UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March 31, 2024

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ___________ to ___________

Commission

File Number: 001-36386

Gulf

Coast Ultra Deep Royalty Trust

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

46-6448579 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

The

Bank of New York Mellon Trust Company, N.A., as trustee

601

Travis Street, 16th Floor |

|

|

| Houston,

Texas |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (512) 236-6555

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☐ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes ☒ No

On

May 13, 2024, there were 230,172,696 royalty trust units outstanding representing beneficial interests in the registrant.

GULF

COAST ULTRA DEEP ROYALTY TRUST

TABLE

OF CONTENTS

Part

I. FINANCIAL INFORMATION

Item

1. Financial Statements.

GULF

COAST ULTRA DEEP ROYALTY TRUST

STATEMENTS

OF ASSETS, LIABILITIES AND TRUST CORPUS

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(audited) | |

| ASSETS | |

| | | |

| | |

| Operating cash | |

$ | 153,554 | | |

$ | 43,741 | |

| Reserve fund cash and short-term investments | |

| 1,116,605 | | |

| 1,116,460 | |

| Overriding royalty interests in subject interests, net | |

| - | | |

| - | |

| Total assets | |

$ | 1,270,159 | | |

$ | 1,160,201 | |

| | |

| | | |

| | |

| LIABILITIES AND TRUST CORPUS | |

| | | |

| | |

| Reserve fund liability | |

$ | 1,130,885 | | |

$ | 1,116,460 | |

| Trust corpus (230,172,696 royalty trust units authorized, issued and outstanding as of March 31, 2024 and December 31, 2023) | |

| 139,274 | | |

| 43,741 | |

| Total liabilities and trust corpus | |

$ | 1,270,159 | | |

$ | 1,160,201 | |

The

accompanying notes are an integral part of these financial statements.

GULF

COAST ULTRA DEEP ROYALTY TRUST

STATEMENTS

OF DISTRIBUTABLE INCOME (Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Royalty income | |

$ | - | | |

$ | 386,947 | |

| Interest income and other | |

| 1,340 | | |

| 8,810 | |

| Administrative expenses | |

| (421,723 | ) | |

| (189,676 | ) |

| Income in excess of administrative expenses (administrative expenses in excess of income) (Note 4) | |

$ | (420,383 | ) | |

$ | 206,081 | |

| Distributable income (Note 4) | |

$ | - | | |

$ | 197,331 | |

| Distributable income per royalty trust unit | |

$ | - | | |

$ | 0.000857 | |

| Royalty trust units outstanding at end of period | |

| 230,172,696 | | |

| 230,172,696 | |

The

accompanying notes are an integral part of these financial statements.

GULF

COAST ULTRA DEEP ROYALTY TRUST

STATEMENTS

OF CHANGES IN TRUST CORPUS (Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Trust corpus, beginning of period | |

$ | 43,741 | | |

$ | 1,245,494 | |

| Trust contributions | |

| 515,916 | | |

| - | |

| Amortization of overriding royalty interests in subject interests | |

| - | | |

| (21,780 | ) |

| Impairment of subject interests | |

| - | | |

| (308,071 | ) |

| Income in excess of administrative expenses (administrative expenses in excess of income) | |

| (420,383 | ) | |

| 206,081 | |

| Distributions paid | |

| - | | |

| (621,894 | ) |

| Trust corpus, end of period | |

$ | 139,274 | | |

$ | 499,830 | |

The

accompanying notes are an integral part of these financial statements.

GULF

COAST ULTRA DEEP ROYALTY TRUST

NOTES

TO FINANCIAL STATEMENTS (Unaudited)

1.

BASIS OF ACCOUNTING AND SIGNIFICANT ACCOUNTING POLICIES

The

financial statements of Gulf Coast Ultra Deep Royalty Trust (the Royalty Trust) are prepared on the modified cash basis of accounting

and are not intended to present the Royalty Trust’s financial position and results of operations in conformity with United States

(U.S.) generally accepted accounting principles (GAAP). This other comprehensive basis of accounting corresponds to the accounting permitted

for royalty trusts by the U.S. Securities and Exchange Commission (SEC), as specified by Staff Accounting Bulletin Topic 12:E, Financial

Statements of Royalty Trusts.

The

accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all

required information and disclosures. Therefore, this information should be read in conjunction with the Royalty Trust’s financial

statements and notes contained in its annual report on Form 10-K for the year ended December 31, 2023 (the 2023 Form 10-K). The information

furnished herein reflects all adjustments that are, in the opinion of The Bank of New York Mellon Trust Company, N.A. (the Trustee),

necessary for a fair statement of the results for the interim periods reported. All such adjustments are, in the opinion of the Trustee,

of a normal recurring nature. Operating results for the three-month period ended March 31, 2024, are not necessarily indicative of the

results that may be expected for the year ending December 31, 2024.

The

Royalty Trust was created to hold a 5% gross overriding royalty interest (collectively, the overriding royalty interests) in future production

from specified Inboard Lower Tertiary/Cretaceous exploration prospects, located in the shallow waters of the Gulf of Mexico and onshore

in South Louisiana that existed as of December 5, 2012 (collectively, the subject interests).

Royalties

are recorded in royalty income on the statements of distributable income when received under the modified cash basis of accounting. Significant

accounting policies are consistent with Note 1 - Summary of Significant Accounting Policies in Part II, Item 8 of the 2023 Form 10-K.

