UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

|

☑

|

| |

|

|

Filed by a Party other than the Registrant

|

☐

|

| |

|

|

Check the appropriate box:

|

|

| |

☐

|

Preliminary Proxy Statement

|

| |

☐

|

Confidential, for Use of the Commission only(as permitted by Rule 14a-6(e)(2))

|

| |

☑

|

Definitive Proxy Statement

|

| |

☐

|

Definitive Additional Materials

|

| |

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

CONSUMERS BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

CONSUMERS BANCORP, INC.

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 24, 2024

To Our Shareholders:

Notice is hereby given that the Annual Meeting of Shareholders of Consumers Bancorp, Inc. will be a virtual meeting hosted exclusively via live webcast at www.meetnow.global/MJ4TKAZ, on Thursday, October 24, 2024, at 10:00 a.m. (local time), for the following purposes:

|

1.

|

To elect four Class III directors to serve a three-year term until the Annual Meeting of Shareholders in 2027 or until their successors are elected and qualified.

|

|

2.

|

To ratify the appointment of Plante & Moran, PLLC as the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2025; and

|

|

3.

|

For the transaction of any other business that may properly come before the meeting or any adjournment thereof.

|

Only those shareholders of record at the close of business on August 30, 2024 are entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournment thereof.

The Annual Meeting will be held in a virtual meeting format only, via live webcast, with no physical in-person meeting. Shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.meetnow.global/MJ4TKAZ. You will use the control number shown on your proxy to access the virtual meeting. Further details regarding the virtual meeting format can be found under the General Information - Virtual Meeting Information section of this Proxy Statement. We encourage you to vote your shares prior to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please sign, date, and return the enclosed proxy card in the envelope provided or authorize your proxy electronically over the Internet as promptly as possible. Please refer to the proxy card enclosed for information on authorizing your proxy electronically. A proxy may be revoked at any time before it is exercised and shareholders who are present online at the virtual Annual Meeting may revoke their proxy and vote online at the Annual Meeting if they wish to do so.

| |

|

By Order of the Board of Directors

|

| |

|

|

|

Frank L. Paden

Chairman

|

Minerva, Ohio

September 6, 2024

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on October 24, 2024

The proxy statement and annual report are available

at www.envisionreports.com/CBKM.

CONSUMERS BANCORP, INC.

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 24, 2024

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Consumers Bancorp, Inc. (the Company, Consumers or Consumers Bancorp) for use at the Annual Meeting of Shareholders (the Annual Meeting) to be hosted virtually at www.meetnow.global/MJ4TKAZ, on Thursday, October 24, 2024, at 10:00 a.m. local time.

This Proxy Statement and the accompanying proxy are first being mailed to shareholders of record on or about September 12, 2024. It is contemplated that solicitation of proxies generally will be by mail. However, officers or employees of Consumers Bancorp or Consumers National Bank, a wholly-owned subsidiary of Consumers Bancorp, may also solicit proxies by electronic media without additional compensation. Consumers Bancorp will pay the costs associated with the solicitation of proxies.

Shareholders of record at the close of business on August 30, 2024 are entitled to notice of and to vote at the Annual Meeting. As of August 30, 2024, 3,123,588 Consumers Bancorp common shares, no par value, were outstanding. Each shareholder will be entitled to one vote for each common share beneficially owned on all matters that come before the Annual Meeting.

Proxies solicited by the Board of Directors will be voted in accordance with the instructions given, unless revoked. Where no instructions are provided, all properly executed proxies will be voted (1) for the election to the Board of Directors of all director nominees named in this Proxy Statement; (2) for the ratification of the appointment of Plante & Moran, PLLC as the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2025; and (3) at the discretion of the holders of the proxies, on such other business that may properly come before the meeting or any adjournment thereof.

The shareholders present or by proxy shall constitute a quorum. The four nominees receiving the highest number of votes cast, including votes cast cumulatively, shall be elected Directors. Abstentions will be counted in establishing the quorum and will be counted as voting on the affected proposal. Broker non-votes will be counted for purposes of establishing a quorum but will not be counted as voting. A proxy may be revoked at any time before it is voted by providing written notice to Consumers Bancorp, by submitting a later dated proxy or by voting at the Annual Meeting. Any written notice revoking a proxy should be sent to Ms. Renee Wood, Secretary, Consumers Bancorp, Inc., P.O. Box 256, Minerva, Ohio 44657.

Virtual Meeting Information

Instruction/Q&A Section

|

Q:

|

How can I attend the Annual Meeting with the ability to ask a question and/or vote?

|

|

A:

|

The Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a shareholder of the Company as of the close of business on the Record Date, or if you hold a valid legal proxy for the Annual Meeting. No physical meeting will be held.

|

If you are a Registered Holder (hold shares through our transfer agent, Computershare, each of such shareholders being referred to herein as a Registered Holder), you will be able to attend the Annual Meeting online, ask a question and vote by visiting www.meetnow.global/MJ4TKAZ. Please follow the instructions on your notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker (each of such shareholders being referred to herein as a Beneficial Holder), you must follow the instructions below in advance to attend the meeting.

If you are a Beneficial Holder and want to attend the Annual Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so) you have two options:

| |

1)

|

Registration in Advance of the Annual Meeting

|

Submit proof of your proxy power (Legal Proxy) from your broker or bank reflecting your Consumers Bancorp, Inc. holdings along with your name and email address to Computershare.

Requests for registration as set forth in (1) above must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on October 18, 2024. You will receive confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

| |

By email:

|

Forward the email from your broker granting you a Legal Proxy, or attach an

image of your Legal Proxy, to legalproxy@computershare.com

|

| |

By mail:

|

Computershare

Consumers Bancorp, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

|

| |

2)

|

Register at the Annual Meeting

|

Beneficial Holder Access to Virtual Meetings 2024 Proxy Season

For the 2024 proxy season, an industry solution has been agreed upon to allow Beneficial Holders to register online at the Annual Meeting to attend, ask questions and vote. We expect that the vast majority of Beneficial Holders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is intended to be provided as a convenience to Beneficial Holders only, and there is no guarantee this option will be available for every type of Beneficial Holder voting control number. The inability to provide this option to any or all Beneficial Holders shall in no way impact the validity of the Annual Meeting. Beneficial Holders may choose the Register in Advance of the Annual Meeting option above, if they prefer to use this traditional, paper-based option.

In any event, please go to www.meetnow.global/MJ4TKAZ for more information on the available options and registration instructions.

The online meeting will begin promptly at 10:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

|

Q:

|

Do I need to register to attend the Annual Meeting virtually?

|

|

A:

|

Registration is only required if you are a Beneficial Holder, as set forth above.

|

|

Q:

|

How can I vote online at the meeting?

|

|

A:

|

If you are a Registered Holder follow the instructions on the notice, email or proxy card that you received to access the meeting.

|

If you are a Beneficial Holder, please see the registration options set forth in numbers (1) and (2) above.

