TIDMCARR

RNS Number : 0833G

Carr's Group PLC

23 November 2020

23 November 2020

CARR'S GROUP PLC

("Carr's" or the "Group")

FULL YEAR RESULTS

For the year ended 29 August 2020

A robust performance in a year of significant challenge

Carr's (CARR.L), the Agriculture and Engineering Group,

announces its full year results for the year ended 29 August

2020.

Financial highlights

Adjusted (1) FY 20 FY 19 +/-

-------------------------- ------ ------ -------

Revenue (GBPm) 395.6 403.9 -2.0%

Adjusted(1) operating

profit (GBPm) 16.2 18.9 -14.2%

Adjusted(1) profit

before tax (GBPm) 14.9 18.0 -17.4%

Adjusted(1) EPS (p) 11.9 14.6 -18.5%

Statutory FY 20 FY 19 +/-

Revenue (GBPm) 395.6 403.9 -2.0%

Operating profit (GBPm) 13.8 17.2 -19.5%

Profit before tax (GBPm) 12.5 16.3 -23.4%

Basic EPS (p) 10.3 13.1 -21.4%

Dividend (p per share) 4.75 4.75 -

Net debt (2) (GBPm) 18.9 20.9 -9.6%

Commercial and strategic highlights

-- Robust performance in challenging circumstances, slightly exceeding

revised Board expectations, demonstrating the benefit of the

Group's diversity

-- Difficult H1 in UK Agriculture largely mitigated by strong

H2, with increased deliveries and a collection model adopted

to maintain supplies to farmers throughout COVID-19 lockdown

-- International growth in Supplements and launch of new products

-- Engineering impacted by project delays, restricted access to

customer sites owing to COVID-19, and weakened oil price

-- Establishment of Global Robotics showrooms in Japan and USA

-- Strong cash and net debt position

Peter Page, Chairman, commented:

"In difficult market conditions the Group delivered a robust

financial performance, with full year profitability slightly ahead

of the Board's revised expectations. Across both divisions, the

Group responded well to managing the challenges arising from the

COVID-19 pandemic.

"The global economy has been dominated by COVID-19, creating

uncertainty and making forecasts difficult. Nevertheless, the Group

is well positioned as the agriculture sector remains crucial in

supplying raw materials and ingredients to the food chain, and our

engineering businesses are predominantly involved in government

funded contracts in the nuclear sector.

"Trading in the new financial year has started in line with the

Board's expectations. Whilst uncertainties remain in the broader

economic environment, the Board is confident about the prospects of

our business in the medium term."

(1) Adjusted results are consistent with how business

performance is measured internally and are presented to aid

comparability of performance. Adjusting items are disclosed in note

3

(2) Excluding leases. Further details of net debt can be found in note 8

Enquiries:

Carr's Group plc Tel: +44 (0) 1228 554 600

Tim Davies (Chief Executive)

Neil Austin (Chief Financial Officer)

Powerscourt Tel: +44 (0) 20 7250 1446

Nick Dibden / Lisa Kavanagh / Sam Austrums

About Carr's Group plc:

Carr's is an international leader in manufacturing value added

products and solutions, with market leading brands and robust

market positions in Agriculture and Engineering, supplying

customers in over 50 countries around the world.

Its Agriculture division manufactures and supplies feed blocks

and supplementation products for livestock, distributes animal

feeds and farm machinery, and runs a UK network of rural stores

which provide a one-stop shop for the farming community. Its

Engineering division designs and manufactures bespoke equipment and

provides technical engineering services into the nuclear, defence,

petrochemical, oil and gas, pharmaceutical, process and renewable

energy industries, including robotic and remote handling

equipment.

Chairman's Statement

Review of the year

For the year ended 29 August 2020, in difficult market

conditions the Group delivered a robust financial performance, with

full year profitability slightly ahead of the Board's revised

expectations. Across both divisions, the Group responded well to

managing the challenges arising from the COVID-19 pandemic.

First half trading in the Agriculture division was characterised

by both challenging market conditions affecting farm incomes and

continued unseasonal weather in the UK and USA. Trading in the

second half of the year recovered well, and overall profitability

exceeded the Board's revised expectations for the year. As COVID-19

restrictions were tightened, the UK Agriculture businesses proved

adept in maintaining supplies to farmers whilst keeping people

safe. In the Supplements business, new and innovative products were

launched, and expanded production and research capabilities

supported our international footprint, particularly in New Zealand

and Canada where feed block sales continued to build.

In the Engineering division, the first half of the year was

impacted by contract phasing. Whilst it had been expected some of

this would recover in the second half, delays in receiving expected

orders on overseas projects meant that this was not the case.

Restrictions imposed on travel and access to customer sites as a

consequence of COVID-19, together with the weakened oil price, also

negatively affected the division's full year performance with

profitability below the Board's revised expectations.

At the onset of COVID-19, all sites moved quickly to follow

government guidelines and implemented a range of safety measures

including social distancing, increased hygiene and shift-working.

People worked from home where possible, maintaining strong

engagement with our customers, suppliers and each other, using

virtual media. Contingencies were planned across both divisions,

which remain under constant review.

Financial review

Revenue for the year decreased by 2.0% to GBP395.6m (2019:

GBP403.9m). Adjusted operating profit was down 14.2% to GBP16.2m

(2019: GBP18.9m), with Agriculture contributing GBP13.4m (2019:

GBP14.7m) and Engineering GBP3.8m (2019: GBP5.9m). Reported

operating profit fell by 19.5% to GBP13.8m (2019: GBP17.2m).

Adjusted profits are before amortisation of acquired intangible

assets totalling GBP1.4m and restructuring and closure costs of

GBP2.0m offset by adjustments to contingent consideration totalling

GBP0.9m, giving a net total adjusting items of GBP2.4m.

Adjusted profit before tax was down 17.4% to GBP14.9m (2019:

GBP18.0m) and reported profit before tax decreased by 23.4% to

GBP12.5m (2019: GBP16.3m). Basic earnings per share were down by

21.4% to 10.3p (2019: 13.1p), with fully diluted earnings per share

of 10.2p (2019: 12.8p) and adjusted earnings per share down 18.5%

to 11.9p (2019: 14.6p).

Net debt at 29 August 2020, excluding leases, was GBP18.9m

(2019: GBP20.9m). This movement included GBP18.1m generated from

operations, GBP8.9m used in investing activities and GBP3.3m paid

in dividends.

The recent leasing standard IFRS 16 has been adopted in the

year, with a consequential reduction to opening net assets of

GBP1.4m as operating leases were brought onto the balance sheet.

There was also a consequential impact to the income statement of an

additional charge to profit before tax of GBP0.1m resulting from

the new standard.

With the onset of COVID-19, t he Group implemented a rigorous

cash forecasting process which is tested regularly against a

variety of scenarios. Cash management measures were also

implemented to limit non-essential expenditure. Whilst an interim

dividend decision in April 2020 was deferred, this was subsequently

confirmed and reinstated in July 2020 once the short-term impact of

COVID-19 on the business became clearer. Such measures preserved

the Group's strong cash and net debt positions, leaving good

headroom on the Group's committed banking facilities.

