TIDMAFC

RNS Number : 6398H

AFC Energy Plc

31 July 2023

The information contained within this announcement is deemed by

the company to constitute inside information as stipulated under

the EU market abuse regulation (596/2014).

31 July 2023

AFC Energy plc

("AFC" or the "Company")

Interim Results

AFC Energy Plc (AIM: AFC), a leading provider of hydrogen power

generation technologies, is pleased to announce its interim results

for the half year ended 30 April 2023.

Commercial Highlights

-- Successful H-Power Tower generator leased programme across

eight customer sites generating further revenue from S Series

platform

-- Follow on agreement with ACCIONA, for six-month lease with

option to purchase, of H-Power Generator plus battery energy

storage system, to be deployed in 2023

-- First deployment of H-Power Tower in film and TV production

sector with large US production studio

-- Confirmation of successful validation by ABB E-mobility of

new S+ Series liquid cooled fuel cell stacks

-- Successful completion of Extreme E Season 2 EV charging contract

-- Award (post period end) of up to GBP4.3m of matched grant

funding from UK Government to support transition from diesel

generators at UK construction, mining and quarrying sites

-- Announced (post period end) plan to execute on our plant hire

strategy with the proposed launch of a UK dedicated hydrogen

powered generator hire business with Speedy Hire

o 50:50 joint venture (JV) to be established

o Speedy Hire is the UK's leading tools and equipment hire

services company

o Initial commitment by joint venture of GBP2m in new H-Power

Generators

o Further orders expected in line with growing demand for zero

emission power across the UK

o Potential to become a significant UK hydrogen off-taker

leveraging further value

Operational highlights

-- S Series H-Power Tower & Generator :

o Completed production run of first 10 H-Power Towers for field

deployment and internal acceptance testing

o Design completed and ordering commenced for components of next

generation S Series 30kW H-Power Generator for completion this

year

o Appointment of consultants to support delivery of a scaled up

third party contract manufacturing strategy

-- S+ Series H-Power Generator :

o Design completed for 200kW H-Power Generator system

o c.850kW of new S+ Series fuel cell stacks (>100kW per

stack) already manufactured and ready for 200kW system integration

this year

o Ordering commenced for components of first 200kW S+ Series

liquid cooled fuel cell system

o 200kW system specification consistent with first ABB system

order with preparation for CE marking commenced

-- Ammonia cracker :

o Launch of AFC Energy's next generation ammonia cracker

technology platform

o Successfully produced first fuel cell grade hydrogen from

cracker reactor, demonstrating "Ammonia to Power" with AFC Energy

fuel cell integration

o Identified potential high-volume routes to market, with

partners, where the benefits of our novel technology are well

positioned

-- Hydrogen supply :

o Hydrogen offtake agreement with Air Products renewed (post

period end) at the Company's Stade facility in Northern Germany to

facilitate onsite factory acceptance testing of fuel cell systems

over the next five years

Financial highlights

-- Cash and cash equivalents at 30 April 2023 of GBP32.7m (30 April 2022: GBP48.6m)

-- Investment by ABB E-mobility in a further GBP2m in newly issued shares

-- Revenue of GBP0.2m (H1 2022: GBP0.3m)

-- Deferred revenue in respect of ABB contract at 30 April 2023

of GBP1.4m (30 April 2022: GBP2.0m)

-- Loss for the period of GBP6.3m (H1 2022: GBP7.8m)

-- R&D tax credit generated of GBP1.8m (H1 2022: GBP0.7m)

-- R&D credit receivable at 30 April 2023 of GBP4.8m (30 April 2022: GBP1.8m)

Outlook

-- Proposed launch of the Speedy Hire joint venture with initial H-Power Generator sales

-- Rental revenue from H-Power Towers (through Speedy Hire going

forwards) before transition to higher sales next financial year

-- Delivery of first next generation S Series H-Power Generator to ACCIONA during 2023

-- GBP/kW cost reduction, relative to H-Power Towers, of c.50%

given benefits of additional value engineering and scale

-- Complete manufacture during 2023 of first 200kW S+ H-Power

Generator (designed for ABB and subsequent CE marking)

-- Establish path to scaled contract manufacturing, with initial

system orders to be delivered from the Company's Dunsfold facility

in Surrey

-- Modular ammonia cracker system delivered for operation and

progression with prospective partners / customers of cracker

technology

-- Deliver the first scaled ammonia cracking test facility in the UK

Adam Bond, Chief Executive of AFC Energy, said:

"We continue to see an accelerated push to decarbonise hard to

abate sectors such as construction and temporary power and are

pleased to see this reflected in the traction we are receiving.

Clearly our focus must remain on delivery of our strategy of

initial customer deployments followed by cementing long term

collaborations with plant hire groups and, with our new partner

Speedy Hire in the UK, we now have a line of site to tangible

product sales and manufacturing scale up. The recently received

backing from the UK Government through our funding award, together

with the new targets in the displacement of diesel on construction

sites, creates a perfect backdrop for AFC Energy's success in the

UK."