Online voting will be available during the meeting.

|

Q:

|

Why are you holding a virtual meeting instead of a physical meeting?

|

|

A:

|

We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our shareholders and the Company. We believe that hosting a virtual meeting will enable more of our shareholders to attend and participate in the meeting since our shareholders can participate from any location around the world with Internet access.

|

|

Q:

|

What if I have trouble accessing the Annual Meeting virtually?

|

|

A:

|

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Note: Internet Explorer is not a supported browser. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call Local 1-888-724-2416 or International +1 781-575-2748.

|

PROPOSAL 1

ELECTION OF DIRECTORS

Election of Directors

The Board of Directors, acting through the Corporate Governance/Nominating Committee, is responsible for identifying and evaluating candidates for Board membership. Generally, the directors in each class are elected to serve staggered three-year terms so that the term of office of one class of directors expires at each annual meeting. Currently, the Board consists of eleven members and Harry W. Schmuck Jr. will be retiring at the 2024 annual meeting because of the Company’s mandatory retirement age policy. Following Mr. Schmuck’s retirement, the Board will consist of ten members with four directors in Class III with terms expiring in 2024, three directors in Class I with terms expiring in 2025, and three directors in Class II with terms expiring in 2026.

The term of office of current Class III directors Ann M. Gano, Joseph A. Gerzina, Richard T. Kiko, Jr., and Ralph J. Lober II will expire at the Annual Meeting on October 24, 2024 and constitute the Class III nominees to be elected to serve until the 2027 annual meeting or until their successors are elected and qualified. Additional information concerning the nominees for director, the directors and executive officers of Consumers Bancorp is provided in the following pages.

The common shares represented by the accompanying proxy will be voted for the election of the nominees to serve as directors unless contrary instructions are indicated on the proxy card. The nominees for director receiving the greatest number of “for” votes will be elected as directors. If the election of directors is by cumulative voting, the persons appointed by the accompanying proxy intend to cumulate the votes represented by the proxies they receive and distribute such votes in accordance with their best judgment, unless authority to vote for any or all nominees is withheld.

If one or more of the nominees should at the time of the Annual Meeting be unavailable or unable to serve as a director, the common shares represented by the proxies will be voted to elect the remaining nominees and any substitute nominee or nominees designated by the Board of Directors. The Board of Directors knows of no reason why any of the nominees will be unavailable or unable to serve.

The Board of Directors recommends that the shareholders vote “FOR”

the election of the nominees for Class III directors.

DIRECTORS AND EXECUTIVE OFFICERS

Director Nominees for Election at the Annual Meeting

Class III Directors – Term ending in 2024

Ann M. Gano (age 54) was appointed by the Board of Directors in January 2023 as a Director of Consumers Bancorp, Inc. and Consumers National Bank. She is an independent member of the Asset/Liability Committee, the Risk & Technology Committee, and serves as the Chair of the Audit Committee. Ms. Gano is a Certified Public Accountant and owner of Keeping Tabs, Inc. in New Philadelphia, Ohio. She is a graduate of Kent State University and The Ohio State University Agricultural Technical Institute. She also serves on the boards of the Friends of Adult Education Buckeye CC, Frontier Community Connection Fund, New Philadelphia Quaker Foundation, the Buckeye Career Center Foundation, and the Frontier Power Cooperative.

Joseph A. Gerzina (age 68) was appointed by the Board of Directors in July 2024 as a Director of Consumers Bancorp, Inc. and Consumers National Bank. He is an independent member of the Audit Committee, the Loan Committee and the Corporate Governance/Nominating Committee. Mr. Gerzina is retired from a 40-year career in the financial industry where he has worked for several regional and local banks in senior management roles including Senior Vice President and Regional President roles. In April 2022, he retired from Farmers National Bank of Canfield where he worked for 11 years as the Regional President and Chief Lending Officer of the west market area (Stark, Wayne, Medina and Cuyahoga counties in Ohio). Mr. Gerzina serves as a director for the Stark County Port Authority and Stark County Catholic Schools. Mr. Gerzina earned a Bachelor of Arts and Science Degree in Business Administration at Capital University in Columbus, Ohio, and is also a graduate of Stonier School of Banking at the University of Delaware.

Richard T. Kiko, Jr. (age 58) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since January 2015 and was appointed Vice Chairman of the Board in January 2024. Mr. Kiko is an independent member of the Asset/Liability Committee, Risk & Technology Committee, and the Chairman of the Executive Committee. He is currently a director and shareholder of Coletta Holdings Inc., a 5th generation family-owned business which includes the following holdings where he is the Chief Executive Officer or President of each: Kiko Auctioneers, Kiko Real Estate Brokerage, which completes auctions and private real estate transactions, Futuregen, LLC, and Generation Three Properties, an owner of commercial real estate. Mr. Kiko is also currently a partner of AK Auction Management LLC, a commercial equipment and vehicle auction dealership in Ohio, a partner of CXO Growth Partners, LLC, an Ohio business brokerage company, and a partner in EXSELLIT, LLC, an Ohio receivership company. Prior to joining the family business, Mr. Kiko held various management positions at Procter & Gamble, KKR Private Equity Co’s Borden Foods Company, and GE Capital’s Eagle Family Foods, Inc. Mr. Kiko is currently Chairman of the Board of RAHAB Ministries, a nonprofit organization that provides services to those directly affected by sex trafficking in NE Ohio. He brings a broad range of experience in sales, marketing, logistics, manufacturing, finance, and general management to the Board of Directors. As a third-generation auctioneer and realtor, Mr. Kiko specializes in working with large clients with land, commercial real estate, Business, and mineral rights transactions. His real estate and business experience broadens the Board’s expertise.

Ralph J. Lober II (age 57) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since 2008. Mr. Lober is currently the President and Chief Executive Officer, first joining the Company in 2007 as Executive Vice President and Chief Operating Officer. Mr. Lober was promoted to President and was appointed to Consumers National Bank’s Board of Directors in January 2008. Mr. Lober is currently a member of the Loan Committee and serves as the Chairman of the Asset/Liability Committee. Having served as Executive Vice President and Chief Financial Officer at Morgan Bank National Association from 1999 until May of 2007, Mr. Lober has a strong background in finance, funds management and operations. Mr. Lober holds BSBA and MBA degrees from Duquesne University, Pittsburgh, is a certified public accountant licensed in Ohio and Pennsylvania and a graduate of the Graduate School of Banking at The University of Wisconsin-Madison. He serves on the board and executive committee of Habitat for Humanity - East Central Ohio, as board treasurer.

Members of the Board of Directors Continuing in Office

Class I Directors – Term ending in 2025

Frank L. Paden (age 73) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since July 2013, and was appointed Chairman of the Boards in January 2024. He is an independent member of the Loan Committee, Compensation Committee, and the Executive Committee. Mr. Paden formerly served in several executive positions at Farmers National Bank of Canfield for 40 years and brings extensive financial expertise to the Board of Directors. Mr. Paden served as President and Chief Executive Officer at Farmers National Bank of Canfield from 1996 until he was appointed Executive Chairman of the Board in 2010. Mr. Paden served as Executive Chairman until September 2011, at which time he retired. He is also Treasurer for the Board of the Mahoning County Agriculture Society’s Canfield Fair, serves as a Trustee with the Circle of Friends Foundation and as Vice President of the Children’s Circle of Friends.