Dividend

The Board is proposing a final dividend of 2.5 pence per share

which, together with the interim dividend of 2.25 pence per share

declared in July 2020, makes a total dividend for the year of 4.75

pence per share (2019: 4.75p). The final dividend, if approved by

Shareholders, will be paid on 15 January 2021, to shareholders on

the register on close of business 4 December 2020, and the shares

will go ex-dividend on 3 December 2020.

Corporate governance and Board succession

This has been an important year for Board succession. After

joining the Board in November 2019, I took over as Non-Executive

Chairman following the AGM in January 2020. In October 2020 Kristen

Eshak Weldon joined the Board as an Independent Non-Executive

Director, bringing international experience of investment appraisal

along with real insight into new technology applications in the

agri-food sector.

In August 2020 we announced that Tim Davies would be stepping

down after seven years as CEO of the Group. On behalf of all

shareholders, I am extremely grateful to Tim for his dedication and

contribution to the business. Tim's leadership style and genuine

concern for colleagues have been most evident since March 2020 as

everyone has come to terms with different ways of working,

heightened levels of uncertainty and increased demands on the

business. Tim will leave the Board at the AGM in January 2021 but

will remain available to give advice and share his knowledge during

a handover period.

Hugh Pelham joins Carr's Group as CEO in January 2021, standing

for election at the AGM. Hugh has relevant experience in developing

and growing businesses and integrating them into larger group

structures, he has worked in many markets around the world, and he

has developed high performing management teams. I look forward to

welcoming Hugh to the Group.

As part of its long-term succession strategy, it is planned that

Alistair Wannop will stand down from the Board at the conclusion of

the AGM in January 2022. Alistair was first appointed to the Board

as a Non-Executive Director in September 2005. Given the level of

Board succession achieved during 2019 and 2020, and recognising

Alistair's deep knowledge of the Group's activities and

understanding of agricultural industries, the Board considers it

appropriate for Alistair to remain appointed for another year to

ensure continuity.

AGM January 2021

In the light of the COVID-19 pandemic, the AGM on 12 January

2021 will be held in a revised format. As shareholders will not be

able to attend the meeting in person, the Board will be inviting

shareholders to vote on the resolutions proposed by proxy, and to

submit any questions in advance of the meeting. We will be

publishing a broadcast on the Company's website, reflecting on the

year, providing an update on current trading, introducing Hugh

Pelham, and answering questions raised by shareholders, following

the AGM on 12 January 2021.

Our people

Carr's employs over 1,100 people across the globe, all of whom

have made a significant contribution to the business this year,

particularly in the demanding situation arising from COVID-19. I am

extremely grateful for everyone's support, endurance and

adaptability.

Outlook

The Group remains committed to building value by focusing on

markets with growth potential, diversifying its international

footprint and differentiation through innovation and

technology.

The global economy has been dominated by COVID-19, creating

uncertainty and making forecasts difficult. Nevertheless, the Group

is well positioned as the agriculture sector remains crucial in

supplying raw materials and ingredients to the food chain, and our

engineering businesses are predominantly involved in government

funded contracts in the nuclear sector. Management will continue to

focus on optimising all the businesses in the Group.

Trading in the new financial year has started in line with the

Board's expectations. Whilst uncertainties remain in the broader

economic environment, the Board is confident about the prospects of

our business in the medium term.

Peter Page

Chairman

23 November 2020

Chief Executive's Review

As outlined in our trading update on 12 March 2020, trading

conditions across both divisions during the first half of the year

were challenging and, unrelated to COVID-19, led to a reduction in

the Board's performance expectations for the full year.

I am pleased to report, however, that despite these challenges,

and the significant measures adopted across the Group in order to

manage the effects of the pandemic, a very robust performance in

the second half resulted in a full year performance which exceeded

those revised expectations.

While cash preservation has remained a key priority, we have

been able to continue to invest in key areas to ensure that the

Group remains well placed for the future. During the year, we

strengthened our presence in growth markets across the world,

whilst driving innovation and technological advances to maintain

our strong position in our established markets.

AGRICULTURE

As previously reported, trading in our Agriculture division in

the first half was slower than the prior year, largely driven by

atypical weather patterns and growing conditions from the previous

summer which reduced demand for key products. Improved trading

during the second half, however, resulted in a robust outturn for

the full year.

During the year, revenue was down 4.1% to GBP342.6m (2019:

GBP357.4m). Adjusted operating profit was down 8.5% to GBP13.4m

(2019: GBP14.7m), whilst reported operating profit was down 4.8% to

GBP13.4m (2019: GBP14.1m).

During the period, following the appointment of a new Managing

Director in the UK Agriculture business, the management team was

strengthened through a further four senior appointments to help

optimise efficiencies and drive strategic growth, whilst

maintaining an absolute focus on serving our customers. We also

appointed a new Commercial Director in our Supplements

business.

Supplements

Total global feed block sales volumes were up 1.2% year-on-year.

Sales volumes were slightly ahead of the Board's expectations as a

direct result of increased demand and growth in target markets

during the second half. Despite overall volume increases, however,

increases in raw material prices were not wholly mitigated through

selling price increases which led to lower margins, particularly in

the UK.

UK feed block volumes were up 5.2% compared to the prior year.

This performance was driven by improved livestock prices in the

second half, which increased farmers' willingness to invest in

supplementation.

Following a weaker first half, US feed block sales subsequently

recovered towards the end of the financial year, with volumes up

0.5% in the period overall. Whilst cattle prices were suppressed

during the majority of the period, prices recovered towards the

end.

During the year, we successfully launched our new FesCool(R)

feed block in the USA following extensive research trials

undertaken in conjunction with Kansas State University. FesCool(R)

enhances the performance of grazing cattle in warm climates by

reducing the impact of fescue toxicity and enhances our range of

innovative supplements that add real value to livestock

farmers.

In 2020, we also invested in and enhanced our production systems

in the USA, spending GBP2.1m in improving our manufacturing

facilities at two of our sites and in the creation of a research

facility. This investment will help drive efficiencies and provide

us with the opportunity to develop and test new product ranges,

ingredients, and manufacturing techniques.

We continue to make progress in developing sales of feed blocks

into Canada. As North America moved into stricter national travel

restrictions, we benefited from having a sales team on the ground

locally. The Canadian market represents a significant potential

market for sales into beef and equine sectors, and can be supplied

out of the Group's existing facility in Belle Fourche, South

Dakota.

New Zealand feed block sales were up 40% in the period where we

continued to make progress in raising customer awareness and

building relationships with further distribution partners. The

Group continues to consider the New Zealand market as offering

strong potential for future growth.

In Germany, our joint venture business, Crystalyx Products GmbH,

saw a 4.1% decrease in feed block sales compared to the prior year.

During the year, the business launched its new Pick Block product,

manufactured out of its plant in Oldenburg, Germany , and sales are

expected to build. Pick Block is designed to improve poultry

welfare standards through environmental enrichment, encouraging

birds to demonstrate a wider range of natural behaviours.

