ECR Minerals PLC Termination of option to acquire Hurricane Project (8622Q)

October 20 2023 - 10:56AM

UK Regulatory

TIDMECR

RNS Number : 8622Q

ECR Minerals PLC

20 October 2023

ECR MINERALS plc

("ECR Minerals" or the "Company")

Termination of option to acquire the Hurricane Project

ECR Minerals plc (LON:ECR), the exploration and development

company focused on gold in Australia, announces that it has today

terminated its option to acquire the Hurricane project.

As announced on 27 October 2022, ECR was granted an option to

acquire the entire issued share capital of Placer Gold Pty Limited,

which is the beneficial holder of three granted mining tenements

located in NE Queensland, together known as the Hurricane Project

(the "Option"). Following the change of board announced on 15

September 2023, the Company had negotiated an extension to the

Option period which was designed to give the new management team

more time to analyse and review the project.

ECR has today sent a formal notification that it no longer

intends to exercise its option to acquire Placer Gold Pty Limited.

Although preliminary results from ECR's due diligence show promise,

in the opinion of the board of directors, the potential value to

ECR of the Hurricane project cannot be justified against the

previously agreed acquisition terms. The vendors have indicated

that they are prepared to make some adjustments to the terms but,

nevertheless, it is the board's view that the two parties remain

some distance apart and that the Company's time and resources

should now be redeployed to other opportunities that could deliver

higher returns.

ECR Managing Director Nick Tulloch commented: "The Hurricane

project has been a feature of ECR's strategy for almost a year now

and terminating the option to acquire it was not a decision that we

took lightly. It is evident that that Hurricane has some excellent

prospects but the combination with ECR is not right at this time.

Results from our due diligence to date have been encouraging but

the size and cost of the opportunity is very significant to ECR and

we simply cannot justify the value placed on the transaction. I

recognise this news may surprise some of our investors but we are

determined to rebuild value in ECR and, however hard the decision

may be, we will not proceed with projects that are not in the best

interests of shareholders."

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0) 20 7929 1010

David Tang, Non-Executive Chairman

Nick Tulloch, Managing Director

Andrew Scott, Director

Email:

info@ecrminerals.com

Website: www.ecrminerals.com

WH Ireland Ltd Tel: +44 (0) 207 220 1666

Nominated Adviser

Katy Mitchell / Andrew de Andrade

SI Capital Ltd Tel: +44 (0) 1483 413500

Broker

Nick Emerson

Novum Securities Limited Tel: +44 (0) 20 7399 9425

Broker

Jon Belliss

Brand Communications Tel: +44 (0) 7976 431608

Public & Investor Relations

Alan Green

ABOUT ECR MINERALS PLC

ECR Minerals is a mineral exploration and development company.

ECR's wholly owned Australian subsidiary Mercator Gold Australia

Pty Ltd ("MGA") has 100% ownership of the Bailieston and Creswick

gold projects in central Victoria, Australia, has six licence

applications outstanding which includes one licence application

lodged in eastern Victoria (Tambo gold project).

ECR also owns 100% of an Australian subsidiary LUX Exploration

Pty Ltd ("LUX") which has three approved exploration permits

covering 946 km(2) over a relatively unexplored area in Lolworth

Range, Queensland, Australia. The Company has also submitted a

license application at Kondaparinga which is approx 120km(2) in

area and located within the Hodgkinson Gold Province, 80km NW of

Mareeba, North Queensland.

Following the sale of the Avoca, Moormbool and Timor gold

projects in Victoria, Australia to Fosterville South Exploration

Ltd (TSX-V: FSX) and the subsequent spin-out of the Avoca and Timor

projects to Leviathan Gold Ltd (TSX-V: LVX), Mercator Gold

Australia Pty Limited has the right to receive up to A$2 million in

payments subject to future resource estimation or production from

projects sold to Fosterville South Exploration Limited.

ECR holds a 90% interest in the Danglay gold project; an

advanced exploration project located in a prolific gold and copper

mining district in the north of the Philippines, which has a 43-101

compliant resource. ECR also holds a royalty on the SLM gold

project in La Rioja Province, Argentina and can potentially receive

up to US$2.7 million in aggregate across all licences.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBUBDGXUDDGXG

(END) Dow Jones Newswires

October 20, 2023 11:56 ET (15:56 GMT)

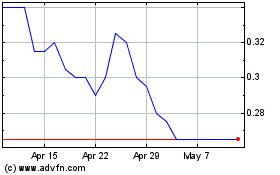

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Apr 2024 to May 2024

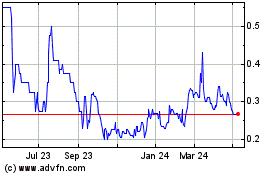

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From May 2023 to May 2024