BlackRock Frontiers Portfolio Update

January 15 2021 - 10:29AM

UK Regulatory

TIDMBRFI

BLACKROCK FRONTIERS INVESTMENT TRUST PLC (LEI: 5493003K5E043LHLO706)

All information is at 31 December 2020 and unaudited.

Performance at month end with net income reinvested.

One Three One Three Five Since

month months year years years Launch*

% % % % % %

Sterling:

Share price 10.1 30.3 -5.4 -14.3 45.1 71.4

Net asset value 5.7 25.3 0.1 -8.9 40.5 76.7

Benchmark (NR)** 1.9 10.0 -7.9 -5.9 38.8 50.9

MSCI Frontiers Index (NR) 3.3 5.2 -1.7 -1.0 46.0 59.9

MSCI Emerging Markets Index (NR) 4.8 13.2 14.7 18.4 97.0 68.8

US Dollars:

Share price 12.7 37.8 -2.4 -13.2 34.7 50.9

Net asset value 8.2 32.5 3.3 -7.8 30.5 55.3

Benchmark (NR)** 4.4 16.3 -5.0 -4.9 28.7 33.4

MSCI Frontiers Index (NR) 5.7 11.2 1.4 0.0 35.4 40.2

MSCI Emerging Markets Index (NR) 7.4 19.7 18.3 19.7 82.7 48.0

Sources: BlackRock and Standard & Poor's Micropal

* 17 December 2010.

** The Company's benchmark changed from MSCI Frontier Markets Index to MSCI

Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index (net

total return, USD) effective 1/4/2018.

At month end

US Dollar

Net asset value - capital only: 162.93c

Net asset value - cum income: 163.86c

Sterling:

Net asset value - capital only: 119.20p

Net asset value - cum income: 119.88p

Share price: 118.50p

Total assets (including income): £289.2m

Discount to cum-income NAV: 1.2%

Gearing: nil

Gearing range (as a % of gross assets): 0-20%

Net yield*: 4.5%

Ordinary shares in issue**: 241,210,518

Ongoing charges***: 1.4%

Ongoing charges plus taxation and performance fee: 1.4%

*The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 4.5% and includes the 2020

final dividend of 4.25 cents per share declared on 11 December 2020 with a pay

date of 12 February 2021. Also included is the 2020 interim dividend of 2.75

cents per share, announced on 28 May 2020 and paid to shareholders on 26 June

2020.

** Excluding 612,283 ordinary shares held in treasury.

***Calculated as a percentage of average net assets and using expenses,

excluding Performance fees and interest costs for the year ended 30 September

2020.

Sector Gross market Country Gross market value as

Analysis value as a % of Analysis a % of net assets*

net assets*

Financials 30.8 Indonesia 14.2

Consumer Discretionary 17.7 Saudi Arabia 11.7

Industrials 14.0 Vietnam 8.7

Materials 13.1 Philippines 8.4

Energy 10.0 Egypt 6.5

Real Estate 5.3 Kazakhstan 5.9

Consumer Staples 5.0 Chile 5.5

Utilities 3.4 Greece 5.5

Communication Services 3.0 Thailand 5.1

Health Care 2.4 Malaysia 4.9

Information Technology 2.1 Poland 4.1

----- Pakistan 3.4

106.8 Qatar 2.9

----- Turkey 2.4

Short positions -1.1 Romania 2.1

===== United Arab Emirates 2.1

Panama 2.0

Hungary 1.9

Pan-Emerging Europe 1.8

Ukraine 1.8

Peru 1.7

Pan Africa 1.6

Kenya 1.0

Colombia 0.8

Nigeria 0.4

Czech Republic 0.4

-----

Total 106.8

-----

Short positions -1.1

=====

*reflects gross market exposure from contracts for difference (CFDs).