Animax, the Group's manufacturer of livestock bolus supplements,

had a challenging year owing to market pressures coupled with

milder weather which reduced customer demand. During the year, the

business appointed a new Commercial Director and increased focus on

international growth opportunities. The Group continues to make

progress on its manufacturing automation project, which is expected

to help drive future efficiencies, new product ranges and even

higher product quality.

UK Agriculture

Total volumes in our compound feed business declined by 6.9%

during the year. This was largely driven by the warm summer in 2019

and subsequent mild winter which led to high stocks of good forage

and reduced farmer demand for bought-in feeds during the first

half. Such reduction in demand gave rise to increased competition

which impacted margins during the period. During the second half,

the initial closure of the food service sector impacted farmer

incomes; however, the strong retail sales subsequently seen led to

a significant pick-up in demand for certain meat and dairy products

which largely offset the effect of this.

The Group's fuel distribution business saw sales volumes

increase 2.9% on the prior year. This was driven by colder weather

during March 2020 and customers stocking up on heating oil in the

early stages of the pandemic when commodity prices were low, as

well as increased demand from farmers due to a busy spring period

on farms generally.

Machinery sales were particularly strong in the year, up 19.2%

overall and achieving record sales of GBP45.5m. New machinery sales

were up 17% on the previous year. The performance was driven by

improved farmer confidence and government loan schemes supporting

farming investments, together with pent-up demand following a

period of subdued activity prior to the original Brexit date.

Growth in the machinery business, which outperformed the market

significantly, is also attributable to the development of our

relationship with a key supplier.

The Group's retail outlets performed resiliently, with

like-for-like sales up 1.6% and overall sales up 0.6% during the

period. During the pandemic, extensive measures were taken to

ensure that our network of country stores could continue to service

our core farming customers, who remain critical to the UK's food

supply chain. These innovative measures included the successful

roll-out of a pre-order, collection and delivery service across all

branches.

During the year we also progressed our rationalisation and

efficiency programme in UK Agriculture. Our ongoing review of

retail store effectiveness resulted in the closure of four sites as

we focus our offering at strategic locations and enhancing our

delivery and collection models. During the pandemic, the early

stages of lockdown gave us the ability to test new ways of working,

which has provided valuable strategic insight for the future and

helped develop our strategy for managing a second wave.

Agriculture Outlook

The Group continues to remain confident in the medium-term

prospects of the Agriculture division.

Whilst short-term uncertainty relating to Brexit continues, our

resilient performance in UK Agriculture during the pandemic

illustrates the strength of our business and its ability to

overcome future challenges. That adaptability, combined with

operational efficiencies and enhanced customer focus, places the

business well for future growth. Since the year-end, we have also

significantly expanded the geographic coverage of our machinery

franchise across southern Scotland with a more focused product

range, which provides an opportunity to grow sales over the medium

term.

Internationally, our Supplements business continues to enhance

its presence in territories with significant growth opportunity,

particularly across Europe, the USA, Canada, and New Zealand. We

also remain focused upon increasing our presence in new markets

including the UK dairy sector. We continue to build growth through

strategic partnerships and sustained research and development, and

remain confident in the division's medium term outlook.

ENGINEERING

The Engineering division performed resiliently despite

significant challenges. First half trading was slow due to contract

phasing and delays in receiving key robotics orders. This did not

improve in the second half, as had been expected, mainly due to

temporary disruption to nuclear and defence projects due to

COVID-19 restrictions, which affected travel and access to customer

sites. In addition, the sharp decline in the oil price led to

customers deferring investments in the oil and gas sector. Whilst

delays to projects had a negative impact on divisional performance,

the business was able to strengthen its customer relationships by

working flexibly to accommodate changing needs.

During the year, revenue was up 14.0% to GBP53.0m (2019:

GBP46.5m). NW Total, acquired towards the end of the prior year,

contributed GBP11.7m (2019: GBP1.9m). Adjusted operating profit was

down 35.6% to GBP3.8m (2019: GBP5.9m) and reported operating profit

was down 77.2% to GBP1.4m (2019: GBP6.0m).

UK Service and Manufacturing

Our UK Service and Manufacturing business delivered a solid

performance during the first half. The second half, however, was

heavily impacted by the decline in the oil price and significantly

reduced investment in the oil and gas sector, which led to delays

on one major project. In the year, total revenues were GBP29.4m

(2019: GBP23.0m), including NW Total revenues of GBP11.7m (2019:

GBP1.9m).

NW Total had a strong performance in its first full year as part

of the Group. Whilst COVID-19 restrictions were imposed temporarily

on one customer site, this had a limited impact on the business

overall and the risk of further impact or delay to that project is

reduced by on-site controls now in place. The order book for the

business remains very strong and we remain very encouraged by the

opportunities, particularly in the defence sector, that NW Total

brings to the division.

During the year the Group also invested GBP1.3m in

state-of-the-art machinery at its site in Carlisle, bringing

large-scale machining capabilities and enhancing the range of

customer services available within the division.

Global Robotics

The Group's Global Robotics business had a challenging year.

This was driven by a weaker order book, resulting from contract

phasing and delays to projects in Japan, together with export

restrictions which continue to affect China. These challenges were

exacerbated by delays and travel restrictions imposed as a result

of COVID-19. Revenues for the year totalled GBP14.8m (2019:

GBP16.5m).

While the business experienced lower levels of activity during

the year, the order book was strengthened significantly. We also

remain optimistic about opportunities in Japan, where many of the

country's nuclear facilities continue to be decommissioned. In the

year, we opened a showroom for our products in Japan which will

help develop opportunities in the region.

Our Global Robotics business continues to develop its position

in the USA. Good progress continues to be made on the significant

$8.5m contract previously announced, and during the year we opened

a robotics showroom at our facility in Mooresville, North Carolina,

which will help demonstrate the efficacy of our products to

customers in North America.

Global Technical Services

The Group's Global Technical Services business performed in line

with expectations, generating revenues of GBP8.8m (2019:

GBP7.0m).

The phasing of several long-term Mechanical Stress Improvement

Process (MSIP(R)) projects enhanced performance in the second half

of the year, which will continue throughout the current year.

During the period, the business was awarded another $6m MSIP(R)

contract to be delivered through to 2022.

The development of our passive cooling technology continues to

progress, following the award of funding from the US Department of

Energy in 2019. It is anticipated that an application for a second

tranche of funding will be made during 2021. This technology has

the potential to be retrofitted on existing nuclear power plants to

improve safety.

Engineering Outlook

The Group remains confident in the medium-term prospects of the

Engineering division.

Whilst parts of the division which serve oil and gas markets

have been impacted in the short-term, owing to a reduction in

customer investment attributable to the low oil price, there remain

significant opportunities across nuclear and defence markets. The

division also continues to develop technologies, in conjunction

with its strategic partners, to provide innovative solutions to

customer challenges in nuclear markets.

Our improved divisional structure provides a comprehensive

offering, able to compete on a larger scale than before. Such

changes provide an uplift in the volume of contracts we can tender

for and leave the division well placed for future growth.

