TIDMAXM

RNS Number : 6872D

Alexander Mining PLC

21 May 2012

Alexander Mining plc

Proposed Capital Re-Organisation

and

Notice of General Meeting

Alexander Mining plc ("Alexander" or the "Company"), the

AIM-listed mineral processing technologies company, announces that

it has today posted to shareholders notice of a general meeting for

approval of a proposed capital re-organisation to be held at

11:00am on 14 June 2012, or immediately following the conclusion of

the AGM being held at 10.30 am, at the East India Club, 16 St

James's Square, London, SW1Y 4LH (the "General Meeting").

Background

Alexander, in common with a multitude of other companies in the

mining sector, has been affected by the acutely challenging

economic and market conditions. The market value of the ordinary

shares has fallen below their nominal value of 10 pence and, as a

result, Alexander is precluded by the Companies Act 2006 (the

"Act") from issuing new shares at or around their current market

value, meaning that, if required, any realistic opportunity to

raise equity finance is closed to the Company. The Company may have

a need to issue new shares, whether as part of an equity

fund-raising or as consideration for the acquisition of new assets,

as and when an opportunity may arise which may complement or

enhance the Company's business. To take advantage expeditiously of

the opportunities that may exist, the Board may be required to take

a flexible approach to agreeing transactions involving the issue of

shares at less than the current nominal value of 10 pence. In order

to facilitate this, the Directors are seeking shareholder approval

for the proposed capital re-organisation.

The Capital Re-organisation and New Articles of Association

Under the proposed capital re-organisation each ordinary share

of 10 pence each ("Existing Ordinary Share") on the register of

members of the Company at 11.59 pm on 14 June 2012 (or such other

time or date as the Board may determine) will be divided into:

1 new ordinary share of 0.1 pence each ("New Ordinary Share");

and

1 deferred share of 9.9 pence each ("Deferred Share").

(the "Capital Re-organisation")

Therefore, following the Capital Re-organisation, the number of

New Ordinary Shares held by each existing shareholder will be the

same as the number of Existing Ordinary Shares held by them

immediately before the Capital Re-organisation.

The New Ordinary Shares will have the same rights and benefits

of the Existing Ordinary Shares. The number of New Ordinary Shares

in issue following the Capital Re-organisation will be unchanged

from the number of Existing Ordinary Shares in issue immediately

prior to the Capital Re-organisation.

The Deferred Shares will not be admitted to trading on AIM, will

have only very limited rights on a return of capital and will be

effectively valueless and non-transferable. The Directors consider

that the Deferred Shares will have no effect on the respective

economic interests of the Shareholders. No share certificates will

be issued for the Deferred Shares. It is currently intended that,

in due course, all the Deferred Shares will be re-purchased by the

Company, at its sole discretion, for an aggregate consideration of

GBP1 and cancelled. For the same purpose, amended articles of

association are proposed to be adopted including the limited rights

proposed for the Deferred Shares (the "New Articles of

Association").

Further, it is proposed that the article setting out the

authorised share capital be removed in the New Articles of

Association as permitted under the Act. The Directors will still be

limited as to the number of shares they can at any time allot

because an allotment authority continues to be required under the

Act.

In addition, shareholders will be asked to grant to the

Directors replacement authorities to issue New Ordinary Shares and

to allot the same without applying pre-emption rights in accordance

with the Act, on the basis of the same number of ordinary shares at

the new nominal value as previously set out in the notice of Annual

General Meeting.

Admission to trading on AIM

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM. Dealings in the Existing Ordinary

Shares will cease at the close of business on the date of the

General Meeting and dealings in the New Ordinary Shares are

expected to commence at 8:00am on 15 June 2012, being the day

following the General Meeting.

The ISIN and SEDOL numbers of the New Ordinary Shares will be

the same as the Existing Ordinary Shares and any share certificates

for the Existing Ordinary Shares will remain valid for the New

Ordinary Shares.

Recommendation and voting intentions

A failure to obtain the requisite support of the shareholders at

the General Meeting would prevent the Company from proceeding with

the Capital Re-organisation which would therefore prohibit the

Directors from issuing shares at less than 10 pence per share.

The Board considers that the proposals described are in the best

interests of the Company and of the shareholders as a whole.

Accordingly, the Board recommends that shareholders should vote in

favour of the resolutions to be proposed at the General Meeting.

The Directors intend to vote in favour of the resolutions in

respect of their own beneficial holdings amounting to, in

aggregate, 10,906,000 Existing Ordinary Shares (representing 8.02

per cent of the Existing Ordinary Shares).

Availability of Documents

A circular which sets out full details of the Capital

Re-organisation (the "Circular"), a form of proxy for shareholders

and a copy of the Company's Annual Accounts for the period ending

31 December 2011 have been sent to shareholders today.

Copies of the Circular, the form of proxy, the proposed New

Articles of Association and Annual Accounts are available on the

Company's website at www.alexandermining.com. Additional copies

will be made available to the public, free of charge, from the

Company's registered office at 35 Piccadilly, London W1J 0DW.

For further information please contact:

Martin Rosser Matt Sutcliffe

Chief Executive Officer Executive Chairman

-----------------------------

Mobile: + 44 (0) 7770 865 341 Mobile: +44 (0) 7887 930 758

-----------------------------

Alexander Mining plc

1st Floor

35 Piccadilly

London

W1J 0DW

Tel: +44 (0) 20 7292 1300

Fax: +44 (0) 20 7292 1313

Email: mail@alexandermining.com

Website: www.alexandermining.com

Nominated Advisor and Joint Broker

RFC Ambrian Limited

Samantha Harrison / Jen Boorer

+44 (0) 20 7634 4700

Joint Broker

XCAP Securities plc

Karen Kelly / Adrian Kirk / David Lawman

+44 (0) 20 7101 7070

Public/Media Relations

Britton Financial PR

Tim Blackstone

+44 (0) 20 7242 9786

Disclaimers

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This news release contains forward looking information, being

statements and information which are not historical facts,

including discussions of future plans and objectives. There can be

no assurance that such statements and information will prove

accurate. Such statements and information are necessarily based

upon a number of estimates and assumptions that are subject to

numerous risks and uncertainties that could cause actual results

and future events to differ materially from those anticipated or

projected. Important factors that could cause actual results to

differ materially from the Company's expectations are in Company

documents filed from time to time with the TSX Venture Exchange and

provincial securities regulators, most of which are available at

www.sedar.com. Although the Company does not anticipate any

objection, the Company is required under the rules of the TSX

Venture Exchange to obtain TSX Venture Exchange approval of the

proposed Capital reorganisation. The Company disclaims any

intention or obligation to revise or update such statements and

information unless required by law.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDMGMKDRVGZZM

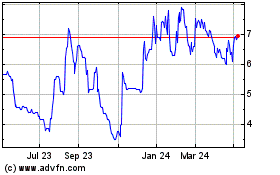

Eenergy (LSE:EAAS)

Historical Stock Chart

From Dec 2024 to Jan 2025

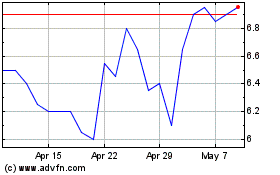

Eenergy (LSE:EAAS)

Historical Stock Chart

From Jan 2024 to Jan 2025