UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by a

Party other than the Registrant

¨

Check the

appropriate box:

|

|

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

x

|

|

Definitive Proxy Statement

|

|

|

|

|

¨

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material under Rule 14a-12

|

|

|

PIONEER BANKSHARES, INC.

|

|

(Name of registrant as specified in its charter)

|

|

|

|

|

|

(Name of person(s) filing proxy statement, if other than the registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

April 12, 2012

Dear Fellow Stockholders:

We invite you to attend the 2012 Annual Meeting of Stockholders of

Pioneer Bankshares, Inc. to be held in the Meeting Room of Pioneer Bank, 252 East Main Street, Stanley, Virginia, at 10:00 a.m. on Wednesday, May 16, 2012. A formal notice of the meeting is enclosed.

At the meeting, we will elect three directors, each to serve a three-year term. Whether you plan to attend or not, please complete, sign, date and return

your proxy in the enclosed postage-paid envelope.

Your vote is important, and the prompt return of your proxy is appreciated

.

We also

cordially invite you to attend the Annual Social Gathering of the Stockholders, Directors and Officers of Pioneer Bankshares, Inc. to be held at the Stanley Fire Hall, Stanley, Virginia, at 6:30 p.m. on Wednesday, May 16, 2012, for an evening

of fine food and good fellowship.

I look forward to seeing you on the 16th of May.

|

|

|

/s/ Thomas R. Rosazza

|

|

Thomas R. Rosazza

President

and Chief Executive Officer

|

PIONEER BANKSHARES, INC.

(Parent Company of Pioneer Bank)

263 East Main Street

Stanley, Virginia 22851

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

(To be held May 16, 2012)

To the Stockholders of

Pioneer Bankshares, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Pioneer Bankshares, Inc. (the “Company”) will be held at the

Main Office of Pioneer Bank, 252 East Main Street, Stanley, Virginia, at 10:00 a.m. on Wednesday, May 16, 2012, for the following purposes:

|

|

1.

|

To elect three (3) individuals to serve as directors, each to serve a three-year term.

|

|

|

2.

|

To transact such other business as may properly come before the meeting or any adjournment thereof.

|

The close of business on April 4, 2012 has been fixed by the Board of Directors as the record date for determination of stockholders

entitled to notice of, and to vote at the Annual Meeting, and any adjournment thereof.

|

|

|

By Order of the Board of Directors

|

|

|

|

/s/ Thomas R. Rosazza

|

|

Thomas R. Rosazza

President and Chief Executive Officer

|

April 12, 2012

PLEASE COMPLETE, SIGN, DATE AND RETURN YOUR PROXY AS SOON AS POSSIBLE REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE MEETING IN PERSON. YOU MAY REVOKE THE PROXY AT ANY TIME PRIOR TO IT BEING EXERCISED.

PIONEER BANKSHARES, INC.

263 East Main Street

Stanley, Virginia 22851

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 16, 2012

GENERAL

The Board of Directors and Management of Pioneer Bankshares, Inc. (the “Company”) solicit your proxy for the Annual Meeting of

Stockholders of Pioneer Bankshares, Inc., the parent of Pioneer Bank, Stanley, Virginia (the “Bank”), to be held at the main office of Pioneer Bank, 252 East Main Street, Stanley, Virginia, at 10:00 a.m. on Wednesday, May 16, 2012.

The approximate mailing date of this Proxy Statement and the accompanying proxy form is April 12, 2012.

Revocation and Voting of

Proxies

Execution of a proxy will not affect a stockholder’s right to attend the Annual Meeting and to vote in

person. Any stockholder who has executed and returned a proxy may revoke it by attending the Annual Meeting and requesting to vote in person. A stockholder may also revoke his proxy at any time before it is exercised by filing a written notice with

the Company or by submitting a proxy bearing a later date. Proxies will extend to, and will be voted at, any adjourned session of the Annual Meeting.

Voting Rights and Solicitation

Only stockholders of record at the close of

business on April 4, 2012 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. As of the close of business on April 4, 2012, there were 1,041,373 shares of the Company’s common stock outstanding and

entitled to vote at the Annual Meeting. The Company has no other class of stock outstanding. A majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum for the transaction of business.

Each share of common stock entitles the record holder thereof to one vote upon each matter to be voted upon at the Annual Meeting. Shares

for which the holder has elected to abstain or to withhold the proxies’ authority to vote on a matter will count toward a quorum but will not be included in determining the number of votes cast with respect to such matter. Shares held by

brokers or other custodians in street name (“broker shares”) that are voted on any matter are included in the quorum. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

Recent regulatory changes determining that director elections are no longer “routine” matters now prevent brokers

from voting uninstructed shares in director elections. If you hold shares in “street name” through a broker or other custodian, please instruct your broker how to vote your shares in connection with the election of directors so that your

shares will be voted.

The cost of solicitation of proxies will be borne by the Company. Solicitation is being made in person,

by telephone, fax, e-mail, or special letter by officers, directors, and employees of the Company, acting without additional compensation other than regular compensation.

Your Board of Directors and management urge you to complete, sign, date and mail your proxy to make certain that your shares will be voted at the meeting.

PROPOSAL ONE — ELECTION OF DIRECTORS

The Board of Directors currently consists of nine members, eight of which are independent directors, as defined under NASDAQ listing

standards, and one is a member of management. In accordance with the Company’s Articles of Incorporation, directors are divided into three classes, each of which is composed of approximately one-third of the total number of directors. At the

Annual Meeting, three directors will be elected for a term of three years expiring on the date of the Annual Meeting of Stockholders in 2015. Each director elected will continue in office until a successor has been elected or until his resignation

or removal in the manner prescribed by the Articles of Incorporation of the Company.

