TIDMACP

RNS Number : 3489N

Armadale Capital PLC

29 September 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

29 September 2021

Armadale Capital Plc

('Armadale' the 'Company' or the 'Group')

Interim Results

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce its unaudited

interim results for the six months ended 30 June 2021.

Highlights:

-- The focus of the Company throughout the interim reporting

period was to obtain all required permits to commence development

of the high-grade long life Mahenge Liandu Graphite project.

o Subsequent to the end of the half year the mining licence was

granted for an initial 10-year term which can be extended marking a

significant milestone for the Company.

o The mining licence, should it be extended would cover the

initial 15 year mine life utilising only 25% of the estimated

Resource.

-- Progressing licencing applications ahead in preparation for development of Mahenge Liandu

o Mining licence application process commenced in June 2020 with

the submission of the mining licence application to the Department

of Energy and Minerals.

o The Environmental and Social Impact Assessment ('ESIA') to the

National Environment Management Council ('NEMC') of Tanzania was

granted in March 2021.

o A mining licence covering the Project was granted in September

2021 (post-period end).

-- Natural Flake Graphite Testing Confirms Suitability For Use In Lithium-Ion Battery Anodes

o Positive confirmation received in June 2020 from Australia's

Commonwealth Scientific and Industrial Research Organisation that

Armadale's natural flake graphite is suitable for use in

lithium-ion batteries.

-- 1st phase of Front-End Engineering Design Studies undertaken

by Chinese EPCM Xinhai Mineral EPC completed

o Positive results received confirming a premium quality high

purity graphite concentrate, also suitable for the battery anode

market and can be produced from Mahenge using conventional plant as

outlined in the Company's existing Definitive Feasibility

Study.

o Included metallurgical bulk test work programme which further

confirmed the efficacy of the Company's intended process flow sheet

and helped ratify project economics.

During the period Armadale further established Mahenge as a

large, long life graphite developer with significant commercial

potential capable of producing high quality graphite concentrate

for the rapidly emerging EV market and as previously advised,

strategic next steps are focused upon the completion of development

funding options specifically a debt package for the project, the

Company is also currently in discussions with a number of potential

finance partners; we are hoping to be able to announce some further

progress with regards to these efforts and also with our offtake

discussions in the near term through optimised Definitive

Feasibility Study ('DFS').

Key metrics for Armadale's Mahenge Graphite project:

o High-grade JORC compliant Indicated and inferred mineral

resource estimate of 59.48Mt @ 9.8% TGC with outstanding purity of

up to of 99.99% TGC achievable using conventional treatment

o Potential for US$985m pre-tax cashflow to be generated from

initial 15 year mine life utilising just 25% of the resource, which

remains open in multiple directions offering significant further

upside

o Estimated pre-tax NPV of US$430m and IRR of 91%

o Average annual production of large flake high-purity graphite

of 109ktpa

Nick Johansen, Director of Armadale, said: "The first half of

2021 has seen Armadale focus on project permitting which has seen

the Company subsequent to the end of the half year progress to

being a fully permitted development company. The mining permit is

the culmination of a long project of advancement for the Company,

which has progressed from the discovery of the deposit through to

feasibility study and now is development ready. The Company is now

well placed to proceed towards financing and development in an

environment where there is increasing demand for graphite and we

look forward to updating investors with regards to how our

activities progress on this workstream as well as offtakes and

additional development activities since the end of the 2021

half-year period"

For and on behalf of the Board

29 September 2021

FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2021

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

Unaudited

Six months ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Administrative expenses (157) (176)

Change in fair value of derivative - 37

Change in fair value of investments 139 2

Finance costs (9) (22)

Loss before taxation (27) (159)

Taxation - -

-------------------- -------------------

Loss after taxation (27) (159)

Other comprehensive income

Items that may be reclassified to

profit or loss:

Exchange differences on translating

foreign entities 2 (13)

-------------------- -------------------

Total comprehensive loss attributable

to equity holders of the parent company (25) (172)

