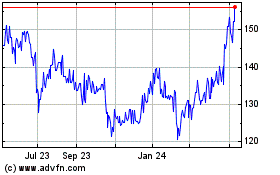

AstraZeneca (PK) (USOTC:AZNCF)

Historical Stock Chart

From Apr 2024 to May 2024

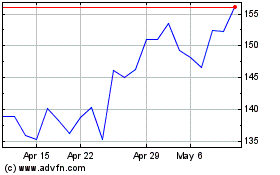

AstraZeneca (PK) (USOTC:AZNCF)

Historical Stock Chart

From May 2023 to May 2024