Tim Davies

Chief Executive Officer

23 November 2020

CONSOLIDATED INCOME STATEMENT

for the year ended 29 August 2020

Note 2020 2019

GBP'000 GBP'000

Continuing operations

Revenue 2 395,630 403,905

Cost of sales (343,381) (349,798)

Gross profit 52,249 54,107

Distribution costs (19,507) (18,454)

Administrative expenses (21,535) (20,835)

Adjusted (1) share of post-tax results

of associate 1,191 1,230

Adjusting items 3 - (306)

Share of post-tax results of associate 1,191 924

Share of post-tax results of joint ventures 1,442 1,453

Adjusted (1) operating profit 16,247 18,930

Adjusting items 3 (2,407) (1,735)

Operating profit 2 13,840 17,195

Finance income 313 463

Finance costs (1,656) (1,349)

Adjusted (1) profit before taxation 14,904 18,044

Adjusting items 3 (2,407) (1,735)

Profit before taxation 2 12,497 16,309

Taxation 4 (1,575) (2,685)

Profit for the year 10,922 13,624

===================== =====================

Profit attributable to:

Equity shareholders 9,533 12,049

Non-controlling interests 1,389 1,575

---------------------

10,922 13,624

===================== =====================

Earnings per ordinary share (pence)

Basic 5 10.3 13.1

Diluted 10.2 12.8

Adjusted 5 11.9 14.6

(1) Adjusted results are consistent with how business

performance is measured internally and is presented to aid

comparability of performance. Adjusting items are disclosed in note

3. An alternative performance measures glossary can be found in

note 9.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 29 August 2020

2020 2019

GBP'000 GBP'000

Profit for the year 10,922 13,624

---------- ---------

Other comprehensive (expense)/income

Items that may be reclassified subsequently

to profit or loss:

* Foreign exchange translation (losses)/gains arising

on translation of overseas subsidiaries (2,552) 1,857

* Net investment hedges (54) 37

* Taxation credit/(charge) on net investment h edges 10 (7)

Items that will not be reclassified subsequently

to profit or loss:

- Actuarial gains/(losses) on retirement

benefit asset:

- Group 142 (1,845)

- Share of associate 408 (88)

* Taxation (charge)/credit on actuarial gains/(losses)

on retirement benefit asset: (27) 314

(96) 15

- Group

- Share of associate

Other comprehensive (expense)/income for

the year, net of tax (2,169) 283

---------- ---------

Total comprehensive income for the year 8,753 13,907

========== =========

Total comprehensive income attributable to:

Equity shareholders 7,364 12,332

Non-controlling interests 1,389 1,575

8,753 13,907

========== =========

CONSOLIDATED BALANCE SHEET

as at 29 August 2020

2020 2019

GBP'000 GBP'000

Assets

Non-current assets

Goodwill 32,041 32,877

Other intangible assets 9,171 9,318

Property, plant and equipment 38,259 41,917

Right-of-use assets 14,856 -

Investment property 158 164

Investment in associate 14,307 13,392

Interest in joint ventures 10,551 9,671

Other investments 73 76

Financial assets

- Non-current receivables 20 22

Retirement benefit asset 8,037 7,769

Deferred tax asset - 410

---------- ----------

127,473 115,616

---------- ----------

Current assets

Inventories 40,961 46,270

Contract assets 8,114 9,466

Trade and other receivables 51,686 56,349

Current tax assets 1,535 -

Financial assets

- Derivative financial instruments 3 -

- Cash and cash equivalents 17,571 28,649

---------- ----------

119,870 140,734

---------- ----------

Total assets 247,343 256,350

---------- ----------

Liabilities

Current liabilities

Financial liabilities

- Borrowings (11,420) (23,856)

- Leases (2,778) -

Contract liabilities (1,061) (1,269)

Trade and other payables (55,522) (62,653)

Current tax liabilities (33) (1,010)

---------- ----------

(70,814) (88,788)

---------- ----------

Non-current liabilities

Financial liabilities

- Borrowings (25,021) (28,586)

- Leases (11,171) -

Deferred tax liabilities (4,783) (4,987)

Other non-current liabilities (1,385) (2,999)

---------- ----------

(42,360) (36,572)

---------- ----------

Total liabilities (113,174) (125,360)

---------- ----------

Net assets 134,169 130,990

========== ==========

Shareholders' equity

Share capital 2,312 2,299

Share premium 9,176 9,165

Other reserves 105,638 102,786

--------

Total shareholders' equity 117,126 114,250

Non-controlling interests 17,043 16,740

-------- --------

Total equity 134,169 130,990

======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 29 August 2020

Equity Foreign Total Non-

Share Share Treasury Compensation Exchange Other Retained Shareholders' controlling

Capital Premium Share Reserve Reserve Reserve Earnings Equity Interests Total

GBP'000 GBP'000 Reserve GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

At 2 September

2018 2,285 9,141 - 1,427 4,259 202 87,843 105,157 15,685 120,842

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

Profit for

the

Year - - - - - - 12,049 12,049 1,575 13,624

Other

comprehensive

income/(expense) - - - - 1,887 - (1,604) 283 - 283

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

Total

comprehensive

income - - - - 1,887 - 10,445 12,332 1,575 13,907

Dividends

paid - - - - - - (4,173) (4,173) (588) (4,761)

Equity-settled

share-based

payment

transactions - - - 53 - - 759 812 68 880

Allotment

of shares 14 24 - - - - - 38 - 38

Purchase

of own shares

held in trust - - (13) - - - - (13) - (13)

Reclassified

from liabilities - - - 97 - - - 97 - 97

Transfer - - 13 - - (3) (10) - - -

At 31 August

2019 2,299 9,165 - 1,577 6,146 199 94,864 114,250 16,740 130,990

========= ========= ========== ============= ========= ========= ========== =========================== ============ =========

As previously

reported

at 31 August

2019 2,299 9,165 - 1,577 6,146 199 94,864 114,250 16,740 130,990

Effect of

IFRS 16 adoption - - - - - - (931) (931) (511) (1,442)

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

At 1 September

2019 (restated) 2,299 9,165 - 1,577 6,146 199 93,933 113,319 16,229 129,548

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

Profit for

the

Year - - - - - - 9,533 9,533 1,389 10,922

Other

comprehensive

(expense)/income - - - - (2,596) - 427 (2,169) - (2,169)

--------- --------- ---------- ------------- --------- --------- ---------- --------------------------- ------------ ---------

Total

comprehensive

(expense)/income - - - - (2,596) - 9,960 7,364 1,389 8,753

Dividends

paid - - - - - - (3,344) (3,344) (588) (3,932)

Equity-settled

share-based

payment

transactions - - - (843) - - 691 (152) 15 (137)

Excess deferred

taxation

on share-based

payments - - - - - - (27) (27) (2) (29)

Allotment

of shares 13 11 - - - - - 24 - 24

Purchase

of own shares

held in trust - - (58) - - - - (58) - (58)

Transfer - - 13 - - (2) (11) - - -

At 29 August

2020 2,312 9,176 (45) 734 3,550 197 101,202 117,126 17,043 134,169

========= ========= ========== ============= ========= ========= ========== =========================== ============ =========

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 29 August 2020

Note 2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from continuing operations 6 22,639 16,004

Interest received 176 178

Interest paid (1,696) (1,276)

