UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

(Mark

One)

FORM

10-K

[X]

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the fiscal year ended December 31, 2018

or

[ ]

Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the transition period from __________ to __________

FORTUNE

VALLEY TREASURES, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

000-55555

|

|

32-0439333

|

|

(State

or other Jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

Incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

No.10

of Tuanjie 2nd Road, Beice,

Humen,

Dongguan, China, 518000

(Address

of Principal Executive Offices) (Zip Code)

(86)

76982268999

(Registrant’s

telephone number, including area code)

Securities

registered under Section 12(b) of the Exchange Act

None

Securities

registered under Section 12(g) of the Exchange Act

Common Stock, par value $0.001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Yes

[X] No [ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition

of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer [ ]

|

Accelerated

filer [ ]

|

|

Non-accelerated

filer [X]

|

Smaller

reporting company [X]

|

|

|

Emerging

growth company [X]

|

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

[ ] No [X]

The

number of shares outstanding of each of the issuer’s classes of common stock, as of March 28, 2019 is as follows:

|

Class

of Securities

|

|

Shares

Outstanding

|

|

Common

Stock, $0.001 par value

|

|

307,750,000

|

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates

and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,”

“believe,” “foresee,” “estimate” and variations of these words and similar expressions to

identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks,

uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results

to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

|

|

●

|

The

availability and adequacy of working capital to meet our requirements;

|

|

|

●

|

Actions

taken or omitted to be taken by legislative, regulatory, judicial and other governmental authorities;

|

|

|

●

|

Changes

in our business strategy or development plans;

|

|

|

●

|

The

availability of additional capital to support capital improvements and development;

|

|

|

●

|

Other

risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC; and

|

|

|

●

|

The

availability of new business opportunities.

|

This

Annual Report on Form 10-K should be read completely and with the understanding that actual future results may be materially different

from what we expect. The forward-looking statements included in this Annual Report on Form 10-K are made as of the date of this

Annual Report on Form 10-K and should be evaluated with consideration of any changes occurring after the date of this Annual Report

on Form 10-K. We will not update forward-looking statements even though our situation may change in the future and we assume no

obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use

of Term

Except

as otherwise indicated by the context hereof, references in this report to “Company,” “FVTI,” “we,”

“us” and “our” are references to Fortune Valley Treasures, Inc. All references to “USD” or

United States Dollars refer to the legal currency of the United States of America.

PART

I

Item

1. Business

Company

Background

Fortune

Valley Treasures, Inc. (“FVTI”

or

the “Company”)

, formerly Crypto-Services, Inc. (“CRYT”), was incorporated

in the State of Nevada on March 21, 2014. We were initially incorporated to offer users with up-to-date information on digital

currencies worldwide online.

On

July 22, 2015, the Company filed an amendment to its Articles of Incorporation with the Nevada Secretary of State

changing its name from Crypto-Services, Inc. to Fortune Valley Treasures, Inc.

As

previously reported in a Current Report on Form 8-K filed on December 14, 2016, we entered into a Sale and Purchase Agreement

(the “Original Agreement”) with DaXingHuaShang Investment Group Limited (“DIGL”) and its

shareholders, Mr. Yumin Lin, Gaosheng Group Co., Ltd. and China Kaipeng Group Co., Ltd. to acquire 100% of the shares and

assets of DIGL, a company incorporated under the laws of the Republic of Seychelles. Pursuant to the Original Agreement, FVTI

had agreed to issue Three Hundred Million (300,000,000) shares of common stock of FVTI to the existing stockholders of DIGL to

acquire 100% of the shares of DIGL.

On

December 14, 2016, in anticipation of the reverse merger between the Company and DIGL, Shen Xinlong resigned from the position

of President, Secretary and Treasurer but remained on the Board as a Director. Additionally, the Company announced the appointment

of Mr. Yumin Lin to the Board of Directors, and as President, Secretary and Treasurer.

On

April 11, 2018, the Company entered into a termination agreement (“Termination Agreement”) with DIGL, terminating

the Original Agreement and all transactions contemplated under the Original Agreement.

On

April 11, 2018, the Company entered into a Share Exchange Agreement (the “Agreement”) to acquire 100% of the outstanding

equity securities of DIGL. Pursuant to the Agreement, the Company agreed to issue 300 million (300,000,000) shares of common stock,

par value $0.001 of the Company to the existing stockholders of DIGL to acquire 100% outstanding equity securities of DIGL (the

“Share Exchange”). The Share Exchange closed on April 19, 2018

Immediately

following the Share Exchange, the business of DIGL became our business. DIGL is engaged in the business of retail and wholesale

of imported wine products in China. We now own all of the issued and outstanding shares of DIGL, which owns all of the equity

capital of DaXingHuaShang Investment (Hong Kong) Limited, Qianhai DaXingHuaShang Investment (Shenzhen) Co. Ltd., and Dongguan

City France Vin Tout Ltd.

On

March 1, 2019, we executed a Sale and Purchase Agreement (the “SP Agreement”) to acquire 100% of the shares and assets

of Jiujiu Group Stock Co., Ltd. (“JJGS”), a company incorporated under the laws of the Republic of Seychelles. The

transaction contemplated in the SP Agreement was closed on March 1, 2019.

Pursuant to the SP Agreement, the Company has issued one hundred (100) shares of

the Company’s common stock to JJGS to acquire 100% of the shares and assets of JJGS for a cost of US$150 reflecting the

value of the rights, titles and interests in the business assets and all attendant or related assets of JJGS. Both parties agreed

that this share issuance by the Company represents payment in full of US$150. Upon Closing, JJGS became the Company’s wholly

owned subsidiary. We now own all of the issued and outstanding shares of JJGS, which owns all of the equity capital of Jiujiu

(HK) Industry Ltd. and Jiujiu (Shenzhen) Industry Ltd. Currently, JJGS

,

Jiujiu (HK) Industry Ltd. and Jiujiu (Shenzhen) Industry Ltd. do not have any operations or active business, nor do they have

any assets.

