TIDMCER

RNS Number : 3253Z

Cerillion PLC

15 May 2023

AIM: CER

Cerillion plc

("Cerillion", the "Company" or the "Group")

Interim results

for the six months ended 31 March 2023

Record Six-month Period and Strong Prospects

Cerillion plc, the billing, charging and customer relationship

management software solutions provider, today issues its interim

results for the six months ended 31 March 2023.

Results H1 2023 H1 2022 Change

---------------------------------- --------- --------- --------

Revenue GBP20.5m GBP16.1m +27%

Annualised recurring revenue(1) GBP13.1m GBP9.8m +34%

Adjusted EBITDA(3) GBP10.0m GBP7.2m +38%

Statutory EBITDA GBP9.9m GBP7.1m +39%

Adjusted EBITDA margin 48.9% 44.9% +400bps

Adjusted profit before

tax(4) GBP9.2m GBP6.3m +46%

Statutory profit before

tax GBP8.6m GBP5.7m +52%

Adjusted basic earnings

per share(5) 25.5p 18.6p +37%

Statutory basic earnings

per share 23.5p 16.4p +43%

Dividend per share 3.3p 2.6p +27%

Net cash GBP23.6m GBP16.5m +43%

---------------------------------- --------- --------- --------

Financial

-- Revenue up 27% to GBP20.5m (H1 2022: GBP16.1m), reflecting

ongoing major implementation projects for new customers and new

orders from existing customers

-- Annualised recurring revenue(1) at 31 March 2023 up 34% to

GBP13.1m (H1 2022: GBP9.8m), mainly driven by increased uptake of

managed services

-- Adjusted EBITDA(3) up 38% to GBP10.0m (H1 2022: GBP7.2m)

-- Adjusted profit before tax(4) up 46% to GBP9.2m (H1 2022: GBP6.3m)

-- Adjusted earnings per share(5) up 37% to 25.5p (H1 2022: 18.6p)

-- Back-order book(2) up 8% to GBP43.0m (H1 2022: GBP39.7m)

-- Total new orders up 40% to GBP15.3m (H1 2022: GBP10.9m)

-- New customer pipeline up 23% to a record GBP212.0m (H1 2022: GBP172.0m)

-- Net cash up 43% to GBP23.6m (31 March 2022: GBP16.5m)

-- Interim dividend up 27% to 3.3p (H1 2022: 2.6p)

Operational

-- Continuing to build teams at new offices in Sofia, Bulgaria

and in Ahmedabad and Indore, India

-- Two major new contracts signed in the period with existing customers, both operating in EMEA:

o 10-year contract worth c. GBP10m, continuing a 20-year

relationship and

o five-year contract worth c. GBP6m

-- The Board believes that the Group is well-positioned to deliver its full year targets

Louis Hall, CEO of Cerillion plc, commented:

"Cerillion's interim results again set new records for our key

performance indicators in any six-month period and demonstrate the

strong momentum in the business and the significant growth

opportunities available.

"We continue to expand our resources and invest in the product

suite. With a strong new customer sales pipeline, which includes

advanced-stage contract discussions with certain potential new

customers, as well as healthy demand from existing customers, we

expect continuing strong growth ahead. Given the Company's progress

and prospects, we believe it is well-placed to deliver our full

year targets and view the future with confidence."

(1) Annualised recurring revenue includes annualised support and

maintenance, managed services and Cerillion Skyline revenue.

(2) Back-order book of GBP43.0m consists of GBP34.7m of sales

contracted but not yet recognised at the end of the reporting

period plus GBP8.3m of annualised support and maintenance revenue.

It is anticipated that 75% of the GBP34.7m of sales contracted but

not yet recognised as at the end of the reporting period will be

recognised within the next 12 to 18 months.

(3) Adjusted EBITDA is a non-GAAP, Company-specific measure,

which is earnings excluding finance income, finance costs, taxes,

depreciation, amortisation and share-based payments charges.

(4) Adjusted profit before tax is a non-GAAP, Company-specific

measure, which is earnings excluding taxes, amortisation of

acquired intangible assets and share-based payments charges.