With regard to the election of

directors, votes may be cast in favor of or withheld. If a quorum is present, the nominees receiving a plurality of the votes cast at the Annual Meeting will be elected directors. Although abstentions and votes withheld are counted for purposes of

determining the presence or absence of a quorum for the transaction of business, they are not counted for purposes of determining whether a proposal has been approved and, therefore, have no effect. Broker non-votes will not be counted as votes cast

on the proposal and will have no effect on the election of directors.

The Board of Directors has recommended three nominees,

each of which is currently serving as a director. Any nominations other than those made by the Board of Directors shall be in accordance with the Bylaws of the Company. The Board of Directors has no reason to believe that any of the nominees will be

unable or unwilling for good cause to serve if elected. However, if any nominee should become unable or unwilling for good cause to serve for any reason, proxies may be voted for another person nominated as a substitute by the Board of Directors, or

the Board of Directors may reduce the number of directors.

|

|

|

|

|

|

|

Name (Age)

|

|

Director Since

(1)

|

|

Principal Occupation

During Past Five Years

|

|

Nominees (For a Term Expiring in 2015):

|

|

Patricia G. Baker (69)

|

|

1989

|

|

Retired Bank Officer.

|

|

Robert E. Long (81)

|

|

1989

|

|

Retired Merchant/Realtor.

|

|

Kyle L. Miller (77)

|

|

1986

|

|

Retired Virginia State Police Investigator.

|

|

Other Directors Not Standing For

Election At This Time:

|

|

|

|

Term expiring in 2013:

|

|

|

|

|

|

Harry F. Louderback (71)

|

|

1998

|

|

Retired from the FBI / Farmer

|

|

Thomas R. Rosazza (70)

|

|

1973

|

|

President/CEO, Pioneer Bankshares, Inc. and Pioneer Bank.

|

|

David N. Slye (59)

|

|

1996

|

|

Insurance Agent/Owner, The Slye Agency.

|

|

Term expiring in 2014:

|

|

|

|

E. Powell Markowitz (60)

|

|

1999

|

|

Chief Financial Officer, F.T. Reuter Enterprises, Inc.

|

|

James F. Printz (68)

|

|

2011

|

|

Retired Insurance Agent / Allstate Insurance Agency

|

|

Mark N. Reed (54)

|

|

1994

|

|

Attorney at Law, Reed & Reed, P.C.;

|

|

|

|

|

|

Board Chair, Pioneer Bankshares, Inc / Pioneer Bank

|

|

(1)

|

Includes service as a director of the Bank.

|

THE BOARD OF DIRECTORS RECOMMENDS THE NOMINEES, AS SET FORTH ABOVE, FOR ELECTION. THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “

FOR

” EACH NOMINEE.

2

Director Qualifications and Experience

(Directors with terms expiring in 2015)

Patricia G. Baker

has

served as a director of the Company and Bank since 1989. She is a retired Bank officer and brings to the Board more than 49 years of banking experience, with knowledge and skills in the areas of branch operations, lending, and executive management.

Mrs. Baker is a graduate of the Virginia Banker’s School of Bank Management at the University of Virginia. Mrs. Baker also brings to the Board strong leadership abilities, as she is actively involved in local community organizations.

She has served on the Boards of the Page County Chamber of Commerce, Page County Council on Domestic Violence, and Page County United Way.

Robert E. Long

has served as a director of the Company and Bank since 1989. He is a retired merchant and is also a licensed realtor. He brings to the Board more than 21 years of

entrepreneurial business management experience, as well as more than 20 years of real estate experience. Mr. Long provides expertise and valuable knowledge relating to the local real estate market and appropriate property valuations, which

enables him to greatly contribute to the credit risk management practices of the institution.

Kyle L. Miller

has served as a director of the Company and Bank since 1986. He is a retired Virginia State Police Investigator and Special Agent. He previously served as an Assistant Special Agent In-Charge of the Bureau of Criminal Investigation Field Office in

Culpeper, Virginia. Mr. Miller has over 17 years of experience investigating a variety of white collar crimes and performing other investigative duties. During his service with the Virginia State Police, Mr. Miller attended numerous

schools and educational programs with specialized training in fraud and embezzlement prevention. Therefore, he brings to the Board his expertise, knowledge and skills in these areas, which enables him to contribute to the consumer protection and

risk management practices of the institution. Additionally, Mr. Miller has owned and operated various local business establishments and manages a farming operation. His farm management experience also enables him to bring additional expertise

when dealing with agricultural production and farm loan requests.

(Directors with terms expiring in 2013)

Harry F. Louderback

has served as a director of the Company and Bank since 1998. He is retired from the FBI and brings to

the Board more than 35 years of experience in telecommunications and system security administration. He currently owns three farming operations, which enables him to bring additional expertise when dealing with agricultural production and farm loan

requests. Mr. Louderback is a graduate of Dunsmore Business College and also attended the Columbia Technical Institute and Grantham School of Electronics. Mr. Louderback also brings leadership abilities, as he is actively involved in the

local community. He serves on the Page County Water Board, is a member of the Page County Broadband Authority and the Page County Farmer’s Association.

Thomas R. Rosazza

has served as a director of the Company and Bank since 1973. He is retired from the Page County School Board and brings to the Company more than 32 years of management and

administrative experience. Additionally, Mr. Rosazza brings valuable insight and knowledge to the Board due to his service as a bank director for 39 years and his service as the President and Chief Executive Officer of the Company and its

subsidiaries for the past 13 years. Mr. Rosazza holds a bachelor’s degree in Economics and Business Administration from Bridgewater College and a master’s degree in Education from the University of Virginia. He is also a graduate of

the Virginia Banker’s School of Bank Management at the University of Virginia. He has previously served as President of the Page Memorial Hospital Association and currently serves on the Board of Visitors for Lord Fairfax Community College,

which have added to his ability to contribute in a leadership capacity. Mr. Rosazza also serves as treasurer for a local non-profit organization.