Currently,

we are engaged in the retail and wholesale wine product business in Dongguan City, Guangdong Province.

Our

office is located at No.10 of Tuanjie 2nd Road, Beice, Humen, Dongguan, 518000, China. Our telephone number is: +

(86)

76982268999

We

offer a variety of wines such as dry red wine, dry white wine, rosé wine, and sweet wine. Currently we

sell about 40 different brands of wine, most of which are imported from France and Spain.

Below is

a list of the most popular products we are selling—

|

Name

|

|

Photo

|

|

Origin

|

|

Alcohol

content

|

|

|

|

|

|

|

|

|

|

Le

Petit Tour

|

|

|

|

France

|

|

13%

|

|

|

|

|

|

|

|

|

|

Los

Beceux

|

|

|

|

Spain

|

|

12%

|

|

|

|

|

|

|

|

|

|

Sorlada

|

|

|

|

Spain

|

|

12%

|

|

Lapso

|

|

|

|

Chile

|

|

13%

|

|

|

|

|

|

|

|

|

|

Saint

Martin

|

|

|

|

France

|

|

12.5%

|

|

Seguelongue

|

|

|

|

France

|

|

13%

|

|

|

|

|

|

|

|

|

|

Saint

Emilion

|

|

|

|

France

|

|

13%

|

We have

put significant efforts in developing and promoting our brand name in different regions of China. We adopt two sales models–

wholesales to distributors and bulk sales to customers. We diversify our portfolio of distributors to maximize our sales turnover

and profits in general. Our distributors include stores, wine shops, regional non-exclusive agents and regional exclusive

agents. There are 151 regional exclusive agents and regional non-exclusive agents authorized to sell our products

throughout China. For regional exclusive agents, our company grants them exclusive distribution rights in certain geographical

territory. For non-exclusive agents, we serve as their supplier and they purchase our products at a higher price than the

regional exclusive agents do.

After

seven years of development, we have cultivated business relationships and achieved recognitions with different organizations

over the years, which has improved our business and management efficacy. Specifically, we have been collaborating with

Shenzhen Institute of Tsinghua University since 2011, who has been helping us develop innovative management model, operating

model and franchising model. Our Company has been a member of Guangdong Provincial Liquor Industry Association since 2011

and was awarded “Excellent Marketing Agency of the Year” in 2012.

Our store is

located in Humen Town, Dongguan City. It is a six-floor building containing a total floor area of 1200 square meters.

We use the first floor exclusively for displaying our sample products. We use the remaining five floors as our Company’s

conference room, offices and storage. Our friendly and knowledgeable staff members on the first floor strive to cultivate long-term

relationships with customers, helping them make informed purchase decisions.

Business

Plan

Our business plan

is to extend our market shares through acquiring quality wine producers and wine importers. Through such business

plan, we believe: (i) we can increase our customer base and obtain more wine supply channels; (ii) such acquisitions will help

us obtain more skilled employees and business connections in the Chinese wine industry.

We

consider following factors when evaluating quality acquisition targets: (i) the costs involved in an acquisition; (ii) the financial

performance of the target; (iii) the reputation of the target in the wine industry; (iv) the target’s existing customer

base; (v) the target’s suppliers; (vi) the expertise and experience of the target’s employees; and (vii) the wine

cellar management and inventory condition of the target.

Our

management believes that successful acquisitions will bring synergies to our business and enhance our shareholders’

value.

Government

Regulations

We

operate our business in China under a legal regime consisting of the National People’s Congress, which is the country’s

highest legislative body, the State Council, which is the highest authority of the executive branch of the PRC central government,

and several ministries and agencies under its authority, including the Ministry of Industry and Information Technology, State

Administration For Industry & Commerce, State Administration of Taxation and their respective local offices. This section

summarizes the principal PRC regulations related to our business.

|

Type

|

|

Name

|

|

Effective

Date

|

|

Content

|

|

President

Order 21 of 2015

|

|

Food

Safety Law

|

|

2015/10/01

|

|

The

Food Safety Law is the foundational law and the most important food safety law for alcoholic products in China. A great majority

of wine regulations are drafted in conformity to the requirements of this law.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Order 144 of 2011

|

|

Measures

for Administration of Imported/Exported Food Safety

|

|

2012/3/1

|

|

This

rule oversees the safety of imported and exported food.

|

|

|

|

|

|

|

|

|

|

CFDA

Order 16 of 2015

|

|

Measures

for Administration of Food Production Licensing

|

|

2015/10/01

|

|

This

rule requires all food producers in China to procure a production license.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Order 27 of 2012

|

|

Administrative

Provisions on Inspections and Supervisions of Labeling of Imported/Exported Pre-packaged Foods

|

|

2012/6/1

|

|

This

rule provides guidelines that governs all pre-packaged foods.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Order 55 of 2012

|

|

Administrative

Provisions on Filing of Importers and Exporters of Imported Foods

|

|

2012/10/1

|

|

This

rule provides the guidelines for imported food inspection procedures, including investigation

of food importers and exporters, tracking of the source and flow of imported foods and

handling of imported food safety inspections.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Order 55 of 2012

|

|

Administrative

Provisions on Recording of Import and Marketing of Imported Foods

|

|

2012/10/1

|

|

This

rule governs the domestic circulation of imported food.

