UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 21, 2010

Utilicraft Aerospace Industries, Inc.

(Exact name of registrant as specified in its charter)

Nevada 333-128758 20-1990623

(State or other jurisdiction of (Commission File (IRS Employer

incorporation) Number) Identification No.)

|

Double Eagle Airport

Albuquerque, New Mexico 87121

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (888)897-0771

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|_| Written communications pursuant to Rule425 under the Securities Act (17 CFR

230.425)

|_| Soliciting material pursuant to Rule14a-12 under the Exchange Act (17 CFR

240.14a-12)

|_| Pre-commencement communications pursuant to Rule14d-2(b)under the Exchange

Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule13e-4(c)under the Exchange

Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On January 21, 2010, Utilicraft Aerospace Industries, Inc. (the "Company"), with

board approval, entered into a Subsidiary Acquisition Agreement with United

Aircraft Development Partners, Inc. ("UADP") pursuant to which the Company

issued 103,250,000 shares of its common stock in exchange for a 100% ownership

of UADP. See Exhibit 10.1.

The Board of Directors decision to acquire United Aircraft Development was based

upon its contributing to the consolidated company, a Memorandum of Understanding

that United Aircraft Development had previously entered into to merge with an

existing operating aerospace company. It is the Utilicraft Board's intention to

build a stronger balance sheet, and to create operating activities with

operating histories which will help Utilicraft Aerospace to become a fully

reporting company on a higher stock trading exchange with increased shareholder

value.

Due to confidentiality agreements, identification of the aerospace company

merger candidate and merger details will be disclosed once a definitive

agreement is reached between Utilicraft Aerospace Industries and the aerospace

operating entity.

United Aircraft Development also contributes to the Company, a Letter of Intent

for major funding from a company with associations with Humanitarian Relief

Organizations as part of this transaction. Details are also subject to

confidentiality agreements until the funding is completed.

Item 3.02. Unregistered Sales of Equity Securities.

On January 21, 2010, Utilicraft Aerospace Industries, Inc. (the "Company")

closed entered into a Subsidiary Acquisition Agreement with United Aircraft

Development Partners, Inc. ("UADP") pursuant to which the Company issued

103,250,000 shares of its common stock in exchange for a 100% ownership of UADP.

See Exhibit 10.1.

On January 21, 2010, the Company issued 12,500,000 shares of its preferred stock

to John J. Dupont, its Chairman, President and Chief Executive Officer and

12,500,000 shares of its preferred stock to Randy Moseley, its Chief Financial

Officer. Each of the preferred shares issued has voting rights equal to ten

voting rights for each share of preferred on all matters requiring a vote of

stockholders.

Item 5.01 Changes in Control of Registrant.

As a result of the transaction described in Item 1.01 ("United Aircraft

Development Partners, Inc. Transaction"), a change in control occurred with

respect to our capital stock ownership.

Each share of common stock is entitled to one vote on all matters upon which

such shares can vote. All shares of common stock are equal to each other with

respect to the election of directors and cumulative voting is not permitted.

There are no preemptive rights. In the event of liquidation or dissolution,

holders of common stock are entitled to receive, pro rata, the assets remaining,

after creditors, and holders of any class of stock having liquidation rights

senior to holders of shares of common stock, have been paid in full. All shares

of common stock are entitled to such dividends as the board of directors of the

Company (the " Board of Directors ") may declare from time to time. There are no

provisions in the articles of incorporation or bylaws that would delay, defer or

prevent a change of control.

Each share of preferred stock is entitled to ten vote on all matters upon which

such shares can vote. All shares of preferred stock are equal to each other with

respect to the election of directors and cumulative voting is not permitted.

There are no preemptive rights. In the event of liquidation or dissolution,

holders of preferred stock are entitled to receive, pro rata, the assets

remaining, after creditors have been paid in full.

The following table will identify, as of January 21, 2010, the number and

percentage of outstanding shares of common stock of the Company owned by (i)

each person known to the Company who owns more than five percent of the

outstanding common stock, (ii) each officer and director, and (iii) and officers

and directors of the Company as a group.

Each person has sole voting and investment power with respect to the shares of

common stock, except as otherwise indicated. Beneficial ownership consists of a

direct interest in the shares of common stock, except as otherwise indicated.

