Armadale Capital PLC Block Admission & TVR (3523D)

June 28 2021 - 6:40AM

UK Regulatory

TIDMACP

RNS Number : 3523D

Armadale Capital PLC

28 June 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

28 June 2021

Armadale Capital Plc

('Armadale' or 'the Company')

Block Admission

and

Total Voting Rights

Armadale Capital plc, the AIM quoted investment group focused on

natural resource projects in Africa, announces that application has

been made for the block admission ("Block Admission") of 43,333,333

ordinary shares of 0.1 pence each in the capital of the Company

("Ordinary Shares"), ranking pari passu with the Company's existing

Ordinary Shares. It is expected that admission of the Block

Admission Ordinary Shares will become effective on 2 July 2021.

These new Ordinary Shares may be issued from time to time pursuant

to the exercise of existing warrants by their respective

holders.

Total Voting Rights

Furthermore, the Company announces that, prior to the issuance

of any Ordinary Shares pursuant to the Block Admission above, it's

current issued share capital consists of 501,167,161 Ordinary

Shares, and not 501,167,889 as announced on 28 May 2021. There are

no shares held in Treasury, therefore the figure of 501,167,161

should be used as the denominator for the calculations by which

shareholder can determine if they are required to notify their

interest in, or a change to their interest in the Company.

Enquiries:

Armadale Capital Plc

Nick Johansen, Chairman

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Seamus Fricker / Teddy Whiley +44 (0) 20 7220 0500

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ALSUWOARAKUNUAR

(END) Dow Jones Newswires

June 28, 2021 07:40 ET (11:40 GMT)

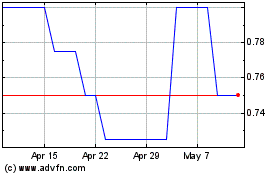

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025