|

|

|

|

|

|

|

|

|

|

|

|

Measures

for Administration of Imported Alcohol in Domestic Market

|

|

1997/9/9

|

|

This

rule governs the administrative procedure involved in regulating imported alcohol in Chinese market, promulgated by a variety

of Chinese agencies such as the State Economic and Trade Commission, the State Administration for Industry and Commerce, and

the Customs General Administration.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Notice on Dec 23 2004

|

|

Rules

for Inspection on Production Licensing of Wines and Fruit Wines

|

|

2005/1/1

|

|

This

is a rule setting up the inspection procedures on production licensing of wines and fruit wines.

|

|

|

|

|

|

|

|

|

|

AQSIQ

Order 78 of 2005

|

|

Geographical

Indication Product Protection Regulation

|

|

2005/7/15

|

|

This

is a regulation that protects China’s geographical indication products. It regulates the use of geographical indication

product names and trademarks while safeguarding the quality of geographical indication products.

|

Intellectual

Property

Protection

of our intellectual property is a strategic priority for our business. We rely primarily on a combination of trademark and trade

secret laws to establish and protect our proprietary rights. We do not rely on third-party licenses of intellectual property for

use in our business.

We currently have

two registered trademarks in China. Our current Chinese trademarks will expire in 2022.

|

Trademark

Number

|

|

Issue

Date

|

|

Expiration

Date*

|

|

Trademark

Title

|

|

|

|

|

|

|

|

|

|

9680266

|

|

2012.08.21

|

|

2022.08.20

|

|

法蓝图

|

|

|

|

|

|

|

|

|

|

9680456

|

|

2006.03.14

|

|

2022.08.20

|

|

|

Employees

As

of April 2, 2019, the Company has 18 full time employees. All employment contracts comply with PRC law. The Company believes

its relationship with its employees is good.

WHERE

YOU CAN FIND MORE INFORMATION

The

registrant is subject to the requirements of the Exchange Act, and files reports, proxy statements and other information with

the SEC. You may read and copy these reports, proxy statements and other information at the public reference room maintained by

the SEC at its Public Reference Room, located at 100 F Street, N.E. Washington, D.C. 20549. You may obtain information on the

operation of the public reference room by calling the SEC at (800) SEC-0330. In addition, we are required to file electronic versions

of those materials with the SEC through the SEC’s EDGAR system. The SEC also maintains a website at http://www.sec.gov,

which contains reports, proxy statements and other information regarding registrants that file electronically with the SEC.

Item

1a. Risk Factors

Not required from a smaller reporting

company.

Item

1b. Unresolved Staff Comments

Not

applicable.

Item

2. Properties

The Company entered

into a lease agreement with Ms. Qingmei Lin on May 1, 2018, to lease approximately 1200

square meters of office space located in No. 10, Tuanjie 2nd Road, Hetaogang, Beizha Community, Humen Town, Dongguan City,

China. The lease agreement will expire on April 30, 2027. The original monthly rent expense was $3,811 (RMB 25,000). Effective

as of May 1, 2018, the monthly rent expense was lowered to $2,323 (RMB15,000) based on a written agreement between Ms. Qingmei

and Company. The total rental expenses for the years ended December 31, 2018 and 2017 were $33,317 and $31,707,

respectively. The lease agreement did not require a rental deposit.

Item

3. Legal Proceedings

From

time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business.

Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that

may harm our business. To the knowledge of management, no federal, state or local governmental agency is presently contemplating

any proceeding against the Company. No director, executive officer or affiliate of the Company or owner of record or beneficially

of more than five percent of the Company’s common stock is a party adverse to the Company or has a material interest adverse

to the Company in any proceeding.

Item

4. Mine Safety Disclosures

Not

applicable.

PART

II

Item

5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

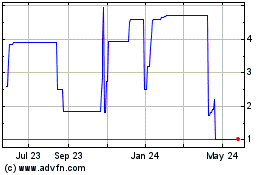

Market

Information

There is a limited public market for our common

stock. Our common stock trades on the OTCQB marketplace under the symbol “FVTI”. The OTCQB marketplace is a quotation

service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity

securities.

OTCQB

securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTCQB securities

transactions are conducted through a telephone and computer network connecting dealers in stocks. OTCQB issuers are traditionally

smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Stockholders

of Record

307,750,000 shares of common stock

were issued and outstanding as of March 28, 2019. They were held by approximately 381 shareholders of record.

Dividends

The

Company has not declared any cash dividends with respect to its common stock and does not intend to declare dividends in the foreseeable

future. There are no material restrictions limiting, or that are likely to limit, the Company’s ability to pay dividends

on its common stock.

Securities

Authorized for Issuance under Equity Compensation Plans

None.

Recent

Sales of Unregistered Securities

None

.

Purchase

of Equity Securities By the Issuer and Affiliated Purchasers.

None.

Item

6. Selected Financial Data

Not

applicable to a smaller reporting company.

Item

7. Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

The

following discussion and analysis should be read in conjunction with our financial statements and related notes thereto.