David N. Slye

has served as a director of the Company and Bank since 1996. He is the owner of the Slye Agency, an independent insurance agency in Luray, Virginia. He brings to the Board more

than 32 years of experience in insurance coverage, sales, service and claims. He holds a designation in the Life Underwriter Training Council (LUTC) and Accredited Advisor in Insurance (AAI) from the Insurance Institute of America. Additionally,

Mr. Slye holds a bachelor’s degree in Business Administration from Elon University. Mr. Slye brings additional leadership abilities, as he is actively involved in the local community and serves on the Luray Downtown Initiative, which

oversees grant funding for various community renovation projects.

3

(Directors with terms expiring in 2014)

E. Powell Markowitz

has served as a director of the Company and Bank since 1999. Mr. Markowitz brings to the Board over

33 years of business and financial management experience. He is the Chief Financial Officer for F. T. Reuter Enterprises, Inc., which operates a hotel and restaurant in Middleburg, Virginia, and trades worldwide, in antique fine art.

Mr. Markowitz was previously with the accounting firm of Yount, Hyde, & Company, as a staff accountant. His financial management knowledge and expertise is specifically advantageous in his role as the chair of the Company’s Audit

Committee. He holds a bachelor’s degree in Business Administration from James Madison College, in Harrisonburg, Virginia.

James F. Printz

was appointed by the Board of Directors of Pioneer Bankshares, Inc. and its subsidiary Pioneer Bank on

February 10, 2011 to fill the directorship vacancy resulting from the recent retirement of former board member Louis L. Bosley. Mr. Printz is a previous owner of the Allstate Insurance Agency in Luray, Virginia, from which he recently

retired. He brings to the board more than 39 years of business management and entrepreneurial experience within the bank’s service area, as well as an intricate knowledge of local economic issues. He holds a bachelor’s degree in Business

Administration from Bridgewater College, as well as various insurance underwriting certifications and designations.

Mark N. Reed

has served as a director of the Company and Bank since 1994. Mr. Reed is an attorney, owner and partner

in the law firm of Reed & Reed, P.C. in Luray, Virginia, where he specializes in real estate law, business law, as well as personal wills and estate law. He also serves as the attorney for the Page County School Board and the Page County

Economic Development Authority. Mr. Reed has over 28 years of experience practicing law and brings to the Board valuable legal expertise, as well as business management and investment knowledge. Mr. Reed currently serves as the board chair

and is the designated legal counsel for both the Company and the Bank. Additionally, Mr. Reed’s strong legal and business background enables him to bring expertise relating to regulatory requirements, strategic planning and future business

development initiatives. Mr. Reed holds a bachelor’s degree in Economics and History and a Juris Doctorate degree in Law from the College of William & Mary.

Board and Committee Information

Each director is expected to devote

sufficient time, energy and attention to ensure diligent performance of the director’s duties, including the attendance at Board and committee meetings. During 2011, the Board of Directors of the Company held 7 meetings and the Board of

Directors of the Bank held 12 meetings. All incumbent directors attended at least 75% of the aggregate total number of meetings of the Board of Directors and its committees on which he or she served in 2011. Directors are encouraged to attend

stockholders meetings, and all directors attended the 2011 Annual Meeting of Stockholders.

There are no immediate family

relationships among any of the directors or among any directors and any officer. No director serves as a director of any other company with a class of securities registered under Section 12 of the Securities Exchange Act of 1934.

The Company’s committee structure is as follows:

Compensation Committee

. The Compensation Committee consists of Robert E. Long, Kyle. L. Miller, Harry F. Louderback, and James. F. Printz. The members of the Compensation Committee meet the

requirements for independence as set forth in NASDAQ’s definition of “independent director,” and meet the definition of “independent” as set forth in Rule 10A-3 of the Securities Exchange Act of 1934. The primary functions

of this committee are to recommend the compensation of the Chief Executive Officer and the Chief Financial Officer to the full Board of Directors, and periodically review the compensation of other employees of the Company. This committee has a

formal charter, which outlines the committee’s specific duties and responsibilities and is available upon request to the Company’s corporate secretary as noted under the Corporate Governance section of this Proxy Statement. This charter

can also be obtained electronically through the Company’s proxy disclosure website at

http://www.cfpproxy.com/4609.

The Compensation Committee met 2 times during 2011.

4

Audit Committee

. The Audit Committee consists of E. Powell Markowitz, Harry F.

Louderback, and James F. Printz. The members of the Audit Committee meet the requirements for independence as set forth in NASDAQ’s definition of “independent director,” and meet the definition of “independent” as set forth

in Rule 10A-3 of the Securities Exchange Act of 1934. In addition, no member of the committee has participated in the preparation of the financial statements of the Company or any subsidiary of the Company at any time during the past three years.

Mr. Markowitz chairs the Audit Committee. For the past 33 years, Mr. Markowitz has served as the Chief Financial

Officer of F. T. Reuter Enterprises, Inc., which operates a hotel and restaurant in Middleburg, Virginia, and trades worldwide, in antique fine art. Prior to becoming affiliated with F. T. Reuter Enterprises, Inc., Mr. Markowitz was a staff

accountant for five years with Yount, Hyde & Company, certified public accountants. Mr. Markowitz earned a Bachelor of Business Administration from James Madison College, in Harrisonburg, Virginia in 1974 and brings a diversity of

financial knowledge and expertise to the Audit Committee. Mr. Markowitz was duly re-appointed as chairman of the Audit Committee in 2011, and serves as the “financial expert” for the Audit Committee of Pioneer Bankshares, Inc.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the Company’s

independent accounting firm. Accordingly, the independent accounting firm reports directly to the Audit Committee of the Company. The Audit Committee is responsible for the selection of the Company’s independent accountants, approval of the

scope of the independent accountants’ audit, review of the reports of examination by the regulatory agencies, the independent accountants and the internal auditor, and for issuing its report to the Board of Directors of the Company. The Audit

Committee met 5 times during 2011.

