SCHLUMBERGER

Former BG Chief Appointed to Board

LONDON -- Oil-services giant Schlumberger Ltd. has appointed

Helge Lund to its board, taking on the former CEO of BG Group PLC

just months after the British oil and natural gas producer was

acquired by Royal Dutch Shell PLC in a roughly $50 billion

deal.

The appointment of Mr. Lund by Schlumberger comes as major oil

and gas producers such as Shell have cut back heavily on capital

spending and other costs in the face of lower oil prices, with

serious knock-on effects on the oil-services sector. Schlumberger

has cut around 36,000 jobs, or 28% of its workforce, since November

2014.

The Shell-BG deal, which completed in February this year, was

engineered by BG's Executive Chairman Andrew Gould, the former head

of Schlumberger and one of the biggest names in the oil

industry.

Mr. Lund, 53, became CEO of BG in February last year, only a few

weeks before Shell moved in with its offer for the company. Mr.

Lund came to BG from Norway's Statoil ASA, where he won praise as a

skillful executive, forcing the Norwegian company over his 10-year

tenure as CEO to drill across the world while also revitalizing its

work in the home country's continental shelf.

When Mr. Lund took up the helm at BG last year, the company had

been roiled by years of under delivery on its own output and profit

targets and turmoil at the top level at the company which had been

without a CEO for almost a year. Last year, the U.K.'s third

largest oil and natural gas firm finally came into its own: The

cash started rolling in as its massive LNG project in Australia

came online, production ramped up in Brazil and a phase of mega

investment ended.

While investors welcomed Mr. Lund's appointment, his generous

compensation package immediately drew controversy. Shareholders

objected to a share award, valued at the time at GBP12 million

($17.4 million), for the incoming Mr. Lund in what became one of

the biggest revolts over executive pay in the U.K. in recent years.

BG eventually bowed to investor pressure and scrapped the share

award.

There had been some speculation about what Mr. Lund would do

after the Shell-BG deal closed. He had always said he wasn't

seeking a role at the new combined company and would move on from

BG once the deal completed

Schlumberger said in a statement that Mr. Lund will serve as a

director until the next annual general meeting. The board hasn't

yet determined which committees Mr. Lund will be assigned to.

--Selina Williams

VIVENDI

Watchdog Rejects Canal Plus Alliance

The French antitrust watchdog has rejected an alliance between

Vivendi SA's pay-TV group Canal Plus and Qatar-controlled beIN

Sports, dealing a major blow to the French media company.

The deal, which had been under discussion for months, involved

Canal Plus paying EUR1.5 billion ($1.7 billion) to distribute

channels from the Qatari group exclusively for five years, people

familiar with the matter said.

"This project to ally, of which we don't know everything,

contained a risk of collusion in sports rights, as the two actors

would have held 80% of sports rights, and the football league was

worried," antitrust chief Bruno Lasserre said.

"An agreement couldn't be found for concessions that would have

limited competition risks. We preferred to say no," he added.

Thursday's verdict is a setback for Vivendi, which has described

the deal as an essential part of its strategy to stem losses at its

struggling French pay-TV channels, which have been losing money for

the last four years.

In a statement, Canal Plus said it "acknowledged" the decision

and would work on "alternative solutions" to stop the losses at its

French channels.

BeIN Sports entered the French market in 2012, spending millions

of euros scooping up live sports rights including the UEFA

Champions League and French Ligue 1 soccer games and quickly

becoming a formidable competitor to Canal Plus.

Although the beIN Sports channel now counts more than 2.5

million subscribers in France, turning a profit has proved more

difficult. Analysts at Natixis estimate the channel is losing

between EUR250 million and EUR300 million a year, partly because it

charges subscribers EUR13 a month for expensively acquired sports

content.

For Vivendi, a lot is at stake in returning Canal Plus to

financial health. The pay-TV group is currently Vivendi's largest

business, accounting for more than half of its sales, and is a key

cornerstone of the group's plans to build a media empire focused on

southern Europe.

--Nick Kostov

USA TODAY

Editor in Chief Leaves to Join TheStreet

USA Today's editor in chief, David Callaway, is leaving the

newspaper to become chief executive at TheStreet Inc., ending a

nearly four-year tenure leading one of the nation's most prominent

news organizations.

Mr. Callaway will also take a board seat at TheStreet, a

financial news site co-founded by CNBC host Jim Cramer. Larry

Kramer, TheStreet's interim CEO, will step down and resume his

position as nonexecutive chairman. The moves are effective in early

July.

Patty Michalski, the paper's managing editor of digital content,

has been named interim editor in chief, Gannett Co. said in a

statement. The paper will launch a nationwide search -- including

internal and external candidates -- for a successor.

The timing of Mr. Callaway's departure is especially notable

given USA Today is the flagship news outlet of Gannett Co.

Gannett has aggressively pursued a takeover of Tribune

Publishing Co., which has rejected two buyout offers from

Gannett.

Mr. Callaway joined USA Today as the paper's top editor in 2012.

He was formerly editor in chief at MarketWatch, a property owned by

Dow Jones, the publisher of The Wall Street Journal.

Robert Dickey, Gannett's CEO, praised Mr. Callaway for

"expanding USA Today's footprint both digitally and in print."

Shares of Gannett, edged down 0.3% in the past three months,

were inactive premarket. TheStreet's stock, which has climbed 26%

in the past three months, also were unchanged.

--Joshua Jamerson

(END) Dow Jones Newswires

June 10, 2016 02:50 ET (06:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

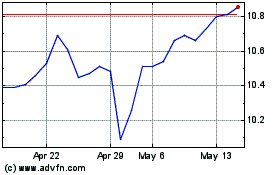

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024