The

Royalty Trust evaluates the carrying values of the overriding royalty interests in the subject interests for impairment if conditions

indicate that potential uncertainty exists regarding the Royalty Trust’s ability to recover its recorded amounts related to the

overriding royalty interests. Indications of potential impairment with respect to the overriding royalty interests can include, among

other things, subject interest lease expirations, reductions in estimated reserve quantities or resource potential, changes in estimated

future oil and natural gas prices, exploration costs, and/or drilling plans, and other matters that arise that could negatively impact

the carrying values of the overriding royalty interests. If an impairment event occurs and it is determined that the carrying value of

the Royalty Trust’s overriding royalty interests in the subject interests may not be recoverable, an impairment will be recognized

as measured by the amount by which the carrying amount of the overriding royalty interests in the subject interests exceeds the fair

value of these assets, which would be measured by discounting projected cash flows. The related impairment amounts are recorded as a

reduction to the overriding royalty interest with an offsetting reduction to the Trust Corpus in the period such impairment is determined.

Impairment of the carrying values of the overriding royalty interests in the subject interests involves a significant amount of judgment

and may be subject to changes over time based on drilling plans and results, geophysical evaluations, the assignment of proved natural

gas reserves, availability of capital and other factors. Fair value accounting guidance includes a hierarchy that prioritizes the inputs

to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets

for identical assets or liabilities (Level 1 inputs) and the lowest priority to unobservable inputs (Level 3). When indicators of impairment

are present and it is determined that the carrying value of the Royalty Trust’s overriding royalty interests in the subject interests

exceeds the estimated undiscounted cash flows of the subject interest, fair value estimates utilized in the impairment assessment are

determined based on inputs not observable in the market and thus represent Level 3 measurements.

2.

OVERRIDING ROYALTY INTERESTS

The

onshore Highlander subject interest is the only subject interest in which the Royalty Trust holds an overriding royalty interest. Amortization

charges related to production volumes associated with the onshore Highlander subject interest reduced the carrying value of the overriding

royalty interests by $0 and $21,780 during the three-month periods ended March 31, 2024 and 2023, respectively.

Highlander

Oil & Gas Assets LLC (HOGA) has a 72 percent working interest and an approximate 48 percent net revenue interest in the onshore Highlander

subject interest. The Royalty Trust holds a 3.6 percent overriding royalty interest in the onshore Highlander subject interest. HOGA

is the operator of the onshore Highlander subject interest.

As

previously disclosed, the sole well producing from the onshore Highlander subject interest experienced an operational issue on January

19, 2023, resulting in substantial amounts of water entering the well, which caused a shut in of the well before production resumed at

significantly reduced levels. Following an evaluation by HOGA’s field operations team, HOGA determined that it would be necessary

to commence operations to control the water production, in expectation of eventually initiating “kill” operations on the

well. HOGA has informed the Trustee that the well was shut in effective March 31, 2023 and production from the well has ceased, with

the well having flowed intermittently but not on a continuous basis from that time. HOGA has informed the Trustee that due to the underground

flow of fluids into the wellbore, the well cannot be salvaged and must be plugged and abandoned. On March 7, 2024, HOGA notified the

Trustee that operations have begun to permanently plug and abandon the sole well producing from the onshore Highlander subject interest.

Abandoning the well eliminated any production from the onshore Highlander subject interest, which also eliminated any proceeds to which

the Royalty Trust would be entitled pursuant to its overriding royalty interests. Unless another well is drilled on the onshore Highlander

subject interest, the Royalty Trust does not expect to receive any income attributable to its overriding royalty interests

and accordingly, does not expect to have any cash available to distribute to Royalty Trust unitholders in future periods. HOGA has not

informed the Trustee of any definitive plans to drill a new well on the Highlander subject interest. Neither the Trustee nor the Royalty

Trust unitholders has any right to control or influence operations of the subject interest.

The Royalty Trust fully impaired the carrying value of the onshore Highlander

subject interest by $308,071 during the quarter ended March 31, 2023. Unless a new well is drilled on the onshore Highlander subject interest,

the Royalty Trust does not expect to receive any income attributable to its overriding royalty interests. Therefore, the Royalty Trust

recognized the remaining carrying value of the onshore Highlander subject interest as of March 31, 2023 as an impairment loss. Accumulated

amortization was $6,756,701 at March 31, 2024 and December 31, 2023.

3.

RELATED PARTY TRANSACTIONS

Royalty

Income. In accordance with the terms of the master conveyance, royalties are paid to the Royalty Trust on the last day of the month

following the month in which production payments are received by HOGA. The Royalty Trust received royalties of $0 and $386,947 during

the three-month periods ended March 31, 2024 and 2023, respectively. Royalties received by the Royalty Trust must first be used to (i)

satisfy Royalty Trust administrative expenses and (ii) reduce Royalty Trust indebtedness. The Royalty Trust had no indebtedness outstanding

as of March 31, 2024 and December 31, 2023.

Each

quarter, the Trustee will determine the amount of funds available for distribution to the Royalty Trust unitholders. Available funds

will equal the excess cash received by the Royalty Trust from the royalty interests and other sources during that quarter over the Royalty

Trust’s liabilities for that quarter. Available funds will be reduced by any cash the Trustee reserves against future liabilities.

