Filed pursuant to Rule 424(b)(3)

Registration No. 333-230888

PROSPECTUS SUPPLEMENT No. 63

(to Prospectus dated April 19, 2019)

PARKERVISION, INC.

17,189,660 Shares of Common Stock

This Prospectus Supplement relates to the prospectus dated April 19, 2019, as amended and supplemented from time to time (the “Prospectus”) which permits the resale by the selling stockholders listed in the Prospectus of up to 17,189,660 shares of our common stock, par value $0.01 per share (“Common Stock”) including:

(i) an aggregate of 1,273,540 shares of our Common Stock, consisting of 923,540 shares of Common Stock sold by us in a private placement consummated on July 6, 2016 and up to 350,000 shares of Common Stock issuable upon exercise of a warrant sold by us on May 27, 2016, with an exercise price of $2.00 per share and a term of five years (“2016 Warrant”); such shares were previously registered on Form S-3 which was declared effective on August 2, 2016 (File No. 333-212670) (the “Resale Registration Statement”);

(ii) up to 10,000,000 shares of Common Stock by Aspire Capital Fund, LLC (“Aspire Capital”) issued and issuable by us in accordance with a securities purchase agreement dated July 26, 2018 (“PIPE Agreement”); such shares were previously registered pursuant to the registrant’s registration statement on Form S-1 along with a pre-effective amendment, which was declared effective on September 10, 2018 (File No. 333-226738) (the “Aspire Resale Registration Statement”); and

(iii) an aggregate of 5,916,120 shares of common stock issuable upon conversion of, and for the payment of interest from time to time at our option for, convertible promissory notes issued September 10, 2018, which have a fixed conversion price of $0.40 per share (“First 2018 Notes”) and a convertible promissory note issued September 19, 2018, which has a fixed conversion price of $0.57 per share (“Second 2018 Note” and together with the First 2018 Notes, the “2018 Notes”); such shares were previously registered pursuant to the registrant’s registration statement on Form S-1 which was declared effective on November 13, 2018 (File No. 333-228184) (the “Conversion Share Resale Registration Statement”).

We will not receive proceeds from the sale of the shares of Common Stock by the selling stockholders. To the extent the 2016 Warrant is exercised for cash, we will receive up to an aggregate of $700,000 in gross proceeds. Additionally, we may receive up to an additional $1,763,500 in proceeds from the sale of our Common Stock or the exercise of warrants issued to Aspire Capital under the PIPE Agreement. We expect to use proceeds received from the exercise of warrants, if any, to fund our patent enforcement actions and for other working capital and general corporate purposes.

This Prospectus Supplement is being filed to update and supplement the information previously included in the Prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 6, 2024. Accordingly, we have attached the 8-K to this prospectus supplement. You should read this prospectus supplement together with the prospectus, which is to be delivered with this prospectus supplement.

Any statement contained in the Prospectus shall be deemed to be modified or superseded to the extent that information in this Prospectus Supplement modifies or supersedes such statement. Any statement that is modified or superseded shall not be deemed to constitute a part of the Prospectus except as modified or superseded by this Prospectus Supplement.

This Prospectus Supplement should be read in conjunction with, and may not be delivered or utilized without, the Prospectus.

Our Common Stock is listed on the OTCQB Venture Capital Market under the ticker symbol “PRKR.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of the Prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the SEC nor any such authority has approved or disapproved these securities or determined whether this Prospectus or Prospectus Supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is September 6, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 6, 2024

PARKERVISION, INC.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

Florida

|

000-22904

|

59-2971472

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

4446-1A Hendricks Avenue Suite 354, Jacksonville, Florida

|

32207

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(904) 732-6100

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

None

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On September 6, 2024, ParkerVision, Inc. (the “Company”) issued a press release which reported that the Court of Appeals for the Federal Circuit issued its opinion in ParkerVision v. Qualcomm. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 hereto, has been “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

Dated: September 6, 2024

|

|

|

| |

|

PARKERVISION, INC.

|

| |

|

|

| |

|

By /s/ Cynthia French

|

| |

|

Cynthia French

|

| |

|

Chief Financial Officer

|

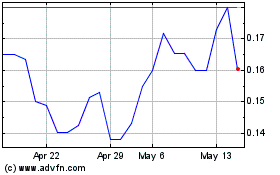

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Nov 2023 to Nov 2024