John W. Parkinson (age 59), formerly a member of Peoples Bancorp of Mt. Pleasant, Inc. board of directors since 2005, was appointed to serve as a Director of Consumers Bancorp, Inc. and Consumers National Bank on January 1, 2020. He is an independent member of the Loan Committee, Asset/Liability Committee, and serves as the Chairman of the Risk & Technology Committee. Mr. Parkinson is President, Chief Compliance Officer of Appalachian Capital Management Ltd., a firm he founded in 1990, which provides money management for individuals, trusts, non-profits, and corporations. He has a Bachelor of Science degree from The Ohio State University and is a Certified Financial Planner.

Michael A. Wheeler (age 41) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since March 2021. He is an independent member of the Asset/Liability Committee, Compensation Committee, and the Risk & Technology Committee. Mr. Wheeler serves as President and Chief Legal Officer of Patriot Software, a Canton Ohio based payroll and accounting software firm and has been with the firm for 18 years. At Patriot Software, Mr. Wheeler handles most business, legal, and financial aspects of the company. He is a graduate of the University of Mount Union and the University of Akron School of Law. He also serves on the boards and advisory committee of several community organizations.

Class II Directors – Term ending in 2026

Bradley Goris (age 70) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since January 2011. Mr. Goris is an independent member of the Corporate Governance/Nominating, Asset/Liability Committee and the chairman of the Compensation Committee. He is a retired agent of the Goris-Meadows Insurance Agency in Alliance, Ohio, and past Vice-President of the A.A. Hammersmith Insurance Agency in Massillon, Ohio. He is currently the managing member of Goris Properties, LLC, a family real estate development and management firm in Alliance. Mr. Goris’ experience and commitment to local service and nonprofit organizations supports Consumers National Bank’s community bank philosophy.

Shawna L. L’Italien (age 53) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since March 2021. Ms. L’Italien is an independent member of the Audit Committee, Compensation Committee, and the Corporate Governance/Nominating Committee. She is partner in the Salem office of the law firm of Harrington, Hoppe, and Mitchell, Ltd and serves on the firm’s Management Committee. Practicing law since 1996, she focuses her practice on business organization, commercial and real estate transactions, succession planning, elder law, and estate planning. She is a graduate of the University of Mount Union and the Ohio State University Moritz College of Law. She serves on the boards of various community organizations.

Laurie L. McClellan (age 71) has served as a Director of Consumers Bancorp, Inc. and Consumers National Bank since October 1987 and served as Chairman of the Boards from March 1998 until her retirement from this position on January 1. 2024. Ms. McClellan is a member of the Executive Committee, Audit Committee and the Loan Committee. Ms. McClellan was the Manager of the Romain Fry Investment Company, LLC and serves on various community and nonprofit advisory boards. She has 37 years of experience in community banking with an extensive knowledge of the Company’s history and operations and has a strong understanding of banking regulation and compliance. Ms. McClellan has served in many capacities with the bank including as Director of Shareholder Relations for Consumers Bancorp, Inc. from 2011 until October 1, 2018, and Corporate Secretary and Vice Chairman of the Boards prior to her becoming Chairman of the Boards in 1998.

THE BOARD OF DIRECTORS AND

ITS COMMITTEES

The Board of Directors conducts its business through meetings of the Board and its committees. Currently, each member of the Board of Directors of Consumers Bancorp also serves as a member of the Board of Directors of Consumers National Bank. Consumers Bancorp and Consumers National Bank each held 12 Board meetings during fiscal year 2024. All directors attended at least 75% of the total number of meetings of the Board of Directors and meetings held by all committees of the Board on which they served during fiscal year 2024. The Company has determined that all directors, except Mr. Lober, are “independent” directors under the listing standards of the NASDAQ Stock Market Marketplace Rules and qualify as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended.

Although the Company does not have a formal policy with respect to Board member attendance at the annual meeting of shareholders, each member is encouraged to attend. All Board members attended the 2023 Annual Meeting of Shareholders except Mr. Kiko.

Consumers Bancorp has an Asset/Liability Committee, Audit Committee, Compensation Committee, Corporate Governance/Nominating Committee, Executive Committee, Loan Committee and Risk & Technology Committee, each of which serves in dual capacity as a committee of Consumers Bancorp and Consumers National Bank.

The Asset/Liability Committee is comprised of Ms. Gano, Mr. Goris Mr. Kiko, Mr. Parkinson, Mr. Wheeler, and Mr. Lober, who serves as committee chairman. The Asset/Liability Committee is primarily responsible for ensuring both Consumers Bancorp and Consumers National Bank have adequate investment and funds management policies. The committee makes recommendations relative to the strategic direction of the Company and establishes key benchmarks relative to performance. The Asset/Liability Committee is also responsible for establishing procedures for monitoring the management of the investment portfolio and Consumers National Bank’s liquidity, capital, and interest rate risk position. During fiscal year 2024, the Asset/Liability Committee met four times.

The Audit Committee is comprised of Ms. Gano, Ms. L’Italien, Ms. McClellan, and Mr. Gerzina following his appointment to the Board of Directors in July 2024. Ms. Gano serves as chairperson and the Board has determined that she satisfies the requirements of a “financial expert” as defined by the applicable Security and Exchange Commission rules and regulations. During the fiscal year 2024, Mr. Parkinson and Mr. Schmuck served on the committee through November 2023 and Mr. Paden served on the committee through June 2024. The primary function of the Audit Committee includes the review and oversight of the financial reporting process, internal control environment and the risk management process, including enterprise risk management. Also, the Audit Committee provides oversight of all internal and external audit functions and the approval and engagement of the Company’s independent auditors and loan review consultants. The Audit Committee Charter is available on the Company’s website at www.consumers.bank. The Board of Directors of Consumers Bancorp has determined that each member of the Audit Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules and qualifies as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. The Report of the Audit Committee is on page 20 of this Proxy Statement. During fiscal year 2024, the Audit Committee met five times.

The Compensation Committee reviews overall bank compensation policies and executive management compensation. This committee is comprised of Ms. L’Italien, Mr. Paden, Mr. Wheeler, and Mr. Goris, who serves as committee chairman. Mr. Furey served on the committee from December 2023 until his retirement in April 2024. The Board of Directors of Consumers Bancorp has determined that each member of the Compensation Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules and qualifies as “non-employee directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. Our compensation philosophy and objectives are described in the Compensation Discussion and Analysis section of this Proxy Statement. During fiscal year 2024, the Compensation Committee met four times. The Compensation Committee Charter is available on the Company’s website at www.consumers.bank.