Tax paid (3,059) (2,306)

Net cash generated from operating activities 18,060 12,600

--------- ---------

Cash flows from investing activities

Acquisition of subsidiaries (net of

overdraft/cash acquired) - (9,868)

Contingent/deferred consideration paid (2,659) (379)

Dividend received from associate and

joint ventures 701 711

Other loans 718 79

Purchase of intangible assets (1,459) (1,310)

Proceeds from sale of property, plant

and equipment 421 831

Purchase of property, plant and equipment (6,569) (4,471)

Purchase of own shares held in trust (58) (13)

---------

Net cash used in investing activities (8,905) (14,420)

--------- ---------

Cash flows from financing activities

Proceeds from issue of ordinary share

capital 24 38

New bank loans and movement on RCF 1,889 14,430

Lease principal repayments (3,171) (1,278)

Repayment of borrowings (2,459) (2,493)

Decrease in other borrowings (14,508) (1,352)

Dividends paid to shareholders (3,344) (4,173)

Dividends paid to related party (588) (588)

--------- ---------

Net cash (used in)/generated from financing

activities (22,157) 4,584

--------- ---------

Effect of exchange rate changes (989) 526

--------- ---------

Net (decrease)/increase in cash and

cash equivalents (13,991) 3,290

Cash and cash equivalents at beginning

of the year 24,295 21,005

--------- ---------

Cash and cash equivalents at end of

the year 10,304 24,295

========= =========

NOTES TO THE PRELIMINARY ANNOUNCEMENT

1. Basis of preparation and going concern

The financial information in this preliminary announcement does

not constitute the Company's statutory accounts for the years ended

29 August 2020 or 31 August 2019. Statutory accounts for 2019 have

been delivered to the Registrar of Companies, and those for 2020

will be delivered in due course. The auditor has reported on those

accounts; their reports were (i) unqualified, (ii) did not include

a reference to any matters to which the auditor drew attention by

way of emphasis without qualifying their report and (iii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

Going concern

The financial information in this preliminary announcement has

been prepared on a going concern basis which the Directors consider

to be appropriate for the following reasons.

The Directors have reviewed the Group's operational forecasts

and projections for the three years to 2 September 2023 as used for

the viability assessment, taking account of reasonably possible

changes in trading performance, together with the planned capital

investment over that same period. The Group is expected to have a

sufficient level of financial resources available through operating

cash flows and existing bank facilities for a period of at least 12

months from approval of the financial statements ("The going

concern period"). The Group has operated within all its banking

covenants throughout the year. In addition, the Group's main

banking facility is in place until November 2023 and an invoice

discounting facility has been recently renewed for a three year

period to August 2023.

For the purpose of assessing the appropriateness of the

preparation of the Group's accounts on a going concern basis, the

Directors have prepared financial forecasts for the Group,

comprising profit before and after taxation, balance sheets and

cash flows through to year ended 2023. The forecasts consider the

current cash position, the availability of banking facilities and

an assessment of the principal areas of risk and uncertainty,

paying particular attention to the impact of Covid-19. These

forecasts have been sensitised for severe but plausible downside

scenarios. The scenarios tested included significant reductions in

profitability and associated cashflows, with a reduction in

consumer demand affecting all business units, additional impacts on

Agriculture business units from Brexit and a larger impact on

Engineering from disruption caused by Covid-19. The results of this

stress testing showed that, due to the stability of the core

business, the Group would be able to withstand the impact of these

severe but plausible downside scenarios occurring over the period

of the financial forecasts.

In addition, several other mitigating measures remain available

and within the control of the Directors that were not included in

the scenarios. These include withholding discretionary capital

expenditure and reducing or cancelling future dividend

payments.

In all the scenarios, the Group complied with its financial bank

covenants, operated within its existing bank facilities, and met

its liabilities as they fall due.

Consequently, the Directors are confident that the Group and the

Company will have sufficient funds to continue to meet their

liabilities as they fall due for at least 12 months from the date

of approval of the financial statements and therefore have prepared

the financial information in this preliminary announcement on a

going concern basis.

Accounting policies

The accounting policies are consistent with those of the prior

year except for the adoption of new standard IFRS 16.

IFRS 16 'Leases'

The Group adopted IFRS 16 with effect from 1 September 2019 and

has applied the standard using the modified retrospective approach

under which the cumulative effect of initially applying the

standard is recognised at the date of initial application. The

Group has restated its opening total equity position as at 1

September 2019 by a charge of GBP1.4m. Comparative information has

not been restated and is therefore still reported under IAS 17

'Leases' and related interpretations. To assist comparability, note

10 shows the balance sheet as at 29 August 2020 had the Group

continued to adopt IAS 17 and related interpretations.

Under the modified retrospective approach used, the Group has

recognised right-of-use assets at their carrying amounts as if the

standard had been applied since the commencement date, but

discounted using the Group's incremental borrowing rate at the date

of initial application. The liability has been recognised at an

amount equal to the present value of the remaining lease payments,

discounted using the Group's incremental borrowing rate at the date

of initial application. The incremental borrowing rates used range

between 1.3% - 3.88% based on the geographic location and economic

circumstances of the lessee. In addition to existing finance leased

assets with a net book value of GBP4.4m being transferred to

right-of-use assets on transition, GBP11.5m of right-of-use assets

were recognised on transition in respect of leases previously

accounted for as operating leases under IAS 17. An additional lease

obligation of GBP12.7m was recognised on transition in respect of

leases previously accounted for as operating leases. Prepayments

and accruals totalling GBP0.5m have been removed from the balance

sheet on transition.

A reconciliation of operating lease commitments disclosed as at

31 August 2019 to the lease liabilities recognised on transition is

as follows:

GBP'000

-------------------------------------------------------------------------------------- --------------------

Operating lease commitments as at 31 August 2019 12,917

Discounted using the incremental borrowing rate at initial application (4,365)

Inclusion of liabilities beyond break clauses 3,746

Other 357

Lease liabilities (excluding existing finance lease liabilities) at 1 September 2019 12,655

-------------------------------------------------------------------------------------- --------------------

Included within:

Current liabilities 1,618

Non-current liabilities 11,037

-------------------------------------------------------------------------------------- --------------------

12,655

-------------------------------------------------------------------------------------- --------------------

The following table shows the effect of IFRS 16 on the income

statement for the period ended 29 August 2020.

GBP'000

------------------------------------------- --------

Reduction in lease expense recognised 2,100

Depreciation on right-of-use assets (1,832)

Profit on disposal of right-of-use leases 37

Interest cost of lease liabilities (362)

Impact on Group profit before tax (57)

------------------------------------------- --------

Depreciation, profit on disposal and interest costs in the table

above exclude amounts in respect of finance leases that would have

been recognised in the income statement under IAS 17.

On transition to IFRS 16 the Group has applied the following

practical expedients permitted by the standard on a lease-by-lease

basis:

-- Accounting for leases where the lease term ends within 12

months of the date of initial application as short-term leases;

-- Exclusion of initial direct costs from the measurement of the

right-of-use asset at the date of initial application; and

-- Use of hindsight, such as in determining the lease term if

the contract contains options to extend or terminate the lease.

