TIDMCAD

CADOGAN PETROLEUM PLC

Half Yearly Report for the Six Months ended 30 June 2019

(Unaudited and unreviewed)

Highlights

Cadogan Petroleum plc ("Cadogan" or the "Company"), an independent, diversified

oil and gas company listed on the main market of the London Stock Exchange, is

pleased to announce its unaudited results for the six months ended 30 June

2019.

* Average oil production increased to 297 boepd in H1 2019, a 27% increase on

the corresponding period in 2018 and a 19% increase over 2018 average

production; this result makes the first half of 2019 the sixth consecutive

semester of production growth. Average daily oil production in June 2019

was 387 bpd[1].

* Cadogan's operational excellence was confirmed by another accident-free

period and by the drilling of the successful Blazh-10 well. This well set a

regional benchmark for drilling and delivered one of the highest initial

production rates ever recorded from the Yamna reservoir in the Carpathian

basin, at 385 bpd during clean-up.

* Approvals required to file the application for a 20-years production

licence for the Monastyretska licence were received and the application was

filed on 2 July 2019.

* The pilot production scheme on the Vovche-2 well was approved by the

authorities and thus all commitments have been fulfilled on the Bitlyanska

licence.

* Trading of gas was limited. Gas prices witnessed an unprecedented nosedive,

with prices in January and February dipping below the level seen the

previous summer; in this scenario, Cadogan sold in January some of its

stored gas with a small loss and kept the remaining balance in storage; on

this latter volume Cadogan, prudently, booked a $0.65 million loss on the

expectation that prices will recover in the second half of the year when

the gas is expected to be sold, though not to the levels seen in 2018.

* Production revenues increased by 15.7% over the the same period in 2018,

notwithstanding a 15.6% reduction in the average realised oil price.

Overall revenues were down by 37.5% over the the same period in 2018 due to

lower volume of gas traded.

* The Company leveraged its cash position during the period, in line with its

strategy. The Blazh-10 well was drilled and put on production and a EUR13.385

million convertible loan agreement was signed with one of the shareholders

of the parent company of Proger S.p.A. ("Proger"), an Italian-based

international engineering company. The loan, whose principal is secured,

carries an entitlement to interest at a rate of 5.5% per year or has an

option to convert into an indirect participating interest in Proger S.p.A.

of c.25%.

* The Company booked a $2.56 million profit; this was driven by a EUR4.21

million ($4.8 million) increase in the fair value of the EUR13.385 million

convertible loan since its signature in February 2019, as a result of a

competitive conversion price and of Proger's growth of EBITDA over the last

year. This confirms that the loan agreement offers Cadogan shareholders

exposure to realizable growth.

* As a result of the above initiatives, net cash[2] at the period-end was

$13.7 million (30 June 2018: $41.4 million, 31 December 2018: $35.1

million). This level of cash is more than sufficient to sustain on-going

operations. Cash-flow from operating activities, though, was positive, at

$1.2 million.

Overall, the first half of 2019 saw a robust operational performance and

confirmed the positive profitability trend started in 2018, albeit the 2019

performance was partially masked by one-off negative effects, such as the loss

in value of the gas inventory. The Company looks with confidence to the second

part of the year, which has started on the tail of higher production, should

benefit from the seasonality of gas trading and will see renewed efforts to

successfully monetize the legacy assets.

Key performance indicators

The Group has monitored its performance in conducting its business with

reference to a number of key performance indicators ('KPIs'):

* to increase oil, gas and condensate production measured on the barrels of

oil equivalent produced per day ('boepd');

* to decrease administrative expenses;

* to increase the Group's basic earnings per share;

* to maintain no lost time incident; and

* to grow and geographically diversify the portfolio.

The Group's performance during the first six months of 2019, measured against

these targets, is set out in the table below, together with the prior year

performance data. No changes have been made to the sources of data or

calculations used in the period/year. The positive trend in the HSE

performances continues with zero incidents.

Unit 30 June 30 June 31 December

2019 2018 2018

Average production (working boepd 297 234 250

interest basis) (a)

Administrative expenses $million 2.0 2.0 4.8

Basic profit/(loss) per share (b) cent 1.1 (0.2) 0.5

Lost time incidents (c) incidents 0 0 0

Geographical diversification new assets - - 1(d)

a. Average production is calculated as the average daily production during the

period/year

b. Basic profit/(loss) per ordinary share is calculated by dividing the net

profit/(loss) for the year attributable to equity holders of the parent

company by the weighted average number of ordinary shares during the period

c. Lost time incidents relate to injuries where an employee/contractor is

injured and has time off work (IOGP classification)

d. Loan agreement with Proger Management & Partners with its option to

convert. The loan was signed in February 2019

An update of the KPI's table will be proposed to the Board in order to better

reflect the current status of the Company and its medium-term objectives. The

new KPI's will become effective from 2020 if approved by the Board.

Enquiries:

Cadogan Petroleum

Plc

Guido Michelotti Chief Executive +380 (44) 594

Ben Harber Officer 5870

Company Secretary +44 (0) 207 264

4366

Cantor Fitzgerald Broker to Cadogan

Europe Petroleum plc

David Porter +44 (0) 207 894

7000

Summary

Introduction

The first half of the year witnessed a recovery of the Brent oil price, which

peaked at more than 70 $/bbl in April from a low of 50 $/bbl towards Christmas

2018. Since then, the Brent price has lost its momentum and declined to 60 $/

bbl. Ukraine increased subsoil use tax (i.e. royalties) for oil by 2% on 1

January 2019 from 29% to 31%. Gas prices in Ukraine, which had started

decreasing in October from a peak of 369 $/thousand m3, continued their decline

through the first part of the year and reached 168$/thousand m3 at the end of

the reporting period, a trend which had no precedent. There were no other

events of consequence that have affected Cadogan in any of the countries where

the Company is active.