-S-

AFC Energy plc +44 (0) 14 8327 6726

Adam Bond (Chief Executive Officer) investors@afcenergy.com

Peel Hunt LLP - Nominated Adviser and Joint

Broker

Richard Crichton / Tom Ballard / Georgia

Langoulant +44 (0) 207 418 8900

Zeus - Joint Broker

David Foreman / James Hornigold (Investment

Banking)

Dominic King (Corporate Broking) / Rupert

Woolfenden (Sales) +44 (0) 203 829 5000

FTI Consulting - Financial PR Advisors +44 (0) 203 727 1000

Ben Brewerton / Tilly Abraham / Dhruv Soni afcenergy@fticonsulting.com

About AFC Energy plc

AFC Energy plc is a leading provider of hydrogen fuel cell power

systems, both air cooled (S Series) and liquid cooled (S+ Series),

to generate clean energy in support of the global energy

transition. Based in the UK, the Company's scalable systems provide

off-grid, zero emission power that are already being deployed for

rapid electric vehicle charging and the replacement of diesel

generators for temporary power applications. AFC Energy is also

working with global partners in the deployment of products for the

Maritime, Ports, Data Centres and Rail industries, emphasising the

central role of its technology in the decarbonisation of global

industry.

Chief Executive's Statement

I am pleased to report that in the first half of 2023, AFC

Energy has continued to make progress across all areas of its

business as it seeks to provide a technically and commercially

viable alternative to the $20bn a year diesel generator market.

Government and industry, both in the UK and overseas, continue

to support the transition away from highly polluting diesel

combustion engines with several high-profile infrastructure

projects now targeting diesel free sites this decade.

"HS2 are building the world's most sustainable high-speed

railway and the goal is to reduce carbon emissions and achieve net

zero from 2035. Cutting the diesel HS2 use to power the vast

construction operations - and stopping using it completely - is

fundamental to our ambition." Extract from HS2 Website

Publicly, a lot of the work undertaken in H1 only became

apparent after the period end, such as our collaboration with the

UK's leading tools and equipment hire services business, Speedy

Hire. This agreement has taken many months to get to this

stage.

Our collaboration with Speedy Hire to launch a dedicated

hydrogen powered generator plant hire business, is now a key focus

for AFC Energy's growth strategy. The joint venture (JV) is

targeting incorporation this year with an initial order commitment

of GBP2m towards the purchase of AFC Energy's latest S Series

H-Power Generators.

Growth in generator orders from the JV will be in line with

expected growing demand for zero emission power across the UK;

however, with many tens of thousands of diesel generators currently

in operation on construction sites in the UK, this market alone

offers tremendous growth potential.

Delivery of this, together with other commercial partnerships

currently under development, is a tribute to the highly skilled and

motivated workforce at AFC Energy to which I'm extremely

grateful.

Fuel Cell Update

The first half of 2023 saw 8 new leased deployments of the

H-Power Tower on construction and off-grid sites, further

validating the technology and its operability in a range of

conditions. The high quality feedback received from these field

trials has now been collated and has facilitated several

improvements and upgrades for the next generation H-Power

Generator. The first of this new version will be delivered to

ACCIONA under a new six-month lease and sale option agreement later

this year.

The accelerated nature in which AFC Energy's technology team

have been able to reflect system upgrades, scaled the system to

30kW and reduced component pricing has been a true testament to

their commitment to commercialisation.

We are forecasting that the 30kW H-Power Generator, harmonised

to an external battery energy storage system, will be on site later

this year and, with its sizing reflecting where we believe the

immediate market demand for power needs on construction sites lies,

we are confident of further system orders.

The strategy of first approaching end user construction

companies for H-Power Generator demonstration, building up a

critical mass of interest in the technology, and then collaborating

with the plant hire industry has been proven with our new

partnership with Speedy Hire. We have been working with the

management of Speedy Hire for several months to develop the

principles of a joint venture, believing this model affords many

commercial benefits for both companies, with an optimised risk /

reward balance achieved under this model. Based on feedback from

our initial phase of field trial customers, many of whom are also

customers of Speedy Hire, we believe the market for a scalable,

targeted, zero emission, hydrogen fuelled generator offering in the

UK market is strong. The JV will provide a clear avenue in which

both Speedy Hire and AFC Energy can achieve scale and first mover

advantage in addressing the needs of this growth market. The

initial focus of this venture will be on the 30kW H-Power

Generator.

Importantly, the potential scale that collaborations like Speedy

Hire present also mean our buying power across the supply chain

improves, meaning better pricing in a fairly short order. We are

already seeing large cost discounts across key fuel cell and

balance of plant components achieved through scale and are

confident this, and other partnerships, will enable AFC Energy to

progress quicker down the cost curve for our customers.

The growth in system orders requires a focus on manufacturing

scale up. Over the past two years, AFC Energy has invested in its

UK facilities and is well positioned to deliver sufficient H-Power

Generators at its Dunsfold site to meet short term deployment

needs. However, the uplift in future order quantities from

collaborations such as that with Speedy Hire necessitates the

review of third-party contract models for system components,

sub-assemblies, and entire generator assembly. We have appointed

consultants well versed in the scale up of hydrogen fuel cell

technologies, to support us in developing our strategy, assessing

opportunities for scaling up with an emphasis on Germany, which

benefits from a more mature hydrogen sector and increased

availability of lower cost hydrogen. We look forward to providing

further detail on this in due course.

Over the past six months, we have also seen material progress in

the validation of the liquid cooled, higher power density S+ Series

fuel cell generators. This technology was first tested in Germany

in October 2022 as part of our collaboration with ABB, and

following the successful validation, multiple stacks, each more

than 100kW in nameplate capacity, are now on site in Dunsfold

awaiting integration into individual 200kW modules.