The Executive Committee reviews and monitors the organizational goals, strategic planning process, and any merger and acquisition opportunities. In addition, all major functions are subject to the review and approval of the Executive Committee, including, but not limited to, new initiatives, new products, services, key vendor relationships, key insurance policies and significant legal matters. The committee also reviews various executive and interim Board matters as outlined by its charter. This committee is comprised of Ms. McClellan, Mr. Paden, Mr. Schmuck and Mr. Kiko, who has served as the committee chairman since December 1, 2023. Mr. Paden served as committee chair prior to Mr. Kiko. During fiscal year 2024, the Executive Committee met four times.

The Loan Committee is comprised of Mr. Gerzina, Mr. Lober, Ms. McClellan, Mr. Paden, Mr. Parkinson, and Mr. Schmuck, who serves as chairman. Mr. Furey served on the committee until his retirement in April 2024. Mr. Parkinson joined the committee in July 2024 and Mr. Gerzina joined following his appointment to the Board in July 2024. The Loan Committee reviews the lending policies and monitors the Loan Administration’s compliance with such policies, ensures that management’s handling of credit risk complies with Board decisions about acceptable levels of risk, ensures management follows appropriate procedures to recognize adverse trends, takes any needed corrective actions and maintains an adequate allowance for loan and lease losses. The Loan Committee is also responsible for approving loans that exceed the Internal Loan Committee’s lending authority. During fiscal year 2024, the Loan Committee met 27 times.

The Corporate Governance/Nominating Committee is responsible for the selection of individuals for nomination or re-election to the Board of Directors, making independent recommendations to the Board of Directors as to best practices for Board governance and conducting an evaluation of Board performance. The Corporate Governance/Nominating Committee is comprised of Mr. Gerzina, Mr. Goris, Mr. Schmuck, and Ms. L’Italien who has served as chairperson since December 1, 2023. Mr. Kiko served as committee chair prior to Ms. L’Italien. Mr. Furey served on the committee until his retirement in April 2024. Mr. Gerzina joined the committee following his appointment to the Board in July 2024. The Board of Directors determined that each member of the Corporate Governance/Nominating Committee meets the independence standards of the NASDAQ Stock Market Marketplace Rules. During fiscal year 2024, the Corporate Governance/Nominating Committee met four times.

Under the terms of the Corporate Governance/Nominating Committee Charter, the committee is responsible for developing and implementing a process and guidelines for the selection of individuals for nomination to the Board of Directors and considering incumbent directors for nomination for re-election. The Corporate Governance/Nominating Committee will consider candidates for director who are recommended by shareholders in accordance with the Company’s Amended and Restated Regulations and the Board Addition/Replacement Procedures found in the Board and Management Succession Policy. As part of its considerations, the Corporate Governance/Nominating Committee places value on having directors with experience and expertise that are diverse from other Board members. Candidates must be individuals with a good reputation who demonstrate civic character, business success and community involvement. They must be willing to commit their time to Board and committee meetings, keep apprised of banking issues and complete continuing education courses. The Corporate Governance/Nominating committee is responsible for the selection of the final slate of nominees for election to the Board of Directors. Those nominees recommended by the Committee are then submitted to the Board of Directors for approval. The Corporate Governance/Nominating Committee Charter is available on the Company’s website at www.consumers.bank.

The Risk & Technology Committee is responsible for the oversight of the Company’s information technology program and risk management process, including Enterprise Risk Management. The Committee shall approve and recommend to the Board of Directors the Company’s risk management framework, including risk, policies, processes, and procedures. Also, the Committee oversees the Information Security Program, key system selection and performance evaluation, vendor management and the business resumption planning process. The Risk & Technology committee is comprised of Ms. Gano, Mr. Kiko, Mr. Wheeler, and Mr. Parkinson who serves as the committee chairman. During fiscal year 2024, the Risk & Technology Committee met four times.

Shareholders desiring to nominate a candidate for election as a director at the 2025 Annual Meeting of Shareholders, other than for inclusion in Consumers Bancorp’s proxy statement and form of proxy, must deliver written notice to the Secretary of Consumers Bancorp, at its executive offices, 614 East Lincoln Way, Minerva, Ohio 44657, not later than July 29, 2025, or such nomination will be untimely. Consumers Bancorp reserves the right to exercise discretionary voting authority on the nomination if a shareholder has failed to submit the nomination by July 29, 2025, or if the candidate does not meet the criteria set forth in the Company’s Amended and Restated Regulations.

Board Leadership Structure; Role in Risk Oversight

In accordance with our regulations, the Board elects our Chairman and Chief Executive Officer, or CEO, and both positions may be held by the same person or may be held by different people. Currently the offices of Chairman and CEO are separated. The Board believes the separation of offices of the Chairman and CEO is appropriate at this time as it allows our CEO to focus primarily on management and operating responsibilities.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic risks, financial risks, legal and regulatory risks, and others, such as the impact of competition. Management is responsible for the day-to-day management of the risks that we face, while the Board, as a whole and through its committees, has responsibility for the broad oversight of risk and the establishment of risk tolerance. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as intended.

Insider Trading Policy and Anti-hedging

Under our Insider Trading Policy, each executive officer and director of the Company is prohibited from buying or selling our securities when he or she is aware of material, non-public information about the Company, or information about other public companies which he or she learns as our executive officer or director. These individuals are also prohibited from providing such information to others. In addition, this policy prohibits executive officers and directors from purchasing Company common stock on margin, engaging in short sales, or buying or selling derivative securities.

Director Compensation

Board of Director compensation differs from the compensation programs offered to executives and employees of the Company. To focus on pay for time and expertise, the compensation for the Board of Directors is limited to a set fee for service (retainer and meeting fees) and equity compensation (restricted stock units). The overall philosophy is to compensate the Board of Directors at the market median (50th percentile) of comparable financial institutions within the region of similar asset size. To provide the proper mix of compensation elements to meet the needs of the Board of Directors, a retainer and committee fees are included to compensate directors for their time and expertise. Additionally, the Company will grant the directors equity compensation to ensure the directors are shareholders and are financially linked to the shareholders they represent. The Compensation Committee annually reviews and recommends to the Board of Directors the proposed director fees after consideration of information from peer surveys, past compensation practices and the Company’s performance. The Board is responsible for approving the fees for attending Board meetings and committee meetings. The Board believes the fees are competitive with the fees paid by other peer banks of a comparable size and will ensure the Company attracts and retains qualified Board members. A peer group analysis was completed during fiscal year 2024 by Blanchard Consulting Group that was used to establish the annual retainer and the committee meeting fees.

