BP PLC BP agrees sale of interest in SECCO to Sinopec (5668D)

April 27 2017 - 6:27AM

UK Regulatory

TIDMBP.

RNS Number : 5668D

BP PLC

27 April 2017

press release

27 April 2017

BP agrees sale of interest in SECCO to Sinopec

BP today announced that it has agreed to sell its 50% stake in

the Shanghai SECCO Petrochemical Company Limited (SECCO) to Gaoqiao

Petrochemical Co Ltd, a 100% subsidiary of China Petroleum &

Chemical Corporation (Sinopec), BP's joint venture partner, for a

total consideration of $1.68 billion.

"This decision aligns our petrochemicals business in China with

our global focus on areas where BP has leading proprietary

technologies and competitive advantage. China is a key region for

our chemicals business and BP will continue to look for

opportunities to build on our position in the country," said Rita

Griffin, Chief Operating Officer, BP Global Petrochemicals.

SECCO is currently owned by BP (50%), Sinopec (30%) and Sinopec

Shanghai Petrochemical Company Limited (20%), in which Sinopec

holds a majority interest. Based in Shanghai, SECCO is a major

producer of olefins - ethylene and propylene - together with

polymers and other derivatives including polyethylene,

polypropylene, acrylonitrile styrene, polystyrene, butadiene and

other products.

"China is a country of great significance to BP given its market

potential," said Dr. Xiaoping Yang, BP China President, "BP has

been committed to doing business in China for more than four

decades. Looking into the future, we plan to continue to invest in

China in areas that provide the best growth opportunities for BP,

our Chinese partners and the country."

The transaction is subject to a number of regulatory approvals

and other conditions, subject to which, it is currently anticipated

to complete before the end of the year with the consideration

payable in instalments.

Notes to editors

-- The BP group's consolidated pre-tax profit for the year-ended

31 December 2016 included the Group's share of the net profits of

SECCO amounting to $301m (comprised of pre-tax profit of $404m,

taken from SECCO's income statement and reconciled to IFRS, and tax

amounting to $103m).

-- As at 31 December 2016, the value of the gross assets the

subject of the transaction was $993 million.

-- BP intends to use the proceeds from the disposal, most if not

all of which are anticipated to be received in 2017 (subject to

completion), for general corporate purposes.

-- BP has had a petrochemicals business in China since the

1970s, first through technology licensing and then manufacturing

joint ventures. In addition to SECCO, BP has three other

petrochemical manufacturing joint ventures in China: purified

terephthalic acid (PTA) production in Zhuhai; and acetic acid and

other acetyls production with YARACO in Chongqing and BYACO in

Nanjing. In March 2015, BP began production from Zhuhai Unit 3, the

world's largest single train PTA unit.

-- BP is one of the leading foreign investors in the Chinese oil

and gas sector. BP's business activities in China include

exploration and development, petrochemicals manufacturing and

marketing, aviation fuel supply, oil products retailing,

lubricants, oil and gas supply and trading, LNG terminal and trunk

line and the chemicals technology licensing. Building on its

business successes in China, BP has also expanded partnerships with

the national energy companies beyond the country's borders.

-- BP is a partner of Sinopec in China as well as

internationally on a variety of projects in both the Upstream and

Downstream.

Further information

BP press office, London: +44 (0)20 7496 4076, bppress@bp.com

BP press office, China: +86 (0)10 6589 3878,

bpchinapress@bp.com

- ENDS -

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISOKODBDBKDNQB

(END) Dow Jones Newswires

April 27, 2017 07:27 ET (11:27 GMT)

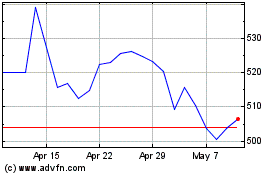

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2024 to May 2024

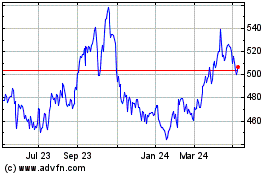

Bp (LSE:BP.)

Historical Stock Chart

From May 2023 to May 2024