The Group is not required to make any transition adjustment for

leases previously classified as operating leases under IAS 17 where

the underlying asset is of low value.

The Group is also not required to reassess whether a contract

is, or contains, a lease at the date of initial application. IFRS

16 permits the Group to apply the standard only to contracts that

were previously identified as containing a lease under IAS 17 and

IFRIC 4 'Determining whether an arrangement contains a lease'.

The Group leases properties, motor vehicles, plant and machinery

and other equipment. Lease terms are negotiated on an individual

basis and contain a wide range of terms and conditions.

Prior to transition to IFRS 16 the Group classified leases as

either finance leases or operating leases in accordance with IAS

17. Payments made under operating leases were charged to the income

statement on a straight-line basis over the term of the lease.

Since transition to IFRS 16, leases are recognised as a

right-of-use asset and a corresponding liability at the date at

which the leased asset is available for use by the Group. Each

lease payment is allocated between the repayment of the lease

liability and finance cost. The finance cost is charged to the

income statement over the lease period so as to produce a constant

periodic rate of interest on the remaining balance of the liability

for each period. The right-of-use asset is depreciated over the

shorter of the asset's useful life and the lease term on a

straight-line basis and is also subject to regular impairment

reviews.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of the following lease payments:

-- Fixed payments (including in-substance fixed payments), less

any lease incentives receivable;

-- Variable lease payments that are based on an index or rate;

-- Amounts expected to be payable by the lessee under residual value guarantees;

-- The exercise price of a purchase option if the lessee is

reasonably certain to exercise that option; and

-- Payments of penalties for terminating the lease, if the lease

term reflects the lessee exercising that option.

The lease payments are discounted using the interest rate

implicit in the lease. Where this cannot be determined, the

lessee's incremental borrowing rate is used, being the rate that

the lessee would have to pay to borrow the funds necessary to

obtain an asset of similar value in a similar economic environment

with similar terms and conditions.

Right-of-use assets are measured at cost comprising the

following:

-- The amount of the initial measurement of the lease liability;

-- Any lease payments made at of before the commencement date

less any lease incentives received;

-- Any initial direct costs incurred by the lessee; and

-- Restoration costs required by the terms and conditions of the lease.

At the commencement date of property leases the Group normally

determines the lease term to be the full term of the lease,

assuming that any option to break or extend the lease is unlikely

to be exercised and it is not reasonably certain that the Group

will continue in occupation for any period beyond the lease term.

Leases are regularly reviewed and will be revalued if it becomes

likely that a break clause or option to extend the lease is

exercised.

Payments associated with short-term leases and leases of low

value assets are recognised on a straight-line basis as an expense

in the income statement. Short term leases are leases with a lease

term of 12 months or less. Low value assets generally comprise

minor office and IT equipment.

The Group acts as lessor in certain operating lease

arrangements. Rental income is recognised on a straight-line basis

in the income statement. The Group is not a lessor in any finance

lease arrangements.

2. Segmental information

The segmental information for the year ended 29 August 2020 is

as follows:

Agriculture Engineering Central Group

GBP'000 GBP'000 GBP'000 GBP'000

Total segment revenue 342,627 53,020 - 395,647

Inter segment revenue (5) (12) - (17)

Revenue from external customers 342,622 53,008 - 395,630

============ ============ ======== ==========

Adjusted(1) EBITDA(2) 14,798 6,754 (781) 20,771

Depreciation, amortisation

and profit/(loss) on disposal

of non-current assets (4,031) (2,944) (182) (7,157)

Share of post-tax results

of associate and joint

ventures 2,633 - - 2,633

Adjusted(1) operating profit 13,400 3,810 (963) 16,247

Adjusting items (note 3) 42 (2,449) - (2,407)

Operating profit 13,442 1,361 (963) 13,840

------------ ------------ --------

Finance income 313

Finance costs (1,656)

Adjusted(1) profit before

taxation 14,904

Adjusting items (note 3) (2,407)

Profit before taxation 12,497

==========

(1) Adjusted results are consistent with how business

performance is measured internally and is presented to aid

comparability of performance. Adjusting items are disclosed in note

3

(2) Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current

assets and share of post-tax results of associate and joint ventures

The segmental information for the year ended 31 August 2019 is

as follows. This has been restated to present central costs

separately. This is to aid comparability with the segmental

information presented for the current year.

Agriculture Engineering Central Group

GBP'000 GBP'000 GBP'000 GBP'000

Total segment revenue 357,399 46,556 - 403,955

Inter segment revenue (11) (39) - (50)

Revenue from external customers 357,388 46,517 - 403,905

============ ============ ======== ==========

Adjusted(1) EBITDA(2) 14,914 7,796 (1,554) 21,156

Depreciation, amortisation and profit/(loss)

on disposal of non-current assets (2,946) (1,879) (84) (4,909)

Share of post-tax results of associate

(adjusted(1) ) and joint ventures 2,683 - - 2,683

Adjusted(1) operating profit 14,651 5,917 (1,638) 18,930

Adjusting items (note 3) (531) 65 (1,269) (1,735)

Operating profit 14,120 5,982 (2,907) 17,195

------------ ------------ --------

Finance income 463

Finance costs (1,349)

Adjusted(1) profit before taxation 18,044

Adjusting items (note 3) (1,735)

Profit before taxation 16,309

==========

(1) Adjusted results are consistent with how business

performance is measured internally and is presented to aid

comparability of performance. Adjusting items are disclosed in note

3

(2) Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current assets and share of

post-tax results of associate and joint ventures

3. Adjusting items

In reporting financial information, the Group presents

alternative performance measures (APMs), which are not defined or

specified under the requirements of IFRS. These APMs are consistent

with how business performance is measured internally and therefore

the Group believes that these APMs provide stakeholders with

additional useful information on the performance of the business.

The following adjusting items have been added back to reported

profit measures.

2020 2019

GBP'000 GBP'000

Amortisation of acquired intangible assets

(i) 1,380 814

Adjustments to contingent consideration

(ii) (937) (1,126)

Restructuring/closure costs (iii) 1,964 437

Business combination expenses (iv) - 509

Past service cost - Group (v) - 795

Past service cost - share of associate

(v) - 306

2,407 1,735

=================================== =============================

(i) Amortisation of acquired intangible assets which do not

relate to the underlying profitability of the Group but rather

relate to costs arising on acquisition of businesses.

(ii) Adjustments to contingent consideration arise from the

revaluation of contingent consideration in respect of acquisitions

to fair value at the year end. Movements in fair value arise from

changes to the expected payments since the previous year end based

on actual results and updated forecasts. Any increase or decrease

in fair value is recognised through the income statement.

(iii) Restructuring/closure costs include redundancy costs and

impairments of assets to recoverable amounts. The impairment to

property, plant and equipment was GBP239,000 (2019: GBPnil).

(iv) Business combination expenses relate to acquisition costs incurred.

(v) The scheme actuary's estimated effect on the Group's, and

share of associate's, pension scheme liabilities following the

equalisation of Guaranteed Minimum Pensions (GMPs). For further

details of the past service costs see note 7.

