-- Net Loans Grew 23% in Year-Over-Year

Comparison --

Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the fourth quarter and full year

ended December 31, 2014.

“F&M’s strong financial performance in 2014 is a result of

an expanded lending team that continues to establish relationships

with the community we serve,” said Henry Walker, president of

Farmers & Merchants Bank. “As the economy shows further signs

of improvement, the Bank is in a position of strength for

sustainable growth.”

Income Statement

For the 2014 fourth quarter, total interest income was $49.8

million, compared with $43.5 million in the fourth quarter of 2013.

Total interest income for the year ended December 31, 2014 was

$184.9 million, compared with $163.2 million reported for 2013.

Interest expense for the 2014 fourth quarter was $1.8 million,

compared with $1.6 million in the same period a year ago. Interest

expense for the full 2014 year was $6.9 million versus $6.2 million

in 2013.

Farmers & Merchants’ net interest income for the 2014 fourth

quarter was $48.0 million, compared with net interest income of

$41.9 million for the fourth quarter in 2013. Net interest income

for 2014 was $178.0 million, versus $157.0 million in 2013.

Farmers & Merchant’s net interest margin was 3.50% for the

year ended December 31, 2014, compared with 3.30% in the previous

year.

The Bank did not have a provision for loan losses in 2014, nor

in 2013, amid continued strength in its loan portfolio. The Bank’s

allowance for loan losses as a percentage of loans outstanding was

1.69% at December 31, 2014, compared with 2.09% at December 31,

2013.

Non-interest income was $7.3 million for the 2014 fourth

quarter, compared with $7.2 million in the 2013 fourth quarter.

Non-interest income for the full 2014 year totaled $32.0 million,

versus $37.8 million for 2013.

Non-interest expense for the 2014 fourth quarter was $32.2

million, compared with $27.2 million for the same period last year.

Non-interest expense for the year ended December 31, 2014 was

$119.4 million, compared with $104.3 million last year.

The Bank’s net income for the 2014 fourth quarter was $15.8

million, or $120.94 per diluted share, compared with $15.0 million,

or $114.41 per diluted share, in the 2013 fourth quarter. The

Bank’s net income for 2014 was $62.4 million, or $476.67 per

diluted share, compared with $62.2 million, or $474.80 per diluted

share, for 2013.

Balance Sheet

At December 31, 2014, net loans totaled $2.96 billion, compared

with $2.40 billion at December 31, 2013. The Bank’s deposits grew

to $4.20 billion at the end of 2014, from $3.83 billion at December

31, 2013. Non-interest bearing deposits represented 37.3% of total

deposits at December 31, 2014, versus 38.5% of total deposits at

December 31, 2013. Total assets increased to $5.58 billion at the

close of 2014 from $5.21 billion at December 31, 2013.

At December 31, 2014, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 23.59%, a Tier 1 risk-based capital

ratio of 22.34%, and a Tier 1 leverage ratio of 14.35%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“F&M maintained its robust financial health in 2014, as well

as enhanced its infrastructure to continue the Bank’s leadership

position throughout the regions we serve,” said Daniel Walker,

chief executive officer and chairman of the board. “As we enter

2015, F&M’s healthy balance sheet and sound fundamentals

provide an excellent platform for introducing the Bank’s

unparalleled service to new clients.”

About Farmers & Merchants Bank

Founded in Long Beach in 1907 by C.J. Walker, Farmers &

Merchants Bank has 23 branches in Los Angeles and Orange Counties.

The Bank specializes in commercial and small business banking along

with business loan programs. Farmers & Merchants Bank of Long

Beach is a California state chartered bank with deposits insured by

the Federal Deposit Insurance Corporation (Member FDIC) and an

Equal Housing Lender. For more information about F&M, please

visit www.fmb.com.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In thousands except per share

