Aquila European Renewables PLC Update re: Investment Adviser (2138A)

January 18 2024 - 12:11PM

UK Regulatory

TIDMAERS TIDMAERI

RNS Number : 2138A

Aquila European Renewables PLC

18 January 2024

Aquila European Renewables PLC

18 January 2024

Update re: Investment Adviser

Aquila European Renewables plc ("AER" or "the Company"), the

London-listed investment company advised by Aquila Capital

Investmentgesellschaft mbH ("Investment Adviser"), notes the

announcement today that the Investment Adviser and Commerzbank have

entered into a strategic partnership aimed at significantly

accelerating Aquila Capital Investmentgesellschaft's growth and

developing the Investment Adviser into one of the leading asset

managers for sustainable investment strategies in Europe. As part

of this partnership, Commerzbank will acquire a 74.9% stake in the

Investment Adviser with the Aquila Group remaining permanently

engaged as a shareholder with its remaining shareholding. The

partnership ensures the managerial independence of the Company's

Investment Adviser as it will remain autonomous in terms of

operations, investment decisions, product development and brand

representation. The existing management and fund management teams

responsible for the Company will remain unchanged.

The transaction is subject to the required regulatory approvals

and is expected to close in the second quarter 2024.

For further details contact:

Media Contacts

Edelman Smithfield

Ged Brumby 07540 412301

Sponsor, Broker and Placing Agent

Numis Securities 020 7260 1000

Tod Davis

David Benda

Apex Listed Companies Services (UK) Limited (Company Secretary)

020 3327 9720

NOTES

About AER

The objective of Aquila European Renewables plc is to provide

investors with an attractive long-term, income-based return in EUR

through a diversified portfolio of onshore wind, solar PV and

hydropower investments across continental Europe and Ireland. As a

result of the diversification of energy generation technologies,

the seasonal production patterns of these asset types complement

each other, providing a balanced cash flow profile, while the

geographic diversification serves to reduce exposure to any one

single energy market. In addition, a balance is maintained between

government supported revenues, fixed price power purchase

agreements and market power price risk. AER is targeting a dividend

of 5.51 cents per share in relation to the financial year ending 31

December 2023, with the aim of increasing this dividend

progressively over the medium term.

Further details can be found at:

www.aquila-european-renewables.com .

LEI Number: 213800UKH1TZIC9ZRP41

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAPFPFEXLEFA

(END) Dow Jones Newswires

January 18, 2024 13:11 ET (18:11 GMT)

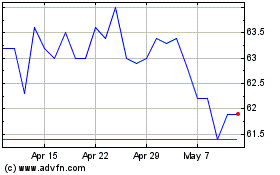

Aquila European Renewables (LSE:AERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aquila European Renewables (LSE:AERS)

Historical Stock Chart

From Apr 2023 to Apr 2024