Telecom Italia Board Proposes Share Conversion

November 05 2015 - 1:40PM

Dow Jones News

MILAN—Telecom Italia's board proposed on Thursday a share

conversion that, if approved, would lead to a dilution of its

current shareholders, the company said.

As a result of the operation, French firm Vivendi SA's stake in

the Italian firm would go down to about 13% from the current 20%.

The operation would bring to a conversion of the savings shares

into ordinary shares. As savings shares are about 30% of the total

capital, it would lead to a dilution of about 30% of all

shareholders.

Holders of savings shares don't have voting rights.

A spokesman for Vivendi declined to comment.

Telecom Italia will get more than €500 million ($545.9 million)

of cash flow coming from the conversion, a source close to the

operation said. The Italian firm said that the aim is to increase

the free float and simplify its capital structure.

Holders of savings shares would have the right to convert them

into ordinary ones, plus a payment of €0.95 for each savings share.

Savings shares which aren't voluntarily converted will be subject

to a mandatory conversion with a ratio equal to 0.87 ordinary share

for each saving share held.

If approved in the next shareholders' meeting, the conversion is

expected to become effective before the distribution of the 2015

dividends, the company said.

Write to Manuela Mesco at manuela.mesco@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 14:25 ET (19:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

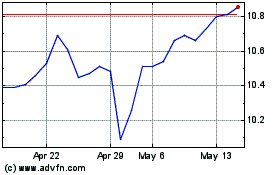

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024