(5) Adjusted earnings per share is a non-GAAP, Company-specific

measure, which is earnings after taxes, excluding amortisation of

acquired intangible assets and share-based payments charges divided

by the average weighted number of shares in the period.

For further information please contact:

Cerillion plc c/o KTZ Communications

Louis Hall, CEO, T: 020 3178 6378

Andrew Dickson, CFO

Liberum (Nomad and Broker) T: 020 3100 2000

Bidhi Bhoma, Ben Cryer, William Hall

Singer Capital Markets (Joint Broker) T: 020 7496 3000

Rick Thompson, George Tzimas, James

Fischer

T: 020 3178 6378

KTZ Communications

Katie Tzouliadis, Robert Morton

About Cerillion

Cerillion is a leading provider of mission critical software for

billing, charging and customer relationship management, with a

23-year track record in providing comprehensive revenue and

customer management solutions. The Company has around 80 customers

across 44 countries, principally serving the telecommunications

market.

The Company is headquartered in London and also has operations

in India (in Pune, Ahmedabad, and Indore), Bulgaria (in Sofia) and

Australia (in Sydney).

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S REPORT

Overview

The Company continues to grow strongly as these excellent

interim results show. All key KPIs are at record highs for a

six-month period, including revenue, profit and cash.

Revenue has increased by 27% year-on-year to GBP20.5m (H1 2022:

GBP16.1m), reflecting the major implementation and upgrade projects

under way with new customers and strong flows of business from

existing customers, as well as an increased baseline of recurring

income. Annualised recurring revenue at 31 March 2023 was 34%

higher than a year ago at GBP13.1m (H1 2022: GBP9.8m), which mainly

reflected the continuing trend for customers to take up managed

services. Adjusted profit before tax rose by 46% to GBP9.2m (H1

2022: GBP6.3m). Net cash at the end of March 2023 was up by 43% at

GBP23.6m (31 March 2022: GBP16.5m).

Total new orders increased year-on-year by 40% to GBP15.3m (31

March 2022: GBP10.9m) and the value of the new customer sales

pipeline rose by 23% to GBP212m (31 March 2022: GBP172m). We are in

advanced discussions with certain potential new customers and

expect new customer contracts to come through in the second half

and beyond.

To accommodate the Company's growth, we have continued to

develop our resource base. The new office in Sofia, Bulgaria has

now grown to a team of over 20 delivery consultants, and we have

added to the teams established at our new satellite offices in

India, in Ahmedabad and Indore. In Ahmedabad, we are focusing on

recruiting support resources, whilst in Indore, we are building a

team of digital customer experience developers. This continues our

policy of aiming to source the best people while also managing the

cost base effectively, particularly given inflationary

pressures.

From a market perspective, we are continuing to see strong

investment in 5G and broadband infrastructure. This will create

substantial opportunities for Cerillion as communications service

providers seek to monetise those new assets and gain more value

from their network real estate.

Looking ahead over the balance of the current financial year, we

remain very confident of continuing progress, supported by our

strong back-order book and new customer sales pipeline.

Financial Overview

Revenue for the six months ended 31 March 2023 increased by 27%

to GBP20.5m (H1 2022: GBP16.1m), which reflected the strong opening

back-order book, including ongoing major implementation projects,

and new orders from existing customers.

The mix of revenue was more weighted towards Software(1)

compared to the prior period, with Software revenue of GBP10.5m

accounting for 51% of total revenue (H1 2022: GBP6.1m and 38% of

total revenue). This was a 72% rise year-on-year and mainly

reflected the timing of software licence recognition. Services

revenue(1) of GBP8.9m made up 44% of total revenue (H1 2022:

GBP9.0m and 56% of total revenue). Other revenue of GBP1.0m

accounted for 5% of total revenue (H1 2022: GBP1.0m and 6% of total

revenue).

Gross margin for the period increased to 81.5% (H1 2022: 78.5%).

This rise principally reflected the higher proportion of software

licence revenue recognised, as well as a favourable impact from

foreign exchange rates. Whilst headcount increased in all regions

to support growth, our focus on building resources in India and

Bulgaria helped to reduce overall payroll inflation across the

Group.