The charter of the Audit Committee is available upon request to the Company’s

corporate secretary as noted under the Corporate Governance section of this Proxy Statement. This charter can also be obtained electronically through the Company’s proxy disclosure website at

http://www.cfpproxy.com/4609

.

Corporate Governance Committee

.

Directors serving on this committee are Mark N. Reed, Thomas R. Rosazza and David N. Slye.

This committee has a formal charter and meets as necessary outside the Board meetings to review corporate governance issues including, but not limited to, director service and assessment, nominations and continuing education. The Corporate

Governance Committee met once in 2011.

Strategic Planning Committee

. Directors serving on this committee are Patricia

G. Baker, E. Powell Markowitz, Mark N. Reed and Thomas R. Rosazza. This committee has a formal charter, which outlines its specific duties and responsibilities. The committee meets as necessary outside the Board meetings to review and establish the

long-term goals of the Company. The Strategic Planning Committee met 2 times in 2011.

Investment Committee

.

Directors serving on this committee are Patricia G. Baker, E. Powell Markowitz, Mark N. Reed and Thomas R. Rosazza. This committee has the primary responsibility of managing the Company’s equity securities and investment portfolios. This

committee met 3 times in 2011.

Other Committees

The Board of Directors of the Bank has, among others, the following additional committees:

Asset/Liability Funds Management Committee

. Directors serving on this committee are Patricia G. Baker, Robert E. Long, and Kyle L. Miller. This committee has the primary responsibility of managing

the Bank’s assets and liabilities, maintaining adequate liquidity and capital positions, and monitoring interest rate sensitivity within the loan and deposit portfolios. This committee met 4 times in 2011.

Electronic Data Processing/IT Steering Committee

.

Directors serving on this committee are James F. Printz, Harry F.

Louderback, and David N. Slye. This committee has the primary responsibility of monitoring the data processing functions of the Bank and making recommendations for system enhancements and computer upgrades. This committee met 4 times in 2011.

5

Corporate Governance

The Company’s Code of Ethics applies to all directors, officers and employees, including the Company’s principal executive officer and principal financial officer. A copy of the Code of Ethics,

as well as any committee charter, is available upon written request to Pioneer Bankshares, Inc., Attn: Judy L. Painter, Corporate Secretary, at 263 East Main Street, Stanley, Virginia 22851.

Nomination Procedures

The Company’s independent directors perform the

functions of a nominating committee based on recommendations from the Corporate Governance Committee. The Board believes it does not need a separate nominating committee because a majority of the directors are independent and stockholders are best

served by having such directors participate in the selection of Board nominees. In their capacity as the nominating committee, the independent members of the Board of Directors will accept for consideration stockholder nominations for directors if

made in writing in accordance with the Company’s Bylaws. The following is a summary of the stockholder nomination procedures as contained in the Company’s Bylaws and is qualified in its entirety by reference to the Bylaws.

The Company’s Bylaws state, in general, that for any nomination of a director to be properly brought before an annual meeting by a

stockholder, the stockholder must provide timely notice of the nomination in writing to the Secretary of the Company. For a notice to be considered timely, the Secretary of the Company must have received the notice no less than 60 days nor more than

90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person

that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, including such person’s written consent to

being named in the proxy statement as a nominee and to serving as a director if elected. The Chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

The Company’s Corporate Governance charter addresses and establishes certain procedures for director nominations and

recommendations. The Company does not have any specific minimum qualifications that must be met by a nominee and does not distinguish between nominees recommended by Board members or by stockholders. Qualifications for consideration as a director

nominee may vary according to the particular areas of expertise that may be desired in order to complement the qualifications that already exist among the Board. Among the factors that the directors consider when evaluating proposed nominees are

their independence, financial literacy, business experience, character, judgment and strategic vision. Other considerations would be their knowledge of issues affecting the business, their leadership experience and their time available for meetings

and consultation on Company matters. Although the Board of Directors has not established a formal written policy with regard to diversity, the Company generally strives to retain a diverse group of candidates who possess the background skills and

expertise to make a significant contribution to the Board, the Company and its stockholders.

The above procedures are in

addition to the procedures regarding inclusion of stockholder proposals in proxy materials set forth in “Stockholder Proposals” in this Proxy Statement.

Board Leadership Structure

The Board of Directors is committed to

maintaining an independent Board, and therefore the majority of the Board is comprised of outside independent directors. It is the Company’s current practice to separate the duties of the Board Chair and the Chief Executive Officer in an effort

to maintain good corporate governance practices and eliminate inherent conflicts of interest that could arise when the roles are combined.

6

Risk Management Oversight

The members of the Board of Directors take an active role as a whole and at various committee levels in the ongoing oversight of the risk management practices of the Company and Bank. The Board has

established a formal risk management policy and appointed a formal risk management committee, consisting of senior and executive officers, as well as other management personnel within the Bank. Additionally, Board members actively participate in

risk management functions of the organization through its appointed committee structure. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly

informed through committee reports about such risks. The Board, or a committee of the Board, also receives specific periodic reports from management on credit risk, liquidity risk, interest rate risk, capital risk, operational risk, strategic risk,

reputational risk, fraud risk, and other economic risks.