Fees Paid in Cash

During the first six months of fiscal year 2024, each non-employee director received a retainer and was compensated for each Consumers National Bank Board of Directors meeting and each committee meeting they attended. The retainer for each non-employee director was $5,000 per quarter, the Chairman of the Board received an additional $2,500 per quarter, and the Vice Chairman received an additional $500 per quarter for serving in those capacities. The compensation for attendance at a Board of Directors meeting was $1,000 per meeting and the following table details the fees that were paid to each non-employee director for attendance at committee meetings:

| |

|

Asset/ Liability

|

|

|

Audit

|

|

|

Compensation

|

|

|

Corporate

Governance/

Nominating

|

|

|

Executive

|

|

|

Loan

|

|

|

Risk &

Technology

|

|

|

Committee Chair

|

|

$ |

* |

|

|

$ |

300 |

|

|

$ |

200 |

|

|

$ |

200 |

|

|

$ |

300 |

|

|

$ |

200 |

|

|

$ |

300 |

|

|

Committee Member

|

|

$ |

100 |

|

|

$ |

200 |

|

|

$ |

100 |

|

|

$ |

100 |

|

|

$ |

200 |

|

|

$ |

100 |

|

|

$ |

200 |

|

* Denotes committee chaired by an employee of the Company

Effective January 1, 2024, the compensation for each non-employee director was changed to a retainer for serving on the Board of Directors and attending the monthly meetings and quarterly compensation for serving on a Board committee. The retainer for serving as the Chairman of the Board is $9,250 per quarter, the Vice Chairman receives $8,500 per quarter, and each non-employee director receives $6,250 per quarter. The following table details the quarterly compensation paid to each non-employee director for serving on a Board committee:

| |

|

Asset/ Liability

|

|

|

Audit

|

|

|

Compensation

|

|

|

Corporate

Governance/

Nominating

|

|

|

Executive

|

|

|

Loan

|

|

|

Risk &

Technology

|

|

|

Committee Chair

|

|

$ |

* |

|

|

$ |

1,500 |

|

|

$ |

1,250 |

|

|

$ |

1,000 |

|

|

$ |

1,000** |

|

|

$ |

2,500 |

|

|

$ |

1,250 |

|

|

Committee Member

|

|

$ |

1,000 |

|

|

$ |

1,250 |

|

|

$ |

1,000 |

|

|

$ |

750 |

|

|

$ |

1,000 |

|

|

$ |

2,000 |

|

|

$ |

1,000 |

|

* Denotes committee chaired by an employee of the Company

** Chair compensation is included in the Vice Chairman’s quarterly retainer

Equity Compensation

Under the Amended and Restated 2010 Omnibus Incentive Plan, stock awards may be granted to all directors if certain specified performance targets as established by the Compensation Committee are achieved. The Compensation Committee selected return on average equity as the Company’s performance target for fiscal year 2024. The Company issued restricted stock units on July 1, 2023 that would have settled following the issuance of the Company’s fiscal year 2024 financial statements if the performance target was achieved. However, these units will not vest since the performance target was not achieved.

Mr. Lober is an employee of Consumers National Bank and received no additional compensation for his service as a director.

The following table summarizes the compensation earned by or awarded to each non-employee director who served on the Board during fiscal year 2024. The compensation received by Mr. Lober is shown in the “Summary Compensation Table” which is included under the “Executive Officers” section in the following pages.

|

Name

|

|

Fees earned or

paid in cash

($)

|

|

|

Stock

Awards

($)

|

|

|

Total

($)

|

|

|

John P. Furey

|

|

$ |

31,105 |

|

|

|

— |

|

|

$ |

31,105 |

|

|

Ann M. Gano

|

|

|

36,500 |

|

|

|

— |

|

|

|

36,500 |

|

|

Bradley Goris

|

|

|

35,000 |

|

|

|

— |

|

|

|

35,000 |

|

|

Shawna L. L’Italien

|

|

|

36,900 |

|

|

|

— |

|

|

|

36,900 |

|

|

Richard T. Kiko, Jr.

|

|

|

39,000 |

|

|

|

— |

|

|

|

39,000 |

|

|

Laurie L. McClellan

|

|

|

44,800 |

|

|

|

— |

|

|

|

44,800 |

|

|

Frank L. Paden

|

|

|

48,100 |

|

|

|

— |

|

|

|

48,100 |

|

|

John W. Parkinson

|

|

|

39,400 |

|

|

|

— |

|

|

|

39,400 |

|

|

Harry W. Schmuck, Jr.

|

|

|

42,000 |

|

|

|

— |

|

|

|

42,000 |

|

|

Michael A. Wheeler

|

|

|

36,300 |

|

|

|

— |

|

|

|

36,300 |

|

Currently no material changes are expected to overall director compensation in fiscal year 2025. Restricted stock units were awarded to all non-employee directors in July 2024 and will vest in June 2025 if each director meets minimum attendance requirements for fiscal year 2025.

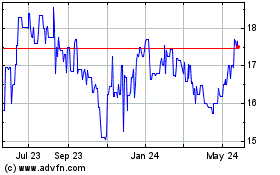

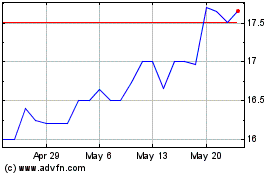

PAY VERSUS PERFORMANCE

The following table provides information about the relationship between executive compensation actually paid for our principle executive officer (PEO) and our non-principle executive officers and certain financial performance of the Company.

|

Year

|

|

Summary

Compensation

Table Total for

PEO (1)

|

|

|

Compensation

Actually Paid

to PEO (2)

|

|

|

Average Summary

Compensation

Table Total for non-

PEO named

executive officers

(NEOs) (3)

|

|

|

Average

Compensation

Actually Paid to non-

PEO NEOs (4)

|

|

|

Value of Initial

Fixed $100

Investment Based

on Total

Shareholder

Return (5)

|

|

|

Net Income (6)

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

2024

|

|

$ |

716,089 |

|

|

$ |

710,821 |

|

|

$ |

377,681 |

|

|

$ |

362,413 |

|

|

$ |

95.11 |

|

|

$ |

8,580,000 |

|

|

2023

|

|

|

1,021,471 |

|

|

|

1,012,080 |

|

|

|

487,683 |

|

|

|

486,390 |

|

|

|

97.29 |

|

|

|

10,674,000 |

|

|

2022

|

|

|

889,477 |

|

|

|

874,792 |

|

|

|

488,462 |

|

|

|

482,853 |

|

|

|

101.74 |

|

|

|

11,192,000 |

|

(1) The amounts reported in column (b) are the amounts of total compensation reported for Mr. Lober, our PEO, for each corresponding year in the “Total” column of the Summary Compensation Table.

(2) The amount reported in column (c) represents the executive compensation actually paid for Mr. Lober as computed in accordance with Item 402(v) of Regulation S-K. The amounts do not reflect the actual compensation earned or paid to Mr. Lober during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments noted in footnote 4 were made to Mr. Lober’s total compensation for each year.

(3) The amounts reported in column (d) represent the average of the amounts reported for the Company’s non-PEO NEOs as a group in the “Total” column of the Summary Compensation Table in each applicable year.