The presidential vote in Ukraine resulted in the election of Volodymyr

Zelenskyy as the new President of Ukraine, with 73% of the valid votes. The

newly-elected President dissolved the Verkhovna Rada shortly after being sworn

in and called for a snap parliamentary elections to be held on 21 July 2019.

Ukraine continued with its efforts to attract new investment in its oil and gas

sector. In particular, 19 special permits for subsoil use of oil and gas were

offered during three licencing rounds by the State Geological Service of

Ukraine. The rounds saw limited participation by foreign investors[3]. In

parallel, the Minister of Energy via the Cabinet of Ministers announced PSA

tenders for 11 areas, covering a total area of approximately 15,000 sq. km.

In Italy, the election for the European Parliament saw a reversal of the

balance of power between the League and the 5 Stars parties, with the former

doubling its consensus. This may lead to a less negative Government attitude

towards oil and gas operations, given the League's different, more open

position.

Operations

E&P activity remained focused on using the assets in Ukraine as a platform for

growth by increasing production from the existing field within the

Monastyretska licence. At the end of the reporting period, the average gross

production rate increased to 297 boepd, which is 27% higher than in the six

months ended 30 June 2018 (234 boepd net, 242 boepd gross).

The Company successfully drilled and completed the Blazh-10 well, on the

Monastyretska licence. The well was drilled on time but at 10% over budget, due

to severe hole instability issues, which were experienced while drilling. The

well was put on production at 275 bpd in natural flow. This additional oil

production more than off-sets the loss of gas production from Debeslavetska and

Cheremkhivska fields, which Cadogan successfully exited in January 2019.

All regulatory approvals required to file the application for a 20-year

production licence, for the Monastyretska licence, were received and the

application was filed on 2 July 2019, well ahead of the licence expiry date of

18 November 2019.

The Bitlyanska licence has been actively advertised for a farm-out and requests

to access the data room have been received at this time. The pilot production

scheme for the Vovche's well was approved, thus confirming that the Company has

fulfilled all its licence obligations. The preparation of the documents

required to apply for a 20-year exploration licence, with further development,

has subsequently started.

Lastly, a third party was engaged to prepare an independent Competent Person's

Report (CPR) on the Company's reserves and resources, which is expected to be

delivered in the second half of the year.

All activities were executed without LTI or TRI[4], with a total of nearly

1,000,000 manhours since the last incident, which occurred to a contractor, in

February 2016.

Emissions to the atmosphere went temporarily up to 89.4 tons of CO2 equivalent/

boe, due to the Blazh-10 well coming on stream with a production rate higher

than the three other wells combined. Actions are on-going to reduce the

intensity ratio and bring it back close to the average value for 2018 (i.e.

58.3 tons of CO2 equivalent/boe). Good progress has already been made and the

intensity ratio in July was some 20% lower than in June. In parallel, the

anticipated third party's audit of the entire measurement and reporting process

will be conducted.

In Italy, activity was focused on maintaining liaisons with the local

authorities and fulfilling the mandatory licence requirements, given the

on-going moratorium in the approval of new licences.

Trading

Volumes of gas trading are normally lower in the first half of the year due to

the seasonality of this business and the first six months of 2019 were even

lower than normal. The Company only sold a limited volume of gas in January,

given the collapse in the gas price, which through the heating season had

dipped below the level of the previous summer. Gas unsold at the beginning of

February was kept in storage for the following heating season.

Cadogan's gas trading operations continued to take minimum credit risk and also

recovered its past receivables.

Financial position

Cash and cash equivalents at 30 June 2019 were $13.7 million; this represents a

$21.4 million decrease over the value at 31 December 2018. This was driven

primarily by the convertible loan granted to Proger in February 2019 and by the

drilling of the Blazh-10 well on Monastyretska licence.

The Directors believe that the capital available at the date of this report is

sufficient for the Group to continue its operations for the foreseeable future.

Outlook

Cadogan remains in a solid position, with the resources and competences

necessary to continue monetizing the value of its Ukrainian assets.

In Ukraine, the Company will seek to further improve the performance of its oil

producing assets and to actively pursue the farm-out of the Bitlyanska licence.

It will also look to protect the long term sustainability of its operations by

securing the 20-year production licences for Monastyretska and Bitlyanska.

Renewed efforts will also go towards continuing to monetize the residual value

of the legacy assets.

The Company will continue to actively pursue opportunities outside of Ukraine,

to leverage its competence and low-cost structure in order to create long term

value for its shareholders. In parallel, the Company will work with Proger to

exploit potential operational synergies and will use their international

footprint to further expand the sourcing of potential investment opportunities.

Operations Review

In H1 2019, the Group held working interests in two (2018: four) conventional

gas-condensate and oil exploration licences in the West of Ukraine. These

assets are operated by the Group and are located in the prolific Carpathian

basin, close to the Ukrainian oil & gas distribution infrastructure. In the

East, the Group took all necessary actions to convert the Pirkovska exploration

licence, which had expired in 2015. The application was neither accepted nor

rejected by the State Geological Service (SGS) of Ukraine within the three-year

exclusivity period, with the last communication from SGS being dated 16 January

2019. The company is currently assessing the available options to safeguard its

rights and the interest of its shareholders in this regard.

