Monthly Update

September 16 2009 - 7:00AM

UK Regulatory

TIDMBTEM

RNS Number : 1640Z

British Empire Sec & Gen Tst PLC

16 September 2009

BRITISH EMPIRE SECURITIES AND GENERAL TRUST PLC

Investment Objective: To achieve capital growth through a focused portfolio of

investments,

particularly in companies whose share prices stand at a discount to estimated

net asset value.

Performance Commentary

This investment management report relates to performance figures as at 31 August

2009.

Over the month NAV was up 6.9%1. This compares to an increase of 5.8%1 in the

Benchmark2 and an increase of 6.0%1 for the MSCI World (GBP) index.

Financial year* to date, net asset value rose 11.2%1 compared to increases of

2.6%1 for the FundData IT Global Growth2 and 3.4%1 for the MSCI World (GBP)

indices.

Manager's Comment

Equity markets continued their upward trajectory, aided by accommodative

monetary policy; generally better economic news and reassuring earnings. Central

banks are keeping policy rates low and seeking to increase the money supply. As

long as the global economy remains subdued, the excess money is likely to find

its way into various asset markets. Very low interest rates on savings deposits

force investors into riskier investment in search of a return. Equities, in many

cases, have a reasonably high and sustainable dividend yield and are not

expensive by historical measures. Equities may be one of the better performing

asset classes in this low interest rate environment with the caveat that

investors will likely have to put up with a considerable amount of volatility.

Statistics

+---------------------+--------+-------+--------+--------+--------+

| | Value | % 1 |% 1 yr |% 3 yr |% 5 yr |

| | | mo | | | |

+---------------------+--------+-------+--------+--------+--------+

| Price (GBP)1 | 416.0 | 6.4 | -5.5 | -3.6 | 82.8 |

+---------------------+--------+-------+--------+--------+--------+

| Net Asset Value1 | 428.3 | 6.9 | -4.9 | 0.5 | 68.2 |

+---------------------+--------+-------+--------+--------+--------+

| Net Asset Value Total | 6.9 | -3.0 | 5.1 | 78.7 |

| Return1 | | | | |

+------------------------------+-------+--------+--------+--------+

| Benchmark1 (GBP) | | 5.8 | -10.2 | -0.4 | 47.6 |

+---------------------+--------+-------+--------+--------+--------+

| Annual Returns (%) | 2008 | 2007 | 2006 | 2005 | 2004 |

+---------------------+--------+-------+--------+--------+--------+

| Price1 | -22.3 | -2.8 | 0.3 | 51.7 | 36.0 |

+---------------------+--------+-------+--------+--------+--------+

| MSCI World1 | -17.4 | 7.7 | 5.8 | 23.0 | 7.2 |

+---------------------+--------+-------+--------+--------+--------+

1 Source: Fundamental Data. Share price total return is on a mid-to-mid basis,

with net income re-invested.