As of March 31, 2024, the Trustee has established a minimum cash reserve of $302,500. The minimum cash reserve is not reflective of the

Royalty Trust’s operating cash balance as of March 31, 2024 and December 31, 2023.

Commencing

with the distribution to unitholders in the first quarter of 2022, the Royalty Trust withheld $8,750 from the funds otherwise available

for distribution each quarter through the first quarter of 2023, with the intent of gradually building a cash reserve of approximately

$350,000. As no proceeds were available for distribution in the first quarter of 2024, the Royalty Trust did not withhold any funds for

the cash reserve. Unless a new well is drilled on the onshore Highlander subject interest as discussed in Note 2 above, the Royalty

Trust does not intend to withhold funds for the cash reserve in the future, as the Royalty Trust does not expect to have any cash available

to distribute to unitholders in future periods. This cash is reserved for the payment of future known, anticipated or contingent expenses

or liabilities of the Royalty Trust. The Trustee may increase or decrease the targeted cash reserve amount at any time, and may increase

or decrease the rate at which it withholds funds to build the cash reserve at any time, without advance notice to the unitholders. Cash

held in reserve will be invested as required by the amended and restated royalty trust agreement governing the Royalty Trust (the royalty

trust agreement). Any cash reserved in excess of the amount necessary to pay or provide for the payment of future known, anticipated

or contingent expenses or liabilities eventually will be distributed to unitholders, together with interest earned on the funds. For

additional information regarding distributions to Royalty Trust unitholders, see Note 4.

Funding

of Administrative Expenses. Pursuant to the royalty trust agreement, Freeport-McMoRan Inc. (FCX) has agreed to pay annual trust expenses

up to a maximum amount of $350,000, with no right of repayment or interest due, to the extent the Royalty Trust lacks sufficient funds

to pay administrative expenses. On February 1, 2024, pursuant to this provision, FCX contributed approximately $166,000 for the payment

of trust expenses incurred during the year ended December 31, 2023, and contributed the maximum of $350,000 for the payment of trust

expenses incurred during the year ending December 31, 2024. In addition to such annual contributions, FCX has agreed to lend money, on

an unsecured, interest-free basis, to the Royalty Trust to fund the Royalty Trust’s ordinary administrative expenses as set forth

in the royalty trust agreement. All funds the Trustee borrows to cover expenses or liabilities, whether from FCX or from any other source,

must be repaid before the Royalty Trust unitholders will receive any distributions. No loans or repayments were made during the quarters

ending March 31, 2024 or December 31, 2023.

Pursuant

to the royalty trust agreement, FCX agreed to provide and maintain a $1.0 million stand-by reserve account or an equivalent letter of

credit for the benefit of the Royalty Trust to enable the Trustee to draw on such reserve account or letter of credit to pay obligations

of the Royalty Trust if its funds are inadequate to pay its obligations at any time. Currently, with the consent of the Trustee, FCX

may reduce the reserve account or substitute a letter of credit with a different face amount for the original letter of credit or any

substitute letter of credit. In connection with this arrangement, FCX provided $1.0 million to the Royalty Trust. The $1.0 million, plus

interest collected thereon, is reflected as reserve fund cash, with a corresponding reserve fund liability in the accompanying Statements

of Assets, Liabilities and Trust Corpus. On February 1, 2024, the Royalty Trust used $14,280 from the reserve account to pay administrative

expenses to the Trustee, which is included in the administrative expenses in the accompanying Statements of Distributable

Income. As of March 31, 2024, FCX had not requested a reduction of the reserve account.

Administration.

HOGA performs all administrative and reporting responsibilities with respect to the Royalty Trust, including those described in Article

III of the royalty trust agreement.

Compensation

of the Trustee. The Trustee receives annual compensation of $200,000. Additionally, the Trustee receives reimbursement for its reasonable

out-of-pocket expenses incurred in connection with the administration of the Royalty Trust. The Trustee’s compensation is paid

out of the Royalty Trust’s assets. The Trustee has a lien on the Royalty Trust’s assets to secure payment of its compensation

and any indemnification expenses and other amounts to which it is entitled under the royalty trust agreement.

4.

DISTRIBUTIONS

Natural

gas sales volumes (measured in thousands of cubic feet, or Mcf), average sales price and net cash proceeds available for distribution

for the three-month periods ended March 31, 2024 and 2023, are set forth in the table below.

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Natural gas sales volumes (Mcf) | |

| - | | |

| 87,121 | |

| Natural gas average sales price (per Mcf) | |

$ | - | | |

$ | 4.98 | |

| Gross proceeds | |

| - | | |

| 434,239 | |

| Post-production costs and specified taxes | |

| - | | |

| (47,292 | ) |

| Royalty income | |

| - | | |

| 386,947 | |

| Interest and dividend income | |

| 1,340 | | |

| 8,810 | |

| Administrative expenses | |

| (421,723 | ) | |

| (189,676 | ) |

| Income in excess of administrative expenses (administrative expenses in excess of income) | |

| (420,383 | ) | |

| 206,081 | |

| Income available for distribution | |

| - | | |

| 206,081 | |

| Adjustment to minimum cash reserve | |

| - | | |

| (8,750 | ) |

| Net cash proceeds available for distribution | |

$ | - | | |

$ | 197,331 | |

A

summary of quarterly per unit distributions for the three-month periods ended March 31, 2024 and 2023, is set forth in the table below.

| 2024 | |

2023 |

| Amount | | |

Per Unit

Amount | | |

Record

Date | |

Payment

Date | |

Amount | | |

Per Unit

Amount | | |

Record

Date | |

Payment

Date |

| $ | - | | |

$ | - | | |

4/30/2024 | |

N/A | |

$ | 197,331 | | |

$ | 0.000857 | | |

4/28/2023 | |

5/12/2023 |

These

distributions are not necessarily indicative of future distributions.