The Group's primary focus during the period continued to be on cost

optimisation and enhancement of current production, through the existing well

stock and new drilling.

Summary of the Group's licences (as of 30 June 2019)

Working Licence Expiry Licence type(1)

interest (%)

99.8 Bitlyanska December 2019 Exploration and

Development

99.2 Monastyretska November 2019 Exploration and

Development

In January 2019, the Group finalised the transfer of its participatory interest

in Debeslavetske JAA and Cheremkhivsko-Strupkivske JAA to NJSC Nadra as part of

the 2018 trilateral agreement with Eni and NJSC Nadra on the exit of Eni from

the shale gas project.

Below we provide an update to the full Operations Review contained in 2018

Annual Report published on 24 April 2019.

Bitlyanska licence

The Borynya-3 well is routinely monitored, as required by existing regulations

for wells which are suspended. The pilot development scheme for the Vovche-2

well was approved by the state authorities and thus fulfilled the only remaing

exploration commitment.

The Company has started preparing the document package required to file the

application for a new 20-year exploration licence with further development. The

Control Department of the State Geological Services of Ukraine confirmed that

there were no breaches throughout the exploration period.

In parallel, efforts to farm-out the licence have continued.

Monastyretska licence

The remaining licence commitment was successfully fulfilled by the Blazh-10

well. The well reached TD, at 3394m, with a benchmark drilling time,

nonwithstanding severe hole instability issues which were experienced while

drilling. The perforated interval covered the entire Yamna formation, which

proved to be all oil bearing with a net pay of 156 meters. The well was put on

production at 275 bpd in natural flow. The Company plans to install a sucker

rod pump to improve production and mitigate paraffin deposition problems.

Oil production for the reported period increased by 76% to 289 bpd vs 164 bpd

in H1 2018.

Through the reporting period, the Company worked to finalize the documents

required to apply for a 20-year production licence. The Company secured

approval of the Environmental Impact Assessment study by the Ministry of

Ecology and the approval of the Reserves Report by the State Commission of

Reserves; it also received a report from the Control Department of the State

Geological Services of Ukraine stating that there were no breaches throughout

the exploration period.

Service Company

activities

Cadogan's 100% owned subsidiary, Astroservice LLC, continued to pursue

opportunities to build a larger portfolio of orders, while serving intra-group

operational needs. The multi-well work-over contract awarded by a third party

in 2018 remained in force through the first six months of the year and

Astroservice was requested to execute two work-overs.

Financial Review

Overview

Income statement

Revenues decreased to $3.3 million in the first half of 2019 (30 June 2018:

$5.3 million), due to the decrease in gas trading revenues, which were down to

$0.9 million (30 June 2018: $3.1 million). Revenues from production conversely

increased to $2.3 million (30 June 2018: $2.1 million) notwithstanding a

reduction of the realized price.

The service business was engaged in a multi-well contract with a third party

and also offered intra-group services, in particular, for the Monastyretska

licence.

The cost of sales consists of $1.0 million of purchases of gas, and $1.8

million of production royalties, operating costs (OPEX), depreciation and

depletion of producing wells, and direct staff costs for production.

Half-year gross profit decreased marginally to $0.5 million (30 June 2018: $0.6

million), driven by higher depreciation charges and lower oil prices.

Impairment of other assets of $0.57 million (30 June 2018: nil) included $0.65

million of provision for the gas in storage and $0.08 million of reversal of

provision for inventory that have been sold. Reversal of impairment of other

assets of $0.25 million (30 June 2018: $0.37 million) represents reversal of

provision for VAT for the gas that have been sold during reporting period.

The increase of fair value of the convertible loan of $4.4 million has been

presented net of transaction costs of $0.4 million, which included due

diligence on the debtor prior to lending, assessment of the company value and

other costs associated with the execution of the transaction.

Other administrative expenses were kept under control at $2.0 million (30 June

2018: $2.0 million). They comprise other staff costs, professional fees,

Directors' remuneration and depreciation charges on non-producing property,

plant and equipment.

Balance sheet

The cash position of $13.7 million at 30 June 2019 decreased compared with the

$35.1 million at 31 December 2018, because of the convertible loan to Proger

provided in February 2019 and the drilling of the successful Blazh-10 well on

the Monastyretska licence.

Intangible Exploration and Evaluation ("E&E") assets of $2.5 million (30 June

2018: $1.7 million, 31 December 2018: $2.4 million) represent the carrying

value of the Group's investment in E&E assets as at 30 June 2019. The Property,

Plant and Equipment ("PP&E") balance of $11.4 million, at 30 June 2019 (30 June

2018: $2.7 million, 31 December 2018: $3.3 million) includes $10.8 million of

development and production assets on the Monastyretska licence and other PP&E

of the Group.

Trade and other receivables of $3.0 million (30 June 2018: $1.3 million, 31

December 2018: $2.5 million) include VAT recoverable of $2.1 million[5] (30

June 2018: $0.6 million, 31 December 2018: $1.9 million), $0.8 million of trade

receivables and prepayments (30 June 2018: $0.5 million, 31 December 2018: $0.3

million) and $0.1 million trading prepayments and receivables (30 June 2018:

$0.1 million, 31 December 2018: $0.3 million).