We remain confident of completing the first 200kW H-Power

Generator this year, subject to the timely delivery of all

components across the supply chain. Once completed, we plan to

commence the CE marking process to enable sales across Europe.

The emphasis of the business is now on the scaling up of H-Power

Generators, initially with a focus on the air cooled S Series,

where we believe the majority of the short term system demand lies

within our core target markets. With this in mind, the Company has

decided, in collaboration with Juelich, to cancel the contract

announced in 2020, for the sale of a 100kW L Series generator,

which if delivered, would now prove a distraction to the Company's

core technology and customer targets. Juelich confirmed it would

only expect to be in a position to receive any fuel cell system in

2024 and so, with the progression of AFC Energy's technology, cost

inflation and the delay to delivery, this was a mutual

decision.

Fuel Conversion Update

In March this year, we announced the launch of our next

generation ammonia cracking technology platform. For AFC Energy,

maritime was always regarded as a key target market due to its

growing emphasis on hydrogen carrier fuels such as ammonia. Indeed,

last year, the International Energy Agency confirmed its estimate

that up to 45% of the maritime fleet will be decarbonised through

the adoption of ammonia fuels.

For this reason, the development of an ammonia cracker was

always part of the technology development roadmap. However, the

accelerating global search for energy security and independence

means that the role of ammonia has become far more pronounced with

large volumes of clean ammonia contracted to be imported to Europe,

and Asia, from countries benefiting from low-cost hydrogen

production. This in turn has created a short-term opportunity to

position the Company's ammonia cracking technology to capitalise on

the immediacy of this demand.

Over the past six months, much testing and validation of the

Company's new cracker technology has been carried out, validating

the performance of the system and enabling progress towards a fully

working modular reactor core. Longevity testing of reactors has

continued to build operational hours with limited, if any, evidence

of strain on materials.

The reactor has a number of commercialisation opportunities,

both as a cracker to make hydrogen within a combustion engine

architecture, which is something we are speaking to engine

manufacturers about, through to hydrogen refuelling infrastructure

to support the decarbonisation of transport, namely trucks and

heavy-duty transport where "traditional" hydrogen refuelling

infrastructure is not feasible.

We continue to explore a number of these use cases that are

generated through our core cracker technology and expect to be

making further progress with partners towards demonstrations later

this year. Firstrevenue from the cracker is not expected before

2025.

ABB E-mobility

On 28 March 2023, after internal analysis following the trials

in October 2022, ABB E-mobility confirmed that AFC Energy had

successfully validated the first S+ Series liquid cooled fuel cell

stacks. Operating in parallel, the initial stacks provided a 100kW

nameplate rating. As a result of this, the Sale and Development

Agreement, signed on 15 November 2021, was revised such that:

- ABB will have a pre-agreed discount, to be spread over the

purchases of the first ten fuel cell systems, the first of which

would be purchased under the revised contract, with the subsequent

nine at ABB's option; and

- The payment of the remaining GBP2.0m, of the GBP4.0m, to be

used for the purchase of issued shares in AFC Energy.

The GBP2.0m balance, was received on 5 April 2023 and the shares

issued shortly thereafter. The shares are of the same class and

have the same voting rights as those already in issue. The cash

value to AFC Energy of the original contract therefore remains

unchanged at GBP4.0m. Payment for the first, and subsequent 200kW

S+ Series H-Power Generators would be in addition to the

GBP4.0m.

Financial update

We recognised revenue in the period of GBP0.2m (H1 2022:

GBP0.3m). GBP0.1m of this revenue was generated by the last race in

the Extreme-E five-race series, with the balance coming from

rentals of the H-Power Towers to customers including: Keltbray and

Kier.

Operating costs of GBP8.2m (H1 2022: GBP8.8m) were predominantly

incurred in respect of qualifying R&D activities and generated

an R&D credit for the period of GBP1.8m (H1 2022: GBP0.7m), as

set out in the table below:

Qualifying R&D expenditure GBP'm

* Materials 1.6

* Payroll 3.0

* Other 0.7

---------------------------- ------

5.3

Non-qualifying expenditure 2.9

---------------------------- ------

8.2

---------------------------- ------

R&D credit 1.8

---------------------------- ------

In keeping with the Company's changing status from research to

development to commercialisation, operating costs are stated after

deduction of GBP0.2m in respect of capitalised development costs

for the S Series H-Power Generator. This is the first time such

costs have been capitalised by the Company.

The GBP2.0m receipt from ABB and GBP1.0m receipt from R&D

credits in respect of the 2021 financial year meant that the

Company finished the year with a cash balance of GBP32.7m, in line

with the expected cash burn for overheads of about GBP1.1m per

month (based on GBP6.8m over six-months). A summary of the cash

flow is set out within the table below:

GBP'm

Net loss before tax (8.0)

Non-cash items 1.2

-------------------------- ------

(6.8)

R&D credits received 1.0

Working capital movement (2.3)

-------------------------- ------

(8.1)

Investing activities (1.1)

Financing activities 1.7

(7.5)

Opening cash 40.2

-------------------------- ------

32.7

-------------------------- ------

The cash position at 30 June 2023 was GBP30.4m with monthly cash

burn expected to increase towards GBP1.5m per month (before

reimbursements under the grant) as the company scales up for

delivery of the S Series H-Power Generators for the grant, ACCIONA

and Speedy Hire.