5.

CONTINGENCIES AND OTHER COMMITMENTS

Litigation.

There are currently no pending legal proceedings to which the Royalty Trust is a party.

6.

SUBSEQUENT EVENTS

The

Royalty Trust evaluated all other events subsequent to March 31, 2024, and through the date the Royalty Trust’s financial statements

were issued, and determined that all events or transactions occurring during this period requiring recognition or disclosure were appropriately

addressed in these financial statements.

Item

2. Trustee’s Discussion and Analysis of Financial Condition and Results of Operations.

OVERVIEW

You

should read the following discussion in conjunction with the financial statements of Gulf Coast Ultra Deep Royalty Trust (the Royalty

Trust) and the related Trustee’s Discussion and Analysis of Financial Condition and Results of Operations and the discussion of

its Business and Properties in the Royalty Trust’s Annual Report on Form 10-K for the year ended December 31, 2023 (2023 Form 10-K),

filed with the United States (U.S.) Securities and Exchange Commission (SEC). The results of operations reported and summarized below

are not necessarily indicative of future operating results. Unless otherwise specified, all references to “Notes” refer to

the Notes to Financial Statements located in Part I, Item 1. “Financial Statements” of this Form 10-Q. Also see the 2023

Form 10-K for a glossary of definitions for some of the oil and gas industry terms used in this Form 10-Q. Additionally, please refer

to the section entitled “Cautionary Statement” on page 13 of this Form 10-Q. The information below has been furnished

to the Trustee by Highlander Oil & Gas Assets LLC (HOGA).

Business

Overview

On

June 3, 2013, Freeport-McMoRan Inc. (FCX) and McMoRan Exploration Co. (MMR) completed the transactions contemplated by the Agreement

and Plan of Merger, dated as of December 5, 2012 (the merger agreement), by and among MMR, FCX, and INAVN Corp., a Delaware corporation

and indirect wholly owned subsidiary of FCX (Merger Sub). Pursuant to the merger agreement, Merger Sub merged with and into MMR, with

MMR surviving the merger as an indirect wholly owned subsidiary of FCX (the merger).

FCX’s

oil and gas assets are held through its wholly owned subsidiary, FCX Oil & Gas LLC (FM O&G). As a result of the merger, MMR and

McMoRan Oil & Gas LLC (McMoRan) are both indirect wholly owned subsidiaries of FM O&G.

The

Royalty Trust is a statutory trust created as contemplated by the merger agreement by FCX under the Delaware Statutory Trust Act pursuant

to a trust agreement entered into on December 18, 2012 (inception), by and among FCX, as depositor, Wilmington Trust, National Association,

as Delaware trustee, and certain officers of FCX, as regular trustees. On May 29, 2013, Wilmington Trust, National Association, was replaced

by BNY Trust of Delaware, as Delaware trustee (the Delaware Trustee), through an action of the depositor. Effective June 3, 2013, the

regular trustees were replaced by The Bank of New York Mellon Trust Company, N.A., a national banking association, as trustee (the Trustee).

The

Royalty Trust was created to hold a 5% gross overriding royalty interest (collectively, the overriding royalty interests) in future production

from specified Inboard Lower Tertiary/Cretaceous exploration prospects located in the shallow waters of the Gulf of Mexico and onshore

in South Louisiana that existed as of December 5, 2012, the date of the merger agreement (collectively, the subject interests). The subject

interests were “carved out” of the mineral interests that were acquired by FCX pursuant to the merger and were not considered

part of FCX’s purchase consideration of MMR. McMoRan has informed the Trustee that it has no plans to pursue, has relinquished,

has allowed to expire or has sold all of its subject interests.

In

connection with the merger, on June 3, 2013, (1) FCX, as depositor, McMoRan, as grantor, the Trustee and the Delaware Trustee entered

into the amended and restated royalty trust agreement to govern the Royalty Trust and the respective rights and obligations of FCX, the

Trustee, the Delaware Trustee, and the Royalty Trust unitholders with respect to the Royalty Trust (the royalty trust agreement); and

(2) McMoRan, as grantor, and the Royalty Trust, as grantee, entered into the master conveyance of overriding royalty interests (the master

conveyance) pursuant to which McMoRan conveyed to the Royalty Trust the overriding royalty interests in future production from the subject

interests. Other than (a) its formation, (b) its receipt of contributions and loans from FCX for administrative and other expenses as

provided for in the royalty trust agreement, (c) its payment of such administrative and other expenses, (d) its repayment of loans from

FCX, (e) its receipt of the conveyance of the overriding royalty interests from McMoRan pursuant to the master conveyance, (f) its receipt

of royalties from McMoRan and HOGA, and (g) its cash distributions to Royalty Trust unitholders, if any, the Royalty Trust has not conducted

any activities. The Trustee has no involvement with, control over, or responsibility for, any aspect of any operations on or relating

to the subject interests.