The $2.4 million of trade and other payables, as of 30 June 2019 (30 June 2018:

$1.5 million, 31 December 2018: $1.3 million) represents $1.7 million (30 June

2018: $1.1 million, 31 December 2018: $0.7 million) of trade payables and $0.7

million of accruals (30 June 2018: $0.4 million, 31 December 2018: $0.6

million).

Cash flow statement

The Consolidated Cash Flow Statement shows positive cash-flow from operating

activities of $1.2 million (30 June 2018: inflow $4.0 million, 31 December

2018: outflow $0.2 million), notwithstanding the limited contribution from gas

trading. Cashflow, before movements in working capital, was an outflow of $1.3

million (30 June 2018: outflow $1.2 million, 31 December 2018: outflow $1.9

million).

Group capital expenditure was $0.01 million on Intangible Exploration and

Evaluation ("E&E") assets during the six months ended 30 June 2019 (30 June

2018: $0.1 million) and $7.0 million (30 June 2018: $0.7 million) on Property,

Plant and Equipment, out of which $6.9 million related to the Monastyretska

licence drilling of the Blazh-10 well.

Commitments

There has been no material change in the commitments and contingencies reported

as at 31 December 2018 (refer to page 79 of the Annual Report).

Treasury

The Group continually monitors its exposure to currency risk. It maintains a

portfolio of cash and cash equivalent balances, mainly in US dollars ('USD')

held primarily in the UK, and holds these mostly in call deposits. Production

revenues from the sale of hydrocarbons are received in the local currency in

Ukraine ('UAH') and to date funds from such revenues have been held in Ukraine

for further use in operations. Funds are transferred to the Company's

subsidiaries in USD to fund operations, at which time the funds are converted

to UAH.

Going concern

The Directors have a reasonable expectation that the Company and the Group have

adequate resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis in

preparing the Interim Financial Statements. For further detail refer to the

detailed discussion of the assumptions outlined in note 2(a) to the Interim

Financial Statements.

Cautionary Statement

The business review and certain other sections of this Half Yearly Report

contain forward looking statements that have been made by the Directors in good

faith based on the information available to them up to the time of their

approval of this report. However they should be treated with caution due to

inherent uncertainties, including both economic and business risk factors,

underlying any such forward-looking information and no statement should be

construed as a profit forecast.

Risks and uncertainties

There are a number of potential risks and uncertainties inherent in the oil and

gas sector which could have a material impact on the long-term performance of

the Group and which could cause the actual results to differ materially from

expected and historical results. The Company has taken reasonable steps to

mitigate these where possible. Full details are disclosed on pages 12 to 14 of

the 2018 Annual Financial Report. There have been no changes to the risk

profile during the first half of the year. The risks and uncertainties are

summarised below.

Operational risks

* Health, safety, and environment

* Climate change

* Drilling and work-over operations

* Production and maintenance

Subsurface risks

Financial risks

* Changes in economic environment

* Counterparty

* Commodity price

Country risk

* Regulatory and licence issues

* Emerging market

Other risks

* Risk of losing key staff members

* Risk of entry into new countries

* Risk of delays in projects related to local communities dialogue

Director's Responsibility Statement

We confirm that to the best of our knowledge:

(a) the Interim Financial Statements has been prepared in accordance

with IAS 34 'Interim Financial Reporting';

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events during the

first six months and description of principal risks and uncertainties for the

remaining six months of the year);

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein); and

(d) the condensed set of financial statements, which has been prepared

in accordance with the applicable set of accounting standards, gives a true and

fair view of the assets, liabilities, financial position and profit or loss of

the issuer, or the undertakings included in the consolidation as a whole as

required by DTR 4.2.4R.

This Half Yearly Report consisting of pages 1 to 22 has been approved by the

Board and signed on its behalf by:

Guido Michelotti

Chief Executive Officer

23 August 2019

CADOGAN PETROLEUM PLC

Consolidated Income Statement

Six months ended 30 June 2019

Six months ended 30 June Year ended

31

December

2019 2018 2018

$'000 $'000 $'000

Notes (Unaudited) (Unaudited) (Audited)

CONTINUING OPERATIONS

Revenue 3 3,319 5,313 14,730

Cost of sales 3 (2,866) (4,696) (12,849)

Gross profit 453 617 1,881

Administrative expenses (2,051) (2,002) (4,762)

Net fair value gain on convertible loan 12 4,421 - -

Impairment of oil and gas assets - - (56)

Reversal of impairment of other assets 248 368 1,730

Impairment of other assets (568) - (751)

Net foreign exchange losses (16) (2) (58)

Other operating income,net 41 121 2,419

Operating profit/(loss) 2,528 (898) 403

Finance income, net 4 124 476 636

Profit/(loss) before tax 2,652 (422) 1,039

Tax (expense)/benefit (97) 107 178

Profit/(loss) for the period/year 2,555 (315) 1,217

Attributable to:

Owners of the Company 5 2,550 (318) 1,220

Non-controlling interest 5 3 (3)

2,555 (315) 1,217

Profit/(loss) per Ordinary share cents cents Cents

Basic and diluted 5 1.1 (0.1) 0.5

CADOGAN PETROLEUM PLC

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2019

Six months ended 30 June Year ended

31

December

2019 2018 2018

$'000 $'000 $'000

(Unaudited) (Unaudited) (Audited)

Profit/(loss) for the period/year 2,555 (315) 1,217

Other comprehensive profit

Items that may be reclassified

subsequently to profit or loss

Unrealised currency translation 1,367 127 354

differences

Other comprehensive profit 1,367 127 354

Total comprehensive profit/(loss) for the 3,922 (188) 1,571

period/year

Attributable to:

Owners of the Company 3,917 (191) 1,574

Non-controlling interest 5 3 (3)

3,922 (188) 1,571

CADOGAN PETROLEUM PLC

Consolidated Statement of Financial Position

Six months ended 30 June 2019

Six months ended 30 June Year ended

31

December

2019 2018 2018

$'000 $'000 $'000

Notes (Unaudited) (Unaudited) (Audited)

ASSETS

Non-current assets

Intangible exploration and evaluation 2,514 1,713 2,386

assets

Property, plant and equipment 6 11,442 2,651 3,297

Convertible loan note 12 20,030 - -

Prepayments for non-current assets - - 1,318

Deferred tax asset 405 431 501

34,391 4,795 7,502

Current assets

Inventories 7 3,322 1,067 4,487

Trade and other receivables 8 2,950 1,294 2,472

Assets held for sale - - 165

Cash and cash equivalents 13,724 41,371 35,136

19,996 43,732 42,260

Total assets 54,387 48,527 49,762

LIABILITIES

Non-current liabilities

Provisions (41) (463) (39)

(41) (463) (39)

Current liabilities

Short-term borrowings 9 - - -

Trade and other payables 10 (2,388) (1,480) (1,271)

Liabilities held for sale - - (140)

Provisions - (386) (276)

(2,388) (1,866) (1,687)

Total liabilities (2,429) (2,329) (1,726)

Net assets 51,958 46,198 48,036

EQUITY

Share capital 13,525 13,525 13,525

Share premium 329 329 329

Retained earnings 196,612 192,524 194,062

Cumulative translation reserves (160,449) (162,043) (161,816)

Other reserves 1,668 1,589 1,668

Equity attributable to equity holders of 51,685 45,924 47,768

the parent

Non-controlling interest 273 274 268

Total equity 51,958 46,198 48,036

CADOGAN PETROLEUM PLC

Consolidated Statement of Cash Flows

Six months ended 30 June 2019

Six months ended 30 June Year ended

31 December

2019 2018 2018

$'000 $'000 $'000

(Unaudited) (Unaudited) (Audited)

Operating loss 2,528 (898) 403

Adjustments for:

Depreciation of property, plant and equipment 355 96 425

Net fair value gain on convertible loan (4,421) - -

Impairment of oil and gas assets - - 56

Impairment of property, plant and equipment - - 751

Termination fee on exit from WGI - - (1,700)

Reversal of impairment of inventories 568 (102) (107)

Reversal of impairment of VAT recoverable (205) (266) (1,730)

Gain on disposal of property, plant and equipment - (33) (45)

Effect of foreign exchange rate changes (88) 2 58

Operating cash flows before movements in working (1,263) (1,201) (1,889)

capital

Decrease/(Increase) in inventories 597 1,570 (2,100)

Decrease in receivables 717 3,430 3,651

Increase in payables and provisions 1,081 179 84

Cash from operations 1,132 3,978 (254)

Interest paid - - (130)

Interest received 44 - 230

Income taxes paid - - -

Net cash inflow/(outflow) from operating 1,176 3,978 (154)

activities

Investing activities

Proceeds from termination fee on exit - - 1,700

from WGI

Purchases of property, plant and (7,021) (664) (3,944)

equipment

Purchases of intangible exploration and (11) (75) (857)

evaluation assets

Convertible loan advanced (15,609) - -

Proceeds from sale of property, plant and - 33 58

equipment

Interest received 81 476 553

Net cash used in investing activities (22,560) (230) (2,490)

Financing activities

Proceeds from short-term borrowings - - 3,965

Repayment of short-term borrowings - - (3,887)

Net cash from financing activities - - 78

Net (decrease)/increase in cash and cash (21,384) 3,748 (2,566)

equivalents

Effect of foreign exchange rate changes (28) (17) 102

Cash and cash equivalents held for sale - - (40)

at end of year

Cash and cash equivalents at beginning of 35,136 37,640 37,640

period/year

Cash and cash equivalents at end of 13,724 41,371 35,136

period/year

CADOGAN PETROLEUM PLC

Consolidated Statement of Changes in Equity

Six months ended 30 June 2019

Share Share Retained Cumulative Reor-gani-sation Equity Non-controlling Total

capital premium earnings translation attributable interest

account reserves to owners of

the Company

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

As at 1 January 13,525 329 192,842 (162,170) 1,589 46,115 271 46,386

2018

Net profit for the - - 1,220 - - 1,220 (3) 1,217

period

Other - - - 354 - 354 - 354

comprehensive

profit

Total - - 1,220 354 - 1,574 (3) 1,571

comprehensive

profit for the

year

Issue of ordinary - - - - 79 79 - 79

shares

As at 31 December 13,525 329 194,062 (161,816) 1,668 47,768 268 48,036

2018

Net profit for the - - 2,550 - - 2,550 5 2,555

period

Other - - - 1,367 - 1,367 - 1,367

comprehensive

profit

Total - - 2,550 1,367 - 3,917 5 3,922

comprehensive

profit for the

year

As at 30 June 2019 13,525 329 196,612 (160,449) 1,668 51,685 273 51,958

CADOGAN PETROLEUM PLC

Notes to the Condensed Financial Statements

Six months ended 30 June 2019

1. General information

Cadogan Petroleum plc (the 'Company', together with its subsidiaries the

'Group'), is incorporated in England and Wales under the Companies Act. The

address of the registered office is 6th Floor, 60 Gracechurch Street, London

EC3V 0HR. The nature of the Group's operations and its principal activities are

set out in the Operations Review on pages 5 to 6 and the Financial Review on

pages 7 to 8.

