TIDMARB

RNS Number : 7245B

Argo Blockchain PLC

06 June 2023

Press Release

6 June 2023

Argo Blockchain plc

("Argo" or "the Company")

Q1 2023 Results (Unaudited)

Argo Blockchain plc (LSE: ARB; NASDAQ: ARBK), a global leader in

cryptocurrency mining, is pleased to announce its unaudited

financial results for the quarter ended 31 March 2023. All $

amounts are in United States Dollars ("USD") unless otherwise

stated.

Q1 2023 Financial Results

-- The Company ended the quarter with $14.2 million of cash on

its balance sheet, along with 85 Bitcoin or Bitcoin Equivalent

(together, "BTC") in its HODL

-- Revenue of $11.4 million, an increase of 15% compared to Q4 2022

-- Net loss of $8.7 million

-- Adjusted EBITDA of $1.6 million

-- Total BTC mined in the quarter was 491, or 5.3 BTC per day

-- Mining margin percentage for the quarter was 49%, an increase

from a 35% mining margin percentage in Q4 2022

-- Reduced operating costs and expenses by 70% compared to the

quarterly average in the second half of 2022

-- Reduced finance costs by 63% compared to the quarterly average in the second half of 2022

Management Commentary

Seif El-Bakly, Interim Chief Executive Officer of Argo, said:

"The Argo team is moving ahead with a focus on financial

discipline, operational excellence, and growth and strategic

partnerships. To support these initiatives, we recently

strengthened our finance team and appointed Jim MacCallum, CPA, CFA

as Chief Financial Officer."

"In terms of financial discipline, we are taking a much more

critical view of all operating expenses, and we've implemented a

robust internal process aimed at reducing non-mining operating

expenses. Compared to 2022, we've reduced our expenses by 70%. We

are also evaluating options to strengthen our balance sheet."

During the first quarter, Argo successfully transitioned the

Helios facility to Galaxy Digital. In addition, the average all-in

price of power and hosting was lower than the previous guidance of

$0.05 - $0.055 per kilowatt-hour for the quarter.

Moving forward, Argo expects to receive and install "BlockMiner"

machines later this year at its Quebec facilities. This is expected

to increase the Company's total hashrate to approximately 2.8

EH/s.

Earnings Conference Call

Argo will host a conference call to discuss its results at 10:00

ET / 15:00 BST today, Tuesday 6 June 2023. The live webcast of the

call can be accessed via the Investor Meet Company platform.

Investors can sign up to Investor Meet Company and add Argo

Blockchain via the following link:

https://www.investormeetcompany.com/argo-blockchain-plc/register-investor

Investors already following Argo Blockchain on the Investor Meet

Company platform will be invited automatically.

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's current

views, interpretations, beliefs or expectations with respect to the

Company's financial performance, business strategy and plans and

objectives of management for future operations. These statements

include forward-looking statements both with respect to the Company

and the sector and industry in which the Company operates.

Statements which include the words "remains confident", "expects",

"intends", "plans", "believes", "projects", "anticipates", "will",

"targets", "aims", "may", "would", "could", "continue", "estimate",

"future", "opportunity", "potential" or, in each case, their

negatives, and similar statements of a future or forward-looking

nature identify forward-looking statements. All forward-looking

statements address matters that involve risks and uncertainties

because they relate to events that may or may not occur in the

future, including the risk that the Company may receive the

benefits contemplated by its transactions with Galaxy, the Company

may be unable to secure sufficient additional financing to meet its

operating needs, and the Company may not generate sufficient

working capital to fund its operations for the next twelve months

as contemplated. Forward-looking statements are not guarantees of

future performance. Accordingly, there are or will be important

factors that could cause the Company's actual results, prospects

and performance to differ materially from those indicated in these

statements. In addition, even if the Company's actual results,

prospects and performance are consistent with the forward-looking

statements contained in this document, those results may not be

indicative of results in subsequent periods. These forward-looking

statements speak only as of the date of this announcement. Subject

to any obligations under the Prospectus Regulation Rules, the

Market Abuse Regulation, the Listing Rules and the Disclosure and

Transparency Rules and except as required by the FCA, the London

Stock Exchange, the City Code or applicable law and regulations,

the Company undertakes no obligation publicly to update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. For a more complete

discussion of factors that could cause our actual results to differ

from those described in this announcement, please refer to the

filings that Company makes from time to time with the United States

Securities and Exchange Commission and the United Kingdom Financial

Conduct Authority, including the section entitled "Risk Factors" in

the Company's Annual Report on Form 20-F.