(4) The amounts reported in column (e) represent the average amount of executive compensation actually paid for the non-PEO NEOs as a group as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the non-PEO NEOs as a group during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the non-PEO NEOs as a group for each year to determine executive compensation actually paid.

| |

|

PEO

|

|

|

Average for Non-PEO NEOs

|

|

| |

|

2024

|

|

|

2023

|

|

|

2022

|

|

|

2024

|

|

|

2023

|

|

|

2022

|

|

|

Total Compensation per Summary Compensation Table (SCT)

|

|

$ |

716,089 |

|

|

$ |

1,021,471 |

|

|

$ |

889,477 |

|

|

$ |

377,681 |

|

|

$ |

487,683 |

|

|

$ |

488,462 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less the amounts or average amounts reported under the Stock Awards column in the SCT

|

|

|

— |

|

|

|

(246,169 |

) |

|

|

(124,542 |

) |

|

|

— |

|

|

|

(87,806 |

) |

|

|

(50,138 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus year-end value of stock grants awarded in the applicable fiscal year that are unvested and outstanding as of the end of the applicable fiscal year

|

|

|

— |

|

|

|

177,318 |

|

|

|

81,523 |

|

|

|

— |

|

|

|

65,234 |

|

|

|

32,823 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus the fair value as of the vesting date of any awards that are granted and vest in the same applicable fiscal year

|

|

|

— |

|

|

|

60,544 |

|

|

|

26,517 |

|

|

|

— |

|

|

|

21,628 |

|

|

|

10,672 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus the change in fair value of prior year awards that are outstanding and unvested as of the end of the applicable fiscal year

|

|

|

(12,773 |

) |

|

|

(4,433 |

) |

|

|

(781 |

) |

|

|

(4,661 |

) |

|

|

(1,807 |

) |

|

|

(348 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plus the change in fair value as of the vesting date of prior year awards that vested at the end of or during the applicable fiscal year

|

|

|

(2,152 |

) |

|

|

3,349 |

|

|

|

2,598 |

|

|

|

(4,283 |

) |

|

|

1,458 |

|

|

|

1,382 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation actually paid for year shown

|

|

$ |

701,164 |

|

|

$ |

1,012,080 |

|

|

$ |

874,792 |

|

|

$ |

368,737 |

|

|

$ |

486,390 |

|

|

$ |

482,853 |

|

(5) Cumulative Total Shareholder Return is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price as the end and the beginning of the measurement period by the Company’s share price as the beginning of the measurement period.

(6) Amounts represent the amount of net income reflected in the Company’s audited financial statements for the applicable year.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Security Ownership of Certain Beneficial Owners

Generally, under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of securities, such as common shares, if such person has or shares voting power or investment power in respect of such securities. In addition, a person is deemed to be the beneficial owner of a security if he or she has the right to acquire such voting or investment power over the security within sixty days, for example, through the exercise of a stock option. Information is provided below about each person known to the Company to be the beneficial owner equal to or more than 5% of the outstanding shares of the Company’s common stock as of June 30, 2024.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature

of Beneficial Ownership

as of June 30, 2024

|

|

|

Percent of

Common Shares

|

|

| |

|

|

|

|

|

|

|

|

|

Beese, Fulmer Investment Management, Inc.

200 Market Avenue South, Suite 1150

Canton, OH 44702

|

|

|

172,739 |

(1) |

|

|

5.55 |

% |

|

(1)

|

Based on a Schedule 13G filing by Beese, Fulmer Investment Management, Inc. on January 23, 2024. Beese, Fulmer Investment Management, Inc., in its capacity as an investment adviser, reported that it may be deemed to beneficially own 172,739 shares held by its clients.

|

Security Ownership of Directors and Management

The following table shows the beneficial ownership of the Company’s common stock as of August 30, 2024 for each director and named executive officer of the Company and for all current directors and executive officers as a group.

|

Name of Beneficial Owner

|

|

Amount and Nature

of Beneficial Ownership

|

|

|

Percent of

Common Shares

|

|

|

Ann M. Gano

|

|

|

3,522 |

|

|

|

* |

|

|

Joseph A. Gerzina

|

|

|

3,000 |

|

|

|

* |

|

|

Bradley Goris

|

|

|

16,814 |

(1) |

|

|

* |

|

|

Shawna L. L’Italien

|

|

|

4,862 |

(2) |

|

|

* |

|

|

Richard T. Kiko, Jr.

|

|

|

13,671 |

(3) |

|

|

* |

|

|

Ralph J. Lober II

|

|

|

65,960 |

(4) |

|

|

2.11 |

% |

|

Laurie L. McClellan

|

|

|

144,646 |

(5) |

|

|

4.63 |

% |

|

Frank L. Paden

|

|

|

9,260 |

|

|

|

* |

|

|

John W. Parkinson

|

|

|

21,980 |

(6) |

|

|

* |

|

|

Harry W. Schmuck, Jr.

|

|

|

26,017 |

(7) |

|

|

* |

|

|

Michael A. Wheeler

|

|

|

2,819 |

(8) |

|

|

* |

|

|

Scott E. Dodds

|

|

|

15,636 |

|

|

|

* |

|

|

Renee K. Wood

|

|

|

22,930 |

(9) |

|

|

* |

|

|

All directors and executive officers as a group (17 persons)

|

|

|

379,138 |

|

|

|

12.14 |

% |

|

*

|

Denotes less than one percent of outstanding shares.

|

|

(1)

|

Includes 14,503 shares owned jointly with family members.

|

|

(2)

|

Includes 3,200 shares owned jointly with family members.

|

|

(3)

|

Includes 10,973 shares owned in a trust.

|

|

(4)

|

Includes 37,274 shares owned jointly with family members.

|

|

(5)

|

Includes 134,719 shares owned jointly with family members and trusts.

|

|

(6)

|

Includes 5,700 shares owned by family members.

|

|

(7)

|

Includes 136 shares owned by family members.

|

|

(8)

|

Includes 1,500 shares owned in a trust.

|

|

(9)

|

Includes 10,596 shares owned jointly with family members.

|

Executive Officers Who Are Not Directors

The following information is provided with respect to each person who currently serves as an executive officer of the Company who does not serve as a director.

Kim K. Chuckalovchak (age 53) serves as Senior Vice President, Chief Information Officer, having been appointed to this position in November 2020. Ms. Chuckalovchak joined Consumers in July 2005 as a member of the information technology department and was promoted to Vice President, Information Technology Manager in January 2016. Prior to joining Consumers, Ms. Chuckalovchak served as Lotus Notes Developer for Emergency Medicine Physicians in Canton and has over 32 years of experience in Information Technology. She holds an associate degree from Stark State College in Computer Science. Ms. Chuckalovchak is currently a member of several Information Technology/Security organizations including FS-ISAC & InfraGard. She also holds two certifications from Secure Banking Solutions: Certified Banking Security Technology Professional and Certified Banking Security Executive.

Scott E. Dodds (age 62) serves as Executive Vice President and Senior Loan Officer, having been appointed to this position in March 2015. Mr. Dodds joined Consumers in November 2013 as Senior Vice President and Senior Lender. Prior to joining Consumers, Mr. Dodds served as Senior Vice President, Business Banking at FirstMerit Bank. He has served in various financial and banking positions, including President for Weather Vane Capital, LLC, Senior Vice President, Ohio Legacy Bank, and Executive Vice President of Retail Banking for Unizan Bank, National Association. Mr. Dodds brings over 37 years of banking experience in the operations, sales, and business development areas of banking. Mr. Dodds is a graduate of the Stonier Graduate School of Banking and BAI Graduate school of Executive Bank Management.