This Half Yearly Report has not been audited or reviewed in accordance with the

Auditing Practices Board guidance on 'Review of Interim Financial Information'.

A copy of this Half Yearly Report has been published and may be found on the

Company's website at www.cadoganpetroleum.com.

2. Basis of preparation

The annual financial statements of the Group are prepared in accordance with

International Financial Reporting Standards ('IFRS') as issued by the

International Accounting Standards Board ('IASB') and as adopted by the

European Union ('EU'). These Condensed Financial Statements have been prepared

in accordance with IAS 34 Interim Financial Reporting, as issued by the IASB.

The same accounting policies and methods of computation are followed in the

condensed financial statements as were followed in the most recent annual

financial statements of the Group except as noted, which were included in the

Annual Report issued on 24 April 2019.

The Group has not early adopted any amendment, standard or interpretation that

has been issued but is not yet effective. It is expected that where applicable,

these standards and amendments will be adopted on each respective effective

date.

The Group has adopted the standards, amendments and interpretations effective

for annual periods beginning on or after 1 January 2019. The adoption of these

standards and amendments did not have a material effect on the financial

statements of the Group, including a specific assessment of the impact of IFRS

16 'Leases'.

(a) Going concern

The Directors have continued to use the going concern basis in preparing these

condensed financial statements. The Group's business activities, together with

the factors likely to affect future development, performance and position are

set out in the Operations Review. The financial position of the Group, its cash

flow and liquidity position are described in the Financial Review.

The Group's cash balance at 30 June 2019 was $13.7 million (31 December 2018:

$35.1 million).

The Group's forecasts and projections, taking into account reasonably possible

changes in operational performance, and the price of hydrocarbons sold to

Ukrainian customers, show that there are reasonable expectations that the Group

will be able to operate on funds currently held and those generated internally,

for the foreseeable future.

The Group continues to pursue its farm-out strategy on Bitlyanska licence with

the objective of managing risks and mitigating capital deployment.

After making enquiries and considering the uncertainties described above, the

Directors have a reasonable expectation that the Company and the Group have

adequate resources to continue in operational existence for the foreseeable

future and consider the going concern basis of accounting to be appropriate

and, thus, they continue to adopt the going concern basis of accounting in

preparing the financial statements. In making its statement the Directors have

considered the recent political and economic uncertainty in Ukraine.

(b) Foreign currencies

The individual financial statements of each Group company are presented in the

currency of the primary economic environment in which it operates (its

functional currency). The functional currency of the Company is US dollar. For

the purpose of the consolidated financial statements, the results and financial

position of each Group company are expressed in US dollars, which is the

presentation currency for the consolidated financial statements.

The relevant exchange rates used were as follows:

1 US$ = GBP Six months ended 30 Year ended

June 31 Dec

2018

2019 2018

Closing rate 1.2719 1.3218 1.2768

Average rate 1.2943 1.3763 1.3415

1 US$ = UAH Six months ended 30 Year ended

June 31 Dec

2018

2019 2018

Closing rate 26.4487 26.3500 27.7477

Average rate 27.0363 26.9419 27.2324

(c) Dividend

The Directors do not recommend the payment of a dividend for the period (30

June 2018: $nil; 31 December 2018: $nil).

(d) Fair value hierarchy

The level in the fair value hierarchy within which the financial asset or

financial liability is categorised is determined on the basis of the lowest

level input that is significant to the fair value measurement. Financial assets

and financial liabilities are classified in their entirety into only one of the

three levels. The fair value hierarchy has the following levels:

- Level 1 - quoted prices (unadjusted) in active markets for identical

assets or liabilities

- Level 2 - inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (i.e. as prices) or

indirectly (i.e. derived from prices)

- Level 3 - inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

3. Segment information

Segment information is presented on the basis of management's perspective and

relates to the parts of the Group that are defined as operating segments.

Operating segments are identified on the basis of internal assessment provided

to the Group's chief operating decision maker ("CODM"). The Group has

identified its executive management team as its CODM and the internal

assessment used by the top management team to oversee operations and make

decisions on allocating resources serve as the basis of information presented.

Segment information is analysed on the basis of the type of activity, products

sold or services provided. The majority of the Group's operations are located

within Ukraine. Segment information is analysed on the basis of the types of

goods supplied by the Group's operating divisions.

The Group's reportable segments under IFRS 8 are therefore as follows:

Exploration and Production

· E&P activities on the production licences for natural gas, oil and

condensate

Service

· Drilling services to exploration and production companies

· Construction services to exploration and production companies

Trading

· Import of natural gas from European countries

· Local purchase and sales of natural gas operations with physical delivery

of natural gas

The accounting policies of the reportable segments are the same as the Group's

accounting policies. Sales between segments are carried out at market prices.

The segment result represents profit under IFRS before unallocated corporate

expenses. Unallocated corporate expenses include management and Board

remuneration and expenses incurred in respect of the maintenance of Kyiv office

premises. This is the measure reported to the CODM for the purposes of resource

allocation and assessment of segment performance.

The Group does not present information on segment assets and liabilities as the

CODM does not review such information for decision-making purposes.