Non-IFRS Measures

Bitcoin and Bitcoin Equivalent Mining Margin and Adjusted EBITDA

are financial measures not defined by IFRS. We believe Bitcoin and

Bitcoin Equivalent Mining Margin and Adjusted EBITDA have

limitations as analytical tools. In particular, Bitcoin and Bitcoin

Equivalent Mining Margin excludes the depreciation of mining

equipment and so does not reflect the full cost of our mining

operations, and it also excludes the effects of fluctuations in the

value of digital currencies and realized losses on the sale of

digital assets, which affect our IFRS gross profit. Further,

Adjusted EBITDA removes such effects of our capital structure,

asset base and tax consequences, but additionally excludes any

unrealized foreign exchange gains or losses, stock-based

compensation charges and other one-time impairments and costs that

are not expected to be repeated in order to provide greater insight

into the cash flow being produced from our operating business,

without the influence of extraneous events. These measures should

not be considered as an alternative to gross margin or net

income/(loss), as applicable, determined in accordance with IFRS,

or other IFRS measures. These measures are not necessarily

comparable to similarly titled measures used by other companies. As

a result, you should not consider these measures in isolation from,

or as a substitute analysis for, our gross margin or net

income/(loss), as applicable, as determined in accordance with

IFRS.

GROUP STATEMENT OF COMPREHENSIVE INCOME

Figures in '000 except per Three Months Ended March 31, Three Months Ended March 31, Six Months

share 2023 2022 Ended December

31, 2022

-------------------------------- -------------------------------- -------------------------------- ----------------

$ $ $

-------------------------------- -------------------------------- -------------------------------- ----------------

Revenues 11,438 19,515 24,979

Direct costs (5,799) (4,596) (16,647)

-------------------------------- -------------------------------- -------------------------------- ----------------

Mining margin 5,639 14,919 8,332

Depreciation of mining

equipment (6,116) (6,961) (6,887)

Change in fair value of digital

currencies (79) (6,039) (1,502)

Gross profit (loss) (556) 1,919 (57)

-------------------------------- -------------------------------- -------------------------------- ----------------

Operating costs and expenses (4,054) (4,173) (21,300)

Restructuring (806) - (11,593)

Foreign exchange 1,300 5,705 8,444

Depreciation/amortisation (323) (205) (7,295)

Share based compensation (958) (1,423) (2,553)

Operating profit (loss) (5,397) 1,823 (34,354)

-------------------------------- -------------------------------- -------------------------------- ----------------

Fair value gain/(loss) of

investments - (174) (53)

Fair value revaluation of - 2,742 -

contingent

consideration

Loss on sale of subsidiary and

investment - - (54,325)

Loss on disposal of fixed

assets - - (22,702)

Finance costs (3,313) (2,442) (17,945)

Other income - - 3,641

Impairment of tangible fixed

assets - - (54,574)

Impairment of intangible assets - - (5,038)

Equity accounted loss from

associate - - (5,298)

Profit/(loss) before taxation (8,710) 1,949 (190,648)

-------------------------------- -------------------------------- -------------------------------- ----------------

Tax credit / (expense) - 117 (7,284)

Profit/(loss) after taxation (8,710) 2,066 (197,932)

-------------------------------- -------------------------------- -------------------------------- ----------------

Other comprehensive income

Items which may be subsequently

reclassified to profit or loss:

Currency translation

reserve - (17,170) 9,544

Total other comprehensive

income

(loss), net of tax - (17,170) 9,544

-------------------------------- -------------------------------- -------------------------------- ----------------

Total comprehensive loss

attributable

to the equity holders of the

Company (8,710) (15,104) (188,387)

-------------------------------- -------------------------------- -------------------------------- ----------------

Earnings per share attributable

to equity owners

Basic earnings/(loss) per share $(0.018) $0.004 $(0.414)

Diluted earnings/(loss) per

share $(0.018) $0.004 $(0.414)

The income statement has been prepared on the basis that all

operations are continuing operations.

