Turner Announces Completion of Acquisition Agreement with US-Based Asphalt Services and Supply Chain Company (Current EBITDA...

August 20 2018 - 8:00AM

HOUSTON, Aug. 20, 2018 (GLOBE NEWSWIRE) -- Turner

Valley Oil and Gas, Inc. (the “Company”) (OTC: TVOG), is pleased to

announce that Turner has completed an acquisition agreement with a

full service asphalt supply chain and services company located in

Tennessee, United States of America. Highlights of the

transaction include:

- Initial acquisition projection of $1,800,558.00 in revenue

and $1,305,398.00 EBITDA.

- Acquisition to be paid for by the sale of Preferred Shares

via Turner’s investment banker.

- Initial dollar amount raised will be $2 million scaling up

to a total of $25 million.

- Further acquisitions currently under review are being

vetted with those deals potentially yielding upwards of $90 million

in revenue and $11 million in EBITDA.

ACQUISITION

Turner has structured the acquisition to include the purchase of

all of the shares of the private company (“PrivCo”) to be owned as

a wholly owned subsidiary. TVOG will audit the books of the PrivCo

and complete a detailed business plan to support continuous

operation and growth as a condition of closing. Final due

diligence, site-visit and audit have been initiated but details

such as the name of the business will remain confidential until

such shares of PrivCo have been transferred.

The Company will use its Preferred Stock for a portion of the

acquisition and will sell the balance of Preferred Stock according

to the Private Placement Agreement to investors via its investment

banking advisor. The transaction includes cash, equity back at

closing and an earn-out to capture upside. This structure protects

both insider and retail investors from dilution to Turner’s common

stock structure as follows:

- Paid at closing to owner's: $1,278,885.94.

- Current management person (s) gets minimum $175,000.00 a year

for 3 years.

- Equity (rolled-in) contributed $782,991.39 or 30% of the

purchase price.

- Earn Out of 25% of EBITDA above $763,715.00

for 5 years or maximum $548,093.97 whichever is first.

- Expansion capital of $500,000.00 is invested into business over

time.

PRIVCO FINANCIALS

- PrivCo has been in operation for 8 years and continues to show

year over year growth.2015, 2016 and 2017 reflected gross revenue

of $364,465.00, $402,682.00 and $1,332,521.00.

- 2015, 2016, and 2017 EBITDA of $113,914.00, $40,733.00 and

$522,032.00.

- 2018 is on track to generate nearly $2,000,000.00 in gross

revenue and over $1,000,000.00 in EBITDA.

STOCK PLACEMENT

The Company intends to advance with its plans for a preferred

stock placement as previous described. It has met with its

investment banking advisors and it is expected a plan and any

revisions will be forthcoming. It is Turner’s intention to open up

the offering to be able to support future capital placements in

order to meet the ongoing capital needs for the acquisitions and

investment of operating profitable businesses. The initial

placement is estimated to be $2,000,000.00 with scalability to

$25,000,000.00 as originally modeled.

NAME CHANGE

As previously indicated, the Company will focus on all segments

of the bitumen and asphalt industry, including real assets, energy,

infrastructure, and the supply chain. While it is likely the

Company will change its name in the future to better reflect the

expanded business plan, Turner has agreed to amend its previous

name change plans and maintain its current name and ticker until

further notice. As a result, Turner will complete the set up

of PrimeStar Bitumen, Inc. as a subsidiary only to prepare for

negotiations with previously indicated partners.

MANAGEMENT

Upon completion of the transfer of committed assets and capital,

Turner expects to expand its Board of Directors by appointing

several new members in addition to current board members and Turner

CEO, Steve Helm. Furthermore, new management with significant

asphalt and/or bitumen experience are expected to join the Board Of

Directors. Included in this transition will be a new CEO,

COO, administration, and investor relations appointments.

CEO Steve Helm stated, “While it has taken longer than we

expected and there have been bumps along the road, we are proud to

announce this initial acquisition. I am excited to work with

our new asset and its management team and start to build the

company here at Turner that we have envisioned since this

infrastructure journey began well over a year ago”.

MERGERS & ACQUISITIONS

In prior announcements, the Company cleared a path for a series

of acquisitions within the services and supply chain markets by

utilizing a build & bolt-on model within the real assets,

energy, infrastructure, bitumen, and asphalt segments. Turner

management, while maintaining an open dialog to bitumen vessel

transactions as originally proposed, has initiated advanced due

diligence on up to 10 or more target acquisitions with

potential gross revenue of $90,000,000.00 and EBITDA

pre-consolidation of over $11,000,000.00. The steps already

underway include vetting out each opportunity, working to integrate

them into existing operations, and engage in final negotiations in

order to complete these additional acquisitions. Management

will provide more details issued in forthcoming press releases.

CLOSING CONDITIONS

Following this initial closing announcement, subsequent events

will include Turner filing a Form 10 or S1 registration, which

includes 10 K and 8 K filings with the SEC. This will meet

all registered and fully reporting standards and a result, Turner

will meet the qualifications needed for it to be an OTCQB, fully

filing company. These are important steps that in addition to

Tuner’s recent Nasdaq system registration, will aid in Turner’s

plan to uplist to a higher exchange. In addition, closing

conditions include transfer of assets, release of escrowed funds,

appointment of a new Board of directors and management, and an

updated corporate website.

About Turner Valley Oil and Gas, Inc.

Turner Valley Oil and Gas, Inc. (OTC:TVOG) is a business holding

company with a historical focus on energy related holdings. The

Company’s acquisition model is focused on finding and evaluating

profitable small to mid-sized businesses as acquisition candidates

where cash flow can be improved through its buy, build &

bolt-on model within the real assets, energy, infrastructure,

bitumen, and asphalt segments.

Certain statements in this press release are forward-looking and

involve a number of risks and uncertainties. Such forward-looking

statements are within the meaning of that term in Section 27A of

the Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. Please read full

disclaimer located at: https://primestarbitumen.com/disclaimer/

Website:

http://PrimeStarBitumen.com

OTC Markets Profile:

http://www.otcmarkets.com/stock/TVOG/profile

Contacts:

Steve Helm, CEO

Turner Valley Oil And Gas, Inc.

Address: 1600 West Loop South, Suite 1600, Houston, Texas 77027

Phone: 1-713-588-9453

Email: TurnerValleyOilandGas@gmail.com

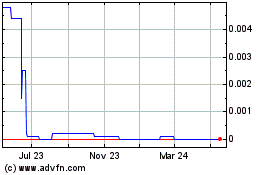

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Dec 2024 to Jan 2025

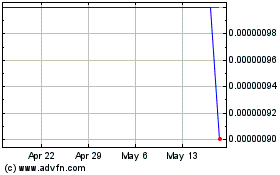

Turner Valley Oil and Gas (CE) (USOTC:TVOG)

Historical Stock Chart

From Jan 2024 to Jan 2025