Casino Says Not Part of Parent Rallye's Bankruptcy-Protection Proceedings

May 24 2019 - 1:44AM

Dow Jones News

By Max Bernhard and Anthony Shevlin

Casino Guichard-Perrachon SA (CO.FR) said late Thursday that it

isn't part of safeguard proceedings relating to its majority

shareholder Rallye.

Rallye said late Thursday that it and its subsidiaries Cobivia,

HMB, Fonciere Euris, Finatis and Euris entered into bankruptcy

protection in France. The so-called safeguard proceedings allow

debtors that are still solvent but face insurmountable difficulties

to be restructured under a court's supervision.

"These procedures do no relate to Casino group, nor its

operations, nor its employees, and do not impact the ongoing

execution of its strategic plan," Casino said. Rallye said in a

separate statement that the proceedings don't concern Casino.

Rallye said that as of December 31, 2018 it had racked up net

financial debt of 2.9 billion euros ($3.2 billion), while its

Fonciere Euris, Finatis and Euris subsidiaries had combined debt of

nearly EUR400 million. Part of this debt is subject to pledge over

Casino, Rallye, Fonciere Euris, or Finatis shares. Rallye holds

51.7% of Casino shares and 61% of voting rights.

"Rallye and its subsidiaries have...pledged nearly all of their

shares," it said.

Shares in Casino were halted earlier in the day on Thursday

following a sharp fall, which came after shares in Rallye were

suspended from the Euronext Paris exchange. Casino and Rallye said

trading of the shares will resume on Friday, May 24 at market

open.

On Wednesday the retailer confirmed that its headquarters were

investigated by European Commission officials as part of a probe

into suspected violations of antitrust rules.

Casino has been beset by a stream of bad news in recent months.

In April Standard & Poor's downgraded its rating for the

company to BB- with a negative outlook from BB with a negative

outlook. "Despite robust sales growth and the completion of its

initial EUR1.5 billion disposal plan, [Casino's] leverage remains

elevated while its cash flows remain burdened by working capital,

interest, and dividends payments," said Standard & Poor's.

Prior to this, Moody's downgraded Casino to Ba3 with a negative

outlook from Ba1 with a negative outlook.

Casino is currently undertaking an asset-disposal plan, and HSBC

analysts say the shrinking of Casino's business and its

margin-maximization strategy could both undermine the French

group's long-term strategic position.

Write to Max Bernhard at max.bernhard@dowjones.com; @mxbernhard

and Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

May 24, 2019 02:29 ET (06:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

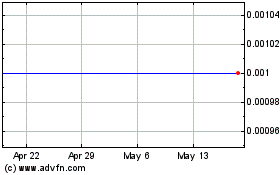

Casino Guichard Perrachon (CE) (USOTC:CGUSY)

Historical Stock Chart

From Jun 2024 to Jul 2024

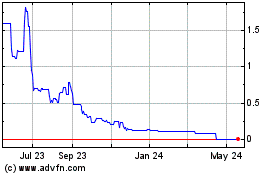

Casino Guichard Perrachon (CE) (USOTC:CGUSY)

Historical Stock Chart

From Jul 2023 to Jul 2024