The

Trustee receives annual compensation of $200,000. Additionally, the Trustee receives reimbursement for its reasonable out-of-pocket expenses

incurred in connection with the administration of the Royalty Trust. The Trustee’s compensation is paid out of the Royalty Trust’s

assets. The Trustee has a lien on the Royalty Trust’s assets to secure payment of its compensation and any indemnification expenses

and other amounts to which it is entitled under the royalty trust agreement.

On

February 5, 2019, McMoRan completed the sale of all of its rights, title and interest in and to the onshore Highlander subject interest

pursuant to a purchase and sale agreement with HOGA (the Highlander Sale). The onshore Highlander subject interest was sold subject to

the overriding royalty interest in future production held by the Royalty Trust. As a result of the Highlander Sale, HOGA has a 72 percent

working interest and an approximate 48 percent net revenue interest in the onshore Highlander subject interest. The Royalty Trust continues

to hold a 3.6 percent overriding royalty interest in the onshore Highlander subject interest. HOGA is the operator of the onshore Highlander

subject interest. McMoRan has informed the Trustee that it has no plans to pursue, has relinquished, has allowed to expire or has sold

all of its subject interests.

In

connection with the Highlander Sale, McMoRan sold its interests in substantially all of its oil and gas leases associated with the Highlander

subject interest to HOGA. At March 31, 2024, HOGA owned interests in gas leases onshore in South Louisiana, covering approximately 9,000

gross acres associated with the onshore Highlander subject interest. Whether or not HOGA maintains the acreage associated with the onshore

Highlander subject interest is determined by HOGA’s current and future plans and other outside factors, over which the Royalty

Trust has no control. As of March 31, 2024, the onshore Highlander subject interest had no production, as HOGA had commenced operations

to permanently plug and abandon the well in early March 2024.

Status

of the Onshore Highlander Subject Interest

As

previously disclosed, the sole well producing from the onshore Highlander subject interest experienced an operational issue on January

19, 2023, resulting in substantial amounts of water entering the well, which caused a shut in of the well before production resumed at

significantly reduced levels. Following an evaluation by HOGA’s field operations team, HOGA determined that it would be necessary

to commence operations to control the water production, in expectation of eventually initiating “kill” operations on the

well. HOGA has informed the Trustee that the well was shut in effective March 31, 2023 and production from the well has ceased, with

the well having flowed intermittently but not on a continuous basis from that time. HOGA has informed the Trustee that due to the underground

flow of fluids into the wellbore, the well cannot be salvaged and must be plugged and abandoned. Abandoning the well eliminated any production

from the onshore Highlander subject interest, which also eliminated any proceeds to which the Royalty Trust would be entitled pursuant

to its overriding royalty interests. Unless a new well is drilled on the onshore Highlander subject interest,

the Royalty Trust does not expect to receive any income attributable to its overriding royalty interests and accordingly, does not expect

to have any cash available to distribute to Royalty Trust unitholders in future periods. HOGA has not informed the Trustee of any definitive

plans to drill a new well on the Highlander subject interest. Neither the Trustee nor the Royalty Trust unitholders has any right to control

or influence operations of the subject interest.

LIQUIDITY

AND CAPITAL RESOURCES

Pursuant

to the royalty trust agreement, FCX has agreed to pay annual trust expenses up to a maximum amount of $350,000, with no right of repayment

or interest due, to the extent the Royalty Trust lacks sufficient funds to pay administrative expenses. On February 1, 2024, pursuant

to this provision, FCX contributed approximately $166,000 for the payment of trust expenses incurred during the year ended December 31,

2023, and contributed the maximum of $350,000 for the payment of trust expenses incurred during the year ending December 31, 2024. In

addition to such annual contributions, FCX has agreed to lend money, on an unsecured, interest-free basis, to the Royalty Trust to fund

the Royalty Trust’s ordinary administrative expenses as set forth in the royalty trust agreement. All funds the Trustee borrows

to cover expenses or liabilities, whether from FCX or from any other source, must be repaid before the Royalty Trust unitholders will

receive any distributions. No loans or repayments were made during the quarters ending March 31, 2024 or December 31, 2023.

Pursuant

to the royalty trust agreement, FCX agreed to provide and maintain a $1.0 million stand-by reserve account or an equivalent letter of

credit for the benefit of the Royalty Trust to enable the Trustee to draw on such reserve account or letter of credit to pay obligations

of the Royalty Trust if its funds are inadequate to pay its obligations at any time. Currently, with the consent of the Trustee, FCX

may reduce the reserve account or substitute a letter of credit with a different face amount for the original letter of credit or any

substitute letter of credit. In connection with this arrangement, FCX provided $1.0 million to the Royalty Trust. The $1.0 million, plus

interest collected thereon, is reflected as reserve fund cash, with a corresponding reserve fund liability in the accompanying Statements

of Assets, Liabilities and Trust Corpus. On February 1, 2024, the Royalty Trust used $14,280 from the reserve account to pay administrative

expenses to the Trustee, which is included in the administrative expenses in the accompanying Statements of Distributable

Income. As of March 31, 2024, FCX had not requested a reduction of the reserve account.

In

connection with the completion of the Highlander Sale, HOGA assumed all administrative and reporting responsibilities with respect to

the Royalty Trust, including those described in Article III of the royalty trust agreement.

In

accordance with the terms of the master conveyance, royalties are paid to the Royalty Trust on the last day of the month following the

month in which production payments are received by HOGA. The Royalty Trust received royalties of $0 and $386,947 during the three-month

periods ended March 31, 2024 and 2023, respectively.