Results

of Operations

|

|

|

Years Ended December 31,

|

|

|

Change

|

|

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

95,849

|

|

|

|

100.0

|

%

|

|

$

|

260,973

|

|

|

|

100.0

|

%

|

|

$

|

(165,124

|

)

|

|

|

(63.3

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

46,497

|

|

|

|

48.5

|

%

|

|

|

134,728

|

|

|

|

51.6

|

%

|

|

|

(88,231

|

)

|

|

|

(65.5

|

)%

|

|

Gross profit

|

|

|

49,352

|

|

|

|

51.5

|

%

|

|

|

126,245

|

|

|

|

48.4

|

%

|

|

|

(76,893

|

)

|

|

|

(60.9

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0

|

%

|

|

|

0

|

|

|

|

|

|

|

Operating expense

|

|

|

315,437

|

|

|

|

329.1

|

%

|

|

|

311,085

|

|

|

|

119.2

|

%

|

|

|

4,352

|

|

|

|

1.4

|

%

|

|

Other income(expense)

|

|

|

847

|

|

|

|

0.9

|

%

|

|

|

177

|

|

|

|

0.1

|

%

|

|

|

670

|

|

|

|

378.5

|

%

|

|

income taxes

|

|

|

(2,814

|

)

|

|

|

(2.9

|

)%

|

|

|

2,833

|

|

|

|

1.1

|

%

|

|

|

(5,647

|

)

|

|

|

(199.3

|

)%

|

|

Net loss

|

|

$

|

(262,424

|

)

|

|

|

(273.8

|

)%

|

|

$

|

(187,496

|

)

|

|

|

(71.8

|

)%

|

|

$

|

(74,928

|

)

|

|

|

(40.0

|

)%

|

Revenue

Net revenues totaled $95,849 for the year

ended December 31, 2018, a decrease of $165,124 compared to that of 2017. This is a 63.3% decrease in net revenues

compared to that of 2017. Such decrease was primarily due to a decrease in sales from $139,990 to

$46,585 with related parties, and a decrease in sales from $165,124 to $93,405 with non-related parties.

Cost

of revenue

Cost of revenue totaled $46,497 for the year

ended December 31, 2018, which is a decrease of $88,231 compared to that of 2017. Such decrease is due to a decrease

in our revenue and hence a decrease in our supplies procurement. Our cost of revenues consisted mainly

of supplies procurement.

Gross

profit

Gross profit was $49,352 and $126,245 for

the year ended December 31, 2018 and 2017, respectively. The decrease in gross profit was due to a decrease in our revenue

in the fiscal year 2018.

Operating

expenses

General and administrative expenses totaled

$315,437 for the year ended December 31, 2018, which is an increase of $4,352 compared to that of 2017. The increase

was primarily due to an increase in expense for professional services.

Net

loss

Net loss totaled $262,424 for the year ended

December 31, 2018, which is an increase of $74,928 compared to that of 2017. Such increase was due to a decrease

in our revenue.

Liquidity

and Capital Resources

Working

Capital

|

|

|

December

31,

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

current assets

|

|

$

|

338,305

|

|

|

$

|

413,362

|

|

|

$

|

(75,057

|

)

|

|

Total

current liabilities

|

|

|

735,342

|

|

|

|

558,668

|

|

|

|

176,674

|

|

|

Working

capital

|

|

$

|

(397,037

|

)

|

|

$

|

(145,306

|

)

|

|

$

|

(251,731

|

)

|

As of December 31, 2018, we had cash and cash

equivalents in an amount of $29,999. To date, we have financed our operations primarily though borrowings

from related parties. The change in working capital was primarily from an increase in due from our related parties.

Cash

Flows

|

|

|

Years

Ended December 31,

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Change

|

|

|

Cash

Flows (used in) generated in Operating Activities

|

|

$

|

(230,379

|

)

|

|

$

|

(279,270

|

)

|

|

$

|

48,892

|

|

|

Cash

Flows used in Investing Activities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Cash

Flows provided by(used in) Financing Activities

|

|

|

182,417

|

|

|

|

254,712

|

|

|

|

(72,295

|

)

|

|

Net

(decrease) increase in Cash During Period

|

|

$

|

(47,962

|

)

|

|

$

|

(24,558

|

)

|

|

$

|

(23,404

|

)

|

Cash

Flow from Operating Activities

Net cash flow used in operating activities

for the year ended December 31, 2018 was $230,379 as compared to that of $279,270 in 2017. The Company experienced an overall

net loss of $262,424, this was partially offset by a decrease in inventory of $33,816, other working capital account balances

remained stable during the period.

Cash

Flow from Financing Activities

Net cash flow provided by financing

activities was $182,417 for the year ended December 31, 2018, compared to that of $254,712 in

2017. The Company’s net cash flow provided by financing activities consisted mainly of borrowings from

our CEO and Director Mr. Yumin Lin, who is a related party to our Company. Our decrease in net cash flow provided by financing

activities was due to our decreased borrowings from Mr. Yumin Lin.

Critical

Accounting Policy and Estimates

In

the ordinary course of business, we make a number of estimates and assumptions relating to the reporting of results of operations

and financial condition in the preparation of our financial statements in conformity with U.S. generally accepted accounting principles.

We base our estimates on historical experience, when available, and on other various assumptions that are believed to be reasonable

under the circumstances. Actual results could differ significantly from those estimates under different assumptions and conditions.

Off-Balance

Sheet Arrangements

We

do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital

resources that is material to investors.

Item

7A. Quantitative And Qualitative Disclosures About Market Risk

Not

applicable to a smaller reporting company.

Item

8. Financial Statements And Supplementary Data

The

consolidated financial statements of the Company are included in this Annual Report on Form 10-K beginning on page F-1, which

are incorporated herein by reference.

Item

9. Changes in And Disagreements With Accountants on Accounting And Financial Disclosure

None.

Item

9a. Controls And Procedures

Evaluation

of Disclosure Control and Procedures.

We

are required to maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed

in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within

the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated

and communicated to our management, including our chief executive officer (also our principal executive officer) and our chief

financial officer (also our principal financial and accounting officer) to allow for timely decisions regarding required disclosure.