Outlook

We remain extremely optimistic over the outlook for the hydrogen

economy and AFC Energy's role in it. Material funding continues to

be allocated by both Governments and the private sector and we now

are seeing the fruits of that investment.

For AFC Energy, the focus for the remainder of this year is to

make the first delivery of the next generation H-Power Generators,

with a particular focus on fulfilling market demand from Speedy

Hire in the UK and ACCIONA in Spain. We are confident that we are

on track to deliver on these commitments, thereby underpinning our

revenue targets for next year.

The remainder of this financial year will see continued rental

revenue from H-Power Towers (via Speedy Hire) and hydrogen sales

into those sites, before the transition to a larger sales-based

revenue model through our relationship with Speedy Hire and other

potential distributors, dealers and plant hire businesses

overseas.

The continued execution of our strategy to deliver a zero

emission, hydrogen fuelled generator to displace diesel continues

to align very well with industry projections and commitments and so

it is important to capitalise on these opportunities with short

term focus on market penetration and deployments.

We will continue to deliver on our manufacturing strategy

highlighting progress with potential third-party contract

manufacturers who can support our ambitious scale up targets.

Further evidence of a scaled up, modular ammonia cracker

technology is also forecast over the next six months, highlighting

the potential value AFC Energy has not just in fuel cell

technology, but also hydrogen generation - each a huge addressable

market in their own right.

STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 April 2023

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

Note 2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

--------------------------------- ------- ----------- ----------- ------------

Revenue from customer

contracts 3 201 276 582

Cost of sales (164) (251) (467)

--------------------------------- ------- ----------- ----------- ------------

Gross income 37 25 115

Other income 13 - 22

Operating costs 4 (8,209) (8,627) (19,749)

--------------------------------- ------- ----------- ----------- ------------

Operating loss (8,159) (8,602) (19,612)

--------------------------------- ------- ----------- ----------- ------------

Finance cost 5 (42) (25) (19)

Bank interest receivable 5 184 84 143

--------------------------------- ------- ----------- ----------- ------------

Loss before tax (8,017) (8,543 ) (19,488)

--------------------------------- ------- ----------- ----------- ------------

Taxation 6 1,765 745 3,042

--------------------------------- ------- ----------- ----------- ------------

Loss for the financial

period and total comprehensive

loss attributable to

owners of the Company (6,252) (7,798) (16,446)

--------------------------------- ------- ----------- ----------- ------------

Basic loss per share 7 (0.85) (1.06)p (2.24)p

Diluted loss per share 7 (0.85) (1.06)p (2.24)p

--------------------------------- ------- ----------- ----------- ------------

All amounts relate to continuing operations. There were no items

of other comprehensive income during the period.

The above unaudited statement of profit and loss should be read

in conjunction with the accompanying notes.

STATEMENT OF FINANCIAL POSITION

As at 30 April 2023

30 April 30 April 31 October

2023 2022 2022

Note GBP000 GBP000 GBP000

Unaudited Unaudited Audited

--------------------------- ------- ----------- ----------- -----------

Assets

Non-current assets

Intangible assets 8 496 890 311

Right-of-use assets 9 1,353 733 976

Tangible fixed assets 10 3,761 3,197 3,282

--------------------------- ------- ----------- ----------- -----------

5,610 4,820 4,569

--------------------------- ------- ----------- ----------- -----------

Current assets

Inventory 43 668 43

Receivables 11 2,892 935 1,160

Income tax receivable 4,815 1,778 4,075

Cash and cash equivalents 32,736 48,578 40,220

Restricted cash 612 612 612

--------------------------- ------- ----------- ----------- -----------

41,098 52,571 46,110

--------------------------- ------- ----------- ----------- -----------

Total assets 46,708 57,391 50,679

--------------------------- ------- ----------- ----------- -----------

Current liabilities

Payables 12 (3,084) (3,920) (3,644)

Lease liabilities (478) (266) (298)

--------------------------- ------- ----------- ----------- -----------

(3,562) (4,186) (3,942)

--------------------------- ------- ----------- ----------- -----------

Non-current liabilities

Lease liabilities (847) (490) (698)

Provisions (301) (400) (301)

--------------------------- ------- ----------- ----------- -----------

(1,148) (890) (999)

--------------------------- ------- ----------- ----------- -----------

Total liabilities (4,710) (5,076) (4,941)

--------------------------- ------- ----------- ----------- -----------

Total net assets 41,998 52,315 45,738

--------------------------- ------- ----------- ----------- -----------

Capital and reserves

attributable to owners

of the Company

Share capital 745 735 735

Share premium 118,477 116,457 116,487

Other reserve 4,585 2,673 4,073

Retained deficit (81,809) (67,550) (75,557)

--------------------------- ------- ----------- ----------- -----------

Total equity attributable

to shareholders 41,998 52,315 45,738

--------------------------- ------- ----------- ----------- -----------

The above unaudited statement of financial position should be

read in conjunction with the accompanying notes.

STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 April 2023

Share Share Other Retained

capital premium reserve loss Total

GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- --------- --------- --------- ---------

Balance at 1 November 2022 735 116,487 4,073 (75,557) 45,738

Loss after tax for the period - - - (6,252) (6,252)

-------------------------------------- --------- --------- --------- --------- ---------

Total comprehensive income - - - (6,252) (6,252)

Issue of equity shares 10 1,990 - - 2,000

Exercise of share options

Equity settled share-based

payments

* Charged in the period - - 512 - 512

-------------------------------------- --------- --------- --------- --------- ---------

Total transactions with shareholders 10 1,990 512 - 2,512

-------------------------------------- --------- --------- --------- --------- ---------

Balance at 30 April 2023 745 118,477 4,585 (81,809) 41,998

-------------------------------------- --------- --------- --------- --------- ---------

For the six months ended 30 April 2022

Share Share Other Retained

capital premium reserve loss Total

GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- --------- --------- --------- ---------

Balance at 1 November 2021 734 116,448 2,456 (59,752) 59,886

Loss after tax for the period - - - (7,798) (7,798)

-------------------------------------- --------- --------- --------- --------- ---------

Total comprehensive income - - - (7,798) (7,798)

Issue of equity shares 1 9 - - 10

Exercise of share options

Equity settled share-based

payments

* Charged in the period - - 217 - 217

-------------------------------------- --------- --------- --------- --------- ---------

Total transactions with shareholders 1 9 217 - 227

-------------------------------------- --------- --------- --------- --------- ---------

Balance at 30 April 2022 735 116,457 2,673 (67,550) 52,315

-------------------------------------- --------- --------- --------- --------- ---------

For the year ended 31 October 2022

Share Share Other Retained

capital premium reserve loss Total

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------------------- --------- --------- --------- --------- ---------

Balance at 1 November 2021 734 116,448 2,456 (59,752) 59,886

Loss after tax for the year - - - (16,446) (16,446)

----------------------------------------------- --------- --------- --------- --------- ---------

Total comprehensive income - - - (16,446) (16,446)

Issue of equity shares 1 39 - - 40

Exercise of share options

Equity settled share-based

payments

* Lapsed or exercised in the period - - (641) 641 -

* Charged in the period - - 1,682 - 1,682

Fair value of warrants accounted

for as equity - - 576 - 576

----------------------------------------------- --------- --------- --------- --------- ---------

Total transactions with shareholders 1 39 1,617 641 2,258

----------------------------------------------- --------- --------- --------- --------- ---------

Balance at 31 October 2022 735 116,487 4,073 (75,557) 45,738

----------------------------------------------- --------- --------- --------- --------- ---------

The above unaudited statements of changes in equity should be

read in conjunction with the accompanying note.

CASH FLOW STATEMENT

For the six months ended 30 April 2022

30 April 30 April 31 October

2023 2022 2022

Note GBP000 GBP000 GBP000

Unaudited Unaudited Audited

------------------------------ ------- ----------- ----------- -----------

Cash flows from operating

activities

Loss before tax for the

period (8,017) (8,543) (19,488)

Adjustments for:

Amortisation of intangible

assets 8 34 61 473

Impairment of intangible

assets 8 - - 294

Depreciation of right

of use asset 9 229 151 379

Depreciation of tangible

assets 10 578 559 994

Impairment of tangible

assets 10 - - 255

Loss on disposal of tangible

assets 10 - - 126

Equity-settled share-based

payment expenses 512 217 1,682

Interest received 5 (184) (84) (143)

Lease finance charges 5 35 15 33

------------------------------ ------- ----------- ----------- -----------

Cash flows from operating

activities before changes

in working capital and

provisions (6,813) (7,624) (15,395)

R&D tax credits received 1,025 549 546

Increase/(decrease) in

inventory - (7) 618

(Increase)/decrease in

other receivables (2,153) 79 (145)

Increase/(decrease) in

payables (141) 2,224 1,948

Increase/(decrease) in

provision - (253) (353)

------------------------------ ------- ----------- ----------- -----------

Cash absorbed by operating

activities (8,082) (5,032) (12,781)

Cash flows from investing

activities

Purchase of plant and

equipment 10 (1,057) (1,488) (2,388)

Additions to intangible

assets 8 (218) (205) (334)

Interest received 5 184 84 151

------------------------------ ------- ----------- ----------- -----------

Net cash absorbed by

investing activities (1,091) (1,609) (2,571)

Cash flows from financing

activities

Proceeds from the issue 2,000 - -

of share capital

Proceeds from the exercise

of options - 9 40

Proceeds from the grant

of warrants - - 576

Lease payments (276) (150) (381)

Lease interest paid 5 (35) (15) (38)

------------------------------ ------- ----------- ----------- -----------

Net cash from financing

activities 1,689 (156) 197

Net decrease in cash

and cash equivalents (7,484) (6,796) (15,155)

Cash and cash equivalents

at start of period 40,220 55,375 55,375

------------------------------ ------- ----------- ----------- -----------

Cash and cash equivalents

at end of period 32,736 48,578 40,220

------------------------------ ------- ----------- ----------- -----------

The above unaudited statement of cash flows should be read in

conjunction with the accompanying note.

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

Details of the significant accounting policies are set out

below.

a) Basis of preparation

These interim results for the six-months ended 30 April 2023 are

unaudited. They have been prepared in accordance with IAS 34

'Interim Financial Reporting' in conformity with Companies Act

2006. These interim results have been drawn up using the accounting

policies and presentation consistent with those disclosed and

applied in the annual report and accounts for the year ended 31

October 2022. The comparative information contained in the report

does not constitute the accounts within the meaning of section 435

of the Companies Act 2006.

A number of new or amended standards became applicable for the

current reporting period. The Company did not have to change its

accounting policies or make retrospective adjustments as a result

of adopting these standards.