The Corporate Governance Committee manages risks that are deemed to

be associated with the independence of the Board of Directors and potential conflicts. The Compensation Committee is responsible for overseeing the management of risks relating to the Bank’s compensation practices and plans. The Company’s

financial and operational risks are managed through the Audit Committee, the Asset/Liability Committee, and the Investment Committee. The Audit Committee also oversees specific financial accounting and reporting risks, as well as internal control

risks. The Bank’s internal audit function and the independent registered public accounting firm report directly to the Audit Committee.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of Pioneer Bankshares,

Inc. has the responsibility, under delegated authority from the Board of Directors, for providing independent, objective oversight of the Company’s accounting functions and internal controls. The Audit Committee is elected by the Board of

Directors of the Company. All members are independent of management. In addition, the Audit Committee operates under a written charter adopted by the Board of Directors. While management has the primary responsibility for the quality and integrity

of the Company’s financial statements and reporting processes, the Audit Committee provides assistance to management in fulfilling this responsibility, as necessary. In fulfilling its oversight responsibilities, the Audit Committee reviewed the

audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 with management and the independent auditors, and discussed the quality and acceptability of the accounting principles,

the reasonableness of significant judgments, and the clarity of disclosure in the financial statements.

In addition, the

committee obtained from the independent auditors a formal written statement discussing any disclosed relationship or service which may impact the objectivity and independence of the independent auditors, as required by Independence Standards Board

Standard No. 1 “Independence Discussions with Audit Committees.” The committee also discussed with the independent auditors all communications required by Public Company Accounting Oversight Board Standard AU Section 380 and Rule

2-07 of Regulation S-X, as amended, and other professional and regulatory standards. The Audit Committee also monitored the internal audit functions of the Company including the independence and authority of its reporting obligation, the proposed

audit plan for the coming year, and the adequacy of management response to internal audit findings and recommendations.

In

reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2011

for filing with the Securities and Exchange Commission. The Company’s Audit Committee has approved the selection of the Company’s independent auditors.

Audit Committee

E. Powell Markowitz, Chair

Harry F. Louderback

James F. Printz

7

ACCOUNTING FIRM FEES

Yount, Hyde and Barbour, P.C. audited the financial statements included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2011. The following table presents aggregate fees paid or to be paid by the Company for professional services rendered by Yount, Hyde and Barbour, P.C. for the audit of the Company’s annual financial statements for

fiscal 2011 and 2010. This table also includes fees billed for audit-related services, tax services and all other services rendered by the audit firm during fiscal years 2011 and 2010.

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2011

|

|

|

Fiscal 2010

|

|

|

Audit Fees

|

|

$

|

65,850

|

|

|

$

|

63,960

|

|

|

Audit-related Fees

|

|

|

—

|

|

|

|

1,013

|

|

|

Tax Fees

|

|

|

4,500

|

|

|

|

5,015

|

|

|

All Other Fees

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

70,350

|

|

|

$

|

69,988

|

|

|

|

|

|

|

|

|

|

|

|

All non-audit services provided by the above named audit firm were approved by the Audit

Committee, which concluded that the provision of such services is compatible with maintaining the firms’ independence. The fees listed above as tax fees are for the preparation of the annual consolidated federal and state income tax returns.

The Audit Committee pre-approves all audit, audit related, and tax services on an annual basis, and in addition,

authorizes individual engagements that exceed pre-established thresholds. Any additional engagement that exceeds the pre-established thresholds must be reported by management at the Audit Committee meeting immediately following the initiation of

such an engagement.

DIRECTORS’ COMPENSATION

Non-employee director compensation is reviewed on an annual basis. Any adjustments made to non-employee director fees are based primarily

on information obtained through the Virginia Bankers Association Salary and Compensation Survey and other outside sources, which provide comparative data for director compensation with other similarly sized institutions across Virginia. Other

factors considered in determining non-employee director compensation are the time commitments involved and the individual risk exposure based on the size of the institution.

The Company’s 1998 Stock Incentive Plan (the “Plan”) was adopted by the Board of Directors on June 11, 1998 and approved by the shareholders on June 11, 1999. This ten year Plan

expired in June of 2008 with respect to the issuance of new option grants. However, grants previously issued under this Plan may still be exercised within the original terms. Options for 800 shares were exercised by non-employee directors and a

former director during 2011 at an exercise price of $12.75 per share.

A Director’s Deferred Compensation Plan was

established by the Company in August of 1987. All directors were given the option of deferring their fee compensation for a period of five years in return for a defined benefit payout beginning at age 65. Not all directors chose to participate in

this plan. The only participating director who received benefit payments during 2011 under this plan was President and Chief Executive Officer, Thomas R. Rosazza. There are no additional deferral options available to directors under this plan.

8

Non-employee directors of the Company received an annual retainer of $2,100 each for their

service in 2011, with the exception of James F. Printz, who received a prorated payment based on his length of service for 2011. The 2011 retainer was distributed to non-employee directors with two-thirds of the amount being paid in the form of a

stock award consisting of shares of the Company’s common stock. All directors, with the exception of James F. Printz, received 99 shares of the Company’s common stock. Mr. Printz received 90 shares of the Company’s common stock.

All shares were issued at a fair market value of $14.11 per share as of December 30, 2011. The remaining one-third of the 2011 retainer was paid as a cash amount of $703.11 to each non-employee director, with the exception of James F. Printz,

who received $655.10 in cash as a prorated portion in accordance with his length of service for 2011.

The non-employee

directors of Pioneer Bank received additional compensation during 2011 in the amount of $1,085 per month for their service as a Bank Board members, which was also distributed two-thirds in stock and one-third in cash. The stock awards for the 2011

director’s fees were distributed in two separate stock issuances, with the first being issued as of June 30, 2011 at a fair market value of $16.50 per share and the second issuance at December 30, 2011 at a fair market value of $14.11

per share. All directors, with the exception of James F. Printz, received 263 shares of common stock for the June 30, 2011 stock issuance. Mr. Printz received 219 shares of common stock for the June 30, 2011 stock issuance. All

directors received 307 shares of the Company’s common stock with the December 30, 2011 stock award. The remaining one-third of the 2011 director fees were paid in cash and were distributed in two separate payments on June 30, 2011 and

December 30, 2011. All directors, with the exception of James F. Printz, received $2,170.50 as their cash portion at June 30, 2011. Mr. Printz received $1,811.50 as his cash portion at June 30, 2011, based on the prorated portion

in accordance with his length of service for 2011. All directors received $2,178.23 in cash for the December 30, 2011 payment.