==================== ===================

Pence Pence

Loss per share attributable to equity

holders of the parent company (note

3)

Basic and fully diluted (0.01) (0.04)

==================== ===================

Consolidated Statement of Financial Position

At 30 June 2021

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Assets

Non-Current assets

Exploration and evaluation assets 4,556 4,084 4,417

Investments 421 108 282

4,977 4,192 4,699

Current assets

Trade and other receivables 559 303 121

Cash and cash equivalents 562 436 252

------------- ------------- ----------------

1,121 739 373

------------- ------------- ----------------

Total assets 6,098 4,931 5,072

============= ============= ================

Equity and liabilities

Equity

Share capital (note 4) 3,237 3,197 3,207

Share premium 23,148 22,122 22,348

Shares to be issued 286 286 286

Share option and warrant reserve 972 813 762

Foreign exchange reserve 129 75 127

Retained earnings (22,376) (22,420) (22,406)

------------- ------------- ----------------

Total equity 5,396 4,073 4,324

============= ============= ================

Current liabilities

Trade and other payables 96 253 171

Loans 606 604 577

Derivative liability - 1 -

Total liabilities 702 858 748

============= ============= ================

Total equity and liabilities 6,098 4,931 5,072

============= ============= ================

Unaudited Consolidated Statement of Changes in Equity

For the period ended 30 June 2021

Share Share Shares Share Foreign Retained Total

Capital Premium to be Option Exchange Earnings

GBP'000 GBP'000 Issued Reserve Reserve GBP'000 GBP'000

GBP'000 GBP'000 GBP'000

Balance 1

January 2020 3,139 21,037 286 662 88 (22,400) 2,812

Loss for the

year - - - - - (196) (196)

Other

comprehensive

income - - - - 39 - 39

------------ ------------ ------------ ------------ ------------- ------------- ------------

Total

comprehensive

loss for the

period - - - - 39 (196) (157)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Issue of

shares and

warrants 68 1,311 - 239 - - 1,618

Release on

conversion

of loan notes - - - - - 51 51

Transfer on

exercise

of warrants - - - (139) - 139 -

Total other

movements 68 1,311 - 100 - 190 1,669

------------ ------------ ------------ ------------ ------------- ------------- ------------

Balance 31

December

2020 3,207 22,348 286 762 127 (22,406) 4,324

Loss for the

period - - - - - (27) (27)

Other

comprehensive

loss - - - - 2 - 2

------------ ------------ ------------ ------------ ------------- ------------- ------------

Total

comprehensive

loss for the

period - - - - 2 (27) (25)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Issue of

shares 30 800 - 267 - - 1,097

Transfer on

exercise

of warrants - - - (57) - 57 -

Total other

movements 30 800 - 210 - 57 1,097

------------ ------------ ------------ ------------ ------------- ------------- ------------

Balance 30

June 2021 3,237 23,148 286 972 129 (22,376) 5,396

============ ============ ============ ============ ============= ============= ============

The following describes the nature and purpose of each reserve

within shareholders' equity:

Reserve Description and purpose

Share capital Amount subscribed for share capital at nominal

value

Share premium Amount subscribed for share capital in excess of

nominal value, net of allowable expenses

Shares to be issued Share capital to be issued in connection

with historical acquisition

Share option and warrant reserve Cumulative charge recognised

under IFRS2 in respect of share-based payment awards

Foreign exchange reserve Gains/losses arising on re-translating

the net assets of overseas operations into sterling

Retained earnings Cumulative net gains and losses recognised in

the statement of comprehensive income

Consolidated Statement of Cash Flows

For the period ended 30 June 2021

Unaudited Audited

Six Months ended Year ended

30 June 31 December

2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss before taxation (27) (159) (196)

Change in fair value of derivative - (37) (37)

Change in fair value of investments (139) (2) (176)

Finance costs 9 22 31

(157) (176) (378)

