Vivendi Gets EUR5 Billion Syndicated Loan To Finance SFR Deal

April 18 2011 - 6:22AM

Dow Jones News

French media giant Vivendi SA (VIVEF, VIV.FR) said Monday it

agreed on a syndicated loan worth EUR5 billion to finance the

acquisition of a 44% stake in French mobile phone operator SFR that

belonged to U.K. mobile phone company Vodafone Group PLC (VOD.LN)

and refinance existing debt.

MAIN FACTS:

- This loan will enable the company to increase its financial

security and extend the maturity of its debt. The banking syndicate

is made up of 15 banks.

- The loan is in three tranches: tranche A at EUR1.5 billion,

maturing end 2012; tranche B at EUR1.5 billion, 3 years maturity;

tranche C at EUR2.0 billion, 5 years maturity, refinancing a

previous syndicated loan of the same amount maturing in April

2012.

- Once this transaction has been completed and after the

acquisition of the 44% of SFR, Vivendi will be able, if necessary,

to call on at least €2 billion of available credit lines.

- By Paris Bureau, Dow Jones Newswires; +331-4017-1740;

inti.landauro@dowjones.com

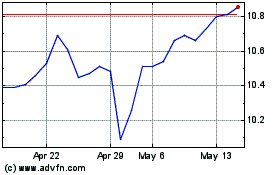

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024