StanChart, DBS Team Up With SGX, Temasek to Launch Carbon-Credit Exchange

May 20 2021 - 8:39AM

Dow Jones News

By Fabiana Negrin Ochoa

Lenders Standard Chartered PLC and DBS Group Holdings Ltd. will

partner with Singapore's exchange operator and state investment

firm Temasek Holdings to establish a carbon-credits marketplace

that aims to help companies play a role in global climate

mitigation.

The companies said Thursday that they would launch an exchange

and a marketplace, to be known as Climate Impact X and based in

Singapore, by the end of the year.

CIX will facilitate the sale of carbon credits mainly among

multinational corporations and institutional investors.

"Climate Impact X will provide a solution for corporates to

address unavoidable carbon emissions in the near term and propel

the development of new carbon-credit projects world-wide," Mikkel

Larsen, DBS's chief sustainability officer and interim chief

executive of CIX, said.

Carbon credits are essentially a form of tradable permit or

certificate that let the holder emit a certain amount of greenhouse

gases. If a company doesn't use up its allowance, it can then trade

that credit.

At a press event, the companies acknowledged the complexities of

carbon credits and the questions that have been raised regarding

their efficacy in the fight against climate change.

"The concerns that have been expressed in this forum and

elsewhere are legitimate. The questions about the way that carbon

credits have been used, and the way that corporations offset,"

StanChart Group CEO Bill Winters said. "And there have been

questions about the underlying standards that have been

applied...questions about the transparency of the market," he

said.

The aim of CIX is to address these concerns by using satellite

monitoring, machine learning and blockchain technology similar to

that used in cryptocurrency to boost the transparency and quality

of carbon credits, while ensuring they deliver a tangible

environmental impact.

The companies say a system of high-quality credits could help

bridge the gap left by low-carbon technologies as countries and

companies pivot away from fossil fuels to try and reach the Paris

climate-change goals set in 2015.

"The only way that we can practically do this is to use offsets

to get money from the hands of people like us and DBS and Temasek

and SGX...from the hands of us that are making zero [carbon]

commitments into the hands of the people that can actually reduce

the carbon in the environment," Mr. Winters said. "And this is

exactly the marketplace and the exchange that CIX is set up to

deliver," he said.

Write to Fabiana Negrin Ochoa at fabiana.negrinochoa@wsj.com

(END) Dow Jones Newswires

May 20, 2021 09:24 ET (13:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

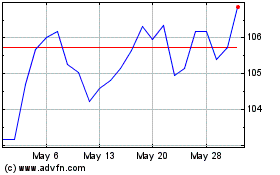

DBS (PK) (USOTC:DBSDY)

Historical Stock Chart

From Nov 2024 to Dec 2024

DBS (PK) (USOTC:DBSDY)

Historical Stock Chart

From Dec 2023 to Dec 2024