Pursuant

to Rule 13a-15(b) under the Securities Exchange Act of 1934 (“Exchange Act”), the Company’s management, including

the Company’s Chief Executive Officer (“CEO”) (the Company’s principal executive officer) and Chief Financial

Officer (“CFO”) (the Company’s principal financial and accounting officer), has evaluated the effectiveness

of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end

of the period covered by this report. Based upon that evaluation the Company’s CEO and CFO concluded that the Company’s

disclosure controls and procedures were not effective as of December 31, 2018 to ensure that information required to be disclosed

by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and

reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated

to the Company’s management, including the Company’s CEO and CFO Mr. Yumin Lin, as appropriate, to allow timely

decisions regarding required disclosure. The principal basis for this conclusion is the lack of segregation of duties within our

financial function and the lack of an operating Audit Committee.

Management’s

Report on Internal Control over Financial Reporting

Our

management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control

over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a

process designed by, or under the supervision of, the company’s principal executive and principal financial officers and

effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting

principles generally accepted in the United States of America and includes those policies and procedures that:

|

|

●

|

Apply

to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of

the assets of the company

|

|

|

|

|

|

|

●

|

Provide

reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance

with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company

are being made only in accordance with authorizations of management and directors of the company; and

|

|

|

|

|

|

|

●

|

Provide

reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s

assets that could have a material effect on the financial statements.

|

Because

of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of

any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes

in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems,

no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only

reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of

internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control

over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore,

it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

We

carried out an assessment, under the supervision and with the participation of our management, including our CEO and CFO Mr. Yumin

Lin, of the effectiveness of the design and operation of our internal controls over financial reporting, as defined in Rules

13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as of December 31, 2018. Integrated Framework (2013). Based on

that assessment and on those criteria, our CEO and CFO concluded that our internal control over financial reporting was not effective

as of December 31, 2018. The principal basis for this conclusion is failure to engage sufficient resources in regards to our accounting

and reporting obligations.

Attestation

Report of Registered Public Accounting Firm

This

prospectus does not include an attestation report of our independent registered public accounting firm, regarding internal controls

over financial reporting. Our internal control over financial reporting was not subject to such attestation as we are a smaller

reporting company.

Changes

in internal control over financial reporting.

As

reported on the Form 8-K filed by the Company with the SEC on November 22, 2018, the Company’s director, Mr. Xinlong Shen,

resigned on November 21, 2018.

Other

than the foregoing, there was no change in our internal controls over financial reporting that occurred during the period covered

by this report, which has materially affected or is reasonably likely to materially affect, our internal controls over financial

reporting

.

Item

9B. Other Information

None.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance

The

name, address, age and titles of our executive officers and director are as follows:

|

Name

& Address

|

|

Age

|

|

Title

|

|

Date

of First Appointment

|

|

Lin

Yu Min

|

|

51

|

|

Chairman

of the Board, Chief Executive Officer, President, Treasurer, and Secretary

|

|

December

14, 2016

|

|

Shen

Xinlong (1)

|

|

37

|

|

Director

|

|

December

14, 2016

|

(1)

On November 21, 2018, Mr. Shen Xinlong resigned from his position as a director.

Lin

Yu Min, age 51, is the Chairman, CEO, President, Secretary and Treasurer of our Company.

From

July 1987 to April 1992 Mr. Lin worked as a manager at the LuChengXinChao Furniture Factory. From April 1992 to April 1999 he

was a manager at the Shangying Business Development Company in Guangdong, China and from April 1993 to April 1999 he worked to

establish the Huizhou Branch of Shangying Business Development Company located in Guangdong. He was the company’s operations

manager and was also responsible for selling construction steel products. From April 1999 to May 2011 he was the General Manager

of the Dongguan Saite Building Material Company. From May 2011 to the present he has served as chairman to Dongguan France Vin

Tout Co., Ltd., located in Dongguan, Guangdong, China. Additionally, from November 2015 to the present, he has served as chairman

at the Shenzhen DaxingHuashang Liquor Culture Company in the Nanchang District, Shenzhen, China.

Xinlong

Shen, age 37, has more than 10-year experience in electronic appliances trading and marketing field in several China-based enterprises.

He graduated in 2003 from Xidian University in China with a bachelor degree in management and major in business administration.

In July 2003, Mr. Shen started his first career as Overseas Sales in Shenzhen Yu Ou Electronics Co., Ltd., which produces and

sells consumer electronics such as DVD and MP3 players. In August 2005, he worked as an Overseas Trade Manager in Shenzhen Richtec

Industry Co., Ltd., which is a high-tech corporation and a global exporter and manufacturer specializing in developing, producing

and marketing home theater systems, iPod/Mp3/mobile speakers and car speakers. In January 2008, he worked as an Overseas Trade

Manager in Shenzhen Zhongmeipeng Industry Co., Ltd., which is an integrated trading company producing industrial products and

consumer electronics. As Overseas Trade Manager in these two firms, Mr. Shen was responsible for leading the marketing team to

conduct overseas marketing for the company’s products. From December 2013 to September 2014, Mr. Shen served as Vice President

in Shenzhen Boao Asset Management Consulting Service Co., Ltd., which is a financial consulting firm providing professional financial

services including asset management and financial planning services to clients. In order to solve clients’ financial issues,

he was dedicated to offer comprehensive, integrated and tailor-made in-depth financial advisory services. From September 2014

to present, Mr. Shen has served as Chairman of the Board in Qianhai Shenzhen Xinzilong Media Co., Ltd., which specializes in production

of film, video and media and entertainment programs. In addition, the Company manages various events ranging from cultural activities

to conferences and exhibitions and provides advisory services. Mr. Shen is responsible for managing media production and sales

and marketing. Moreover, he gives professional advice to clients related to branding, marketing and advertising. Since November

2014, Mr. Shen has served as Vice Chairman in Chinacom Investment Association, which was mutually found by Chinese merchants and

entrepreneurs. It aims at providing integrated information platform service to facilitate communication between association members

and government departments and bilateral and multilateral trade and investment activities.