Changes in working capital

Receivables 9 (16) 11

Payables (33) 8 (7)

------------ ----------------- ----------------

Net cash used in operating activities (181) (184) (374)

============ ================= ================

Cash flows from investing activities

Expenditure on exploration and

evaluation assets (157) (350) (689)

Net cash used in investing activities (157) (350) (689)

============ ================= ================

Cash flows from financing activities

Proceeds from share issues 648 845 1,246

Loan repayment - - (50)

Proceeds from loan - 50 50

Interest paid - (21) (27)

Net cash from financing activities 648 874 1,219

============ ================= ================

Net increase/(decrease) in cash

and cash equivalents 310 340 156

Cash and cash equivalents at

1 January 2021 252 96 96

Cash and cash equivalents at

30 June 2021 562 436 252

============ ================= ================

Notes to the unaudited condensed consolidated financial

statements

For the period ended 30 June 2021

1. Incorporation and principal activities

Country of incorporation

Armadale Capital Plc was incorporated in the United Kingdom as a

public limited company on 19 August 2005. Its registered office is

1 Arbrook Lane, Esher, Surrey, KT10 9EG.

Principal activities

The principal activity of the Group during the period was that

of an investment company.

2. Accounting policies

2.1. Statement of compliance

The financial information for the six months ended 30 June 2021

and 30 June 2020 is unreviewed and unaudited and does not

constitute the Group's statutory financial statements for those

periods within the meaning of Section 434 of the Companies Act

2006. The comparative financial information for the year ended 31

December 2020 has been derived from the Annual Report and Accounts,

which were approved by the Board of Directors on 28 May 2021 and

delivered to the Registrar of Companies. The report of the Auditors

on those accounts was unqualified and did not contain any statement

under Section 498 of the Companies Act 2006.

This condensed set of financial statements has been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This condensed set of financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2020 which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 31 December 2020 as

described in those annual financial statements.

In respect of new financial reporting standards which came into

effect for reporting periods beginning on 1 January 2021, the

Directors consider that their implementation has no material effect

on the financial information presented in this statement.

2.2. Going Concern

The financial statements have been prepared on the going concern

basis as, in the opinion of the Directors, there is a reasonable

expectation that the Group will continue in operational existence

for the foreseeable future. The Company's ability to continue as a

going concern and to achieve its long term strategy of developing

its exploration projects is dependent on further fundraising.

During the period, a total of GBP1,095,350 was raised from share

placing and warrant exercises (see note 4). Since the period end,

all remaining loan notes, together with accrued interest, have been

converted into Ordinary Shares in the Company, which is now debt

free.

2.3. Exploration and evaluation assets

These assets are recorded at cost and are amortised over their

expected useful life on a pro rata basis of actual production for

the period to expected total production.

2.4. Investments

Investments are stated at fair value.

3. Loss per share

The calculation of loss per share is based on a loss of

GBP27,000 (2020, GBP159,000) and on 480,763,732 (2020, 419,492,599)

Ordinary Shares, being the weighted average number of Ordinary

Shares in issue during the period.

There was no difference between basic loss per share and diluted

loss per share as the Group reported a loss for the period.

4. Share capital

During the period, the Company placed 18,888,889 Ordinary Shares

in the Capital of the Company to raise GBP850,000 with

institutional and other investors. Also during the period

10,467,913 warrants were exercised providing proceeds of

GBP245,350.

**ENDS**

For further information, please visit the Company's website

www.armadalecapitalplc.com , follow Armadale on Twitter

@ArmadaleCapital or contact:

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary +44 (0)20 7236 1177

------------------------

Nomad and broker: finnCap Ltd

Christopher Raggett / Seamus Fricker /Edward

Whiley +44 (0)20 7220 0500

------------------------

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GUGDCBXDDGBC

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

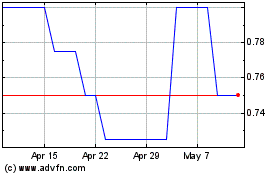

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025