4. Taxation

2020 2019

GBP'000 GBP'000

Analysis of the charge in the year

Current tax:

UK corporation tax

Current year 1,077 1,447

Adjustment in respect of prior years (150) 45

Foreign tax

Current year 356 1,557

Adjustment in respect of prior years (217) 109

------------------ ------------------

Group current tax 1,066 3,158

------------------ ------------------

Deferred tax:

Origination and reversal of timing differences

Current year 450 (357)

Adjustment in respect of prior years 59 (116)

------------------ ------------------

Group deferred tax 509 (473)

------------------ ------------------

Tax on profit 1,575 2,685

================== ==================

Profit before taxation 12,497 16,309

------------------ ------------------

Tax at 19% (2019: 19%) 2,374 3,099

Effects of:

Tax effect of share of results of associate

and joint ventures (500) (452)

Tax effect of expenses that are not

allowable in determining taxable profit 184 180

Tax effect of non-taxable income (633) (482)

Effects of different tax rates of foreign

subsidiaries 83 256

Effects of changes in deferred tax rates 304 (24)

Unrecognised deferred tax on losses 71 70

Adjustment in respect of prior years (308) 38

------------------ ------------------

Total tax charge for the year 1,575 2,685

================== ==================

The tax effect of expenses that are not allowable in determining

taxable profit includes adjustments for share based payments,

depreciation and amortisation on non-qualifying assets, and other

expenses disallowable for UK corporation tax. The prior year also

includes business combination expenses (note 3) which were treated

as disallowable for tax purposes.

The tax effect of non-taxable income includes the adjustments to

contingent consideration (note 3) and the effect of income within

the patent box regime.

The prevailing UK corporation tax rate of 19% was substantively

enacted as part of the Finance Act 2019 on 12 March 2019. The rate

was due to reduce to 17% from April 2020, however, in the budget on

12 March 2020 it was announced that the main rate of UK corporation

tax will be held at 19%. Deferred tax is therefore provided at 19%.

UK deferred tax balances at the prior year end were provided at

17%.

5. Earnings per ordinary share

Basic earnings per share are based on profit attributable to

shareholders and on a weighted average number of shares in issue

during the year of 92,346,828 (2019: 91,828,015). The calculation

of diluted earnings per share is based on 93,731,044 shares (2019:

94,347,658).

Adjusting items disclosed in note 3 that are charged or credited

to profit do not relate to the underlying profitability of the

Group. The Board believes adjusted profit before these items

provides a useful measure of business performance. Therefore, an

adjusted earnings per share is presented as follows:

2020 2020 2019 2019

Earnings Earnings Earnings Earnings

per per

GBP'000 share pence GBP'000 share pence

Earnings per share -

basic 9,533 10.3 12,049 13.1

Adjusting items:

Amortisation of acquired

intangible assets 1,380 1.5 814 0.9

Adjustments to contingent

consideration (937) (1.0) (1,126) (1.2)

Restructuring/closure

costs 1,964 2.1 437 0.5

Business combination

expenses - - 509 0.6

Past service cost -

Group - - 795 0.9

Past service cost -

share of associate - - 306 0.3

Taxation effect of the

above (639) (0.7) (367) (0.4)

Non-controlling interest

in the above (273) (0.3) (57) (0.1)

Earnings per share -

adjusted 11,028 11.9 13,360 14.6

========= ============ ========= ============

6. Cash generated from continuing operations

2020 2019

GBP'000 GBP'000

Continuing operations

Profit for the year 10,922 13,624

Adjustments for:

Tax 1,575 2,685

Tax credit in respect of R&D (250) (526)

Depreciation of property, plant and equipment 4,567 4,804

Depreciation on right-of-use assets 2,462 -

Depreciation of investment property 6 6

Intangible asset amortisation 1,513 943

Loss/(profit) on disposal of property,

plant and equipment 265 (30)

Profit on disposal of right-of-use assets (37) -

Business combination expenses - 509

Adjustments to contingent consideration (937) (1,126)

Net fair value (credit)/charge on share

based payments (137) 880

Release of loan provision (783) -

Other non-cash adjustments (504) (139)

Interest income (313) (463)

Interest expense and borrowing costs 1,716 1,399

Share of results of associate and joint

ventures (2,633) (2,377)

IAS19 income statement charge (excluding

interest):

Administrative expenses 13 21

Past service cost - 795

Changes in working capital (excluding the

effects of acquisitions):

Decrease/(increase) in inventories 4,811 (670)

Decrease/(increase) in receivables 3,862 (1,008)

Decrease in payables (3,479) (3,323)

--------- ---------

Cash generated from continuing operations 22,639 16,004

========= =========

7. Pensions

The Group operates its current pension arrangements on a defined

benefit and defined contribution basis. The valuation of the

defined benefit scheme under the IAS19 accounting basis showed a

surplus in the scheme at 29 August 2020 of GBP8.0m (2019:

GBP7.8m).

In the year, the retirement benefit charge, excluding interest,

in respect of the Carr's Group Pension Scheme was GBP13,000 (2019:

GBP816,000). The prior year includes GBP795,000 in respect of GMP

equalisation which is discussed further below.

A Group subsidiary undertaking is a participating employer in a

defined benefit pension scheme of the associate, Carrs Billington

Agriculture (Operations) Ltd. The IAS19 accounting basis showed a

surplus for that scheme at 29 August 2020 of GBP3.5m (2019:

GBP1.9m). The scheme is treated as a defined contribution scheme by

the Group, and its level of participation in the scheme is

estimated at 48.5%, which is based on its estimated share of the

buyout liabilities. Due to the fact that the sponsoring employer is

an associate company of the Group, 49% of the surplus calculated on

an IAS19 accounting basis is included in the Group's balance sheet

within its 'Investment in associate'.

In October 2018 the High Court ruled on the case of Lloyds

Banking Group Pensions Trustees Ltd v Lloyds Bank plc and others.

This ruling required all UK defined benefit pension schemes to

equalise Guaranteed Minimum Pensions (GMPs) between males and

females. The Scheme's actuary estimated the effect on the Carr's

Group Pension Scheme liabilities to be GBP795,000 and this was

recognised as a past service cost through the Income Statement and

disclosed as an adjusting item in the prior year (note 3). The

Group also recognised its share of the effect of the GMP

equalisation on the associate's pension scheme liabilities through

its 'Share of post-tax results of associates' in the prior year.

The Group's share recognised was GBP306,000 which has also been

disclosed as an adjusting item in the prior year (note 3).

The Group continues to monitor further clarifications arising

from the High Court case.

8. Analysis of net debt

At Other At

1 September Cash Non-Cash Exchange 29

August

2019 Flow Changes Movements 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash

equivalents 28,649 (10,089) - (989) 17,571

Bank overdrafts (4,354) (2,913) - - (7,267)

------------------------ --------- ---------- ----------- -----------------------------------

24,295 (13,002) - (989) 10,304

Loans and other

borrowings:

- current (18,319) 13,615 528 23 (4,153)

- non-current (26,846) 1,463 (60) 422 (25,021)

Net debt

(excluding

leases) (20,870) 2,076 468 (544) (18,870)

======================== ========= ========== =========== ===================================

Finance leases

(IAS 17):

- current (1,183)

- non-current (1,740)

------------------------

Net debt

(including

leases) (23,793)

========================

9. Alternative performance measures glossary

The Preliminary Announcement includes alternative performance

measures (APMs), which are not defined or specified under the

requirements of IFRS. These APMs are consistent with how business

performance is measured internally and therefore the Directors

believe that these APMs provide stakeholders with additional useful

information on the Group's performance.