These interim results have been prepared on a going concern

basis notwithstanding the trading losses being carried forward and

the expectation that trading losses will continue for the near

future as the company transitions from research and development to

commercial operations.

The directors are required to assess whether it is appropriate

prepare these interim results on a going concern basis. In making

this assessment the directors need to be satisfied that the company

can meet its obligations as they fall due for at least 12 months

from the date of this report.

The directors make their assessment based on a cash flow model

prepared by management which sets out expected cash flows through

to 31 October 2024. Extending the period beyond the minimum 12

months from the date of this report provides additional comfort

when making the assessment.

Downside sensitivities have been applied to the cash flows

primarily related to an overspend of product development costs (for

both materials and labour) and an under-recovery of R&D tax

credits.

Having concluded that the company remains a going concern, these

interim results have therefore been prepared on that basis.

2. SEGMENTAL ANALYSIS

Operating segments are determined by the chief operating

decision maker based on information used to allocate the Company's

resources. The information as presented to internal management is

consistent with the statement of comprehensive income. It has been

determined that there is one operating segment, which researches

and develops fuel cell and fuel conversion technologies. In the

period to 30 April 2023, the Company operated mainly in the United

Kingdom. All non-current assets are in the United Kingdom.

3. REVENUE

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

----------------------- ----------- ----------- ------------

Rendering of services

earned over time

Rental 133 107 225

Other revenue 68 169 357

----------------------- ----------- ----------- ------------

Revenue 201 276 582

----------------------- ----------- ----------- ------------

Being

Cah consideration 129 82 367

Consideration in kind 72 194 215

----------------------- ----------- ----------- ------------

Revenue 201 276 582

----------------------- ----------- ----------- ------------

The consideration in kind related to marketing services received

from the customer and fair valued in accordance with the contract.

The fair value was expressly quantified in the contract and agreed

by both parties.

4. OPERATING COSTS

The operating costs consist of:

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

------------------------------- ----------- ----------- ------------

Materials 1,502 2,788 5,105

Payroll (excluding directors) 3,078 1,483 4,907

4,580 4,271 10,012

Directors' costs 776 813 1,642

Other employment costs 463 655 1,047

Occupancy costs 368 972 772

Other administrative expenses 911 985 2,750

------------------------------- ----------- ----------- ------------

7,098 7,695 16,223

Amortisation of intangible

assets 34 62 474

Depreciation of Right of

Use assets 229 151 379

Depreciation of tangible

fixed assets 578 559 994

Less depreciation of rental

asset charged to cost of

sales (96) (112) (218)

Consideration in kind 72 194 215

Share based payments 512 217 1,682

Operating costs capitalised (218) - -

------------------------------- ----------- ----------- ------------

8,209 8,766 19,749

------------------------------- ----------- ----------- ------------

Occupancy costs include repairs and maintenance, utilities and

lease payments. For the six-months ended 30 April 2022, occupancy

costs included information technology costs, which have been

reclassified into administrative expenses to better reflect the

nature of the costs.

5. NET FINANCE INCOME

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

--------------------------- ----------- ----------- ------------

Lease interest (35) (15) (38)

Exchange rate differences - (9) 21

Bank charges (7) (1) (2)

--------------------------- ----------- ----------- ------------

Total finance cost (42) (25) (19)

--------------------------- ----------- ----------- ------------

Bank interest receivable 184 84 143

--------------------------- ----------- ----------- ------------

142 59 124

--------------------------- ----------- ----------- ------------

6. TAXATION

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

----------------------------- ----------- ----------- ------------

Recognised in the statement

of comprehensive income:

R&D tax credit - current

period 1,765 745 3,050

R&D tax credit - prior

year - - (8)

Total tax credit 1,765 745 3,042

----------------------------- ----------- ----------- ------------

7. LOSS PER SHARE

The calculation of the basic loss per share is based upon the

net loss after tax attributable to ordinary Shareholders and a

weighted average number of shares in issue for the period.

Six months Six months Year ended

ended ended 31 October

30 April 30 April 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

------------------------------ ----------- ----------- ------------

Basic loss per share (pence) 0.85 1.06p 2.24p

Diluted loss per share

(pence) 0.85 1.06p 2.24p

Loss attributable to equity

Shareholders GBP6,252 GBP7,798k 16,466k

------------------------------ ----------- ----------- ------------

Weighted average number

of shares in issue 736,732 734,500 734,745

------------------------------ ----------- ----------- ------------

Diluted earnings per share:

There are share options and warrants outstanding as at 30 April

2023 which, if exercised, would increase the number of shares in

issue. However, the diluted loss per share is the same as the basic

loss per share, as the loss for the period has an anti-dilutive

effect.