Directors also received $200 for each Board committee meeting they attended in 2011. Director E. Powell Markowitz served as the Chair of the Audit Committee during 2011 and received an additional $100 per

committee meeting for his service. Director Mark N. Reed served as Chair of the Board in 2011, for which he received chair fees in the amount of $800 per board meeting.

The following table presents the total compensation paid to non-employee directors for their service during 2011:

Director Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

(1)

|

|

Fees

Earned or

Paid

in Cash

(2

)

|

|

|

Stock

Awards

(2

)

|

|

|

Total

|

|

|

Patricia G. Baker

|

|

$

|

6,652

|

|

|

$

|

10,068

|

|

|

$

|

16,720

|

|

|

Robert E. Long

|

|

|

6,252

|

|

|

|

10,068

|

|

|

|

16,320

|

|

|

Harry F. Louderback

|

|

|

6,852

|

|

|

|

10,068

|

|

|

|

16,920

|

|

|

E. Powell Markowitz

|

|

|

7,052

|

|

|

|

10,068

|

|

|

|

17,120

|

|

|

Kyle L. Miller

|

|

|

6,052

|

|

|

|

10,068

|

|

|

|

16,120

|

|

|

James F. Printz

|

|

|

5,845

|

|

|

|

9,215

|

|

|

|

15,060

|

|

|

Mark N. Reed

|

|

|

14,652

|

|

|

|

10,068

|

|

|

|

24,720

|

|

|

David N. Slye

|

|

|

5,652

|

|

|

|

10,068

|

|

|

|

15,720

|

|

|

(1)

|

The Company’s President and CEO, Thomas R. Rosazza, is not included in this table as he is an executive officer of the Company and receives no compensation for

his services as a director. The President and CEO’s compensation is shown in the Summary Compensation Table included in this proxy statement.

|

|

(2)

|

Each Company director also serves on the Bank’s Board of Directors, therefore the amounts reported in this table reflect compensation for Board services paid by

the Company and the Bank.

|

9

EXECUTIVE COMPENSATION

No officer receives compensation from the Company. All compensation is paid directly through the Bank. The following table presents

compensation information for the President and Chief Executive Officer of the Company for the years indicated. No other executive officer of the Company earned over $100,000 in salary and bonus in 2011.

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

All Other

Compensation

(1)

|

|

|

Total

|

|

|

Thomas R. Rosazza

President and CEO

|

|

|

2011

|

|

|

$

|

181,556

|

|

|

$

|

13,500

|

|

|

$

|

3,600

|

|

|

$

|

198,656

|

|

|

|

|

2010

|

|

|

$

|

181,849

|

|

|

$

|

18,500

|

|

|

$

|

3,600

|

|

|

$

|

203,949

|

|

|

(1)

|

Represents employer contributions to the Bank’s 401(k) profit sharing plan for each year.

|

Executive Compensation Discussion

The Company’s executive compensation program is designed to (i) attract and retain key executives critical to the success of the Company; (ii) integrate performance and compensation with

the short and long-term strategic plans of the Company; (iii) reward performance with respect to achieving the Company’s goals; and (iv) align the interests of the executives with the long-term interests of the stockholders. The

compensation program of the Company for its executive officers is generally administered at the direction of the Compensation Committee and reviewed annually.

In determining executive compensation, the Compensation Committee reviews the elements of each executive officer’s compensation and considers both objective and subjective criteria. With respect to

the objective portion of the performance evaluation, the committee specifically considers certain financial performance measures of the Company which may include, but are not limited to, net income, return on equity, non-interest income, net

interest margin and efficiency ratio. Additionally, the Compensation Committee reviews the results of the Virginia Bankers Association compensation survey, and compares the Company’s executive compensation with other similarly sized banks

across Virginia. The committee also takes into account the performance of the Company’s stock and shareholders’ return. As to the subjective component, the Compensation Committee considers the executive’s level of responsibility and

performance, and the individual’s contribution in achieving the Company’s long-term mission.

The Compensation

Committee considers input from the President and Chief Executive Officer with respect to executive officers that report to him and makes appropriate recommendations to the Board of Directors. In determining the compensation of the President/Chief

Executive Officer, the Chief Financial Officer and other executive officers, the committee uses the same objective and subjective measures as previously discussed, and their subjective assessment of the particular officer’s contribution to the

overall success of the Company.

Employment Contracts and Termination and Change in Control Arrangements

No employment contracts or change in control agreements have been entered into by the Company with any of its officers and none are

contemplated at this time.

10

Stock Option Information

The Company’s 1998 Stock Incentive Plan, which expired in June of 2008, previously provided for the granting of stock options to executive officers and employees of the Company and its subsidiaries.

No stock options were granted to the President and Chief Executive Officer or any other executive officer under the Plan.

Benefit Plans

Equity Compensation Plan Information.

The Company’s 1998 Stock Incentive Plan was adopted by the Board of

Directors on June 11, 1998 and approved by the shareholders on June 11, 1999. The Plan expired in June of 2008 with respect to the issuance of new option grants. However, grants previously issued under the Plan may still be exercised

within the original terms. Generally, the Plan provided for the grants of incentive stock options and non-qualified stock options. The exercise price of an option could not be less than 100% of the fair market value of the common stock (or if

greater, the book value) on the date of the grant. The option terms applicable to each grant were determined at the grant date, but no option could be exercisable in any event, after ten years from its grant date. As of April 4, 2012, there

were 4,800 exercisable options outstanding for non-employee directors under the Plan.