Existing customers (those customers acquired at least 12 months

before the end of the reporting period) made up a high proportion

of the Group's revenue, as is typical, and generated 89% of total

revenue in the period (H1 2022: 91%).

Recurring revenue(2) , from support and maintenance and managed

service contracts, grew by 36% to GBP6.5m (H1 2022: GBP4.8m) and

accounted for 32% of the Group's revenue (H1 2022: 30%). The rise

largely reflected increased uptake of managed services, from both

new and existing customer deployments, and support and maintenance

fee increments. Annualised recurring revenue at the end of March

2023 increased by 34% year-on-year to GBP13.1m (31 March 2022:

GBP9.8m).

As expected, operating expenses increased to GBP8.3m (H1 2022:

GBP7.0m), an 18% rise. The main factors behind the rise were higher

headcount, higher sales commission and the effect of foreign

exchange rates. On a constant currency basis, operating expenses

increased by 13%.

Adjusted earnings before interest, tax, depreciation and

amortisation ("EBITDA"), which excludes share based payments

charges, rose by 38% to GBP10.0m (H1 2022: GBP7.2m). Statutory

EBITDA increased by 39% to GBP9.9m (H1 2022: GBP7.1m).

Adjusted profit before tax(3) rose by 46% to GBP9.2m (H1 2022:

GBP6.3m) and adjusted earnings per share(4) was 37% higher at 25.5p

(H1 2022: 18.6p). Statutory profit before tax increased by 52% to

GBP8.6m (H1 2022: GBP5.7m), and statutory earnings per share

increased by 43% to 23.5p (H1 2022: 16.4p).

The balance sheet remains strong. Net assets rose by 38% to

GBP31.8m as at 31 March 2023 (31 March 2022: GBP23.0m).

Cash Flow and Banking

Net cash at 31 March 2023 increased by 43% to GBP23.6m (31 March

2022: GBP16.5m), with no debt in either periods. Net cash generated

from operations in the period was GBP6.6m (H1 2022: GBP6.5m).

Development costs of GBP0.6m were capitalised in the period (H1

2022: GBP0.5m) after investment to further enhance the Company's

intellectual property.

Expenditure on fixed assets was GBP0.2m (H1 2022: GBP0.1m).

Free cash generation in the period was broadly maintained at

GBP5.8m (H1 2022: GBP5.9m), principally reflecting the higher

profit, offset by an increase in working capital due to the higher

software licence revenue recognised. Cash generated in the period

was partly utilised to pay the final dividend of GBP1.9m (H1 2022:

GBP1.5m) in respect of the year ended 30 September 2022.

Dividend

The Board is pleased to declare an increased interim dividend of

3.3p per share (H1 2022: 2.6p), a 27% rise year-on-year. The

interim dividend will become payable on 23 June 2023 to those

shareholders on the Company's register as at the close of business

on the record date of 2 June 2023. The ex-dividend date is 1 June

2023.

As previously stated, the Board aims to distribute between a

third to a half of the Group's free cash flow as dividends each

year, subject to the Group's performance and the Board's assessment

of the trading environment.

Operational Overview

Demand from the existing customer base was very healthy over the

first half, with new orders from existing customers up by 40% to

GBP15.3m (H1 2022: GBP10.9m). These new orders included additional

modules, software licence expansions, scope expansions on

implementation projects, upgrade programmes and managed services.

We were particularly pleased to agree a major new 10-year contract

worth GBP10 million with an existing customer with operations in

EMEA, continuing a 20 year-relationship. We also signed a GBP6

million agreement, which has a five-year term, with another EMEA

customer. The new customer sales pipeline grew strongly, up 23%, to

GBP212m as at 31 March 2023 (31 March 2022: GBP172m), and with

certain discussions at an advanced stage, we expect to close new

customer orders in the second half and beyond.

The back-order book stood at a very healthy level of GBP43.0m at

31 March 2023 (31 March 2022: GBP39.7m), buoyed by new orders.

These contracted (but not yet recognised) orders will drive

revenues over the coming quarters. It is also very encouraging to

see the Group's base of recurring revenue increase as the business

grows and both new and existing customers take up managed services

and support and maintenance contracts. We expect this trend to

continue.

