Turner Announces Completion Of Bitumen Shipping Acquisition & Placement Agreement

December 11 2017 - 8:14AM

Turner Valley Oil and Gas, Inc. (the “Company”) (OTC:TVOG), pending

name change, is pleased to announce that Turner has finalized its

phase 1 infrastructure and shipping acquisition agreement in

conjunction with the preferred stock placement with Network 1

Securities, Inc. (“Network 1”).

Stock Placement

The Company has successfully executed a binding Purchase And

Sale Agreement (“Agreement”) through a portfolio company of a

multi-generational family office based in Dubai, United Arab

Emirates. This family office has investments and operating

businesses that include dry shipping, crude shipping, natural

resource development, construction, civil engineering, and banking.

Their investment into Turner will focus on bitumen (also known as

asphalt), and the supply chain and transportation of

bitumen.

“We are thrilled that the closing process has started and we can

now move forward with building a globally integrated bitumen

shipping company. With the current and impending demand for global

infrastructure spending, spurred by global growth and the current

US President’s $1 trillion infrastructure plan, we believe this is

an ideal time for Turner to enter the bitumen sector,” stated

Network 1 Securities investment banker, Adam Pashok.

Acquisition

Turner has structured the Preferred Stock placement to exchange

Series A shares with cash and assets from the anchor investor and

third party sellers. The transaction includes the issuance of

25,000,000 Series A Preferred Shares, convertible at a ratio of 2

to 1, with a minimum price per share of $1.00 in exchange for

vessels and capital. This structure protects both insider and

retail investors from dilution to Turner’s common stock

structure.

This transaction allows for capital to be deployed as a bolt on

to each vessel as they come under Turner control. Already,

two (2) ships have been committed to the placement under the Series

A Preferred Share structure. The initial commitment under the

Agreement is approximately $15 Million of cash and assets. The

vessels are undergoing third party appraisal which will determine

their dollar value. The remaining balance of the initial

$25,000,000 will be used to secure additional shipping vessels

during the extend phase of Turner’s shipping acquisition.

Coming Name Change

The newly expanded Company will focus on all segments of the

bitumen industry, including real assets, energy, infrastructure,

and the supply chain. Turner has agreed to amend its previous

name change plans to reflect the new business model moving

forward. As a result, a proposed name change for shareholder

approval to PrimeStar Bitumen, Inc is forthcoming. A

ticker symbol change will also initiate once the name change

is approved by FINRA.

Management

Upon completion of the transfer of committed assets and capital,

Turner expects to expand its Board of Directors by appointing

several new members in addition to current board member and Turner

CEO, Steve Helm. Furthermore, new management, with decades of

shipping experience, are expected to join the Board Of

Directors. Included in this transition will be a new CEO,

administration, and the current Chairman of the family office will

take on the same title at the new company.

“I am very pleased to see several quarters of hard work come to

a successful fruition and I am excited to support the transition of

the Company by expanding the management team and executing the

extended business model,” stated CEO Steve Helm.

Mergers & Acquisitions

In a prior announcement on August 10th, 2017 Turner outlined its

acquisition plans over the next Two (2) years, which includes a

plan to integrate into the supply chain by utilizing a build &

bolt-on model within the real assets, energy, infrastructure,

bitumen, and asphalt segments. Steps are already underway and more

details will be issued in coming press releases.

Pro-forma Projections

In a prior announcement on June 8th, 2017, Turner released

expectations to fully operate an initial fleet of five (5) Bitumen

tanker vessels once acquired. Further expansion is planned

once the initial fleet is acquired, which could result in

adjustment to the Company’s prior initial guidance. Details are

forthcoming.

Closing Conditions

Following this initial closing announcement, subsequent events

will include Turner filing a Form 10, which includes 10 K and 8 K

filings with the SEC. This will meet all registered and fully

reporting standards and a result, Turner will meet the

qualifications needed for it to be an OTCQB, fully filing

company. These are important steps, that in addition to

Tuner’s recent Nasdaq system registration, will aid in Turner’s

plan to uplist to a higher exchange. In addition, closing

conditions include transfer of shipping vessels, release of

escrowed funds, appointment of a new Board of directors and

management, name change, and an updated corporate website.

About Turner Valley Oil and Gas,

Inc.

Turner Valley Oil and Gas, Inc. (pending name change) (OTC:TVOG) is

a business holding company with a historical focus on energy

related holdings. The Company’s acquisition model is focused on

finding and evaluating profitable small to mid-sized businesses as

acquisition candidates where cash flow can be improved through its

buy, build & bolt-on model within the real assets, energy,

infrastructure, bitumen, and asphalt

segments.

Certain statements in this press release are forward-looking and

involve a number of risks and uncertainties. Such forward-looking

statements are within the meaning of that term in Section 27A of

the Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. Please read full

disclaimer located at:

http://turnerventuregroup.com/disclaimer/

Website:

http://bitumentankers.com/ OTC Markets Profile:

http://www.otcmarkets.com/stock/TVOG/profile

Contacts:

Steve Helm, CEOTurner Valley Oil And Gas, Inc.Address: 3270 Sul

Ross, Houston, TX 77098Phone:

1-713-588-9453Email:

ir@turnerventuregroup.com

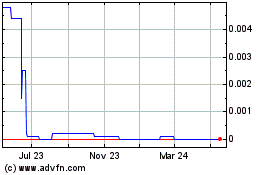

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Dec 2024 to Jan 2025

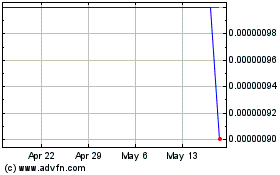

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Jan 2024 to Jan 2025