Royalties

received by the Royalty Trust must first be used to (i) satisfy Royalty Trust administrative expenses and (ii) reduce Royalty Trust indebtedness.

The Royalty Trust had no indebtedness outstanding as of March 31, 2024 and December 31, 2023.

Each

quarter, the Trustee will determine the amount of funds available for distribution to the Royalty Trust unitholders. Available funds

will equal the excess cash received by the Royalty Trust from the royalty interests and other sources during that quarter over the Royalty

Trust’s liabilities for that quarter. Available funds will be reduced by any cash the Trustee decides to hold as a reserve against

future liabilities. As of March 31, 2024, the Trustee has established a minimum cash reserve of $302,500. The minimum cash reserve is

not reflective of the Royalty Trust’s operating cash balance as of March 31, 2024 and December 31, 2023.

Commencing

with the distribution to unitholders in the first quarter of 2022, the Royalty Trust withheld $8,750 from the funds otherwise available

for distribution each quarter through the first quarter of 2023, with the intent of gradually building a cash reserve of approximately

$350,000. As no proceeds were available for distribution in the first quarter of 2024, the Royalty Trust did not withhold any funds for

the cash reserve. Unless another well is drilled on the onshore Highlander subject interest as discussion “Overview – Status

of the Onshore Highlander Subject Interest” above, the Royalty Trust does not intend to withhold funds for the cash reserve as

the Royalty Trust does not expect to have any cash available to distribute to unitholders in future periods. This cash is reserved for

the payment of future known, anticipated or contingent expenses or liabilities of the Royalty Trust. The Trustee may increase or decrease

the targeted cash reserve amount at any time, and may increase or decrease the rate at which it is withholding funds to build the cash

reserve at any time, without advance notice to the unitholders. Cash held in reserve will be invested as required by the royalty trust

agreement. Any cash reserved in excess of the amount necessary to pay or provide for the payment of future known, anticipated or contingent

expenses or liabilities eventually will be distributed to unitholders, together with interest earned on the funds.

Distributable

income totaled $0 and $197,331 during the three-month periods ended March 31, 2024 and 2023, respectively. These distributions are not

necessarily indicative of future distributions. As previously disclosed, the sole well producing from the onshore Highlander subject

interest experienced an operational issue on January 19, 2023, resulting in substantial amounts of water entering the well, which caused

a shut in of the well before production resumed at significantly reduced levels. Following an evaluation by HOGA’s field operations

team, HOGA determined that it would be necessary to commence operations to control the water production, in expectation of eventually

initiating “kill” operations on the well. HOGA informed the Trustee that the well was shut in effective March 31, 2023 and

production from the well has ceased with the well having flowed intermittently but not on a continuous basis from that time. In October

2023, HOGA informed the Trustee that due to the underground flow of fluids into the wellbore, the well cannot be salvaged and must be

plugged and abandoned. HOGA subsequently informed the Trustee that operations to permanently plug and abandon the well commenced in early

March 2024. The onshore Highlander subject interest is the only subject interest that has established commercial production. Abandoning

the well eliminated any production from the onshore Highlander subject interest, which also eliminated any proceeds to which the Royalty

Trust would be entitled pursuant to its overriding royalty interests during the same period. Unless another well is drilled on the onshore

Highlander subject interest, the Royalty Trust does not expect to receive any income attributable to its overriding royalty interests

and accordingly, does not expect to have any cash available to distribute to Royalty Trust unitholders in future periods. HOGA has not

informed the Trustee of any definitive plans to drill a new well on the Highlander subject interest. Neither the Trustee nor the Royalty

Trust unitholders has any right to control or influence operations of the subject interest.

The

Royalty Trust’s only other sources of liquidity are mandatory annual contributions, any loans and the required standby reserve

account or letter of credit from FCX. As a result, any material adverse change in FCX’s, McMoRan’s or HOGA’s financial

condition or results of operations could materially and adversely affect the Royalty Trust and the underlying royalty trust units.

OFF-BALANCE

SHEET ARRANGEMENTS

The

Royalty Trust has no off-balance sheet arrangements. The Royalty Trust has not guaranteed the debt of any other party, nor does the Royalty

Trust have any other arrangements or relationships with other entities that could potentially result in unconsolidated debt, losses or

contingent obligations.

RESULTS

OF OPERATIONS

Royalty

Income. In accordance with the terms of the master conveyance, during the three-month period ended March 31, 2024, the Royalty Trust

did not receive royalty income. During the three-month period ended March 31, 2023, the Royalty Trust received royalties of $386,947

related to 87,121 Mcf of natural gas production attributable to the onshore Highlander subject interest with average post-production

costs of $0.54 per Mcf and an average sales price of $4.98 per Mcf.

Administrative

Expenses. Administrative expenses consist primarily of audit, legal and trustee expenses incurred in connection with the administration

of the Royalty Trust. During the three-month periods ended March 31, 2024 and 2023, the Royalty Trust paid administrative expenses of

$421,723 and $189,676, respectively. Administrative expenses were higher for the three-month period ended March 31, 2024, as compared

to the corresponding period in 2023, primarily due to the Trust’s payment of fourth quarter 2023 administrative expenses in the

first quarter of 2024.

NEW

ACCOUNTING STANDARDS

None.