The BSS/OSS(5) solutions that we provide remain a core

requirement for telecommunications operators and service providers,

and substantial investment in 5G and fibre rollout continues to

drive investment in replacing, upgrading and improving BSS/OSS

solutions. This is done in order to drive more revenue from the

network infrastructure real estate, with BSS/OSS solutions

providing the bridge between network and customer and hence

monetisation. The importance of the solutions that the Company

provides is illustrated in a survey(6) of communications service

providers, published by Gartner, the US-based technological

research and consulting firm, in April 2023. The survey cites the

following as priorities for software investments, all of which are

enabled by the Company's solutions:

-- Digitisation of sales and support;

-- Support for new business models/product types;

-- Improved customer lifetime values; and

-- Improved customer experience and engagement.

In order to enhance our product offering and our competitive

positioning, we continue to invest in R&D and issue two major

product releases a year. These provide new features and

improvements to existing functionality. This year, we expect to

invest a total of approximately 12,000 man-days in R&D.

We have also continued to expand and develop our teams, as noted

above, adding new and experienced talent in the UK, Bulgaria and

India.

Outlook

The business has made strong progress and is very well placed in

a growing marketplace. Our 'productised', 'as-a-service' approach

stands out, and the quality, breadth and completeness of our

solutions provides us with strong competitive differentiation.

We believe that Cerillion remains well-positioned to achieve its

full year targets, supported by existing major implementation

projects, the healthy back-order book, and our strong new customer

pipeline, which includes a number of advanced-stage new contract

discussions.

The Company's robust balance sheet, which carries no debt, and

the increasing level of recurring income, provide a strong

underpinning for the business as it continues to grow and develop.

The Board views near and mid-term growth prospects very

positively.

Alan Howarth Louis Hall

Chairman Chief Executive Officer

Notes:

(1) Software revenue is made up of software licence, support and

maintenance, managed service and Cerillion Skyline revenue. In the

prior period, software revenue was only made up of software licence

and support and maintenance revenue; managed service and Cerillion

Skyline revenue were included within services. The prior period

comparatives have been restated to reflect the updated definition,

which is consistent with that used for year-end reporting.

(2) Recurring revenue includes annualised support and

maintenance, managed service and Cerillion Skyline revenue.

(3) Adjusted profit before tax is a non-GAAP, Company-specific

measure which is earnings excluding taxes, amortisation of acquired

intangible assets and share-based payments charges.

(4) Adjusted earnings per share is a non-GAAP, Company-specific

measure which is earnings after taxes, excluding share-based

payments charges and amortisation of acquired intangible assets

divided by the average weighted number of shares in the period.

(5) BSS/OSS; in telecommunications, this refers respectively to

business support systems and operating support systems.

Gartner Disclaimer:

(6) GARTNER is a registered trademark and service mark of

Gartner, Inc. and/or its affiliates in the U.S. and internationally

and is used herein with permission. All rights reserved.

The industry report referred to above is Gartner "Market Guide

for CSP Customer Management and Experience Solutions" (published 10

April 2023).

Gartner does not endorse any vendor, product or service depicted

in our research publications, and does not advise technology users

to select only those vendors with the highest ratings or other

designation. Gartner research publications consist of the opinions

of Gartner's research organization and should not be construed as

statements of fact. Gartner disclaims all warranties, expressed or

implied, with respect to this research, including any warranties of

merchantability or fitness for a particular purpose.