As of 30 June 2019 and for the six months then ended the Group's segmental

information was as follows:

Exploration Service(1) Trading Consolidated

and

Production

$'000 $'000 $'000 $'000

Sales of hydrocarbons 2,349 - 916 3,265

Other revenue - 54 - 54

Total revenue 2,349 54 916 3,319

Other cost of sales (1,554) (23) (976) (2,553)

Depreciation (288) (25) - (313)

Other administrative expenses (234) (34) (62) (330)

Finance income, net - - 27 27

Segment results 273 (28) (95) 150

Unallocated other administrative - - - (1,679)

expenses

Depreciation - - - (42)

Net fair value gain on - - - 4,421

convertible loan

Net foreign exchange loss - - - (16)

Other income, net - - - (183)

Profit before tax - - - 2,651

As of 30 June 2018 and for the six months then ended the Group's segmental

information was as follows:

Exploration Service(1) Trading Consolidated

and

Production

$'000 $'000 $'000 $'000

Sales of hydrocarbons 2,030 - 3,270 5,300

Other revenue - 13 - 13

Sales between segments 108 - (108) -

Total revenue 2,138 13 3,162 5,313

Other cost of sales (1,534) (4) (3,098) (4,636)

Depreciation (43) (17) - (60)

Other administrative expenses (197) (26) (43) (266)

Segment results 364 (34) 21 351

Unallocated other administrative - - - (1,736)

expenses

Net foreign exchange loss - - - (2)

Other income, net - - - 965

Loss before tax - - - (422)

(1) In the first half 2018 and in the first half 2019 the Service business was

focused on internal projects, in particular, providing services to

Monastyretska licence.

4. Finance income/(costs), net

Six months ended 30 June Year ended

31 December

2019 2018 2018

$'000 $'000 $'000

Interest expense on short-term borrowings (9) - (135)

Total interest expenses on financial (9) - (135)

liabilities

Interest income on receivables,net 27 - -

Investment revenue 62 315 553

Interest income on cash deposit in Ukraine 44 180 230

Total interest income on finacial assets 133 495 783

Unwinding of discount on decomissioning - (19) (12)

provision

124 476 636

5. Profit/(loss) per ordinary share

Profit/(loss) per ordinary share is calculated by dividing the net profit/

(loss) for the period/year attributable to Ordinary equity holders of the

parent by the weighted average number of Ordinary shares outstanding during the

period/year. The calculation of the basic profit/(loss) per share is based on

the following data:

Six months ended 30 June Year ended

31 December

Profit/(loss) attributable to owners of the 2019 2018 2018

Company $'000 $'000 $'000

(Loss)/profit for the purposes of basic (loss)/ 2,550 (318) 1,220

profit per share being net profit/(loss)

attributable to owners of the Company

Number Number Number

Number of shares '000 '000 '000

Weighted average number of Ordinary shares for the 235,729 231,092 235,729

purposes of basic profit/(loss) per share

Cent Cent Cent

Profit/(loss) per Ordinary share

Basic 1.1 (0.1) 0.5

The diluted profit/(loss) per share is equal to the basic profit/(loss) per

share owing to the (loss)/profit for the period.

6. Proved properties

As of 30 June 2019 the development and production assets balance which forms

part of PP&E has increased in comparison to 31 December 2018 due to the

drilling of Blazh-10 well on Monastyretska licence.

7. Inventories

The Group had volumes of natural gas stored at 31 December 2018 which were only

partially sold during the six months ended 30 June 2019; however most of the

volume remains unsold and the Group plan to realise it in the second half of

the year, as this represents the start of the heating season which typically

sees higher prices. No other substantial changes in inventories balances

occured.

8. Trade and other receivables

Six months ended 30 Year ended

June 31 December

2019 2018 2018

$'000 $'000 $'000

VAT recoverable 2,115 588 1,874

Prepayments 285 110 -

Trading prepayments 31 99 258

Trading receivables - 41 39

Receivable from joint venture - 29 62

Trade receivables 404 - -

Other receivables 115 427 239

2,950 1,294 2,472

The Directors consider that the carrying amount of the other receivables

approximates their fair value.

Management expects to realise VAT recoverable through the activities of the

business segments.

9. Short-term borrowings

In 2019 the Group continued to have a revolving credit line drawn in UAH at a

Ukrainian bank, a 100% subsidiary of a European bank for its trading

activities. The credit line is secured by $5 million of cash balance placed at

a European bank in the UK. The process to renew the credit line was on-going at

the date of reporting.

The Group did not use the credit line during the six months ended 30 June 2019

as it has managed to finance its trading activities with its own funds.

10. Trade and other payables

The $2.4 million of trade and other payables as of 30 June 2018 (30 June 2018:

$1.5 million, 31 December 2018: $1.3 million) represent $1.7 million (30 June

2018: $1.1 million, 31 December 2018: $0.8 million) of payables and $0.7

million of accruals (30 June 2018: $0.4 million, 31 December 2018: $0.7

million).

11. Commitments and contingencies

There have been no significant changes to the commitments and contingencies

reported on page 79 of the Annual Report.

12. Loan issued - Proger

Background and terms

On 26 February 2019 the Group entered into a Euro 13,385,000[6] loan agreement

with Proger Managers & Partners s.r.l. ("PMP"), a privately owned Italian

company whose only interest is a 59.6% participation in Proger Ingegneria

s.r.l. ("Proger Ingegneria"), a privately owned company which has a 67.9%

participating interest in Proger S.p.A. ("Proger").

