Farmers & Merchants Bank of Long Beach (OTCBB:FMBL) today

reported financial results for the third quarter ended September

30, 2011.

“The economic climate continues to pose challenges for

businesses and consumers alike, but Farmers & Merchants’ sound

approach to lending practices in the third quarter helped the Bank

maintain strength and profitability,” said Henry Walker, chief

executive officer of Farmers & Merchants Bank of Long Beach.

“While many of our peers may believe that introducing products with

fancy bells and whistles will drive performance, our priority

remains delivering no-nonsense banking that customers can depend on

in good times and bad.”

Income Statement

For the 2011 third quarter, interest income increased to $44.6

million from $44.4 million earned in the 2010 third quarter.

Interest income for the nine-month period ended September 30, 2011

was $135.3 million, compared with $135.0 million reported for the

same period in 2010.

Interest expense for the 2011 third quarter declined slightly to

$2.3 million from $2.9 million in last year’s third quarter, mostly

related to the low interest rate environment. Interest expense for

the nine-month period ended September 30, 2011 declined to $7.5

million from $9.4 million reported for the same period last

year.

Net interest income for the 2011 third quarter increased to

$42.2 million from $41.5 million for the third quarter of 2010, and

improved to $127.8 million for the first nine months of 2011 from

$125.6 million for the same period in 2010.

The Bank’s provision for loan losses equaled $2.0 million for

the third quarter of 2011, compared with $6.0 million for the

preceding second quarter, and $4.0 million for the third quarter of

2010. Provision for loan losses totaled $8.8 million for the first

nine months of 2011 versus $19.5 million for the same period in

2010. The Bank’s allowance for loan losses as a percentage of loans

outstanding was 2.83% at September 30, 2011, compared with 2.72% at

June 30, 2011.

Non-interest income decreased to $3.3 million for the 2011 third

quarter from $4.3 million in the third quarter a year ago.

Non-interest income was $9.9 million for the nine-month period

ended September 30, 2011, compared with $11.2 million for the same

period in 2010.

Non-interest expense for the 2011 third quarter was $18.8

million, versus $22.2 million for the same period last year.

Non-interest expense for the first nine months of 2011 was $58.6

million, compared with $57.7 million last year.

The Bank's net interest margin was 4.05% for the quarter ended

September 30, 2011 and 4.19% for the first nine months of 2011.

Net income for the 2011 third quarter increased to $16.0

million, or $121.86 per diluted share, from $12.7 million, or

$96.66 per diluted share, in the year-ago period. The Bank’s net

income for the first nine months of 2011 rose to $45.3 million, or

$346.24 per diluted share, from $37.7 million, or $287.90 per

diluted share, for the same period in 2010.

Balance Sheet

At September 30, 2011, net loans totaled $2.00 billion,

approximately the same when compared with the end of 2010. The

Bank’s deposits totaled $3.24 billion at the end of the 2011 third

quarter, compared with $3.00 billion at December 31, 2010.

Non-interest bearing deposits represented 35.0% of total deposits

at September 30, 2011, versus 33.4% of total deposits at December

31, 2010. Total assets increased to $4.51 billion at the close of

the 2011 third quarter, compared with $4.26 billion at the close of

the prior year.

At September 30, 2011, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 28.57%, a Tier 1 risk-based capital

ratio of 27.31%, and a Tier 1 leverage ratio of 14.69%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Farmers & Merchants has cultivated a reputation of strength

and stability for more than a century, and upholding that

reputation with a strong balance sheet, as reflected in our third

quarter, is absolutely imperative,” said Daniel Walker, president

and chairman of the board. “Our ‘well-capitalized’ status is a

testament to the solid fundamentals that have been core to the

bank’s philosophy since its inception in 1907.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 22 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG

BEACH

Balance Sheets (unaudited)

(in thousands)

