Current Report Filing (8-k)

July 02 2019 - 5:08AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 26, 2019

FOOTHILLS

EXPLORATION, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-55872

|

|

27-3439423

|

|

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

10940

Wilshire Blvd., 23

rd

Floor

Los

Angeles, CA 90024

(Address

of principal executive offices) (Zip Code)

(424)

901-6655

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement

On

June 26, 2019, Foothills Exploration, Inc., through its indirect wholly owned subsidiary, Foothills Exploration, LLC (the “Company”),

entered into a letter agreement (the “Agreement”) with an unrelated third party seller (the “Seller”),

with respect to a proposed transaction (the “Transaction”) to acquire a total of 12 shut-in wells and approximately

5,769 acres located in Montana (the “Assets”). The Assets consist of four natural gas wells, associated acreage, additional

miscellaneous leases, associated pipelines, gathering systems, compression and processing facilities, and related yards and equipment,

located in Stillwater and Golden Valley counties, Montana.

Closing

of the purchase and sale of the Assets will occur within 60 days following the full execution of the Agreement. At closing, the

Company and Seller will execute an assignment and bill of sale to provide for the Company’s acquisition of all of Seller’s

right, title and interest in and to the Assets, including all oil and gas properties, land, and yards, together with the gathering

system and compressor station, and all easements, rights of way and equipment related to the gathering systems and the lands associate

with the compressor station.

Upon

signing the Agreement, the Company paid the Seller a non-refundable which will be applied towards and deducted from the final

purchase price at closing. Pursuant to the Agreement, the Company will acquire all interest in the Assets currently owned by Seller

and this interest shall be conveyed free and clear of any liens or other encumbrances for an undisclosed sum. The Company shall

also assume all of the liabilities and obligations of the Seller related to the Assets being acquired, as set forth in the assignment

and bill of sale.

The

transaction documents contain additional terms and provisions, representations and warranties, including further provisions covering

effective time of transfer, venue, and governing law. No assurances can be given that the Company will complete the acquisition.

Item

8.01 Other Events.

Private

Placement Offering

The

Company recently formed a special purpose vehicle, Foothills Production II, LLC, and is currently marketing a Regulation D, 506(c)

confidential private placement offering to accredited investors only (the “Offering”). Sixty (60) Units of membership

interest (the “Units”) in Foothills Production II, LLC (“FP2”), are being offered on behalf of FP2 to

accredited investors only, as may be permitted by the jurisdictions in which the Units are to be offered and sold. The purchase

price of the Units, $50,000 per Unit, has been determined by the manager of FP2 (the “Manager”). Charles R. Cox, attorney-at-law,

is the Manager and B.P. Allaire is the Secretary and serves at the pleasure of the Manager. As Secretary, Mr. Allaire’s

duties consist of assisting the Manager in administering the corporate affairs of the Company. Mssrs. Cox and Allaire shall each

be paid an annual salary of $9,000 (or $750 per month), which salary shall be paid directly by FP2.

Subscriptions

must be for at least one (1) Unit, unless an agreement is reached with the Manager to subscribe for less than this minimum purchase

in a manner permitted by federal and state securities laws. There is no established public market for these Units, and it is probable

that no such market will ever develop. Subscriptions for each $50,000 investment in one Membership Unit of the Company consist

of the following:

|

●

|

Pro-rata

membership interest in Foothills Production II, LLC, based on the total number of Units purchased, providing investors with

their proportionate share of the net income generated from the net profits interest being acquired (as defined below) pursuant

to the participation agreement (the “Participation Agreement”) between FP2 and Foothills Exploration, LLC, (the

“Operator”) of the Assets;

|

|

|

|

|

●

|

The

Participation Agreement provides for FP2’s acquisition of the following “Net Profits Interest” from the

Operator of the Assets described in the Offering documents in exchange for a total of $3,000,000 (the “Participation

Funds”).

|

|

|

○

|

An

undivided fifty percent (50%) of Operator’ interest in the net profits of the participation well and operations from

the other wells, leases, and pipelines on the leasehold (the “Leasehold” as defined in the assignment of net profits

interest), set forth for an initial term of four (4) years; and thereafter

|

|

|

|

|

|

|

○

|

An

undivided twenty-five percent (25%) of the net profits from the participation well and operations from the other wells, leases,

and pipelines on the Leasehold for an additional term of four (4) years subsequent, insofar and only insofar as such net profits

rights entitle the owner thereof to the proceeds from the sale of hydrocarbons produced from such wells and the Leasehold,

incurred in connection with acquisition of the Assets and the drilling and completion of the participation well described

therein.

|

|

●

|

Common

Stock

– 50,000 shares of the Company’s restricted common stock; and

|

|

|

|

|

●

|

A-Warrant

– warrants to buy 50,000 shares of the Company’s common stock at $0.20 per share with an exercise term of

18-months without cashless exercise provisions; and

|

|

|

|

|

●

|

B-Warrant

– warrants to buy 50,000 shares of the Company’s common stock at $0.40 per share with an exercise term of

24 months without cashless exercise provisions.

|

The

Manager reserves the right to permit a less than one Unit minimum subscription for any investor. The Offering is not underwritten

and no placement agent has been retained as of the date of this Memorandum. The Units are offered on a “reasonable best

efforts” basis by the Company through its officers and directors. All proceeds from the sale of Units up to $3,000,000 will

be deposited into FP2’s corporate account and be available for use by FP2 at its discretion.

Units

may also be sold by FINRA member brokers or dealers who enter into a participating dealer agreement with FP2, who may receive

commissions of up to 10% of gross proceeds of the Units sold by those brokers or dealers. The Offering will terminate on the earliest

of: (a) the date FP2, in its discretion, elects to terminate, or (b) the date upon which all Units have been sold, or (c) December

31, 2019, or such date as may be extended from time to time by FP2, but not later than 180 days thereafter. In addition to selling

commissions if any, offering expenses, if any, shall be paid by Foothills Production II, LLC.

The

summary of the Offering described in this Form 8-K is qualified in its entirety by reference to the Business Plan for Foothills

Production II, LLC (Exhibit A of the Offering memorandum), which is filed as Exhibit 10.1 to this report.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

July 2, 2019

|

|

|

|

|

|

FOOTHILLS

EXPLORATION, INC.

|

|

|

|

|

|

By:

|

/s/

B. P. Allaire

|

|

|

|

B.

P. Allaire

|

|

|

|

Chief

Executive Officer

|

|

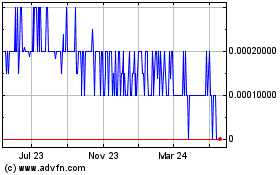

Foothills Exploration (CE) (USOTC:FTXP)

Historical Stock Chart

From Dec 2024 to Jan 2025

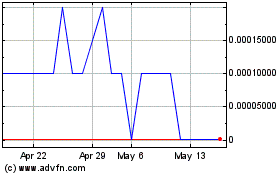

Foothills Exploration (CE) (USOTC:FTXP)

Historical Stock Chart

From Jan 2024 to Jan 2025