The loan carries an entitlement to interest at a rate of 5.5% per year, payable

at maturity (which is 24 months after the execution date and assuming that the

call option described below is not exercised). The principal of the loan is

secured by a pledge on PMP's current participating interest in Proger

Ingegneria s.r.l., up to a maximum guaranteed amount of Euro 13,385,000.

In exchange for providing the loan, and besides the pledge on PMP's current

participating interest in Proger Ingegneria, the Group has secured:

I. The right to designate two out of the seven directors in each of Proger

and Proger Ingegneria's Boards of Directors. One of the two directors

designated by the Group will be appointed as Proger's Chairman of the Board,

with a supervisory role on financial affairs.

II. The right to designate one of the three members of Statutory Auditors in

each of Proger and Proger Ingegneria Boards.

III. A call option to acquire, at its sole discretion, 33% of the

participating interest that PMP will be holding in Proger Ingegneria as a

result of its forthcoming subscription; the exercise of the option would give

the Group an indirect 25 interest in Proger. The call option is granted at no

additional cost and can be exercised at any time between the 6th (sixth) and

24th (twenty-fourth) months following the execution date of the loan agreement

and subject to the Group's shareholders having approved the exercise of the

call option as explained further below. Should the Group exercise the call

option, the price for the purchase of the 33% participating interest in Proger

Ingegneria shall be paid by setting off the corresponding amount due by PMP to

the Group, by way of reimbursement of the principal, pursuant to the loan

agreement. If the call option is exercised, then the obligation on PMP to pay

interest is extinguished.

This exercise of the call option (or the enforcement of the pledge referred to

above) would be likely to constitute a reverse takeover for the Group under the

Listing Rules.

In that instance, the exercise of the call option would be subject to and

require publication of: (i) a shareholder circular and notice to convene a

general meeting seeking the Group shareholder approval of the proposed exercise

of the call option by the Group; and (ii) a prospectus in connection with the

proposed re-admission of the Group's shares to the Standard segment of the

Official List and to trading on the London Stock Exchange (as the Group's

listing would be cancelled following the consummation of a reverse takeover).

Accounting treatment

Under IFRS 9 'Financial Instruments' the instrument has been classified as a

financial asset at fair value through profit and loss as a result of the call

option. As such, the loan was initially recorded at fair value and revalued as

at 30 June 2019. If the loan is converted to equity under the call option, it

is anticipated that the investment would then be held as an equity accounted

investment in associate.

At 30 June 2019 carrying amount of the loan approximates to its fair value.

Fair value of this financial asset is categorized at Level 3 (note 2 (d).

During H1 there were no transfers between levels of fair value hierarchy.

Valuation of the loan was performed with the assistance of independent

valuation experts which used an EV/EBITDA peer multiples valuation model, which

included both precedent transaction multiples and trading multiples valuation

methods and then averaged the results. The basis of the evaluation were Proger

S.p.A.'s EBITDA of 2018 (based on 2018 audited income statement) and the

expert's database of multiples for comparable companies and transactions.

In July 2019 Proger released it financial statements for 2018, which showed

improved results for the period and in particular a 24% y-o-y increase of the

EBITDA. The Board have assessed the fair value of the loan instrument at 30

June 2019, which included consideration of the underlying performance and used

the original investment case valuation methodology. The improved performance

resulted in a higher implied valuation of Proger and consequently an increase

in the fair value of the instrument given the Group's call option. In addition,

the Company's indirect participating interest if the call option is exercised

increased to some 25% as not all Proger's shareholders subscribed the increase

of capital. Based on the fair value assessment the Group has recognised an

increase in the fair value of the instrument of $4.4 million recorded in profit

and loss and Directors believe that the $20 million (EUR 17.6 million)

represents the fair value of the loan at 30 June 2019.

Reconciliation: Level 3 fair value measurement

$'000

Opening balance as at 26 February 2019 15,246

Fair value gain on convertible loan 4,421

Transaction costs 372

Exchange difference (9)

Closing balance as at 30 June 2019 20,030

12. Events subsequent to the reporting date

On 2 July the application for a 20-year production licence for Monastyretska,

renamed Blazhiv oil field, was filed.

[1] Gas production was discontinued in January 2019 when the Group finalised

the transfer of its participatory interest in Debeslavetske JAA and

Cheremkhivsko-Strupkivske JAA to NJSC Nadra. Since then production is only oil

and is measured in barrels per day (bpd)

[2] Cash and cash equivalents less short-term borrowings

[3] 15 out of the 19 licenses were awarded to the state company

Ukrgasvydobuvannya and the remaining four to local, privately owned companies

[4] Lost Time Incident, Total Recordable Incident

[5] Most of the recoverable VAT is VAT paid on drilling services which will be

off-set by VAT due on crude sales in future periods under local legislation

[6] Equivalent to $15,246,000 at the date of issuance and to $15,237,000

million at the exchange rate of 30 June 2019

END

(END) Dow Jones Newswires

August 27, 2019 02:00 ET (06:00 GMT)

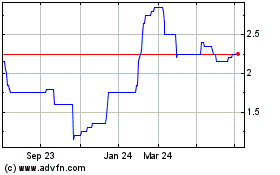

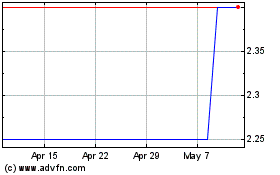

Cadogan Energy Solutions (LSE:CAD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cadogan Energy Solutions (LSE:CAD)

Historical Stock Chart

From Jul 2023 to Jul 2024