8. INTANGIBLE ASSETS

D evelopment C ommercial Intangible

costs P atents rights assets

GBP000 GBP000 GBP000 GBP000

-------------------------- ------------- ----------- ------------ -----------

Cost

As at 1 November 2022 229 1,220 121 1,570

Additions 2 18 1 - 219

D isposal (229) - - (229)

-------------------------- ------------- ----------- ------------ -----------

As at 30 April 2023 218 1,221 121 1,560

-------------------------- ------------- ----------- ------------ -----------

Amortisation

As at 1 November 2022 229 979 51 1,259

Charge for the financial

period - 22 12 34

D isposal (229) - - (229)

-------------------------- ------------- ----------- ------------ -----------

As at 30 April 2023 - 1,001 63 1,064

-------------------------- ------------- ----------- ------------ -----------

Net book value

As at 1 November 2022 - 241 70 311

As at 30 April 2023 218 219 58 496

-------------------------- ------------- ----------- ------------ -----------

D evelopment C ommercial Intangible

costs P atents rights assets

GBP000 GBP000 GBP000 GBP000

-------------------------- ------------- ----------- ------------ -----------

Cost

As at 1 November 2021 229 886 121 1,236

Additions - 206 - 334

-------------------------- ------------- ----------- ------------ -----------

As at 30 April 2022 229 1,092 121 1,442

-------------------------- ------------- ----------- ------------ -----------

Amortisation

As at 1 November 2021 74 384 33 491

Charge for the financial

period 0 14 47 61

-------------------------- ------------- ----------- ------------ -----------

As at 30 April 2022 74 398 80 552

-------------------------- ------------- ----------- ------------ -----------

Net book value

As at 1 November 2021 155 504 88 747

As at 30 April 2022 155 694 41 890

-------------------------- ------------- ----------- ------------ -----------

D evelopment C ommercial Intangible

costs P atents rights assets

GBP000 GBP000 GBP000 GBP000

----------------------- ------------- ----------- ------------ -----------

Cost

As at 1 November 2021 229 886 121 1,236

Additions - 334 - 334

----------------------- ------------- ----------- ------------ -----------

As at 31 October 2022 229 1,220 121 1,570

----------------------- ------------- ----------- ------------ -----------

Amortisation

As at 1 November 2021 74 384 33 491

Charge for the year 34 422 18 474

Impairment charge 121 173 - 294

----------------------- ------------- ----------- ------------ -----------

As at 31 October 2022 229 979 51 1,259

----------------------- ------------- ----------- ------------ -----------

Net book value

As at 1 November 2021 155 504 88 747

As at 31 October 2022 - 241 70 311

----------------------- ------------- ----------- ------------ -----------

9. RIGHT-OF-USE ASSETS

Buildings

GBP000

-------------------------- ----------

Cost

As at 1 November 2022 1,885

Additions 606

Disposals ( 476)

----------------------------- ----------

As at 30 April 2023 2,009

----------------------------- ----------

Depreciation

As at 1 November 2022 909

Charge for the financial

period 229

Disposals ( 476)

----------------------------- ----------

As at 30 April 2023 662

----------------------------- ----------

Net book value

As at 1 November 2022 976

As at 30 April 2023 1,353

----------------------------- ----------

Buildings

GBP000

-------------------------- ----------

Cost

As at 1 November 2021 1,415

Additions -

-------------------------- ----------

As at 30 April 2022 1,415

----------------------------- ----------

Depreciation

As at 1 November 2021 531

Charge for the financial

period 151

----------------------------- ----------

As at 30 April 2022 682

----------------------------- ----------

Net book value

As at 1 November 2021 884

As at 30 April 2022 733

----------------------------- ----------

Buildings

GBP000

----------------------- ----------

Cost

As at 1 November 2021 1,415

Additions 470

-------------------------- ----------

As at 31 October 2022 1,885

-------------------------- ----------

Depreciation

As at 1 November 2021 530

Charge for the year 379

As at 31 October 2022 909

-------------------------- ----------

Net book value

As at 1 November 2021 884

As at 31 October 2022 976

-------------------------- ----------

10.tangible fixed ASSETS

Fixtures,

fittings

Leasehold Decommissioning and Motor Demonstration

Improvements Asset equipment vehicles equipment Subtotal

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2022 2,570 300 1,581 18 504 4,973

Additions - - 32 32 - 64

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2023 2,570 300 1,613 50 504 5,037

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2022 746 285 1,327 18 334 2,710

Charge for the

financial period 303 5 79 - 23 410

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2023 1,049 290 1,406 18 357 3,120

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2022 1,824 15 254 - 170 2,263

As at 30 April

2023 1,521 10 207 32 147 1,917

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Manu-

facturing Assets

Rental Computer and test under

Subtotal asset equipment stands construction Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2022 4,973 703 318 438 406 6,838

Additions 64 - 9 - 984 1,057

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2023 5,037 703 327 438 1,390 7,895

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2022 2,710 504 157 185 - 3,556

Charge for the

financial period 410 96 46 26 - 578

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2023 3,120 600 203 211 - 4,134

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2022 2,263 199 161 253 406 3,282

As at 30 April

2023 1,917 103 124 227 1,390 3,761

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

The company has set up a decommissioning asset for the estimated

cost of removing the plant and equipment installed at the Stade

site in Germany. Having renewed the Stade hydrogen offtake

agreement for a further five-years, from January 2023, no decision

has been taken as to when the site might be decommissioned.

GBP1.2m of the assets under construction relate to leasehold

improvement work concluded following the end of the six-month

period.