2 Fundamental Data Investment Trust Global Growth Index, official Benchmark from

1st October 2008

Top 10 Equity Holdings%

+-----------------------------+-------+

| Sofina | 4.95 |

+-----------------------------+-------+

| Jardine Strategic | 4.86 |

+-----------------------------+-------+

| Investor AB | 4.80 |

+-----------------------------+-------+

| GBL | 4.63 |

+-----------------------------+-------+

| Vivendi | 4.20 |

+-----------------------------+-------+

| Jardine Matheson | 4.17 |

+-----------------------------+-------+

| Electra | 2.99 |

+-----------------------------+-------+

| Paris Oréans | 2.71 |

+-----------------------------+-------+

| Aksigorta | 2.27 |

+-----------------------------+-------+

| Tupras | 2.25 |

+-----------------------------+-------+

| Total | 37.83 |

+-----------------------------+-------+

Capital Structure

+-------------------------------------+---------------+

| Ordinary Shares | 160,080,089 |

+-------------------------------------+---------------+

| 10 3/8% Debenture stock 2011 | GBP8,514,940 |

+-------------------------------------+---------------+

| 8 1/8% Debenture stock 2023 | GBP15,000,000 |

+-------------------------------------+---------------+

| Equities index unsecured loan stock | 2,635,996 |

| 2013** | |

+-------------------------------------+---------------+

** Updated annually

Gross Assets/Gearing

+-------------------------------------+------------+

| Gross Assets | GBP670 |

| | mil. |

+-------------------------------------+------------+

| Debt | GBP29.6 |

| | mil. |

+-------------------------------------+------------+

| Actual Gearing (Debt less cash | -15.6% |

| divided by net asset value) | |

+-------------------------------------+------------+

Fund Codes

+--------------------+-----------------------------+

| Bloomberg | Reuters Ticker / ISIN |

+--------------------+-----------------------------+

| BTEM | GB0001335081 |

+--------------------+-----------------------------+

Geographical Breakdown

+----------------------------------------+---------+

| Continental Europe | 41.3% |

+----------------------------------------+---------+

| Liquidity | 16.2% |

+----------------------------------------+---------+

| UK | 15.5% |

+----------------------------------------+---------+

| Asia Pacific | 11.4% |

+----------------------------------------+---------+

| Japan | 7.8% |

+----------------------------------------+---------+

| EMEA | 5.0% |

+----------------------------------------+---------+

| Canada / US | 2.8% |

+----------------------------------------+---------+

| | |

+----------------------------------------+---------+

Further Information

Investment Manager - John Pennink, AVI Ltd.

+44 20 7647 2900 info@assetvalueinvestors.com

The share price can be found under 'INVESTMENT COMPANIES' in The Financial

Times, The Times, The Daily Telegraph, The Scotsman and The Evening Standard.

*British Empire Securities & General Trust financial year commences on the 1st

of October.

** Last audited figure updated annually

# Book Values

Information may be found on the following websites.

www.british-empire.co.uk or www.assetvalueinvestors.com

Risk Factors you should consider before investing

Investment in the British Empire Securities and General Trust plc (the "Trust")

carries risks, which are more fully described in the Key Features Document.

Listed below are some of the key risks:

Investors are reminded that past performance is not a guide to future

performance and that their capital will be at risk and they may therefore lose

some or all of the amounts that they choose to invest in the Trust.

The Trust utilises gearing techniques (leverage) which exaggerate market

movements both down and up and which could mean sudden and large falls in market

value.

Movements in exchange rates can impact both the level of income received and the

capital value of your investment. If the currency of your residence strengthens

against the currency in which the underlying investments of the fund are made,

the value of your investment will reduce and vice versa.

As with all stock exchange investments the value of investment trust shares will

immediately fall by the difference between the buying and selling prices.

Where investments are made in emerging market, unquoted securities or smaller

companies, their potential volatility may increase the risk to the value of, and

the income from the investment.

British Empire Securities and General Trust plc, 54 St James's Street, London

SW1A 1JT, United Kingdom. Registered in England & Wales No: 28203

All figures as at 31 July 2009 unless otherwise stated. All sources Asset Value

Investors Ltd unless otherwise stated. Asset Value Investors Limited ("AVI") is

authorised and regulated by the Financial Services Authority ("FSA"). This

document does not constitute an offer to buy or sell shares in the British

Empire Securities and General Trust plc (the "Trust"). The contents of this

message are not intended to constitute, and should not be construed as,

investment advice. Potential investors in the Trust should seek their own

independent financial advice. AVI neither provides investment advice to, nor

receives and transmits orders from, investors in the Trust nor does it carry on

any other activities with or for such investors that constitute "MiFID or

equivalent third country business" for the purposes of the FSA's rules.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PFUCKAKPDBKDOCD

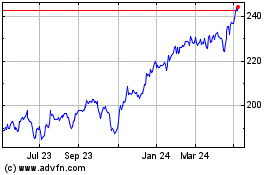

Avi Global (LSE:AGT)

Historical Stock Chart

From Dec 2024 to Jan 2025

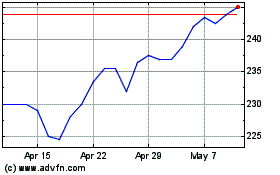

Avi Global (LSE:AGT)

Historical Stock Chart

From Jan 2024 to Jan 2025