Aquila Energy Efficiency Trust PLC Net Asset Value as at 30 June 2023 (9844I)

August 11 2023 - 1:00AM

UK Regulatory

TIDMAEET

RNS Number : 9844I

Aquila Energy Efficiency Trust PLC

11 August 2023

11 August 2023

Aquila Energy Efficiency Trust PLC

(the "Company")

Net Asset Value as at 30 June 2023

The Company today announces its unaudited net asset value

("NAV") as at 30 June 2023, on a cum-income basis, was GBP93.54

million (GBP95.23 million as at 31 December 2022) or 93.54 pence

per ordinary share (95.23 pence as at 31 December 2022).

The NAV as at 30 June 2023 was as follows:

Summary GBPm

Investments 65.67

-------

Cash and cash equivalents 28.69

-------

Other net current assets (0.82)

-------

NAV 93.54

-------

Non GBP investments are valued in local currency and translated

at EUR1.1647 :GBP1. For cash in Euro accounts, converted at

EUR1.1647 :GBP1.

Investments :

30 June 2023 Assets GBPm Commentary

Weighted average discount rate

applied of 8.2% (range 7.2%

Variable rate to 9.2%). Long term power price

return investments forecasts provided by leading

valued at fair market consultants. P50 level

value 12 11.62 of output energy yield.

------- ------ -----------------------------------

Fixed rate return Includes an allowance for Expected

investments valued Credit Loss pursuant to IFRS

at amortised cost 25 54.05 9 of GBP0.36 million.

------- ------ -----------------------------------

Total 37 65.67

------- ------ -----------------------------------

All the investments remain unlevered. The number of investments

reduced from 38 to 37 because the Company discontinued a c. GBP1.7

million commitment to finance a Solar PV plant in Spain and battery

projects that were to be deployed at sites of the leading operator

of wellness centres in Spain.

Cash and cash equivalents :

The cash and cash equivalents figure of GBP28.69 million noted

above includes GBP 2.5 million of cash held as collateral for the

Company's existing currency hedges in line with its strategy.

As at 30 June 2023, the Company and its immediate investment

holding entities had contractual legal obligations for existing

investments (the "Unfunded Commitments") equivalent to

approximately GBP23.3 million (translating Euro obligations at

EUR1.1647:GBP1 and which includes an allowance for external

transaction costs).

By 31 December 2023, the investment adviser expects the Company

and its immediate investment holding entities to have Unfunded

Commitments no greater than GBP1.6 million (translating Euro

obligations at EUR1.1647:GBP1 and which includes an allowance for

external transaction costs), on the assumption the capital is

deployed in line with expectations.

By 31 March 2024, as a result of the expected run-off of certain

investments, in particular the Superbonus projects, the investment

adviser expects the Company and its immediate investment holding

entities to have no less than GBP24 million of cash (prior to any

dividend or return of capital to shareholders). It should be noted

that the nature of the Company's investments in Superbonus projects

is such that it is difficult to be sure when the investments will

be realised although they will continue to be income producing if

actual redemption is later than forecast.

Following the Company's AGM held in June 2023, the Company's

portfolio is being managed consistently with the Continuation

Managed Run-Off Resolution as defined in the notice of AGM dated 30

April 2023, and as approved by shareholders at the AGM.

For further information, please contact:

Aquila Capital (Investment Adviser) Via Buchanan

Stifel Nicolaus Europe Limited (Sole Financial Adviser

and Corporate Broker)

Edward Gibson-Watt, Mark Young, Rajpal Padam, Madison

Kominski 020 7710 7600

Buchanan (Financial PR)

Charles Ryland, George Beale 020 7466 5000

Apex Listed Companies Services (UK) Limited (Company

Secretary)

Sinead van Duuren 020 3327 9720

The Company's LEI is 213800AJ3TY3OJCQQC53

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFLFEVTRIILIV

(END) Dow Jones Newswires

August 11, 2023 02:00 ET (06:00 GMT)

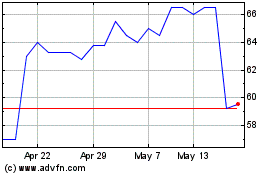

Aquila Energy Efficiency (LSE:AEET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aquila Energy Efficiency (LSE:AEET)

Historical Stock Chart

From Apr 2023 to Apr 2024