data) Three Months Ended Dec. 31,

Twelve Months Ended Dec. 31, 2014 2013

2014 2013 Interest and dividend

income: Loans $ 35,281 $ 28,351 $ 128,254 $ 105,163

Securities available-for-sale 982 1,778 5,148 8,067 Securities

held-to-maturity 12,490 13,323 49,864 49,441 Investments in FHLB

and FRB stock 956 7 1,290 26 Deposits with banks 63 31 313 488

Total interest and dividend income 49,772 43,490 184,869

163,185

Interest expense: Deposits 1,491 1,296

5,744 5,049 Securities sold under repurchase agreements 267 274

1,140 1,113 Other borrowings 29 3 34 3 Total interest

expense 1,787 1,573 6,918 6,165 Net interest income before

provision for loan losses 47,985 41,917 177,951 157,020

Provision for loan losses - - - - Net interest income

after provision for loan losses 47,985 41,917 177,951 157,020

Non-interest income: Service charges on

deposit accounts 1,098 1,151 4,570 4,554 Gains on sale of

securities 689 261 1,114 1,308 Other real estate owned income 827

482 1,583 3,757 Merchant bankcard income 2,281 2,348 9,365 9,358

Other income 2,361 2,944 15,385 18,810 Total non-interest

income 7,256 7,186 32,017 37,788

Non-interest

expense: Salaries and employee benefits 17,093 15,726

64,492 55,986 FDIC and other insurance expense 782 123 3,087 4,825

Occupancy expense 2,077 1,952 8,043 6,987 Software and equipment

expense 2,143 1,434 7,057 6,026 Other real estate owned expense 703

285 3,207 528 Amortization of public welfare investments 2,117

2,021 8,468 8,082 Merchant bankcard expense 1,814 1,929 7,386 7,493

Legal and professional services 1,151 885 3,709 3,604 Marketing

expense 1,925 772 6,333 3,706 Other expense 2,399 2,119 7,644 7,025

2,922 2,922 Total non-interest expense 32,204 27,246 119,426

104,262 Income before income tax expense 23,037 21,857

90,542 90,546

Income tax expense 7,202 6,878 28,133

28,382

Net income $ 15,835 $

14,979 $ 62,409 $ 62,164

Basic and diluted earnings per common share $ 120.94 $ 114.41 $

476.67 $ 474.80

FARMERS & MERCHANTS BANK OF LONG

BEACH Balance Sheets (Unaudited) (In thousands except

share and per share data) Dec. 31, 2014 Dec.

31, 2013 Assets Cash and due from banks:

Noninterest-bearing balances $ 55,322 $ 65,261 Interest-bearing

balances 137,826 20,755 Securities available-for-sale 215,223

427,942 Securities held-to-maturity 2,008,064 2,145,289 Loans held

for sale 1,751 465 Gross loans 3,009,945 2,454,302 Less allowance

for loan losses (50,804 ) (51,251 ) Less unamortized deferred loan

fees, net (2,991 ) (1,704 ) Net loans 2,956,150 2,401,347

Other real estate owned, net 3,406 14,502 Investments in

FHLB and FRB stock 28,440 440 Public welfare investments 45,457

27,722 Bank premises and equipment, net 85,002 66,212 Net deferred

tax assets 23,296 23,512 Other assets 20,788 21,139

Total assets $ 5,580,725

$ 5,214,586 Liabilities and

Stockholders' Equity Liabilities:

Deposits: Demand, non-interest bearing $ 1,567,046 $ 1,475,888

Demand, interest bearing 552,432 413,291 Savings and money market

savings 1,228,584 1,080,774 Time deposits 852,211 861,489

Total deposits 4,200,273 3,831,442 Securities

sold under repurchase agreements 546,758 595,991 Other liabilities

27,133 27,986

Total liabilities

4,774,164 4,455,419

Stockholders' Equity: Common Stock, par value $20;

authorized 250,000 shares; issued and outstanding 130,928 shares

2,619 2,619 Additional paid-in capital 112,044 12,044 Retained

earnings 689,892 742,408 Accumulated other comprehensive income

2,006 2,096

Total stockholders' equity

806,561 759,167 Total

liabilities and stockholders' equity $ 5,580,725

$ 5,214,586

Farmers & Merchants Bank of Long BeachJohn HinrichsExecutive

Vice President562-437-0011, ext. 5035orPondelWilkinson Inc.Evan

PondelInvestor Relations310-279-5980investor@pondel.com

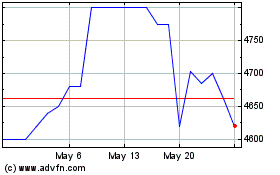

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Mar 2024 to Mar 2025