TIDMAEET

RNS Number : 2406K

Aquila Energy Efficiency Trust PLC

20 December 2022

20 December 2022

Aquila Energy Efficiency Trust PLC

(the "Company")

Trading Update

Material Commitment and Deployment Progress

The Company is pleased to announce an update on the continued

progress in the commitment and deployment of capital since the last

update published on 15 September 2022.

Commitments increased materially to GBP87.3m as at 19 December

2022 (31 August 2022: GBP55.5m). Total income-generating, deployed

capital has increased to GBP54.4m (31 August 2022: GBP32.1m). The

Company is expected to achieve an average gross unlevered project

yield of 8.0% over all investments made to date.

The Board has approved commitments totalling a further GBP8.7m,

which are awaiting financial close. These commitments would be in

addition to the GBP87.3m commitments made. The Investment Adviser

currently expects that by the end of Q1 2023 approximately 80% of

the capital available for investment will have been deployed.

Further deployment from existing and new commitments will be made

in the course of 2023.

The Company's portfolio now comprises 30 diverse investments in

Germany, Italy, Spain and the United Kingdom with 19 different ESCO

partners, across a wide range of technologies including Solar PV,

Combined Heat & Power, Biogas, Sub-metering, Wind and Water

Management together with the suite of building energy efficiency

technologies deployed in Italian Superbonus projects. It is

noteworthy that there has been a significant increase in

investments in Germany with the completion of two large investments

with commitments of GBP18.7m and deployment to date of GBP15.0m

with GBP3.7m remaining to be deployed.

Investments since 31 August 2022 include:

-- GBP10.7m investment to acquire receivables due under water

management service agreements for condominiums and multi-family

homes in Germany, mainly managed by large property managers.

-- GBP8.0m commitment to fund the acquisition of a biogas plant

and investment in liquefaction equipment by one of Germany's

leading biogas development companies with more than 20 years'

experience in the sector.

-- GBP5.8m commitment to fund the refurbishment of condominiums

in Spain under the "Programa de Rehabilitacion Energetica de

Edificios" ("PREE") incentive scheme. The investment is based on

the purchase of receivables generated by energy saving

contracts.

-- GBP3.5m commitment to fund Solar PV plants in

self-consumption for residential properties located around Madrid,

Barcelona and Valencia originated by Solarnub, a fast-growing

trading management platform for solar companies; this is the second

investment with Solarnub.

-- GBP0.9m commitment to fund a Solar PV project for

self-consumption for a leading Spanish ceramic tiles manufacturer,

developed by a Valencia based ESCO.

-- GBP0.8m commitment to fund a Solar PV project for

self-consumption for an Italian manufacturing business.

-- GBP0.6m commitment to invest in a cluster of Solar PV

projects in self-consumption located in Cordoba and Granada marking

the start of a new relationship with a Spanish developer based in

Córdoba

-- GBP0.5m of other commitments including the fourth Solar PV

project with an Italian developer and a second Solar PV project

with another Spanish developer based in Barcelona; and

-- GBP0.4m investment in operational small wind farms in the UK

which benefit from feed-in and export tariffs and provide onsite

power for self-consumption.

The CHP project being developed by Ega Energy for Vale of

Mowbray Limited, referred to in the Half Yearly Financial Report

for the six months ended 30 June 2022, is on hold due to this

company having entered into administration. The amount of GBP0.9m

has been invested in the project with the majority of the capital

applied to acquire the CHP equipment, which is not yet onsite. Ega

Energy is identifying other clients who may use the equipment if

the Vale of Mowbray site is not acquired by a business with a

sufficiently strong credit rating. The Investment Adviser believes

that its contractual arrangements with Ega Energy protect the value

of the investment made to date and so no impairment has been made

at this point.

The Board and the Investment Adviser believe that the market

outlook for energy efficiency investments remains positive and that

energy savings should be considered the "first fuel". Investments

to reduce primary energy consumption and to generate on-site

energy, the focus of the Company's investment strategy, address

critical concerns for businesses seeking to reduce their exposure

to high energy prices and transition to "net zero". Notwithstanding

this environment, the Investment Adviser has experienced delays to

decision making by corporates, which it attributes to significant

volatility in wholesale electricity prices and uncertainties over

the impact of new energy policies designed to address this issue,

for example, energy price caps. Nevertheless, energy policies have

become clearer, including in the United Kingdom, and the Board and

Investment Adviser expect opportunities for long term energy

efficiency contracts will continue to accelerate and that it is

well placed to secure attractive investment opportunities through

the growing number of partnerships that have been forged with

European energy services companies.

The next semi-annual NAV, as at 31 December 2022, will be

published in early February 2023.

For further information please contact:

Aquila Capital (Investment Adviser) Via Buchanan

Buchanan (Financial PR) 020 7466 5000

Charles Ryland, Henry Wilson, George Beale

Peel Hunt (Broker) 020 7418 8900

Luke Simpson, Huw Jeremy (Investment Banking)

LEI: 213800AJ3TY3OJCQQC53

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFVLFRLALIF

(END) Dow Jones Newswires

December 20, 2022 02:00 ET (07:00 GMT)

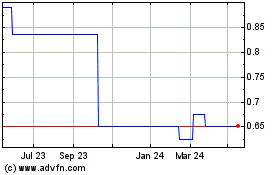

Aquila Energy Efficiency (LSE:AEEE)

Historical Stock Chart

From Nov 2024 to Dec 2024

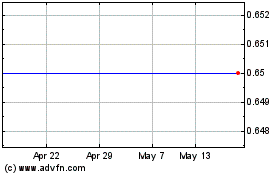

Aquila Energy Efficiency (LSE:AEEE)

Historical Stock Chart

From Dec 2023 to Dec 2024