- Amended Securities Registration (section 12(b)) (8-A12B/A)

February 15 2012 - 5:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

|

Washington, D.C. 20549

|

|

FORM 8-A/A

FOR REGISTRATION OF CERTAIN CLASSES

OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Dejour Energy Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

British Columbia

|

|

Not Applicable

|

|

(State of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

598-999 Canada Place, Vancouver, British Columbia, Canada

|

V6C 3E1

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Securities to be registered pursuant

to Section 12(b) of the Act:

|

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

|

|

|

|

Common Shares, no par value

|

|

NYSE Amex

|

|

If this form relates to the

registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c),

check the following box.

þ

If this form relates to the registration

of a class of securities pursuant Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d),

please check the following box.

¨

|

|

Securities Act registration statement file number to which this form relates:

|

|

(if applicable)

|

|

Securities to be registered pursuant to Section 12(g) of the Act: None

|

|

|

|

|

|

|

EXPLANATORY NOTE

This Amendment

to Registration Statement on Form 8-A is being filed by Dejour Energy Inc., a British Columbia corporation, to amend and restate

in its entirety the Registration Statement on Form 8-A filed by Dejour with the Securities and Exchange Commission on May 22, 2007.

INFORMATION REQUIRED IN

REGISTRATION STATEMENT

Item 1. Description of Registrant’s Securities

to be Registered.

Dejour is registering

its common shares, no par value, pursuant to Section 12(b) of the Securities Exchange Act of 1934. The authorized capital of Dejour

consists of an unlimited number of common shares, without par value. Dejour’s common shares do not carry any cumulative voting

rights, pre-emptive rights, purchase rights or conversion rights.

Each holder

of Dejour’s common shares is entitled to one vote per share on all matters on which holders of common shares are entitled

to vote. Each holder of a common share is entitled to receive notice of and to attend all meetings of common shareholders of Dejour.

Because the common shares do not have cumulative voting rights, the holders of more than fifty percent of the shares voting for

the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining

shares will not be able to elect any person to Dejour’s board of directors.

There are no

sinking fund provisions in relation to Dejour’s common shares, and holders of common shares, in their capacity as such, are

not liable to further calls or assessment by Dejour.

Subject to the

rights of any holders of preferred shares or Series 1 preferred shares that may be issued by Dejour, holders of Dejour’s

common shares are entitled to dividends if and when declared by Dejour’s board of directors out of funds legally available

therefor. Dejour is limited in its ability to pay dividends on its common shares by limitations under the

Business Corporations

Act

(British Columbia) relating to solvency requirements. Dividends may be paid in cash, property or additional common shares.

Subject to applicable

law and the rights of any holders of preferred shares or Series 1 preferred shares that may be issued by Dejour, holders of Dejour’s

common shares are entitled to their pro rata share in all of Dejour’s assets available for distribution upon the liquidation

or winding up of Dejour.

There are no

restrictions in Dejour’s Articles or under the

Business Corporations Act

(British Columbia) with regard to the repurchase

or redemption of its common shares, provided that Dejour is not insolvent at the time of such repurchase or redemption and would

not be made insolvent as a result of such action.

Provisions as

to the modification, amendment or variation of the rights of holders of common shares are as contained in the

Business Corporations

Act

(British Columbia). Pursuant to the applicable provisions of the

Business Corporations Act

(British Columbia), no

right or special right attached to shares issued by Dejour may be prejudiced, altered or otherwise interfered with unless the members

of the affected class of shareholders consent to such action by a separate resolution of the members of such class adopted by at

least two-thirds of the votes cast with respect to the resolution.

Item 2. Exhibits.

Not applicable.

SIGNATURE

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration

statement to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

DEJOUR ENERGY INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: February 14, 2012

|

By:

|

/s/ Mathew Wong

|

|

|

|

|

Mathew Wong

|

|

|

|

|

Chief Financial Officer

|

|

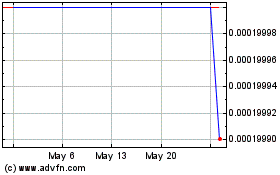

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

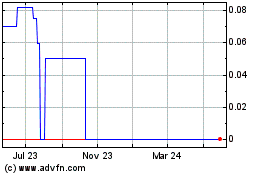

DXI Capital (CE) (USOTC:DXIEF)

Historical Stock Chart

From Jul 2023 to Jul 2024