UPDATE: Porsche SE Considers Strategic Investments In Car Industry

May 10 2012 - 9:25AM

Dow Jones News

Porsche Automobil Holding SE (PAH3.XE) wants to plow the

proceeds from the planned sale of its sports-car division to

Volkswagen AG (VOW.XE) into investment in other automotive assets

after it has paid back its remaining bank debt.

"The proceeds should mainly be used for further investments

focusing on the automotive value chain," Porsche said Thursday in

the agenda for its shareholder meeting published on the corporate

website.

Porsche said it will adjust its corporate statutes to reflect a

broader investment brief at the meeting scheduled for June 25.

A spokesman for Porsche said this was a precautionary move to

keep all strategic options open for the time after the integration

of Porsche's sports-car operation into Volkswagen has been

completed. There are no concrete plans for outright acquisitions,

he said.

Porsche sold a 49.9% stake in its sports-car unit to Volkswagen

in 2009 as part of a complex deal to forge a combined company after

its attempt to take over its much larger rival backfired amid

ballooning debt in the aftermath of the financial crisis.

At the time, Porsche and Volkswagen mutually granted each other

options to transfer the remaining 50.1% stake to Volkswagen if the

initial plan for a merger including Porsche's holding firm doesn't

work out. This initial plan was abandoned last year due to legal

obstacles.

The sale of the remaining 50.1% stake in Porsche's sportscar

unit is expected to be worth roughly EUR4 billion, substantially

more than Porsche Holding's financial liabilities of EUR1.5 billion

at the end of the first quarter.

Paying back the remaining debt would mark a turning point for

Porsche's holding firm after it almost collapsed in 2009 under more

than EUR10 billion in debt. Porsche's highly-leveraged and

ultimately unsuccessful takeover of Volkswagen proved one of the

most spectacular corporate maneuvers in recent years in Europe.

Porsche's holding firm, which is controlled by the Porsche and

Piech families, ended up with a 50.7% voting stake in Volkswagen

which forced out the Porsche management. Porsche's owner families

agreed to a new merger deal under Volkswagen's leadership.

The timeframe for selling the Porsche sportscar unit, however,

remains uncertain as both companies are still looking into possible

alternatives to speed up the integration into Volkswagen's stable

of eleven car, truck and motorbike brands.

Porsche's holding firm can exercise the put option to sell the

remaining 50.1% of its sports car business, held through a company

called Zwischenholding GmbH, between Nov. 15, 2012, and Jan. 14,

2013, or between Dec. 1, 2014, and Jan. 31, 2015.

Volkswagen can exercise the respective call option to buy the

remaining 50.1% stake in Zwischenholding between March 1, 2013 and

April 30, 2013, or between Aug. 1, 2014 and Sept. 30, 2014.

A key aspect of the evaluation is a potential tax charge of

about EUR1 billion if Volkswagen and Porsche go ahead with the deal

before mid-2014. But concluding the deal earlier would enable

Volkswagen and Porsche to extract cost savings faster.

Porsche's preferred stock, its only traded securities, were 1.3%

lower at EUR43.81 around 1345 GMT Thursday on the Frankfurt stock

exchange.

-By Christoph Rauwald, Dow Jones Newswires; +49 69 29 725 512;

christoph.rauwald@dowjones.com

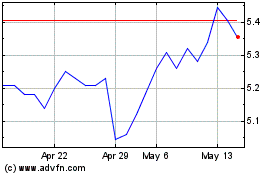

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024