Sept. 30, 2011

Dec. 31, 2010

Assets Cash and due from banks: Noninterest-bearing

balances $ 66,432 $ 49,628 Interest-bearing balances 350,731 48,509

Investment securities 1,932,172 1,977,343 Gross loans 2,062,960

2,070,493 Less allowance for loan losses (58,315 ) (55,627 ) Less

unamortized deferred loan fees, net (489 ) (426 ) Net loans

2,004,156 2,014,440 Bank premises and equipment

52,380 51,650 Other real estate owned 32,106 37,300 Accrued

interest receivable 16,037 17,134 Deferred tax asset 28,067 27,032

Other assets 27,460 39,370

Total assets

$ 4,509,541 $ 4,262,406

Liabilities and stockholders' equity

Liabilities: Deposits: Demand, non-interest bearing $

1,131,461 $ 1,004,272 Demand, interest bearing 274,612 261,961

Savings and money market savings 894,163 754,446 Time deposits

936,484 983,314 Total deposits 3,236,720 3,003,993

Securities sold under agreements to repurchase 596,705 628,192

Accrued interest payable and other liabilities 13,369 7,141

Total liabilities 3,846,794

3,639,326 Stockholders' Equity:

Common Stock, par value $20; authorized250,000 shares; issued and

outstanding130,928 shares 2,619 2,619 Surplus 12,044 12,044

Retained earnings 638,945 601,861 Other comprehensive income 9,139

6,556

Total stockholders' equity

662,747 623,080 Total liabilities

and stockholders' equity $ 4,509,541

$ 4,262,406

FARMERS & MERCHANTS BANK OF LONG

BEACH

Income Statements (unaudited)

(in thousands)

Three Months Ended

Sept. 30, Nine Months

Ended Sept. 30, 2011

2010 2011

2010 Interest income: Loans $ 28,892 $

29,144 $ 86,728 $ 87,132 Securities held to maturity 11,997 11,709

37,431 35,796 Securities available for sale 3,521 3,320 10,862

11,355 Deposits with banks 162 204 273 689 Total interest income

44,572 44,377 135,294 134,972

Interest expense:

Deposits 1,971 2,379 6,211 7,780 Securities sold under agreement to

repurchase 373 520 1,241 1,595 Total interest expense 2,344 2,899

7,452 9,375 Net interest income 42,228 41,478 127,842 125,597

Provision for loan losses 2,000 4,000 8,750 19,450

Net int. income after provision for loan losses 40,228 37,478

119,092 106,147

Non-interest income: Service charges

on deposit accounts 1,281 1,264 3,633 3,833 Gains on sale of

securities 95 - 103 870 Merchant bankcard fees 348 328 903 923

Escrow fees 227 276 704 602 Other 1,301 2,382 4,548 4,985 Total

non-interest income 3,252 4,250 9,891 11,213

Non-interest

expense: Salaries and employee benefits 10,925 9,845 31,963

30,535 FDIC and other insurance expense 1,208 1,227 3,029 3,616

Occupancy expense 1,464 1,611 4,127 4,230 Equipment expense 1,381

1,309 4,112 3,757 Other real estate owned expense, net 318 5,564

2,360 6,819 Legal and professional fees 962 734 2,575 1,747

Marketing and promotional expense 933 784 2,838 2,312 Printing and

supplies 171 187 653 613 Postage and delivery 256 288 778 856 Other

1,179 641 6,128 3,210 Total non-interest expense 18,797 22,190

58,563 57,695 Income before income tax expense 24,683 19,538

70,420 59,665

Income tax expense 8,729 6,882 25,088

21,971

Net income $ 15,954 $

12,656 $ 45,332 $ 37,694

Basic and diluted earnings per common share $ 121.86 $ 96.66 $

346.24 $ 287.90

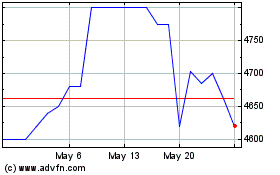

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Mar 2024 to Mar 2025