TIDMACP

RNS Number : 2575A

Armadale Capital PLC

28 May 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

Date 28 May 2021

Armadale Capital Plc ('Armadale' or 'the Company')

Subscription and Investment Portfolio Update

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa is pleased to

announce that is has raised GBP850,000 via a private subscription

with certain existing high-net worth shareholders in the Company

(the 'Subscription').

As part of the Subscription, 18,888,889 new ordinary shares

('Ordinary Shares') ('Subscription Shares') in the Company will be

issued at a price of 4.5 pence per Ordinary Share which was the

mid-market price on 27 May 2021, being the last trading day

immediately preceding this announcement. In addition, Subscribers

will also receive one warrant for each Ordinary Share subscribed

for, exercisable at a price of 7.00 pence and expiring on the

three-year anniversary of the date of issue (the 'Warrants'). In

aggregate, 18,888,889 Warrants will be issued alongside this

Subscription.

The Subscription was carried out directly with investors and

there were no broker fees paid.

Use of Proceeds

Following the delivery of an extremely compelling feasibility

study for the Mahenge Liandu graphite project in Tanzania, these

funds will strengthen the Company's balance sheet as it seeks to

progress development finance workstreams ahead of construction;

they will also enable Armadale to further progress essential Front

End Engineering Design studies being carried out by the Chinese

group Xinhai Mineral EPC and also be used for general working

capital purposes.

Investment Portfolio Update

In addition to driving development at Mahenge Liandu graphite

project, Armadale continues to operate as a diversified investing

company investing in natural resource projects in Africa and to

this end it has maintained a small portfolio of quoted investments,

principally in resource companies where the Directors believe there

are opportunities for capital gain.

With regard to these investments, Armadale wishes to inform

investors that recently there have been significant gains in the

Company's listed portfolio and that the current value of listed

investments is approximately CAD 1.4 million.

The Company continues to keep its portfolio under review. The

Company's strategy with its quoted portfolio is to gain exposure in

projects that have the potential to create short to medium term

returns for the Company as well as diversify the Company's exposure

to a broader range of commodities while being able to enter and

exit the position with minimal cost and time.

Armadale Chairman, Nick Johansen, commented:

"It is fantastic to have such strong inward demand by investors

and to be able to conduct this Subscription without a discount to

the prevailing share price - a testament indeed to the compelling

economics of Mahenge and a recognition of the way Armadale has

significantly derisked the Mahenge project and driven significant

shareholder value since previous fundraises more so in recent

months with the approval of the Environmental and Social Impact

Assessment which is the final necessary step in our Mining Licence

application process. We have also delivered a successful first

phase of our FEED studies testwork thus confirming our process

flowsheet as per our Definitive Feasibility Study and helping to

ratify the exceptional economics of the project. These funds will

also help to strengthen the Company's existing balance sheet as we

look to further potential progress development finance options with

the number of finance partner / provider candidates with whom we

are currently engaged.

We are also delighted to report that the Company's quoted

investment portfolio has done particularly well as of late and with

a present value of circa CAD 1.4 million, has delivered healthy

returns for shareholders. The Company will continue to review

opportunities as appropriate; investors should note that profits

and capital from listed investments may at some stage be used to

progress development at our Mahange graphite project. We look

forward to updating the market regularly."

Total Voting Rights and Share Admission

Following Admission, the Company will have 501,167,889 Ordinary

Shares of 0.1 pence each in issue with no shares held in treasury,

each with one vote per share. Therefore, the total number of voting

rights in the Company will be 501,167,889. This figure may be used

by shareholders in the Company as the denominator for calculations

to determine if they have a notifiable interest in the share

capital of the Company under the FCA's Disclosure Guidance and

Transparency Rules, or if such interest has changed.

The Subscription is conditional upon, inter alia, admission

('Admission') of the Subscription Shares to trading (which will be

issued and settled in CREST to the extent possible) on AIM.

Application will be made for Admission, which is expected to occur

on or around 8.00 a.m. on 04 June 2021.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSSEVITFIL

(END) Dow Jones Newswires

May 28, 2021 10:45 ET (14:45 GMT)

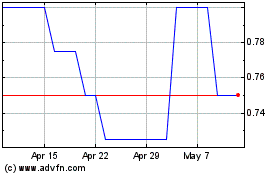

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025