401(k) Plan

. The Bank has a

401(k) Profit Sharing Plan covering employees who have completed six months of service and are at least 21 years of age. Employees may contribute compensation subject to certain limits based on federal tax laws. The Bank makes matching contributions

up to 3 percent of an employee’s annual compensation contributed to the Profit Sharing Plan. Additional amounts may be contributed, at the option of the Bank’s Board of Directors. Employer contributions vest to the employee at 100% after

six years of service. A year of vesting service is a plan year during which an employee is credited with at least 1,000 hours of service. For the years ended December 31, 2011, 2010 and 2009, total expense attributable to this 401(k) plan

amounted to approximately $47,000, $44,000 and $35,000, respectively.

Equity Awards.

The Board of Directors

adopted formal resolutions in February 2008, authorizing the granting of stock awards to certain Company and Bank employees and non-employee directors of the Company. With respect to the employees, awards are generally made in recognition of

employee performance and their contribution to the Company’s overall performance. The awards for directors are generally made in lieu of director and retainer fees. Stock awards paid to directors during 2011 are disclosed within the

Directors’ Compensation section of this Proxy Statement. There were no stock awards issued to executive officers or other employees during 2011.

INTEREST OF DIRECTORS AND OFFICERS IN CERTAIN TRANSACTIONS

Some of the

Company’s directors, executive officers, and members of their immediate families, and corporations, partnerships and other entities, of which such persons are officers, directors, partners, trustees, executors or beneficiaries, are customers of

the Bank. As of December 31, 2011, total borrowings for executive officers, directors, their immediate families, and affiliated companies and other entities were approximately $213,000. All loans and loan commitments to these individuals were

made in the ordinary course of business, upon substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons not related to the lender and did not involve more

than normal risk of collectability or present other unfavorable features. It is the policy of the Bank to provide loans to officers and employees who are not executive officers and to employees at more favorable rates than those prevailing at the

time for comparable transactions with other persons.

The law firm of Reed & Reed, P.C. serves as legal counsel to

the Company and the Bank. Director Mark N. Reed is a senior partner in this firm. Total fees paid to the firm of Reed & Reed, P.C. from the Company and Bank were approximately $39,000, $19,000 and $31,000 for fiscal years 2011, 2010, and

2009, respectively.

11

OWNERSHIP OF COMPANY COMMON STOCK

The following table provides as of April 4, 2012 certain information with respect to the beneficial ownership of the Company’s

common stock for (i) each stockholder known by the Company to own beneficially more than 5% of the Company’s common stock, (ii) the directors and director nominees of the Company, (iii) the executive officer named in the Summary

Compensation Table in this Proxy Statement, and (iv) all directors, director nominees and executive officers of the Company as a group.

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Amount and Nature

of

Beneficial Ownership

(1)

|

|

|

Percent

of Class

|

|

|

Directors and Officers

:

|

|

|

|

|

|

|

|

|

|

Patricia G. Baker

|

|

|

16,561

|

(2)(3)

|

|

|

1.59

|

%

|

|

Robert E. Long

|

|

|

21,594

|

(3)

|

|

|

2.07

|

%

|

|

Harry F. Louderback

|

|

|

22,309

|

(2)(3)

|

|

|

2.14

|

%

|

|

E. Powell Markowitz

|

|

|

5,979

|

(3)

|

|

|

*

|

|

|

Kyle L. Miller

|

|

|

17,199

|

(2)(3)

|

|

|

1.65

|

%

|

|

James F. Printz

|

|

|

24,516

|

(2)

|

|

|

2.35

|

%

|

|

Mark N. Reed

|

|

|

10,109

|

(2)(3)

|

|

|

*

|

|

|

Thomas R. Rosazza

|

|

|

17,067

|

(2)

|

|

|

1.64

|

%

|

|

David N. Slye

|

|

|

6,594

|

(3)

|

|

|

*

|

|

|

Executive officers who are not directors (as a group)

|

|

|

1,122

|

|

|

|

*

|

|

|

All directors and executive officers as a group

|

|

|

143,050

|

(4)

|

|

|

13.68

|

%

|

|

Principal Stockholder

:

|

|

|

|

|

|

|

|

|

|

Richard T. Spurzem

810 Catalpa Court

Charlottesville, Virginia 22903

|

|

|

98,856

|

(5)

|

|

|

9.49

|

%

(6)

|

|

*

|

Indicates less than 1% beneficial ownership.

|

|

(1)

|

For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under

which, in general, a person is deemed to be the beneficial owner of a security if he has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he has the right to

acquire beneficial ownership of the security within sixty days. Shares of common stock which are subject to stock options are deemed to be outstanding for the purpose of computing the percentage of outstanding common stock owned by such person or

group but not deemed outstanding for the purpose of computing the percentage of common stock owned by any other person or group.

|

|

(2)

|

Includes shares held by close relatives and children, and shares held jointly with spouses or as custodians or trustees, as follows: Mrs. Baker, 3,245 shares;

Mr. Louderback, 650 shares; Mr. Miller, 5,690 shares; Mr. Printz,500 shares; Mr. Reed, 4,960 shares; and Mr. Rosazza, 9,182 shares.

|

|

(3)

|

Includes shares of unexercised stock options directly owned as follows: Mrs. Baker, 600 shares; Mr. Long, 600 shares; Mr. Louderback, 600 shares;

Mr. Markowitz, 600 shares; Mr. Miller, 600 shares; Mr. Reed, 600 shares; and Mr. Slye, 600 shares.

|

|

(4)

|

Includes 4,200 shares of unexercised stock options directly owned; 24,227 shares held by close relatives and children; and shares held jointly with spouses or as

custodians or trustees.

|

|

(5)

|

Based on the most recent information available as derived from Form 4’s dated June 2, 2009 and January 13, 2012 as filed with the Securities and

Exchange Commission, which include 400 shares held by Sandbox, LLC, of which Mr. Spurzem is the designated manager.

|

|

(6)

|

Percentage ownership of the principal stockholder is calculated based on the total number of outstanding shares of common stock as of the record date.

|

12

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, directors and executive officers of the Company are required to

file reports with the Securities and Exchange Commission indicating their holdings of and transactions in Company common stock. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and

written representations that no other reports were required, insiders of the Company complied with all filing requirements during 2011.