Hillary A. Hudak (age 53) serves as Senior Vice President, Chief People Officer, having been appointed to this position in November 2019. Ms. Hudak joined Consumers in April 2015 as Vice President, Director of Human Resources. Prior to joining Consumers, Ms. Hudak served as Director of Human Resources for TTT Holdings, Inc. from 1999 to 2015. Ms. Hudak has over 27 years of human resources experience, she has a strong background in managing human resources, benefits, and compensation analysis, and supporting strategic initiatives for varying sized organizations and industries. Ms. Hudak has developed the bank’s corporate training, mentorship, and leadership development programs. Ms. Hudak carries both the SPHR and SCP human resources certifications, has a bachelor’s degree in business management from Walsh University, and attended the Human Resources Management School through the Graduate School of Banking in Madison, Wisconsin.

Suzanne Mikes (age 45) serves as Senior Vice President, Chief Credit Officer, having been appointed to this position in July 2017. Ms. Mikes joined Consumers in June 2017 as Vice President, Chief Credit Officer. Prior to joining Consumers, Ms. Mikes served as a Senior Credit Analyst, AVP for CFBank, National Association from 2011 to 2017 and has over 23 years of credit experience. She completed her undergraduate degree at Mount Union College in 2001 and her MBA at Kent State University in 2007. Ms. Mikes is actively involved in her community and currently is a member of University of Mount Union’s Business Advisory Council and on the board at The Green Community Improvement Corporation. Ms. Mikes is also a graduate of the Graduate School of Banking at The University of Wisconsin-Madison and has her credit risk certification from Risk Management Association.

Derek G. Williams (age 65) serves as Senior Vice President, Retail Operations and Sales, having been appointed to this position in March 2013. Mr. Williams previously served as Senior Vice President, Training and Sales Development Officer from July 2011 to March 2013. Prior to joining Consumers, Mr. Williams served as Vice President, Senior Business Banker for Huntington National Bank and as Senior Vice President, Chief Deposit Officer at Ohio Legacy Bank. Mr. Williams is a graduate of the Bank Administration Institute (BAI) School, Retail Banking Management and has obtained a broad range of retail and commercial experience in his banking career that extends over 46 years.

Renee K. Wood (age 53) serves as Executive Vice President, Chief Financial Officer and Treasurer and was appointed as the Corporate Secretary in January 2022. Ms. Wood joined Consumers in January 2005 and was appointed the Chief Financial Officer and Treasurer in July 2005. Prior to joining Consumers, Ms. Wood served as Vice President, Controller of the Finance Department for Unizan Bank, National Association from 2002 to 2005. Her 30 years of banking experience includes senior or management level positions, primarily in the accounting or finance areas of banking. Ms. Wood is a graduate of the Graduate School of Banking at The University of Wisconsin-Madison.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The appointment of the Company’s independent registered public accounting firm is made annually by the Audit Committee. The Audit Committee, with the approval of the Board of Directors, has appointed Plante & Moran, PLLC (Plante Moran) to serve as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2025. Although the Company’s shareholders are not required to vote on the appointment of the Company’s independent registered public accounting firm, the Audit Committee and the Board of Directors are submitting the appointment of Plante Moran to the shareholders for ratification as a matter of good corporate governance and because of the important role the Company’s independent registered public accounting firm plays in reviewing the quality and integrity of the Company’s financial statements. The Company has been advised by Plante Moran that they are independently certified public accountants with respect to the Company within the meaning of the Exchange Act and the rules and regulations promulgated thereunder.

Plante Moran audited the Company’s consolidated financial statements as of and for the fiscal year ended June 30, 2024. The Company expects that representatives of Plante Moran will attend the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Unless instructed to the contrary, it is intended that proxies will be voted for the ratification of the selection of Plante Moran, as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2025. Ratification of Plante Moran as the Company’s independent registered public accounting firm will require the affirmative vote of a majority of the shares of common stock by proxy at the annual meeting. Abstentions will not be counted as votes “FOR” or “AGAINST” this proposal and will have no effect on the outcome of this proposal. Even if the appointment of Plante Moran is ratified by the shareholders, the Audit Committee, in its discretion, could decide to engage another firm if the Audit Committee determines such action is necessary or desirable. If the appointment of Plante Moran is not ratified, the Audit Committee will reconsider the appointment, but may decide to maintain the appointment.

The Board of Directors recommends that shareholders vote "FOR" the ratification of the appointment of Plante Moran as the Company's independent registered public accounting firm for the fiscal year ending June 30, 2025.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction and Overview

This Compensation Discussion and Analysis provides information regarding the compensation awarded to, earned by, or paid to the named executive officers serving as of June 30, 2024 whose compensation is detailed in this proxy statement. These named executive officers are the President and Chief Executive Officer, Chief Financial Officer, and Senior Loan Officer. The Board of Directors has delegated to the Compensation Committee responsibility for the oversight and administration of the compensation programs. The committee reviews and recommends company benefit and incentive plans and reviews the individual performance of the Chief Executive Officer and executive management.

Compensation Philosophy and Objectives

The objective of the Company’s compensation program is to fairly compensate the executive officers considering their individual performances and their contributions to the performance of the Company, thereby aligning executives’ incentives with shareholder value creation. The compensation philosophy is designed to reward effort and achievement by the officers and provide them with compensation targeted at market competitive levels. The Company’s compensation program includes the following core components: base salary, cash incentive compensation, equity-based awards, and long-term compensation. The Compensation Committee manages all components on an integrated basis with a goal of achieving the following objectives: to attract and retain highly qualified management, to provide shorter-term incentive compensation that varies directly with the Company’s financial performance and to focus management on both annual and long-term goals. The Company believes that, by setting and adjusting these elements, it has the flexibility to offer appropriate incentives to its executive officers.

From time to time, the Compensation Committee utilizes outside consultants to provide analysis regarding our executive compensation program. Typically, this is done once every three years. During fiscal year 2024, the Compensation Committee engaged Blanchard Consulting Group to review executive officers’ compensation and to make recommendations regarding the structure of their future compensation packages. Per the Compensation Committee’s instructions, Blanchard performed a market assessment and made recommendations on base salary, incentive pay and benefits for each named executive officer as compared to similar peer banks.

Although the Compensation Committee makes independent determinations on all matters related to compensation of executive officers, certain members of management are requested to attend committee meetings and provide input to the Compensation Committee. Input may be sought from the Chief Executive Officer, human resources, finance, and others as needed to ensure the Compensation Committee has the information and perspective it needs to carry out its duties. The Compensation Committee will seek input from the Chief Executive Officer on matters relating to strategic objectives, company performance goals and input on his assessment of the other executive officers. The Compensation Committee delegates some responsibilities to management to assist in the development of design of the annual incentive compensation program for the Compensation Committee’s consideration. The Compensation Committee does not delegate the determination of compensation of the named executive officers to management.