INTERIM FINANCIAL INFORMATION

Unaudited Consolidated Statement of Comprehensive Income

for the six months ended 31 March 2023

Consolidated Consolidated Consolidated

Unaudited Unaudited Audited

half year half year year to

to to 30 Sep 2022

31 Mar 2023 31 Mar 2022 GBP'000

GBP'000 GBP'000

Continuing operations

Revenue 20,497 16,140 32,726

Cost of sales (3,790) (3,476) (7,221)

------------- ------------- -------------

Gross profit 16,707 12,664 25,505

Operating expenses (8,254) (7,018) (13,031)

Impairment losses on financial

assets (168) - (1,770)

Adjusted EBITDA* 10,017 7,248 13,750

Depreciation and amortisation (1,615) (1,465) (2,986)

Share based payment charge (117) (137) (60)

Operating profit 8,285 5,646 10,704

Finance costs (65) (73) (146)

Finance income 371 82 337

Adjusted profit before

tax** 9,204 6,288 11,948

Share based payment charge (117) (137) (60)

Amortisation of acquired

intangibles (496) (496) (993)

--------------------------------- ------------- ------------- -------------

Profit before tax 8,591 5,655 10,895

Taxation (1,671) (802) (1,551)

------------- ------------- -------------

Adjusted profit for the

period*** 7,533 5,486 10,397

Share based payment charge (117) (137) (60)

Amortisation of acquired

intangibles (496) (496) (993)

--------------------------------- ------------- ------------- -------------

Profit for the period 6,920 4,853 9,344

Other comprehensive income

Exchange differences on

translating foreign operations (95) 4 70

------------- ------------- -------------

Total comprehensive profit

for the period 6,825 4,857 9,414

------------- ------------- -------------

All transactions are attributable to the owners of the

parent.

H1 2023 H1 2022 FY 2022

Basic earnings per share from continuing 23.5 pence 16.4 pence 31.7 pence

operations

Diluted earnings per share from 23.4 pence 16.4 pence 31.6 pence

continuing operations

Adjusted basic earnings per share 25.5 pence 18.6 pence 35.2 pence

from continuing operations

* Adjusted EBITDA is a non-GAAP, Company-specific measure,

which is earnings excluding finance income, finance costs,

taxes, depreciation, amortisation and share-based payments

charge.

** Adjusted profit before tax is a non-GAAP, Company-specific

measure which is earnings excluding taxes, amortisation

of acquired intangible assets and share-based payments

charge.

*** Adjusted profit for the period is a non-GAAP, Company-specific

measure which is earnings excluding share-based payments

charge and amortisation of acquired intangible assets.

Unaudited Condensed Consolidated Statement of Changes in

Equity

as at 31 March 2023

Share Share Share Treasury Foreign Retained Total Equity

capital premium option stock exchange earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Balance at 1 October

2021 (audited) 147 13,319 128 - (167) 6,778 20,205

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Profit for the period - - - - - 4,853 4,853

Exchange difference

on translating foreign

operations - - - - 4 - 4

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Total comprehensive

income - - - - 4 4,853 4,857

Share option charge - - 137 - - - 137

Purchase of treasury

stock - - - (827) - - (827)

Exercise of share options - - (46) 730 - (576) 108

Dividends - - - - - (1,476) (1,476)

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Balance at 31 March

2022 (unaudited) 147 13,319 219 (97) (163) 9,579 23,004

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Profit for the period - - - - - 4,491 4,491

Exchange difference

on translating foreign

operations - - - - 66 - 66

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Total comprehensive

income - - - - 66 4,491 4,557

Share option charge - - (76) - - - (76)

Exercise of share options - - (6) 97 - (77) 14

Dividends - - - - - (767) (767)

Balance at 30 September

2022 (audited) 147 13,319 137 - (97) 13,226 26,732

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Profit for the period - - - - - 6,920 6,920

Exchange difference

on translating foreign

operations - - - - (95) - (95)

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Total comprehensive

income - - - - (95) 6,920 6,825

Share option charge - - 117 - - - 117

Dividends - - - - - (1,918) (1,918)

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Balance at 31 March

2023 (unaudited) 147 13,319 254 - (192) 18,228 31,756

--------------------------- --------- --------- --------- --------- ---------- ---------- -------------