OTHER MATTERS

Management knows of no other business to be brought before

the Annual Meeting. Should any other business be properly presented for action at the meeting, the shares represented by the enclosed proxy shall be voted by the persons named therein in accordance with their best judgment and in the best interests

of the Company.

STOCKHOLDER PROPOSALS

To be considered for inclusion in the Company’s proxy materials relating to the 2013 Annual Meeting of Stockholders pursuant to applicable Securities and Exchange Commission rules, the Secretary of

the Company must receive stockholder proposals no later than December 13, 2012. Stockholder proposals should be addressed to Pioneer Bankshares, Inc., Attn: Judy L. Painter, Corporate Secretary, at 263 East Main Street, P.O. Box 10, Stanley,

Virginia 22851.

The 2013 Annual Meeting of Stockholders is tentatively scheduled for Wednesday, May 15, 2013.

STOCKHOLDER COMMUNICATIONS

Pioneer Bankshares, Inc. has a process whereby stockholders can contact the Company’s directorship. A stockholder or other party interested in communicating directly with a director of the Company or

the entire Board may do so by writing to that director or the Board, Attn: Judy L. Painter, Corporate Secretary, at 263 East Main Street, P.O. Box 10, Stanley, Virginia 22851.

AVAILABILITY OF PROXY MATERIALS AND ANNUAL REPORT ON FORM 10-K

The

Company’s 2012 Proxy Materials and Annual Report on Form 10-K for the year ended December 31, 2011, excluding exhibits, as filed with the Securities and Exchange Commission, are available to the public in electronic format and can be

accessed free of charge at

http://www.cfpproxy.com/4609

. Copies of the 2012 Proxy Materials and the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, excluding exhibits, as filed with the Securities and

Exchange Commission can also be obtained without charge by writing to Pioneer Bankshares, Inc., Attn: Thomas R. Rosazza, President and Chief Executive Officer, at 263 East Main Street, P.O. Box 10, Stanley, Virginia 22851. This information may also

be accessed, without charge, by visiting the Securities and Exchange Commission’s Electronic Data Gathering and Retrieval Service EDGAR website at

www.sec.gov

.

13

|

|

|

|

|

|

|

x

|

|

PLEASE MARK VOTES

AS

IN THIS EXAMPLE

|

|

REVOCABLE PROXY

PIONEER

BANKSHARES, INC.

|

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

MAY 16, 2012

The

undersigned, revoking all prior proxies, hereby appoints Harry F. Louderback and E. Powell Markowitz, as proxies, and each or either of them with full power of substitution, and hereby authorizes them to represent and to vote, as designated below,

all shares of the common stock of Pioneer Bankshares, Inc. held of record by the undersigned as of the close of business on April 4, 2012, at the Annual Meeting of Stockholders to be held at the Main Office of Pioneer Bank, Stanley, Virginia,

at 10:00 a.m. on May 16, 2012, or any adjournment thereof, on each of the following matters:

|

|

|

|

|

Please complete, date and sign the proxy and return it in the

enclosed postage-paid envelope. The proxy must be signed exactly as the name(s) appear on the label affixed to this proxy. If signing as a trustee, executor, etc., please so indicate. Please return as soon as possible.

|

|

Date:

|

|

|

|

|

|

Stockholder sign above

|

|

Co-holder (if any) sign

above

|

|

1.

|

PROPOSAL ONE

- ELECTION OF DIRECTORS: THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR”

ALL NOMINEES LISTED

|

|

|

|

|

|

|

|

|

|

• Patricia G. Baker

• Kyle L. Miller

• Robert E. Long

|

|

For

|

|

With-

hold

|

|

For All

Except

|

|

|

¨

|

|

¨

|

|

¨

|

Directors to be elected for a three year term to expire in 2015 (except as marked to the contrary below):

INSTRUCTION: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name in the space provided.

|

2.

|

To transact any other business which may properly be brought before the meeting or any adjournment thereof.

|

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS

MADE, THIS PROXY WILL BE VOTED “FOR” PROPOSAL 1 ABOVE. IF ANY OTHER MATTER SHALL BE BROUGHT BEFORE THE MEETING, THE SHARES WILL BE VOTED AT THE DISCRETION OF THE HOLDERS OF THE PROXY.

¿

Detach above card, complete, sign, date and mail in

postage-paid envelope provided.

¿

PIONEER BANKSHARES, INC.

(Parent Company of Pioneer Bank, Stanley, Virginia)

PLEASE ACT PROMPTLY

COMPLETE, SIGN, DATE & MAIL YOUR PROXY CARD TODAY

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROXY MATERIALS ARE

|

|

|

|

|

|

|

|

|

|

AVAILABLE ON-LINE AT:

|

|

|

|

|

|

|

|

|

|

http://www.cfpproxy.com/4609

|

|

|

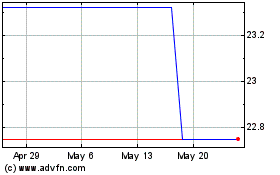

Pioneer Bankshares (PK) (USOTC:PNBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

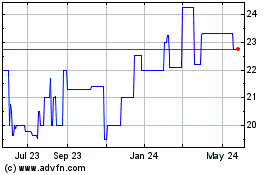

Pioneer Bankshares (PK) (USOTC:PNBI)

Historical Stock Chart

From Jul 2023 to Jul 2024