TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

7 February 2018

Armadale Capital Plc ('Armadale' or 'the Company')

Mahenge Liandu Resource Upgrade to 51.1Mt at 9.3% TGC

With 75% now in the Indicated Category

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce a Resource

upgrade at the Mahenge Liandu Graphite Project in Tanzania

('Mahenge Liandu').

Overview

-- Infill drilling of the resource at Mahenge Liandu undertaken to

upgrade the category from Inferred to Indicated to allow for

feasibility studies, mine planning and economics

-- Resource successfully upgraded to 51.1Mt at 9.3% Total Graphitic

Carbon ('TGC'), including 38.7Mt Indicted at 9.3% and 12.4Mt at

9.1%

TGC

-- Upgrade represents a 25% increase from the previous 40.9Mt inferred

resource at 9.41% TGC

-- Over 75% of the Resource now in the Indicated category

-- TGC grade and quantum of indicated resource confirms Mahenge Liandu as

one of the highest-grade graphite deposits in Tanzania and the

rest of

the world

-- Areas of high-grade, near surface mineralisation have been confirmed,

allowing a staged approach to development, which lowers the

capital

development and operating costs early in the mine life

-- Test work completed to date has confirmed that premium quality, high

purity concentrates can be produced using a conventional

flotation

circuit

-- A diamond drilling programme is planned to commence at the conclusion

of the wet season (March / April 2018) to provide samples for

more

extensive metallurgical test work

-- The deposit remains open to the north south and down dip, meaning

there is significant potential to increase the resource further,

with

further drilling planned for later in 2018

-- Mine planning has now commenced and the results from this and the

updated resource will be incorporated in the Scoping Study

being

carried out by experienced engineering consultancy

BatteryLimits,

which is currently underway - results of the Scoping Study

are

expected by the end of Q1 2018

-- Combination of a number of key factors - high overall TGC grade,

sizable indicated resource, ability to utilise convention

flotation

circuit to produce premium quality product and near surface

mineralisation with super high grade TGC (see below) - all point

to

the ability to produce an extremely robust initial scoping study

which

will provide first pass project economics

Nick Johansen, Director of Armadale said: "A 25% increase in the

known graphite resource is a significant achievement. Add to this

the fact that over 75% of the resource is now in the indicated

category and it is clear to see both the value of our project and

the success of our work programmes to-date. We are committed to

maintaining this pace of development, and testament to this we are

pleased to confirm that mine planning has now commenced. The

results of this, together with the expanded and upgraded resource,

will feed into the on-going Scoping Study, which is targeted for

completion by the end of Q1 2018 and will give further clarity on

the commercial potential of Mahenge Liandu. Critically, our Project

has already been proven to be one of the highest-grade graphite

deposits in Tanzania, and with significant amounts of this

mineralisation located near surface we will be able to commence

mining via staged development, which will help fast-track to

production and also lower the capital development and operating

costs early in the mine life. We look forward to providing

shareholders with further updates on our progress in the near

term."

High Grade near Surface mineralisation

The Mahenge Liandu Resource has increased to 51.1Mt with greater

than 75% in the indicated Resource Category. The resource is an

increase of 25% from the 40.9Mt previously reported. The updated

resource figures are reported in Table 1.

Table 1. Mahenge Liandu Resource Statement

Tonnage (Mt) % Cut-Off TGC Average %TGC

Inferred 12.4 3.5 9.1

Indicated 38.7 3.5 9.3

Measured 0 3.5 0

Total 51.1 3.5 9.3

The Resource contains areas of high grade near surface

mineralisation. Armadale is currently working on mine optimisation

with a focus on targeting this near surface high grade

mineralisation. Some of the better near surface high-grade

intercepts include;

-- -- 6m @ 12.8% Total Graphitic Content ('TGC') from surface

-- 14m @ 16.7% TGC from 2m

-- 15m @ 14% TGC from surface

-- 11m @ 14.8% TGC from 15m

-- 10m @ 18.5% TGC from 16m

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc +44 20 7236 1177

Tim Jones, Company Secretary

Nomad and broker: finnCap Ltd +44 20 7220 0500

Christopher Raggett / Simon Hicks

Joint Broker: Beaufort Securities Limited +44 20 7382 8300

Jon Belliss

Press Relations: St Brides Partners Ltd +44 20 7236 1177

Susie Geliher / Charlotte Page

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

51.1Mt @ 9.3% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Aside from Mahenge Liandu, Armadale has an interest in a

portfolio of quoted investments and in January 2018 agreed to sell

its interest in the Mpokoto Gold Project in the Democratic Republic

of Congo for total potential consideration of US$562,500 and a 1.5%

royalty on gold produced. Completion of the sale agreement is

subject to execution of a formal binding agreement, which is

expected in Q1 2018.

More information can be found on the website

www.armadalecapitalplc.com

Competent Person statement

The Resource Statement has been prepared by Mark Biggs for and

on behalf of Armadale Capital Plc. Mark Biggs has over 34 years of

experience in base metal, industrial mineral, coal exploration and

mine evaluation throughout Australia, South Africa, Mongolia and

China. He has worked extensively within the Bowen and Surat Basins

and was resident at several Central Queensland coal mines for 22

years. He has held a number of roles in these mine's Technical

Services, including Senior Geologist, Chief Geologist, Coal Quality

and Scheduling Superintendent and Acting Technical Services

Manager. Mark has extensive experience in open cut and underground

exploration techniques, geophysical techniques, assay

interpretation, geotechnical and structural modelling, mining, and

scheduling. The information in this announcement that relates to

exploration results is based on information compiled by Mr Matt

Bull, a competent person, who is a Member of the Australian

Institute of Geoscientists. Mr Bull has sufficient experience which

is relevant to the style of mineralisation and type of deposit

under consideration and to the activity which he is undertaking to

qualify as a competent person as defined in the 2012 Edition of the

"Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves". Both Mr Biggs and Mr Bull consents to

the inclusion in the report of the matters based on his information

in the form and context in which it appears.

View source version on

businesswire.com:http://www.businesswire.com/news/home/20180207005561/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

February 07, 2018 05:00 ET (10:00 GMT)

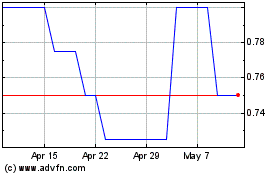

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Apr 2023 to Apr 2024