Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the second quarter ended June 30,

2013.

“Despite prevailing headwinds from the low interest rate

environment, our second quarter results were in line with

expectations, as F&M maintained its strong financial position

for the first half of 2013,” said Henry Walker, president of

Farmers & Merchants Bank of Long Beach. “As favorable economic

signs appear to be surfacing, the Bank is well poised to serve its

personal and business banking customers, while we also benefit from

the talents and prowess of new members of our team.”

Income Statement

For the three months ended June 30, 2013, interest income was

$39.2 million, compared with $42.9 million in the second quarter of

2012; the decline reflects the continuing low interest rate and

competitive loan pricing environment. Interest income for the first

half of 2013 was $78.8 million, compared with $89.2 million

reported for the first half of 2012.

Interest expense for the 2013 second quarter declined to $1.5

million from $1.8 million in the second quarter of 2012. Interest

expense for the first half of 2013 declined to $3.0 million from

$3.6 million reported for the first half of 2012. Interest expense

continues to reflect the impact of historically low rates and

strong levels of non-interest bearing demand accounts.

Net interest income for the 2013 second quarter was $37.6

million, compared with $41.1 million for the second quarter of

2012. Net interest income for the first half of 2013 was $75.7

million, compared with $85.5 million for the six months ended June

30, 2012.

Farmers & Merchants’ net interest margin was 3.20% for the

2013 second quarter, compared with 3.73% in the 2012 second

quarter. Net interest margin was 3.24% for the first half of 2013,

compared with 3.87% for the same period in 2012.

The Bank did not have a provision for loan losses in the first

half of 2013, nor in the same period a year ago, reflecting the

continued improvement in the quality of the Bank’s loan portfolio.

The Bank’s allowance for loan losses as a percentage of loans

outstanding was 2.40% at June 30, 2013, compared with 2.57% at

December 31, 2012.

Non-interest income was $10.0 million for the 2013 second

quarter, which included one-time income of $3.5 million, compared

with non-interest income of $4.5 million in the second quarter of

2012. In the first half of 2013, non-interest income was $20.1

million, compared with $10.9 million for the six months ended June

30, 2012.

Non-interest expense for the 2013 second quarter was $25.9

million, compared with $21.0 million for the same period last year.

Non-interest expense for the first half of 2013 was $49.1 million,

compared with $44.1 million for the first half of 2012.

Net income for the 2013 second quarter totaled $14.9 million, or

$113.76 per diluted share, compared with net income of $16.7

million, or $127.88 per diluted share, for the 2012 second quarter.

Net income for the first half of 2013 was $32.1 million, or $245.44

per diluted share, compared with $35.3 million, or $269.35 per

diluted share, for the six months ended June 30, 2012.

Balance Sheet

At June 30, 2013, net loans increased to $2.06 billion from

$1.93 billion at December 31, 2012. The Bank’s deposits rose to

$3.77 billion at the end of the 2013 second quarter from $3.69

billion at December 31, 2012. Non-interest bearing deposits

represented 40.5% of total deposits at June 30, 2013, versus 40.0%

of total deposits at December 31, 2012. Total assets increased to

$5.15 billion at the close of the 2013 second quarter from $4.99

billion at December 31, 2012.

At March 31, 2013, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 29.09%, a Tier 1 risk-based capital

ratio of 27.84%, and a Tier 1 leverage ratio of 14.48%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“We continued to report steady loan and deposit growth and

maintained strong capital ratios during the first half of the

year,” said Daniel Walker, chief executive officer and chairman of

the board. “As Farmers & Merchants Bank continues to grow, the

financial health of our balance sheet is indicative of the Bank’s

competitive advantage in the communities we serve.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In Thousands Except Per Share

Data) Three Months Ended

June 30, Six Months Ended June 30, 2013

2012 2013 2012 Interest income:

Loans $ 25,252 $ 27,945 $ 50,811 $ 59,355 Securities

available-for-sale 2,069 2,776 4,309 5,791 Securities

held-to-maturity 11,688 11,911 23,317 23,544 Deposits with banks

146 252 353 471 Total interest income 39,155

42,884 78,790 89,161

Interest expense:

Deposits 1,224 1,513 2,485 3,079 Securities sold under

repurchase agreements 284 280 557 549 Total

interest expense 1,508 1,793 3,042 3,628 Net

interest income 37,647 41,091 75,748 85,533

Provision for

loan losses - - - - Net interest income

after provision for loan losses 37,647 41,091 75,748

85,533

Non-interest income: Service charges on

deposit accounts 1,115 1,153 2,268 2,352 Gain on sale of securities

- - 1,048 42 Merchant bankcard income 2,388 1,598 4,562 3,226 Other

income 6,483 1,794 12,271 5,303 Total

non-interest income 9,986 4,545 20,149 10,923

Non-interest expense: Salaries and employee benefits

13,383 11,803 26,724 23,564 FDIC and other insurance expense 1,707

1,609 3,399 3,179 Occupancy expense 1,384 1,358 2,704 2,736

Equipment expense 1,538 1,379 2,972 2,716 Other real estate owned

expense, net 658 (757 ) (469 ) 538 Amortization of public welfare

investments 2,020 1,830 4,041 4,031 Merchant bankcard expense 1,939

1,063 3,660 2,170 Legal and professional services 1,001 580 1,749

1,045 Marketing expense 801 483 1,407 1,113 Other expense 1,493

1,627 2,922 3,022 2,922 Total non-interest expense

25,924 20,975 49,109 44,114 Income before

income tax expense 21,709 24,661 46,788 52,342

Income tax

expense 6,815 7,918 14,653 17,077

Net

income $ 14,894 $ 16,743

$ 32,135 $ 35,265 Basic

and diluted earnings per common share $ 113.76 $ 127.88 $

245.44 $ 269.35

FARMERS & MERCHANTS

BANK OF LONG BEACH Balance Sheets (Unaudited) (In

Thousands Except Share and Per Share Data)

June 30, 2013 Dec. 31, 2012

Assets Cash and due from banks: Noninterest-bearing

balances $ 76,231 $ 60,914 Interest-bearing balances 193,267

253,087 Securities available-for-sale 566,239 630,055 Securities

held-to-maturity 2,083,998 1,942,085 Gross loans 2,112,854

1,984,440 Less allowance for loan losses (50,762 ) (50,994 ) Less

unamortized deferred loan fees, net (360 ) (364 ) Net loans

2,061,732 1,933,082

Other real estate owned, net

17,953 17,696 Public welfare investments 31,763 35,804 Bank

premises and equipment, net 64,530 60,504 Net deferred tax assets

26,784 26,060 Other assets 23,646 29,674

Total assets $ 5,146,143 $

4,988,961 Liabilities and

Stockholders' Equity Liabilities:

Deposits: Demand, non-interest bearing $ 1,527,624 $ 1,474,215

Demand, interest bearing 359,149 346,991 Savings and money market

savings 1,048,565 1,011,029 Time deposits 836,735 853,631

Total deposits 3,772,073 3,685,866 Securities

sold under repurchase agreements 605,373 551,293 Other liabilities

29,643 34,543

Total liabilities

4,407,089 4,271,702

Stockholders' Equity: Common Stock, par value $20;

authorized 250,000 shares; issued and outstanding 130,928 shares

2,619 2,619 Additional paid-in capital 12,044 12,044 Retained

earnings 721,543 695,169 Other comprehensive income 2,848

7,427

Total stockholders' equity

739,054 717,259 Total

liabilities and stockholders' equity $ 5,146,143

$ 4,988,961

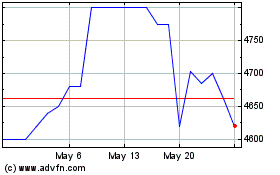

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Mar 2024 to Mar 2025