Alternative performance

measure Definition and comments

------------------------ ------------------------------------------------------

Adjusted EBITDA Earnings before interest, tax, depreciation,

amortisation, profit/(loss) on the disposal

of non-current assets, share of post-tax results

of the associate and joint ventures and excluding

items regarded by the Directors as adjusting

items. This measure is reconciled to statutory

operating profit and statutory profit before

taxation in note 2. EBITDA allows the user

to assess the profitability of the Group's

core operations before the impact of capital

structure, debt financing and non-cash items

such as depreciation and amortisation.

------------------------ ------------------------------------------------------

Adjusted operating Operating profit after adding back items regarded

profit by the Directors as adjusting items. This

measure is reconciled to statutory operating

profit in the income statement and note 2.

Adjusted results are presented because if

included, these adjusting items could distort

the understanding of the Group's performance

for the year and the comparability between

the years presented.

------------------------ ------------------------------------------------------

Adjusted profit Profit before taxation after adding back items

before taxation regarded by the Directors as adjusting items.

This measure is reconciled to statutory profit

before taxation in the income statement and

note 2. Adjusted results are presented because

if included, these adjusting items could distort

the understanding of the Group's performance

for the year and the comparability between

the years presented.

------------------------ ------------------------------------------------------

Adjusted earnings Profit attributable to the equity holders

per share of the Company after adding back items regarded

by the Directors as adjusting items after

tax divided by the weighted average number

of ordinary shares in issue during the year.

This is reconciled to basic earnings per share

in note 5.

------------------------ ------------------------------------------------------

Net debt The net position of the Group's cash at bank

and borrowings. Details of the movement in

net debt is shown in note 8.

------------------------ ------------------------------------------------------

10. Adoption of IFRS 16 'Leases'

The Group adopted IFRS 16 with effect from 1 September 2019 and

has applied IFRS 16 using the modified retrospective approach with

the cumulative effect of initially applying the standard recognised

at the date of initial application. Comparative information has not

been restated and is therefore still reported under IAS 17.

Adjustments to the opening balance sheet arising from the

adoption of IFRS 16 are as follows.

31 August 2019 Adjustments 1 September 2019

GBP'000 GBP'000 GBP'000

------------------------------- --------------------

Non-current assets

Property, plant and equipment 41,917 (4,409) 37,508

Right-of-use assets - 15,903 15,903

Current assets

Trade and other receivables 56,349 (776) 55,573

Current liabilities

Borrowings (23,856) 1,183 (22,673)

Leases - (2,801) (2,801)

Trade and other payables (62,653) 229 (62,424)

Non-current liabilities

Borrowings (28,586) 1,740 (26,846)

Leases - (12,777) (12,777)

Deferred tax liabilities (4,987) 266 (4,721)

Equity

Retained earnings 94,864 (931) 93,933

Non-controlling interests 16,740 (511) 16,229

Headline figures

Non-current assets 115,616 11,494 127,110

Current assets 140,734 (776) 139,958

Total assets 256,350 10,718 267,068

Current liabilities (88,788) (1,389) (90,177)

Non-current liabilities (36,572) (10,771) (47,343)

Total liabilities (125,360) (12,160) (137,520)

Net assets 130,990 (1,442) 129,548

Total shareholders' equity 114,250 (931) 113,319

Total equity 130,990 (1,442) 129,548

The adjustments to the opening position reflect the recognition

of GBP11.5m right-of-use assets previously accounted for as

operating leases under IAS 17 together with GBP4.4m of existing

assets held under finance lease arrangements reclassified to the

new balance sheet category of right-of-use assets. Prepayments and

accruals in respect of leases recognised on the balance sheet as at

31 August 2019 have been removed and additional lease liabilities

of GBP12.7m have been recognised in respect of leases previously

accounted for as operating leases under IAS 17. Finance lease

liabilities of GBP2.9m have been reclassified from borrowings to

leases on transition.

To enable users of these accounts to compare the years presented

in this preliminary announcement the following table shows the

balance sheet of the Group as at 29 August 2020 as though IAS 17

still applied .

29 August 2020 29 August 2020

(as reported) Adjustments (IAS 17)

GBP'000 GBP'000 GBP'000

------------------------------- --------------

Non-current assets

Property, plant and equipment 38,259 4,851 43,110

Right-of-use assets 14,856 (14,856) -

Current assets

Trade and other receivables 51,686 806 52,492

Current tax assets 1,535 (17) 1,518

Current liabilities

Borrowings (11,420) (1,259) (12,679)

Leases (2,778) 2,778 -

Trade and other payables (55,522) (175) (55,697)

Non-current liabilities

Borrowings (25,021) (1,558) (26,579)

Leases (11,171) 11,171 -

Deferred tax liabilities (4,873) (285) (5,158)

Equity

Retained earnings 101,202 1,029 102,231

Non-controlling interests 17,043 427 17,470

Headline figures

Non-current assets 127,473 (10,005) 117,468

Current assets 119,870 789 120,659

Total assets 247,343 (9,216) 238,127

Current liabilities (70,814) 1,344 (69,470)

Non-current liabilities (42,360) 9,328 (33,032)

Total liabilities (113,174) 10,672 (102,502)

Net assets 134,169 1,456 135,625

Total shareholders' equity 117,126 1,029 118,155

Total equity 134,169 1,456 135,625

The adjustments to the reported figures as at 29 August 2020

reflect the de-recognition of right-of-use assets and lease

liabilities except for finance leases that would have been

capitalised under IAS 17. It also reinstates prepayments in respect

of lease premiums paid at the commencement of the lease together

with prepayments and accruals in respect of the regular lease

payments for those leases that were accounted for as operating

leases under IAS 17.

11. The Board of Directors approved the preliminary announcement on 23 November 2020.

12. The Company intends to provide a copy of the Report and

Accounts to shareholders by 9 December 2020. The full Report and

Accounts will also be available upon request from the Company

Secretary, Carr's Group plc, Old Croft, Stanwix, Carlisle, CA3 9BA

or alternatively on the Company's website: www.carrsgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAPFEAASEFFA

(END) Dow Jones Newswires

November 23, 2020 02:00 ET (07:00 GMT)

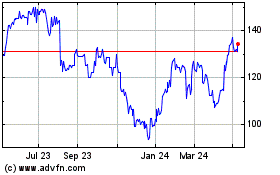

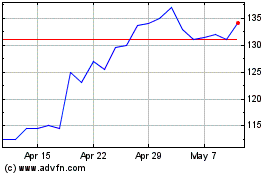

Carr's (LSE:CARR)

Historical Stock Chart

From Apr 2024 to May 2024

Carr's (LSE:CARR)

Historical Stock Chart

From May 2023 to May 2024