Director

Independence

We are not currently subject to listing requirements

of any national securities exchange or inter-dealer quotation system which has requirements that a majority of the board of directors

be “independent” and, as a result, we are not at this time required to have our Board of Directors comprised of a

majority of “independent directors.” Our sole director is not independent under the applicable standards.

Family

Relationships

There

are no family relationships among our directors or executive officers.

Involvement

in Certain Legal Proceedings

During

the past 10 years, to our knowledge, except as described below, none of our present or former directors, executive officers or

persons nominated to become directors or executive officers has been the subject of any of the following:

(1)

A petition under the federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent

or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a

general partner at or within two (2) years before the time of such filing, or any corporation or business association of which

he was an executive officer at or within two (2) years before the time of such filing;

(2)

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations

and other minor offenses);

(3)

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of

competent jurisdiction, permanently or temporarily enjoining him or her from, or otherwise limiting, the following activities:

(i)

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker,

leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person

of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person,

director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing

any conduct or practice in connection with such activity;

(ii)

Engaging in any type of business practice; or

(iii)

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation

of Federal or State securities laws or Federal commodities laws;

(4)

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal

or State authority barring, suspending or otherwise limiting for more than sixty (60) days the right of such person to engage

in any activity described in paragraph (3)(i) above, or to be associated with persons engaged in any such activity;

(5)

Such person was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any federal or state

securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or

vacated;

(6)

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to

have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission

has not been subsequently reversed, suspended or vacated;

(7)

Such person was the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding,

not subsequently reversed, suspended or vacated, relating to an alleged violation of:

(i)

Any federal or state securities or commodities law or regulation; or

(ii)

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent

injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal

or prohibition order; or

(iii)

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8)

Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any

self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26)), any registered entity

(as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity

or organization that has disciplinary authority over its members or persons associated with a member.

Except

as disclosed herein, we are not a party to any pending legal proceeding. To the knowledge of our management, except as disclosed

herein, no federal, state or local governmental agency is presently contemplating any proceeding against us.

Board

Committees

The

Company currently has not established any committees of the Board of Directors. Our Board of Directors may designate from among

its members an executive committee and one or more other committees in the future. We do not have a nominating committee or a

nominating committee charter. Further, we do not have a policy with regard to the consideration of any director candidates recommended

by security holders. To date, other than as described above, no security holders have made any such recommendations. The entire

Board of Directors performs all functions that would otherwise be performed by committees. Given the present size of our board,

it is not practical for us to have committees. If we are able to grow our business and increase our operations, we intend to expand

the size of our board and allocate responsibilities accordingly.

Audit

Committee Financial Expert

We

have no separate audit committee at this time. The entire Board of Directors oversees our audits and auditing procedures. Our

sole director is not an “audit committee financial expert” within the meaning of Item 407(d)(5) of SEC Regulation

S-K.

Compensation

Committee

We

have no separate compensation committee at this time. The entire Board of Directors oversees the functions, which would be performed

by a compensation committee.

Code

of Ethics

The

Company did not adopt a Code of Ethics.

Item

11. Executive Compensation

The

following table sets forth the compensation paid or accrued by us to our Chief Executive Officer, Chief Financial Officer and

each of our other officers for the year ended December 31, 2018 and the period ended December 31, 2017.

|

Name and Principal Position

|

|

Year

|

|

Salary

($)

|

|

|

All Other Compensation

($)

|

|

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Xilong Shen

|

|

2017

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yumin Lin

|

|

2017

|

|

|

10,489

|

|

|

|

|

|

|

|

|

|

|

President, CEO,

|

|

2018

|

|

|

17,497

|

|

|

|

|

|

|

|

|

|

|

Secretary, CFO,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Xilong

Shen was appointed as President, CEO, Secretary, CFO and director on August 3, 2016. He resigned from all the positions except

director on December 14, 2016. On November 21, 2018, Mr. Shen Xinlong resigned from his position as a director.

Yumin

Lin was appointed as President, CEO, Secretary, CFO and director on December 14, 2016.

Outstanding

Equity Awards

There

are no outstanding equity awards.

Equity

Compensation Plan Information

We

currently do not have an equity compensation plan.

Director

Compensation

We

do not pay our directors any money and we have no plans to pay our directors any money in the future.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, requires our executive officers, directors and

persons who beneficially own more than 10% of a registered class of our equity securities to file with the Securities and Exchange

Commission initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. These

executive officers, directors, and greater than 10% beneficial owners are required by SEC regulation to furnish us with copies

of all Section 16(a) forms filed by such reporting persons.

Based

solely on our review of such forms furnished to us and written representations from certain reporting persons, we believe that

all filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were filed in a

timely manner during the fiscal year ended December 31, 2018.

Item

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The

following table sets forth information with respect to the beneficial ownership of our Common Stock as of March 28, 2019,

by (i) each stockholder known by us to be the beneficial owner of more than 5% of our Common Stock (our only class of voting securities),

(ii) each of our directors and executive officers, and (iii) all of our directors and executive officers as a group. To the best

of our knowledge, except as otherwise indicated, each of the persons named in the table has sole voting and investment power with

respect to the shares of our Common Stock beneficially owned by such person, except to the extent such power may be shared with

a spouse. To our knowledge, none of the shares listed below are held under a voting trust or similar agreement, except as noted.

To our knowledge, there is no arrangement, including any pledge by any person of securities of the Company or any of its parents,

the operation of which may at a subsequent date result in a change in control of the Company.