Unaudited Condensed Consolidated Balance Sheet

as at 31 March 2023

Unaudited Consolidated Consolidated Consolidated

Note Unaudited Unaudited Audited

31 Mar 2023 31 Mar 2022 30 Sep 2022

GBP'000 GBP'000 GBP'000

Assets

Non-current

Goodwill 2,053 2,053 2,053

Other intangible assets 2,172 3,097 2,653

Property, plant and equipment 951 678 980

Right-of-use assets 2,704 3,367 3,057

Other receivables 5 3,619 2,681 2,171

Deferred tax assets 238 224 260

------------- ------------- -------------

11,737 12,100 11,174

------------- ------------- -------------

Current assets

Trade receivables 2,812 1,744 2,503

Other receivables 5 11,149 9,575 8,702

Cash and cash equivalents 23,645 16,514 20,249

------------- ------------- -------------

37,606 27,833 31,454

------------- ------------- -------------

Total assets 49,343 39,933 42,628

------------- ------------- -------------

Equity and liabilities

Shareholders' equity

Share capital 147 147 147

Share premium account 13,319 13,319 13,319

Treasury stock - (97) -

Foreign exchange reserve (192) (163) (97)

Share option reserve 254 219 137

Retained earnings 18,228 9,579 13,226

------------- ------------- -------------

Total Equity 31,756 23,004 26,732

------------- ------------- -------------

Liabilities

Non-current

Other payables 469 428 934

Deferred tax liabilities 624 767 719

Lease liabilities 2,616 3,460 3,050

------------- ------------- -------------

3,709 4,655 4,703

------------- ------------- -------------

Current liabilities

Trade payables 2,382 385 1,154

Other payables 5 11,496 11,889 10,039

13,878 12,274 11,193

------------- ------------- -------------

Total equity and liabilities 49,343 39,933 42,628

------------- ------------- -------------

Unaudited Condensed Consolidated Cash Flow Statement

for the six months ended 31 March 2023

Consolidated Consolidated Consolidated

Unaudited Unaudited Audited

half year half year year to

to 31 Mar to 30 Sep 2022

2023 31 Mar 2022 GBP'000

GBP'000 GBP'000

Operating activities

Reconciliation of profit to operating

cash flows

Profit for the period 6,920 4,853 9,344

Add back:

Taxation 1,671 802 1,551

Depreciation 582 505 1,085

Amortisation 1,033 960 1,901

Share option charge 117 137 60

Finance costs 65 73 146

Finance income (371) (82) (337)

10,017 7,248 13,750

Increase in trade and other receivables (4,061) (1,805) (1,182)

Increase in trade and other payables 1,897 2,465 1,324

------------- ------------- -------------

Cash from operations 7,853 7,908 13,892

Finance costs (65) (73) (146)

Finance income 182 82 337

Tax paid (1,371) (1,434) (1,745)

------------- ------------- -------------

Net cash generated from operating

activities 6,599 6,483 12,338

------------- ------------- -------------

Investing activities

Capitalisation of development

costs (552) (486) (983)

Purchase of property, plant and

equipment (213) (85) (626)

------------- ------------- -------------

Net cash used in investing activities (765) (571) (1,609)

------------- ------------- -------------

Financing activities

Purchase of treasury stock - (827) (827)

Receipts from exercise of share

options - 108 122

Principal elements of finance

leases (430) (400) (807)

Dividends paid (1,918) (1,476) (2,243)

------------- ------------- -------------

Net cash used in financing activities (2,348) (2,595) (3,755)

------------- ------------- -------------

Net increase in cash and cash

equivalents 3,486 3,317 6,974

Translation differences (90) 23 101

Cash and cash equivalents at beginning

of period 20,249 13,174 13,174

------------- ------------- -------------

Cash and cash equivalents at end

of period 23,645 16,514 20,249

------------- ------------- -------------

Unaudited Notes

1. Basis of Preparation and Accounting Policies

The condensed financial information is unaudited and was

approved by the Board of Directors on 12 May 2023.

The Company is a public limited company, which was incorporated

in England and Wales on 5 March 2015. The address of its registered

office is 25 Bedford Street, London, WC2E 9ES. The interim

financial information for the six months ended 31 March 2023 has

been prepared in accordance with UK-adopted International

Accounting Standards. The interim financial information for the six

months ended 31 March 2023 has been prepared under the historical

cost convention.