CAUTIONARY

STATEMENT

This

Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Forward-looking statements are all statements

other than statements of historical facts, such as any statements regarding the future financial condition of the Royalty Trust or the

trading market for the royalty trust units, all statements regarding the respective plans of McMoRan or HOGA for the subject interests,

the potential results of any drilling on the subject interests by the applicable operator, anticipated interests of McMoRan or HOGA and

the Royalty Trust in any of the subject interests, HOGA’s geologic models and the nature of the geologic trend onshore in South

Louisiana discussed in this Form 10-Q, the amount and date of quarterly distributions to Royalty Trust unitholders, expectations regarding

any drilling of another well on the Highlander subject interest, and statements regarding the Royalty Trust’s future income from

the overriding royalty interests and future distributions to Royalty Trust unitholders and all statements regarding any belief or understanding

of the nature or potential of the subject interests. The words “anticipates,” “may,” “can,” “plans,”

“believes,” “estimates,” “expects,” “projects,” “intends,” “likely,”

“will,” “should,” “to be,” “potential,” and any similar expressions and/or statements

that are not historical facts are intended to identify those assertions as forward-looking statements.

Forward-looking

statements are not guarantees or assurances of future performance and actual results may differ materially from those anticipated, projected

or assumed in the forward-looking statements. Important factors that may cause actual results to differ materially from those anticipated

by the forward-looking statements include, but are not limited to, the future plans of FCX and HOGA for their remaining oil and gas properties;

the risk that the subject interests will not produce additional hydrocarbons; general economic and business conditions; variations in

the market demand for, and prices of, oil and natural gas; drilling results; changes in oil and natural gas reserve expectations; the

potential adoption of new governmental regulations; decisions by FCX, McMoRan or HOGA not to develop and/or transfer the subject interests;

any inability of FCX, McMoRan or HOGA to develop the subject interests; damages to facilities resulting from natural disasters or accidents;

fluctuations in the market price, volume and frequency of the trading market for the royalty trust units; the amount of cash received

or expected to be received by the Trustee from the underlying subject interests on or prior to a record date for a quarterly cash distributions;

the cost and timing of drilling a new well on the Highlander subject interest; and other factors described in Part I, Item 1A. “Risk

Factors” in the 2023 Form 10-K, as updated by the Royalty Trust’s subsequent filings with the SEC. Any differences in actual

cash receipts by the Royalty Trust could affect the amount of quarterly cash distributions.

Investors

are cautioned that current production rates may not be indicative of future production rates or of the amounts of hydrocarbons that a

well may produce, and that many of the assumptions upon which forward-looking statements are based are likely to change after such forward-looking

statements are made, which the Royalty Trust cannot control. The Royalty Trust cautions investors that it does not intend to update its

forward-looking statements, notwithstanding any changes in assumptions, changes in business plans, actual experience, or other changes,

and the Royalty Trust undertakes no obligation to update any forward-looking statements except as required by law.

Item

3. Quantitative and Qualitative Disclosures About Market Risk.

As

a smaller reporting company, the Royalty Trust is not required to provide the information required by this Item.

Item

4. Controls and Procedures.

(a)

Evaluation of disclosure controls and procedures. The Royalty Trust has no employees, and, therefore, does not have a principal

executive officer or principal financial officer. Accordingly, the Trustee is responsible for making the evaluations, assessments and

conclusions required pursuant to this Item 4. The Trustee has evaluated the effectiveness of the Royalty Trust’s “disclosure

controls and procedures” (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered

by this Form 10-Q. Based on this evaluation, the Trustee has concluded that the Royalty Trust’s disclosure controls and procedures

are effective as of the end of the period covered by this Form 10-Q.

Due

to the nature of the Royalty Trust as a passive entity and in light of the contractual arrangements pursuant to which the Royalty Trust

was created, including the provisions of (i) the amended and restated royalty trust agreement and (ii) the master conveyance, the Royalty

Trust’s disclosure controls and procedures necessarily rely on (A) information provided by FCX or HOGA, including information relating

to results of operations, the costs and revenues attributable to the subject interests and other operating and historical data, plans

for future operating and capital expenditures, reserve information, information relating to projected production, and other information

relating to the status and results of operations of the subject interests and the overriding royalty interests, and (B) conclusions and

reports regarding reserves by the Royalty Trust’s independent reserve engineers.

(b)

Changes in internal control over financial reporting. During the quarter ended March 31, 2024, there has been no change in the

Royalty Trust’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect,

the Royalty Trust’s internal control over financial reporting. The Trustee notes for purposes of clarification that it has no authority

over, and makes no statement concerning, the internal control over financial reporting of FCX or HOGA.

PART

II. OTHER INFORMATION

Item

1. Legal Proceedings.

There

are currently no pending legal proceedings to which the Royalty Trust is a party.

Item

1A. Risk Factors.

Please

refer to Part I, Item 1A. “Risk Factors” in the 2023 Form 10-K. Any of these factors could result in a significant or material

adverse effect on the Royalty Trust’s results of operations or financial condition. There have been no material changes to the

Royalty Trust’s risk factors since the 2023 Form 10-K.

Item

5. Other Information.

Rule

10b5-1 Trading Plans. During the three months ended March 31, 2024, no officer or employee of the Trustee who performs policy-making

functions for the Royalty Trust adopted, modified, or terminated any Rule 10b5-1 trading arrangement or non-Rule 10b5-1 trading arrangement,

as such terms are defined in Item 408(a) of Regulation S-K, with respect to the Royalty Trust units.

