- Current report filing (8-K)

April 09 2010 - 9:08AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________

FORM

8-K

___________

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

DATE OF

REPORT (DATE OF EARLIEST EVENT REPORTED): April 5, 2010

Foodfest

International 2000 Inc.

(Exact

name of registrant as specified in charter)

|

Delaware

|

333-142658

|

74-3191757

|

|

(STATE

OR OTHER JURISDICTION OF

INCORPORATION

OR ORGANIZATION)

|

(COMMISSION

FILE NO.)

|

(IRS

EMPLOYEE

IDENTIFICATION

NO.)

|

26

Kendall Street

New

Haven, CT 06512

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)

(905)

709-4775

(ISSUER

TELEPHONE NUMBER)

Henya Food Corp

.

26

Kendall Street

New

Haven, CT 06512

(FORMER

NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (

see

General Instruction A.2. below):

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

ITEM

3.02 UNREGISTERED SALE OF EQUITY SECURITIES.

On April

5, 2010 Foodfest International 2000 Inc. , (the “Company”) issued

12,000,000 shares of the Company’s common stock, $0.001 par value,

per share (the “Common Stock”) to 11 individuals for services rendered to the

Company. After issuance, the Common Stock represents 99% of the

Company’s issued and outstanding common shares.

These

shares were issued in reliance on the exemption under Section 4(2) of the

Securities Act of 1933, as amended (the ‘Act’). Such securities were not

registered under the Act. These securities qualified for exemption

under the Act since the issuance of securities by us did not involve a public

offering. The offering was not a “public offering” as defined in Section 4(2)

due to the insubstantial number of persons involved in the deal, size of the

offering, manner of the offering and number of securities offered. We did not

undertake an offering in which we sold a high number of securities to a high

number of investors. In addition, these shareholders had the necessary

investment intent as required by Section 4(2) since they agreed to and received

share certificates bearing a legend stating that such securities are restricted

pursuant to Rule 144 of the Securities Act. This restriction ensures that these

securities would not be immediately redistributed into the market and therefore

not be part of a “public offering.” Based on an analysis of the above factors,

we have met the requirements to qualify for exemption under Section 4(2) of the

Securities Act for this transaction.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits:

None.

Dated: April 5,

2010

FOODFEST

INTERNATIONAL 2000 INC.

|

By:

|

/s/Henry

Ender

|

|

|

|

Henry

Ender

Chief

Executive Officer

|

|

|

By:

|

/s/Fred

Farnden

|

|

|

|

Fred

Farnden

Chief

Financial Officer

|

|

2

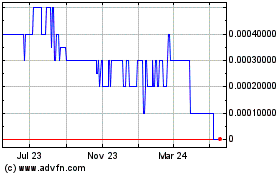

Foodfest International 2... (CE) (USOTC:FDFT)

Historical Stock Chart

From Feb 2025 to Mar 2025

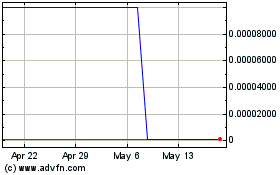

Foodfest International 2... (CE) (USOTC:FDFT)

Historical Stock Chart

From Mar 2024 to Mar 2025