Officers

and Directors

|

Title

of Class

|

|

Name

and Address of Beneficial Owner (1)

|

|

Amount

and Nature of Beneficial Ownership

|

|

|

Percent

|

|

|

Common

Stock

|

|

Yumin

Lin

19F, Lianhe Tower, 1069 Nanhai Ave, Nanshan District,Shenzhen, 518000, China

|

|

|

18,000,000

|

|

|

|

5.85

|

%

|

|

Officers and Directors as a Group(1person)

|

|

|

|

|

18,000,000

|

|

|

|

5.85

|

%

|

Greater

than 5% Shareholders

|

Title of Class

|

|

Name and Address of Beneficial Owner (1)

|

|

Amount and Nature of Beneficial Ownership

|

|

|

Percent

|

|

|

Common Stock

|

|

Gaosheng Group Co.,Ltd.

Luo Nai Yong (Beneficial Owner)

Second Floor, Capital City Independence Avenue Mahe Victoria Seychelles

|

|

|

89,953,274

|

|

|

|

29.23

|

%

|

|

Common Stock

|

|

China Kaiping Group CO., Ltd.

Ma Hui Jun (Beneficial Owner)

Second Floor, Capital City Independence Avenue Mahe Victoria Seychelles

|

|

|

153,000,000

|

|

|

|

49.72

|

%

|

The percent of class is based

on 307,750,000 shares of common stock issued and outstanding as of March 28, 2019.

Item

13. Certain Relationships, Related Transactions and Director Independence

The

Company sold its wine and liquor products to Mr. Naiyong Luo in the amounts of $41,565 and $139,990 for the years ended

December 31, 2018 and 2017. As of December 31, 2018, the Company had a customer deposit from Mr. Luo in the amount of $78,639.

These sales occurred in the normal course of business. Mr. Luo is a shareholder of Gaosheng Group Co., Ltd., the prior owner of

DIGL.

The

Company sold its wine and liquor products to Mr. Hongwei Ye in the amounts of $5,020 and $0 for the years ended December 31, 2018

and 2017. As of December 31, 2018, the Company had a customer deposit from Mr. Ye in the amount of $25,719. These sales occurred

in the normal course of business.

The

Current CEO, Mr. Yumin Lin, settled the loan amount $21,500 due to the former CEO Mr. Sheng on behalf of the Company. During the

year ended December 31,2018 Mr. Yumin Lin also extended a loan of $532,561 to the Company for working capital purposes. As of

December 31, 2018, the note payable due to Mr. Yumin Lin amounted to $554,061. These notes were unsecured, non-interest

bearing and due on demand. The imputed interest on these notes was deemed immaterial.

Item

14. Principal Accountant Fees and Services

The

following table shows the fees that were billed for the audit and other services for

the fiscal year ended December 2018 and 2017.

|

|

|

2018

|

|

|

2017

|

|

|

Audit Fees

|

|

|

50,177

|

|

|

|

55,850

|

|

|

Audit-Related Fees

|

|

|

-

|

|

|

|

-

|

|

|

Tax Fees

|

|

|

-

|

|

|

|

-

|

|

|

All Other Fees

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

|

-

|

|

|

|

-

|

|

Audit

Fees

— This category includes the audit of our annual financial statements, review of financial statements included

in our Quarterly Reports on Form 10-Q and services that are normally provided by the independent registered public accounting

firm in connection with engagements for those fiscal years. This category also includes advice on audit and accounting matters

that arose during, or as a result of, the audit or the review of interim financial statements.

Audit-Related

Fees

— This category consists of assurance and related services by the independent registered public accounting firm

that is reasonably related to the performance of the audit or review of our financial statements and is not reported above under

“Audit Fees.” The services for the fees disclosed under this category include consultation regarding our correspondence

with the Securities and Exchange Commission and other accounting consulting.

Tax

Fees

— This category consists of professional services rendered by our independent registered public accounting firm

for tax compliance and tax advice. The services for the fees disclosed under this category include tax return preparation and

technical tax advice.

All

Other Fees

— This category consists of fees for other miscellaneous items.

Our

Board of Directors has adopted a procedure for pre-approval of all fees charged by our independent registered public accounting

firm. Under the procedure, the Board approves the engagement letter with respect to audit and review services. Other fees are

subject to pre-approval by the Board, or, in the period between meetings, by a designated member of Board. Any such approval by

the designated member is disclosed to the entire Board at the next meeting. The audit fees that were paid to the auditors with

respect to 2018 were pre-approved by the entire Board of Directors.

Item

15. Exhibits, Financial Statement Schedules

(1)

All financial statements

Index

to Consolidated Financial Statements

(2)

Financial Statement Schedules

All

financial statement schedules have been omitted, since the required information is not applicable or is not present in amounts

sufficient to require submission of the schedule, or because the information required is included in the consolidated financial

statements and notes thereto included in this Annual Report on Form 10-K.

(3)

Exhibits

|

Number

|

|

Description

|

|

2.1*

|

|

Share

Exchange Agreement, dated April 6, 2018, by and among FVTI, DKTI and Yumin Lin. (incorporated by reference to Exhibit

2.1 to the Company’s Current Report on Form 8-K as filed with the SEC on April 19, 2018)

|

|

2.2*

|

|

Termination

Agreement, dated April 6, 2018, by and among FVTI, DKTI and Yumin Lin. (incorporated by reference to Exhibit 2.2 to

the Company’s Current Report on Form 8-K as filed with the SEC on April 19, 2018)

|

|

3.1*

|

|

Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-1 as amended filed with the SEC on December 5, 2014)

|

|

3.2*

|

|

Bylaws (incorporated by reference to Exhibit 3.2 the Company’s Registration Statement on Form S- as amended filed with the SEC on December 5, 2014).