Item

6. Exhibits.

The

following exhibits are filed or furnished as part of this quarterly report on Form 10-Q:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

Gulf

Coast Ultra Deep Royalty Trust |

| |

|

|

| |

By: |

The

Bank of New York Mellon |

| |

|

Trust

Company, N.A., as Trustee |

| |

|

|

| |

By: |

/s/

Sarah C. Newell |

| |

|

Sarah

C. Newell |

| |

|

Vice

President |

| |

|

|

| Date:

May 13, 2024 |

|

|

The

Registrant, Gulf Coast Ultra Deep Royalty Trust, has no principal executive officer, principal financial officer, controller or chief

accounting officer, board of directors or persons performing similar functions. Accordingly, no additional signatures are available and

none have been provided. In signing the report above, the Trustee does not imply that it has performed any such function or that any

such function exists pursuant to the terms of the amended and restated royalty trust agreement, dated June 3, 2013, under which it serves.

Exhibit

31

Certification

I,

Sarah C. Newell, certify that:

| 1. | I

have reviewed this quarterly report on Form 10-Q of Gulf Coast Ultra Deep Royalty Trust,

for which The Bank of New York Mellon Trust Company, N.A. acts as Trustee; |

| 2. | Based

on my knowledge, this report does not contain any untrue statement of a material fact or

omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered

by this report; |

| 3. | Based

on my knowledge, the financial statements, and other financial information included in this

report, fairly present in all material respects the financial condition, distributable income

and changes in trust corpus of the registrant as of, and for, the periods presented in this

report; |

| 4. | I

am responsible for establishing and maintaining disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)), or for causing such controls

and procedures to be established and maintained for the registrant, and have: |

| (a) | Designed

such disclosure controls and procedures, or caused such disclosure controls and procedures

to be designed under my supervision, to ensure that material information relating to the

registrant, including its consolidated subsidiaries, is made known to me by others within

those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed

such internal control over financial reporting, or caused such internal control over financial

reporting to be designed under my supervision, to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with the basis of accounting described in Note 1 to the financial

statements; |

| (c) | Evaluated

the effectiveness of the registrant’s disclosure controls and procedures and presented

in this report my conclusions about the effectiveness of the disclosure controls and procedures,

as of the end of the period covered by this report based on such evaluation; and |

| (d) | Disclosed

in this report any change in the registrant’s internal control over financial reporting

that occurred during the registrant’s most recent fiscal quarter (the registrant’s

fourth fiscal quarter in the case of an annual report) that has materially affected, or is

reasonably likely to materially affect, the registrant’s internal control over financial

reporting; and |

| 5. | I

have disclosed, based on my most recent evaluation of internal control over financial reporting,

to the registrant’s auditors: |

| (a) | All

significant deficiencies and material weaknesses in the design or operation of internal control

over financial reporting which are reasonably likely to adversely affect the registrant’s

ability to record, process, summarize and report financial information; and |

| (b) | Any

fraud, whether or not material, that involves any persons who have a significant role in

the registrant’s internal control over financial reporting. |

In

giving the foregoing certifications in paragraphs 4 and 5, I have relied to the extent I consider reasonable on information provided

to me by Highlander Oil & Gas Assets LLC.

Date:

May 13, 2024

| |

/s/

Sarah C. Newell |

| |

Sarah

C. Newell |

| |

Vice

President |

| |

The

Bank of New York Mellon Trust Company, |

| |

N.A.,

as Trustee of Gulf Coast Ultra Deep Royalty Trust |

Exhibit

32

Certification

Pursuant to 18 U.S.C. Section 1350

(Adopted

Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002)

Securities

and Exchange Commission

100

F Street, N.E.

Washington,

D.C. 20549

In

connection with the Quarterly Report on Form 10-Q of Gulf Coast Ultra Deep Royalty Trust (the “Trust”) for the quarter ended

March 31, 2024, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned,

not in its individual capacity but solely as the trustee of the Trust, hereby certifies, pursuant to 18 U.S.C. §1350, as adopted

pursuant to §906 of the Sarbanes-Oxley Act of 2002, that, to the best of its knowledge:

(1)

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2)

The information contained in the Report fairly presents, in all material respects, the financial condition, distributable income and

changes in trust corpus of the Trust.

| Date:

May 13, 2024 |

|

| |

|

| |

/s/

Sarah C. Newell |

| |

Sarah

C. Newell |

| |

Vice

President |

| |

The

Bank of New York Mellon Trust Company, N.A., as Trustee of Gulf Coast Ultra Deep Royalty Trust |

The

above certification is furnished solely pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) and is not being filed

as part of the Form 10-Q or as a separate disclosure document.

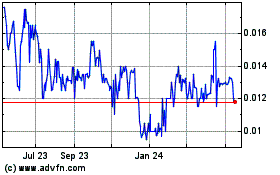

Gulf Coast Ultra Deep Ro... (PK) (USOTC:GULTU)

Historical Stock Chart

From Dec 2024 to Jan 2025

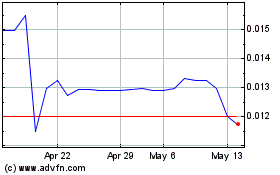

Gulf Coast Ultra Deep Ro... (PK) (USOTC:GULTU)

Historical Stock Chart

From Jan 2024 to Jan 2025