Vivendi Prices EUR1.25 Billion 4.125% July 2017 Bond At 99.405

January 10 2012 - 10:07AM

Dow Jones News

French media company, Vivendi S.A. (VIV.FR) priced its EUR1.25

billion five-and-a-half-year bond, one of the banks running the

deal said Tuesday.

Societe Generale SA, Barclays PLC, Natixis SA and Royal Bank of

Scotland Group PLC are lead managers on the issue. Details are as

follows:

Amount: EUR1.25 billion

Maturity: July 18, 2017

Coupon: 4.125%

Issue Price: 99.405

Payment Date: Jan 18, 2011

Spread: 245 basis points over midswaps

Yield: 4.253%

Debt Ratings: Baa2 (Moody's)

BBB (Standard & Poor's)

-By Serena Ruffoni, Dow Jones Newswires, +44 (0) 207 842

9349;

serena.ruffoni@dowjones.com

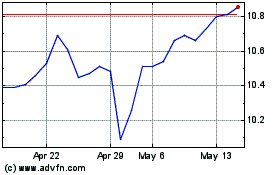

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024