The interim financial information for the six months ended 31

March 2023 does not constitute statutory accounts within the

meaning of section 434 of the Companies Act. Statutory accounts for

the year ended 30 September 2022 have been delivered to the

Registrar of Companies. These accounts contain an unqualified audit

report and did not contain a statement under the Companies Act 2006

regarding matters which are required to be noted by exception.

The preparation of the interim financial information for the six

months ended 31 March 2023 in conformity with generally accepted

accounting principles requires the use of estimates and assumptions

that affect the reported amounts of assets and liabilities at the

date of the Statements and the reported amounts of revenues and

expenses during the period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates. The accounting

policies adopted are consistent with those of the previous

financial year and corresponding interim reporting period, except

for the adoption of new and amended standards which have no

material impact on the accounting policies, financial position or

performance of the Group.

There is no material difference between the fair value of

financial assets and liabilities and their carrying amount.

The functional and presentational currency is UK Sterling.

2. Going concern

The Directors have assessed the current financial position of

the Group, along with future cash flow requirements, to determine

if the Group has the financial resources to continue as a going

concern for the foreseeable future. The conclusion of this

assessment is that it is appropriate that the Group be considered a

going concern. For this reason the Directors continue to adopt the

going concern basis in preparing the interim financial information

for the six months ended 31 March 2023 . The interim financial

information does not include any adjustments that would result in

the going concern basis of preparation being inappropriate.

3. Basis of consolidation

The consolidated financial information incorporates the

financial information of the Company and entities controlled by the

Company (its subsidiaries) at 31 March 2023. Control is achieved

where the Company has the power to govern the financial and

operating policies of an investee entity so as to obtain benefit

from its activities.

Except as noted below, the financial information of subsidiaries

is included in the consolidated financial statements using the

acquisition method of accounting. On the date of acquisition the

assets and liabilities of the relevant subsidiaries are measured at

their fair values.

All intra-Group transactions, balances, income and expenses are

eliminated on consolidation.

4. Adjusted earnings

EBITDA, profit before tax, profit for the period and earnings

per share have been adjusted to take account of GBP116,558 (six

months to 31 March 2022 GBP136,836) relating to P&L charges in

respect of the Company's share based payments charges. The profit

before tax, profit for the period and earnings per share have also

been adjusted to take account of the amortisation of acquired

intangibles of GBP496,416 (six months to 31 March 2022

GBP496,416).

5. Other receivables and other payables

Unaudited Unaudited Audited

31 Mar 2023 31 Mar 30 Sep

GBP'000 2022 2022

GBP'000 GBP'000

Other receivables - non-current

Amounts recoverable on contracts 3,551 2,611 2,094

Other receivables 68 70 77

3,619 2,681 2,171

------------- ---------- ---------

Other receivables - current

Amounts recoverable on contracts 9,009 8,709 7,759

Prepayments 1,792 712 632

Other receivables 348 154 311

11,149 9,575 8,702

------------- ---------- ---------

Other payables

Taxation 1,177 276 776

Other taxation and social

security 549 420 495

Pension 56 49 46

Accruals 3,097 2,781 3,119

Deferred income 4,991 6,953 4,245

Lease liability 980 954 976

Other payables 646 456 382

11,496 11,889 10,039

------------- ---------- ---------

6. Availability of this announcement

This announcement together with the financial statements herein

and a presentation in respect of the interim financial results are

available on the Group's website, www.cerillion.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKSAFDADEFA

(END) Dow Jones Newswires

May 15, 2023 02:00 ET (06:00 GMT)

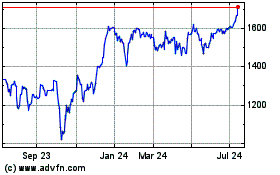

Cerillion (LSE:CER)

Historical Stock Chart

From Mar 2024 to Apr 2024

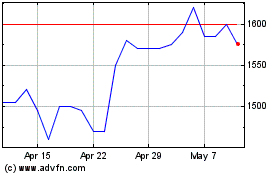

Cerillion (LSE:CER)

Historical Stock Chart

From Apr 2023 to Apr 2024