Fixtures,

fittings

Leasehold Decommissioning and Motor Demonstration

Improvements Asset equipment vehicles equipment Subtotal

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2021 958 300 1,340 18 622 3,258

Additions 1,100 - 350 - - 1,450

Disposals - - - - (118) (118)

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2022 2,058 300 1,690 18 504 4,570

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2021 302 265 1,244 18 198 2,027

Charge for the

financial period 145 10 33 - 105 293

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2022 447 275 1,277 18 303 2,320

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2021 655 35 96 - 424 1,211

As at 30 April

2022 1,611 25 413 - 201 2,250

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Manu-

facturing Assets

Rental Computer and test under

Subtotal asset equipment stands construction Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2021 3,258 703 199 436 - 4,576

Additions 1,450 - 64 - - 1,514

Disposals (118) - - - - (118)

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2022 4,570 703 263 436 - 5,972

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2021 2,027 98 86 96 - 2,307

Charge for the

financial period 293 111 26 38 - 468

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

As at 30 April

2022 2,320 209 112 134 - 2,775

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2021 1,211 605 113 340 - 2,269

As at 30 April

2022 2,250 494 151 302 - 3,197

------------------- -------------- ---------------- ----------- ----------- -------------- ---------

Fixtures,

fittings

Leasehold Decommissioning and Motor Demonstration

Improvements Asset equipment vehicles equipment Subtotal

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2021 958 300 1,340 18 622 3,258

Additions 1,620 - 241 - - 1,861

Disposals (8) - - - (118) (126)

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

As at 31 October

2022 2,570 300 1,581 18 504 4,973

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2021 302 265 1,244 18 198 2,027

Charge for the

year 444 20 83 - 69 616

Impairment - - - - 67 67

As at 31 October

2022 746 285 1,327 18 334 2,710

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2021 655 35 96 - 424 1,211

As at 31 October

2022 1,824 15 254 - 170 2,263

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Manu-

facturing Assets

Rental Computer and test under

Subtotal asset equipment stands construction Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Cost

As at 1 November

2021 3,258 703 199 436 - 4,576

Additions 1,861 - 119 2 406 2,388

Disposals (126) - - - - (126)

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

As at 31 October

2022 4,973 703 318 438 406 6,838

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Depreciation

As at 1 November

2021 2,027 98 86 96 - 2,307

Charge for the

year 616 218 71 89 - 994

Impairment 67 188 - - - 255

As at 31 October

2022 2,710 504 157 185 - 3,556

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

Net book value

As at 1 November

2021 1,211 605 113 340 - 2,269

As at 31 October

2022 2,263 199 161 253 406 3,282

------------------ -------------- ---------------- ----------- ----------- -------------- ---------

11. RECEIVABLES

30 April 30 April 31 October

2023 2022 2022

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

------------------- ----------- ----------- -----------

Trade receivables 166 57 142

VAT receivables 1,110 - 401

Other receivables 844 565 303

Prepayments 772 313 314

2,892 935 1,160

------------------- ----------- ----------- -----------

There is no significant difference between the fair value of the

receivables and the values stated above. Of the GBP1.1m of VAT

receivables, GBP0.7m was received in May 2023.

The increase in other receivables is mainly due to the increase

in advance payments made to suppliers, as the value of materials

purchases increases.

12. PAYABLES

30 April 30 April 31 October

2023 2022 2022

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

------------------ ----------- ----------- -----------

Trade payables 986 770 445

Deferred revenue 1,424 2,177 1,600

Other payables 485 217 349

Accruals 189 756 1,250

3,084 3,920 3,644

------------------ ----------- ----------- -----------

The deferred revenue relates to non-refundable payments made

under the November 2021 ABB contract. As part of the renegotiation

of this contract in March 2023, it was agreed with ABB that this

balance would be earned evenly against pre-agreed discounts over

the sale of the first ten units to ABB. If these sales are not all

made within the pre-agreed time period then any residual balance

will be deemed earned by the company, as the payments are

non-refundable.

The GBP0.2m reduction in deferred revenue between 31 October

2022 and 30 April 2023 reflects the cancellation of the Juelich

contract.

13. PosT BALANCE SHEET EVENTS

On 18 July 2023, the company announced that it had renewed the

hydrogen offtake agreement at the Stade facility in Germany. The

contract is for a five-year period, from January 2023, with a

six-month notice period.

On 26 July 2023, the company announced that it had secured a UK

Government Grant of up to GBP4.3m in match funding.

On 27 July 2023, the company announced that it had appointed,

effective 1 August 2023, Duncan Neale as a non-executive director

and chair of the Audit Committee.

On 28 July 2023, the company announced the proposed launch of a

dedicated hydrogen powered generator plant hire business as a joint

venture with Speedy Hire plc.

14. PUBLICATION OF NON-STATUTORY ACCOUNTS

The financial information contained in this interim statement

does not constitute accounts as defined by the Companies Act 2006.

The financial information for the preceding period is based on the

statutory accounts for the year ended 31 October 2022. Those

accounts, upon which the auditors issued an unqualified opinion,

have been delivered to the Registrar of Companies.

Copies of the interim statement may be obtained from the Company

Secretary, AFC Energy PLC, Unit 71.4 Dunsfold Park, Cranleigh,

Surrey GU6 8TB, and can be accessed from the Company's website at

www.afcenergy.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR RMMJTMTJJBFJ

(END) Dow Jones Newswires

July 31, 2023 02:00 ET (06:00 GMT)

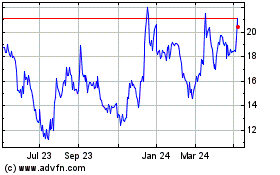

Afc Energy (LSE:AFC)

Historical Stock Chart

From Apr 2024 to May 2024

Afc Energy (LSE:AFC)

Historical Stock Chart

From May 2023 to May 2024