Market Exposure

31.01 29.02 31.03 30.04 31.05 30.06 31.07 31.08 30.09 31.10 30.11 31.12

2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020

% % % % % % % % % % % %

Long 113.0 107.1 106.4 105.9 109.6 109.8 110.3 110.2 107.8 106.9 107.3 107.9

Short 1.1 3.8 2.5 2.6 2.5 1.5 1.1 0.0 0.0 0.0 0.0 1.1

Gross 114.1 110.9 108.9 108.5 112.1 111.3 111.4 110.2 107.8 106.9 107.3 109.0

Net 111.9 103.3 103.9 103.3 107.1 108.3 109.2 110.2 107.8 106.9 107.3 106.8

Ten Largest Investments

Company Country of Risk Gross market value as a

% of net assets

JSC Kaspi Kazakhstan 3.1

Indocement Tunggal Prakarsa Indonesia 3.0

Mobile World Vietnam 2.7

PTT Exploration & Production Public Thailand 2.6

Astra International Indonesia 2.6

Tupras Turkey 2.4

LT Group Philippines 2.4

National Commercial Bank Saudi Arabia 2.3

United International Transport Saudi Arabia 2.3

Quimica Y Minera - ADR Chile 2.3

Commenting on the markets, Sam Vecht and Emily Fletcher, representing the

Investment Manager noted:

The Company's NAV returned +8.2% versus its benchmark the MSCI Emerging ex

Selected Countries + Frontier Markets + Saudi Arabia Index ("Benchmark Index"),

which returned +4.4% in December. For reference, the MSCI Emerging Markets

Index ended the month +7.4% and the MSCI Frontier Markets Index +5.7% over the

same period (all performance figures are on a US Dollar basis with net income

reinvested).

For the year ending December 2020, the Company's NAV returned +3.3% versus its

benchmark the MSCI Emerging ex Selected Countries + Frontier Markets + Saudi

Arabia Index ("Benchmark Index"), which returned -5.0% for the year. For

reference, the MSCI Emerging Markets Index ended the year +18.3% and the MSCI

Frontier Markets Index +1.4% over the same period (all performance figures are

on a US Dollar basis with net income reinvested).

December was another very strong month for the Company, both in absolute and

relative terms. As we have discussed extensively over the past few months, the

Company is positioned for a normalizing economic environment and a return of

emerging market growth as COVID-19 pressures ease. News flow around the various

vaccines, pointing to significantly higher than expected efficacy, has given

investors confidence that we can see normalization come through in 2021. On the

back of this, we saw strong returns to our positioning, as some of our more

cyclical positions rallied strongly.

In Kazakhstan, online payment platform Kazpi.kz (+32%) contributed most to the

portfolio as the company continued its post IPO rally. Maiden results, reported

in November 2020, showed operating trends tracking in line with our

expectations and we believe the company is on track to show earnings growth

above 50% for the year.

Aeon (+29%), a credit card operator in Thailand, was also a strong performer

after the company guided for better credit conditions in the kingdom.

National Bank of Greece (+52%) contributed strongly after reporting better

non-performing loan trends in its Q3 results. The company also benefited from

capital going back to European financials and a better environment for

dividends returning across Europe.

Ferrexpo (+37%), an Iron Ore producer in Ukraine, benefited from the continued

tightness in the iron ore market as Vale, the world's second largest producer,

failed to meet production expectations in Q4. Chinese steel demand continues to

be at record levels.

On the other hand, relative detractors came mostly from positions we did not

own in countries like Turkey or Colombia. Our positions in the Philippines gave

back some of their earlier gains on concerns current shutdowns will be extended

following the emergence of more contagious COVID-19 strains in the UK and South

Africa.

As markets have rallied, we have locked some profits on stocks that have shown

very strong performance, such as Aeon in Thailand and Mr DIY in Malaysia. We

initiated a new position in Tupras, a Turkish refiner, expecting some recovery

in spreads in 2021 on which basis we think valuation is very attractive.

However, in aggregate we have traded little, choosing to maintain current

portfolio positioning.

We continue to be positioned for a strong rebound in global economic activity

which we expect to see over the next six months. We believe that the

combination of strong liquidity, easy financial conditions and high levels of

disposable income is a very powerful mix for earnings growth, a factor that has

been scarce in emerging markets for an extended period. Even now, despite the

strong bounce, we believe that frontier and small emerging markets contain some

of the best valued companies globally with a number of markets still trading

significantly below their average 10-year price to book valuations.

Sources:

1BlackRock as at 31 December 2020

2MSCI as at 31 December 2020

15 January 2020

ENDS

Latest information is available by typing www.blackrock.com/uk/brfi on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on BlackRock's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

January 15, 2021 11:29 ET (16:29 GMT)

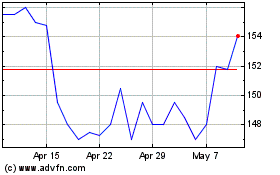

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Apr 2024 to May 2024

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From May 2023 to May 2024