Unless otherwise indicated, the address for each Beneficial Owner shall be

Utilicraft Aerospace Industries, Inc., Double Eagle Airport, Albuquerque, New

Mexico, 87121.

--------------------------------------------------------------------------------

Name and Address of Beneficial Owner Amount and Percentage

Nature of of Class(1)

Beneficial

Ownership(1)

--------------------------------------------------------------------------------

John J. Dupont (2) 65,000,000 22.8%

--------------------------------------------------------------------------------

Randy J. Moseley (3) 46,500,000 16.3%

--------------------------------------------------------------------------------

Garrett Robinson (4) 21,000,000 7.4%

--------------------------------------------------------------------------------

Edward F. Eaton (5) 7,958,726 2.8%

--------------------------------------------------------------------------------

Officers and Directors as a group (4 persons) 140,458,726 49.2%

--------------------------------------------------------------------------------

|

(1) Based on 285,250,000 shares of common stock and 25,000,000 of preferred

stock issued and outstanding. Except as otherwise indicated, we believe that the

beneficial owners of the common stock listed above, based on information

furnished by such owners, have sole investment and voting power with respect to

such shares, subject to community property laws where applicable. Beneficial

outstanding for purposes of computing the percentage ownership of any other

person.

Ownership is determined in accordance with the rules of the SEC and generally

includes voting or investment power with respect to securities. Shares of common

stock subject to options or warrants currently exercisable, or exercisable

within 60 days, are deemed outstanding for purposes of computing the percentage

ownership of the person holding such option or warrants, but are not deemed

(2) John J. Dupont is the President, Chief Executive Officer and a Director of

the Company. Represents shares owned by Mr. Dupont and his spouse. Combined with

Mr. Dupont's 12,500,000 shares of Preferred Stock and their ten to one voting

rights, Mr. Dupont will have voting rights equal to 35.3% on all matters

requiring a shareholder vote.

2

(3) Randy J. Moseley is the Chief Financial Officer and a Director of the

Company. Represents shares owned by Mr. Moseley and his spouse. Combined with

Mr. Moseley's 12,500,000 shares of Preferred Stock and their ten to one voting

rights, Mr. Moseley will have voting rights equal to 32.1% on all matters

requiring a shareholder vote.

(4) Garrett Robinson is a Director of the Company. Represents shares owned by

Mr. Robinson and his spouse.

(5) Edward F. Eaton is a Director of the Company. Represents shares owned by Mr.

Eaton and his spouse.

Item 5.02. Departure of Directors or Principal Officers; Election of

Directors; Appointment of Principal Officers

On January 21, 2010, the board of directors of the Company appointed Garrett

Robinson as a member of the Company's board of directors. Mr. Robinson is to

serve as a director of the Company until the next election. From 2006 to

present, Mr. Robinson has served as Managing Director of RFT Holdings LLC, a

real estate development and investment company. From 1993 to 2006, Mr. Robinson

was the founder, director and manager of Bridges Farms, which was the largest

sea shipper of humanitarian supplies to the country of Haiti.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(c) Exhibits

Exhibit No. Description

--------------------------------------------------------------------------------

10.1 Subsidiary Acquisition Agreement with United Aircraft Development

Partners, Inc.

--------------------------------------------------------------------------------

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

UTILICRAFT AEROSPACE INDUSTRIES, INC.

Date: January 22, 2010

/s/ John J. Dupont

-------------------------------------

John J. Dupont

Chief Executive Officer

|

3

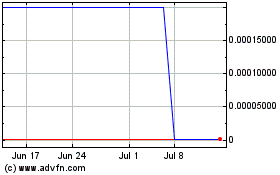

Utilicraft Aerospace Ind... (CE) (USOTC:UITA)

Historical Stock Chart

From Oct 2024 to Nov 2024

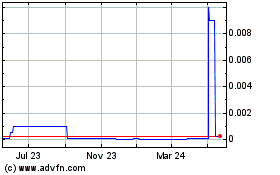

Utilicraft Aerospace Ind... (CE) (USOTC:UITA)

Historical Stock Chart

From Nov 2023 to Nov 2024