GROUP STATEMENT OF FINANCIAL POSITION

As at

March 31, December

31, 2022

2023

----------------------------------- ----------- --- ----------

Figures in '000 $ $

----------------------------------- ----------- --- ----------

ASSETS

Non-current assets

Investments at fair value through

profit or loss 417 414

Investments accounted for using

the equity method 2,933 2,863

Intangible fixed assets 2,106 2,103

Property, plant and equipment 71,106 76,991

Right of use assets 525 525

Total non-current assets 77,087 82,896

----------------------------------- ----------- --- ----------

Current assets

Cash and cash equivalents 14,244 20,092

Trade and other receivables 7,652 6,802

Digital assets 20 443

Total current assets 21,916 27,337

----------------------------------- ----------- --- ----------

Total assets 99,003 110,233

----------------------------------- ----------- --- ----------

EQUITY AND LIABILITIES

Equity

Share Capital 590 576

Share Premium 177,541 173,334

Share based payment reserve 9,358 8,201

Currency translation reserve 1,339 2,132

Accumulated surplus / (deficit) (183,344) (170,495)

----------------------------------- ----------- --- ----------

Total equity 5,484 13,748

----------------------------------- ----------- --- ----------

Current liabilities

Trade and other payables 7,504 10,021

Loans and borrowings 12,499 11,605

Deferred tax 2,165 2,647

Lease liability 5 5

----------------------------------- ----------- --- ----------

Total current liabilities 22,173 24,278

----------------------------------- ----------- --- ----------

Non-current liabilities

Deferred tax 8,134 7,942

Issued debt - bond 37,824 37,809

Loans 24,848 25,916

Lease liability 540 540

Total liabilities 93,519 96,485

----------------------------------- ----------- --- ----------

Total equity and liabilities 99,003 110,233

----------------------------------- ----------- --- ----------

GROUP STATEMENT OF CASH FLOWS

For the three months ended 31 March

2023

Figures in '000 $

----------------------------------------- --------

Cash flows from operating activities

Loss before tax (8,710)

Adjustments for:

Depreciation/Amortisation 6,439

Foreign exchange (1,301)

Finance costs 3,313

Fair value change in digital

assets through profit or loss 79

Share based payment expense 958

----------------------------------------- --------

Cash flow from operating activities

before working capital changes 778

Working capital changes:

Increase in trade and other receivables (685)

Decrease in trade and other payables (3,345)

Decrease in digital assets 356

Net cash used in operating activities (2,895)

----------------------------------------- --------

Investing activities

Purchase of tangible fixed assets (329)

Net cash used in investing activities (329)

----------------------------------------- --------

Financing activities

Loan repayments (364)

Interest paid (2,728)

Net cash generated used in financing

activities (3,092)

----------------------------------------- --------

Net decrease in cash and cash

equivalents (6,316)

----------------------------------------- --------

Effect of foreign exchange on

cash 468

Cash and cash equivalents at

beginning of period 20,092

----------------------------------------- --------

Cash and cash equivalents at

end of period 14,244

----------------------------------------- --------

The table below reconciles Adjusted EBITDA to net income/(loss),

the most directly comparable IFRS measure, for the three months

ended 31 March 2023 and three months ended 31 March 2022.

2023 2022

Figures in '000 $ $

Net income/(loss) (8,710) 2,066

-------------------------------- ------- -------

Interest expense 3,313 2,442

Depreciation / amortisation 6,439 7,168

Income tax (credit) / expense - (117)

EBITDA 1,042 11,559

Change in fair value of digital

currencies 79 6,039

Impairment of intangible assets - 703

One-time restructuring costs 806 -

Foreign exchange gain (1,300) (5,705)

Share based payment charge 958 1,423

-------------------------------- ------- -------

Adjusted EBITDA 1,585 14,019

-------------------------------- ------- -------

For further information please contact:

Argo Blockchain

Investor Relations ir@argoblockchain.com

------------------------------

finnCap Ltd

------------------------------

Corporate Finance

Jonny Franklin-Adams

Seamus Fricker

Joint Corporate Broker

Sunila de Silva +44 207 220 0500

------------------------------

Tennyson Securities

------------------------------

Joint Corporate Broker

Peter Krens +44 207 186 9030

------------------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

------------------------------

Salamander Davoudi argoblock@tancredigroup.com

Emma Valgimigli

Fabio Galloni-Roversi Monaco

Nasser Al-Sayed

------------------------------

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With mining facilities in Quebec, mining operations in

Texas, and offices in the US, Canada, and the UK, Argo's global,

sustainable operations are predominantly powered by renewable

energy. In 2021, Argo became the first climate positive

cryptocurrency mining company, and a signatory to the Crypto

Climate Accord. For more information, visit www.argoblockchain.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFDGGDLUUGDGXU

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

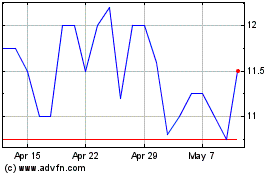

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024