Components of Compensation

Base Salary

Base salary is a major factor in attracting and retaining key personnel and therefore is the primary component of our executive officer’s compensation. In setting an executive officer’s base salary, the Company considers parameters set by its size and complexity and the salaries offered by peers. The Compensation Committee has adopted the philosophy to target executive compensation to the midpoint of its peer group that was developed for the compensation analysis. The Company’s performance, as measured by its results compared to previous years, is also considered in determining the overall adjustments to executive officers’ salaries. Specific salaries are adjusted to reflect the contributions of the executive officer to the Company’s operations and the accomplishment of its long-term goals.

Based on a review of the Company’s strategic direction, individual career path objectives and succession planning in conjunction with the broad databases and other publicly available information, the Company believes that its executive compensation practices are in line with its compensation philosophy and objectives described above.

Incentive Compensation

The purpose of the incentive compensation program is to focus executives on achieving and possibly exceeding the Company’s annual performance objectives consistent with safe and sound operations of the Company. Incentive compensation is provided to recognize the achievement of annual financial targets and is paid in accordance with the quantitative and qualitative objectives established by the Compensation Committee. In establishing the incentive compensation’s metrics and targets for fiscal year 2024, the Compensation Committee utilized the Company’s budget to set the performance at levels that were determined to be reasonable and achievable. In setting the named executive officers’ awards, the Compensation Committee considered the following core corporate financial measures: net income, efficiency ratio, total delinquency and growth in total loans and deposits.

The following table sets forth the core corporate financial metrics, targets, and actual results for the named executive officers:

| |

|

Award Ranges

|

|

|

|

|

|

|

Metrics

|

|

Threshold

|

|

|

Target

|

|

|

Maximum

|

|

|

2024 Actual

|

|

|

Net income

|

|

$ |

10,606,650 |

|

|

$ |

10,834,750 |

|

|

$ |

12,089,300 |

|

|

$ |

8,580,000 |

|

|

Efficiency ratio

|

|

|

65.74 |

% |

|

|

64.47 |

% |

|

|

60.67 |

% |

|

|

70.46 |

% |

|

Delinquency

|

|

|

0.92 |

% |

|

|

0.88 |

% |

|

|

0.72 |

% |

|

|

0.28 |

% |

|

Gross loans – net of warehouse line

|

|

$ |

778,891,200 |

|

|

$ |

791,016,374 |

|

|

$ |

831,628,625 |

|

|

$ |

732,995,000 |

|

|

Total deposits and customer repurchase agreements

|

|

$ |

996,783,360 |

|

|

$ |

1,012,358,099 |

|

|

$ |

974,182,000 |

|

|

$ |

991,287,000 |

|

For the Chief Executive Officer, a range of 14.0% to 50.0% of salary is tied to these core corporate financial measures. For the Chief Financial Officer and Senior Loan Officer, a range of 11.0% to 40.0% of salary is tied to these core corporate financial measures. Performance was assessed after the end of the performance period and cash incentive payments based on the Company’s performance will be made only if one or more financial metrics met or exceeded the targets established by the Compensation Committee. The Board of Directors does have the discretion to award additional incentive compensation to the named executive officers and other management personnel in the program. No discretionary awards were made in fiscal year 2024.

Based on the above performance measures and the Compensation Committee’s assessment of individual performance, the 2024 cash incentive payments were awarded as follows relative to the 2024 threshold and maximum award ranges:

|

Named Executive Officer

|

|

2024

Threshold

Award Value ($)

|

|

|

2024

Maximum

Award Value ($)

|

|

|

2024 Actual

Cash Incentive Payment ($) (1)

|

|

|

Ralph J. Lober, II

|

|

$ |

65,171 |

|

|

$ |

232,752 |

|

|

$ |

34,913 |

|

|

Renee K. Wood

|

|

$ |

26,426 |

|

|

$ |

96,096 |

|

|

$ |

14,414 |

|

|

Scott E. Dodds

|

|

$ |

26,438 |

|

|

$ |

96,138 |

|

|

$ |

14,421 |

|

| |

(1)

|

The amounts included in this column are included in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

|

Long-term Compensation

Long-term compensation includes a qualified retirement plan in the form of a 401(k) Plan, a non-qualified Salary Continuation Program and the Amended and Restated 2010 Omnibus Incentive Plan. The Company provides safe harbor contributions under the 401(k) Plan, matching up to 100% of the first 4.0% contributed by the employee. The amount contributed on behalf of the executive officers is determined in accordance with the provisions of the plan applicable to all employees. The Salary Continuation Plan is designed to retain executive and senior management personnel. Participation in the Salary Continuation Plan is limited and recommended by the Compensation Committee and approved by the Board of Directors. Annually, the Compensation Committee approves the issuance of restricted stock units to all executive officers and certain other senior management personnel that will vest if the Company’s performance target selected by the Compensation Committee is achieved. The Compensation Committee selected return on average equity as the Company’s performance target for fiscal year 2024. The Company issued restricted stock units on July 1, 2023, however, these units will not vest since the performance target was not achieved. These long-term incentive compensation plans are designed to promote a vested interest in the long-term strategic performance goals of the Company and discourage turnover among its executive officers and other employees.

The following table sets forth the cash compensation and certain other compensation paid or earned by the Company’s principal executive officer, principal financial officer, and the next most highly compensated executive officer serving at the end of fiscal year 2024. The individuals listed in this table are sometimes referred to in this Proxy Statement as the “named executive officers.”

Summary Compensation Table

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

|

Nonqualified

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Stock

|

|

|

Option

|

|

|

Incentive Plan

|

|

|

Deferred

|

|

|

All Other

|

|

|

|

|

|

| |

|

|

|

Salary |

|

|

Bonus |

|

|

Awards |

|

|

Awards |

|

|

Compensation

|

|

|

Compensation

|

|

|

Comp. |

|

|

Total |

|

| Name and Principal Position |

|

Year |

|

($) |

|

|

($) (1) |

|

|

($) (2) |

|

|

($) |

|

|

($) (3) |

|

|

Earnings ($) |

|

|

($) (4) |

|

|

($) |

|

|

Ralph J. Lober II

|

|

2024

|

|

$ |

461,028 |

|

|

$ |

300 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

34,913 |

|

|

$ |

196,703 |

|

|

$ |

23,145 |

|

|

$ |

716,089 |

|

|

President and Chief Executive Officer

|

|

2023

|

|

|

425,221 |

|

|

|

250 |

|

|

|

246,169 |

|

|

|

— |

|

|

|

121,300 |

|

|

|

206,970 |

|

|

|

21,561 |

|

|

|

1,021,471 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Renee K. Wood

|

|

2024

|

|

$ |

237,930 |

|

|

$ |

300 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

14,414 |

|

|

$ |

60,877 |

|

|

$ |

24,388 |

|

|

$ |

337,909 |

|

|

Executive Vice President, Chief Financial Officer/Treasurer

|

|

2023

|

|

|

228,250 |

|

|

|

250 |

|

|

|

88,209 |

|

|

|

— |

|

|

|

54,863 |

|

|

|

58,321 |

|