|

|

31.1**

|

|

Certification of Chief Executive Officer, pursuant to SEC Rules 13a-14(a) and 15d-14(a), adopted pursuant Section 302 of the Sarbanes Oxley Act of 2002

|

|

31.2**

|

|

Certification of Chief Financial Officer, pursuant to SEC Rules 13a-14(a) and 15d-14(a), adopted pursuant Section 302 of the Sarbanes Oxley Act of 2002

|

|

32.1***

|

|

Certification of Chief Executive Officer, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.2***

|

|

Certification of Chief Financial Officer, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

101.INS

|

|

XBRL

Instance Document

|

|

|

|

|

|

101.SCH

|

|

XBRL

Taxonomy Schema

|

|

|

|

|

|

101.CAL

|

|

XBRL

Taxonomy Calculation Linkbase

|

|

|

|

|

|

101.DEF

|

|

XBRL

Taxonomy Definition Linkbase

|

|

|

|

|

|

101.LAB

|

|

XBRL

Taxonomy Label Linkbase

|

|

|

|

|

|

101.PRE

|

|

XBRL

Taxonomy Presentation Linkbase

|

|

*

|

Previously

filed

|

|

**

|

Filed

herewith

|

|

***

|

In

accordance with Item 601(b)(32)(ii) of Regulation S-K and SEC Release No. 34-47986, the certifications furnished in Exhibits

32.1 and 32.2 herewith are deemed to accompany this Form 10-K and will not be deemed filed for purposes of Section 18 of the

Exchange Act. Such certifications will not be deemed to be incorporated by reference into any filings under the Securities

Act or the Exchange Act.

|

Item

16. Form 10–K Summary

None.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date:

April 2, 2019

|

FORTUNE

VALLEY TREASURES, INC.

|

|

|

|

|

|

|

By:

|

/s/

Yumin Lin

|

|

|

Name:

|

Yumin

Lin

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer (Principal Executive Officer and Principal Financial Officer)

|

Fortune

Valley Treasures, Inc.

Consolidated

Financial Statements

For

the year ended December 31, 2018 and 2017

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

To:

|

The

Board of Directors and Stockholders of

|

|

|

Fortune

Valley Treasures, Inc.

|

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheets of Fortune Valley Treasures, Inc. (the Company) as of December

31, 2018 and 2017, and the related consolidated statements of operations, comprehensive loss, stockholders’

deficit, and cash flows for each of the years in the two-year period ended December 31, 2018, and the related notes (collectively

referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the

financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for each

of the years in the two-year period ended December 31, 2018, in conformity with accounting principles generally accepted in the

United States of America.

Emphasis

of Matter

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 3 to the financial statements, the Company had incurred substantial losses and has a working capital deficit, which raises

substantial doubt about its ability to continue as a going concern Management's plans in regards to these matters are also described

in Note 3. These financial statements do not include any adjustments that might result from the outcome of this uncertainly.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on

the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company

Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance

with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the

PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit

to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error

or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but

not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.

Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to

error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence

regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles

used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that our audits provide a reasonable basis for our opinion.

WWC,

P.C.

Certified

Public Accountants

We

have served as the Company’s auditor since December 4, 2017

San

Mateo, California

April

1, 2019

Fortune

Valley Treasures, Inc.

Consolidated

Balance Sheets

At

December 31, 2018 and 2017

|

|

|

2018

|

|

|

2017

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

29,999

|

|

|

$

|

77,782

|

|

|

Accounts and other receivable, net

|

|

|

7,706

|

|

|

|

15,317

|

|

|

Inventories

|

|

|

236,175

|

|

|

|

273,491

|

|

|

Prepaid expenses

|

|

|

8,000

|

|

|

|

5,895

|

|

|

Due from related parties

|

|

|

54,344

|

|

|

|

40,126

|

|

|

Prepaid taxes and taxes recoverable

|

|

|

2,081

|

|

|

|

751

|

|

|

Total current assets

|

|

$

|

338,305

|

|

|

$

|

413,362

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

Plant and equipment, net

|

|

|

9,809

|

|

|

|

13,824

|

|

|

Total Assets

|

|

$

|

348,114

|

|

|

$

|

427,186

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts and taxes payable

|

|

|

48,282

|

|

|

|

44,187

|

|

|

Accrued liabilities and other payables

|

|

|

291

|

|

|

|

2,175

|

|

|

Customers advances and deposits

|

|

|

-

|

|

|

|

11,697

|

|

|

Due to related parties

|

|

|

686,769

|

|

|

|

500,609

|

|

|

Total current liabilities

|

|

$

|

735,342

|

|

|

$

|

558,668

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

$

|

735,342

|

|

|

$

|

558,668

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

Common stock (3,000,000,000 shares authorized, 307,750,000 issued and outstanding at December 31, 2018 and 2017)

|

|

|

307,750

|

|

|

|

307,750

|

|

|

Accumulated deficit

|

|

|

(708,097

|

)

|

|

|

(445,673

|

)

|

|

Accumulated other comprehensive income

|

|

|

13,119

|

|

|

|

6,441

|

|

|

Total Stockholders’ Deficit

|

|

|

(387,228

|

)

|

|

|

(131,482

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

|

|

348,114

|

|

|

|

427,186

|

|

See

accompanying notes to the financial statements

Fortune

Valley Treasures, Inc.

Consolidated

Statements of Operations and Comprehensive Loss

For

the Years ended December 31, 2018 and 2017

|

|

|

2018

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

Net revenues (related party revenue $46,585 and $139,990 for 2018 and 2017)

|

|

$

|

95,849

|

|

|

$

|

260,973

|

|

|

Cost of revenues

|

|

|

46,497

|

|

|

|

134,728

|

|

|

Gross profit

|

|

|

49,352

|

|

|

|

126,245

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

315,437

|

|

|

|

311,085

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(266,085

|

)

|

|

|

(184,840

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

1,442

|

|